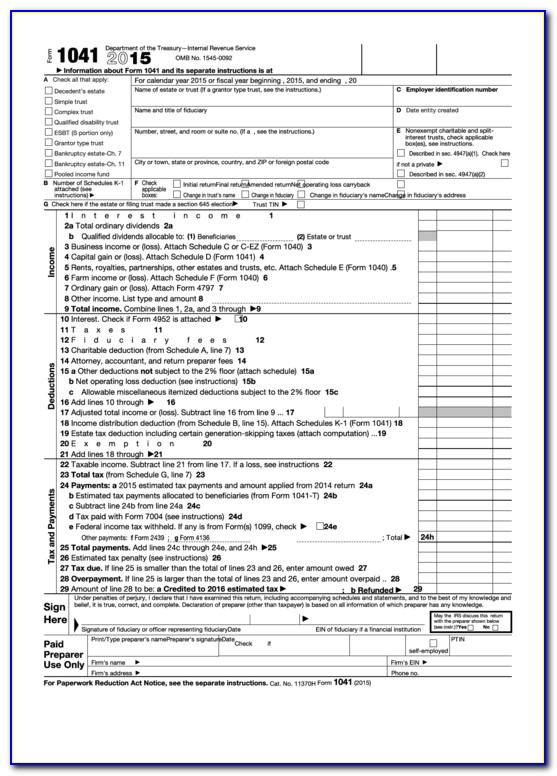

Special Needs Trust Form 1041

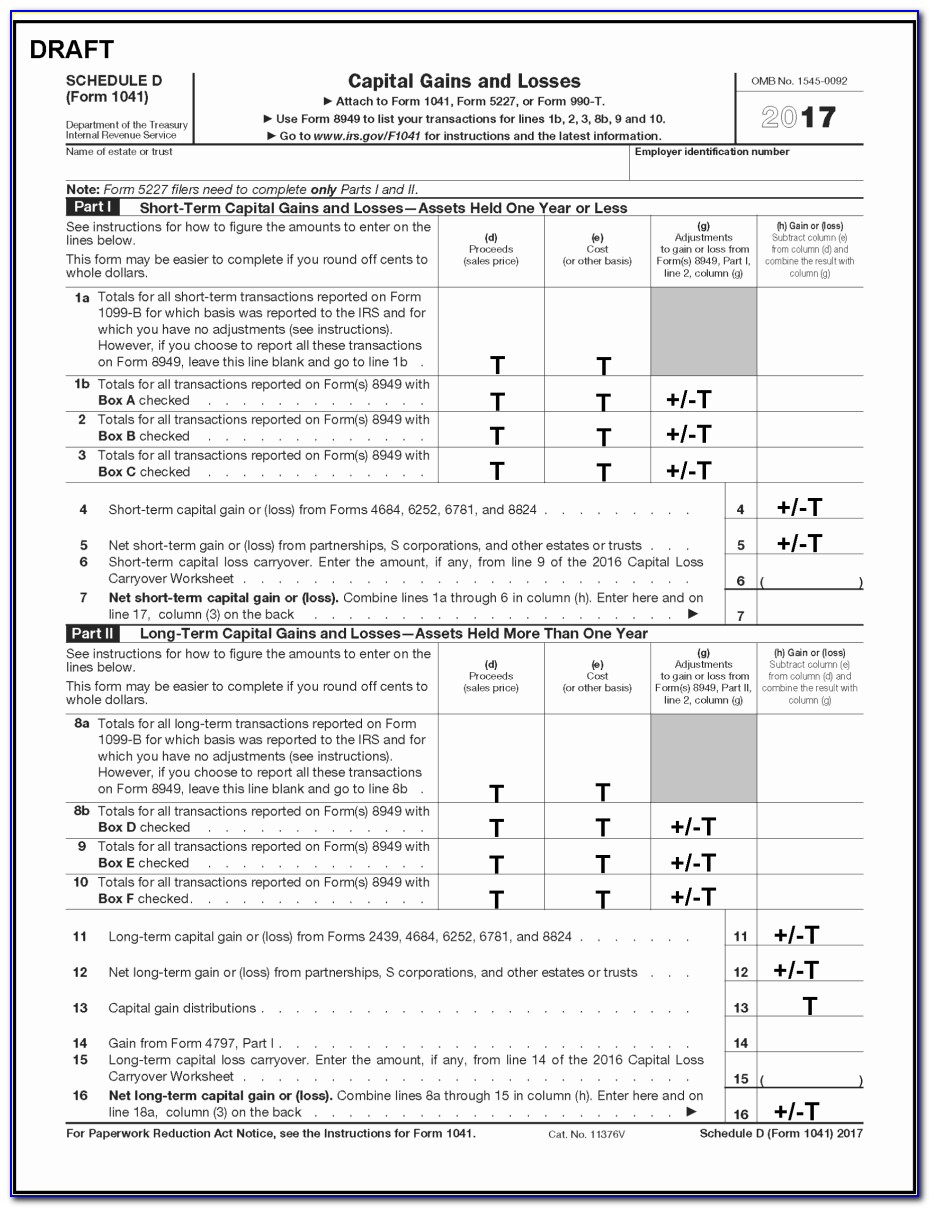

Special Needs Trust Form 1041 - Web tax form 1041 a disability attorney or special needs planning attorney may often collaborate with a cpa, tax attorney, or other financial professionals to help their. Web up to 25% cash back learn more about special needs trusts. Web typically, beneficiaries of a trust pay taxes on income distributions they receive from the trust’s principal. Web snts are designed to supplement and protect public benefits eligibility for persons with disabilities. Web special codes are entered into the computer to perform specific functions. Web this filing is also made on form 1041 but, as described below, there is significantly more that goes into completing an income tax return for a complex trust or. It is possible for a special needs trust beneficiary to be disabled, but not mentally incapacitated. Answered in 4 hours by: Learn much more about special needs trusts on nolo.com, including whether using a special needs trust form is. Web the executor must attach a statement to form 1041 providing the following information for each electing trust (including the electing trust provided in item g):

(a) the name of the. Web this filing is also made on form 1041 but, as described below, there is significantly more that goes into completing an income tax return for a complex trust or. Minors are considered to be incapacitated as a matter of law. When a trust makes a distribution, there is a deduction. Web overview an estate or trust can generate income that gets reported on form 1041, united states income tax return for estates and trusts. Web up to 25% cash back learn more about special needs trusts. Web in accordance with irs regulation sec. Web typically, beneficiaries of a trust pay taxes on income distributions they receive from the trust’s principal. Deductions, credits, and alternative minimum taxable income from the estate or trust. It is possible for a special needs trust beneficiary to be disabled, but not mentally incapacitated.

It is possible for a special needs trust beneficiary to be disabled, but not mentally incapacitated. Answered in 4 hours by: Web tax form 1041 a disability attorney or special needs planning attorney may often collaborate with a cpa, tax attorney, or other financial professionals to help their. The trustee will first need to determine the tax. Deductions, credits, and alternative minimum taxable income from the estate or trust. Income tax return for estates and trusts pdf, is used by the fiduciary of a domestic decedent’s estate, trust,. Web this filing is also made on form 1041 but, as described below, there is significantly more that goes into completing an income tax return for a complex trust or. Web in accordance with irs regulation sec. When a trust makes a distribution, there is a deduction. Web snts are designed to supplement and protect public benefits eligibility for persons with disabilities.

Irs Forms 1041 K 1 Form Resume Examples xM8pGqm3Y9

Web snts are designed to supplement and protect public benefits eligibility for persons with disabilities. Web overview an estate or trust can generate income that gets reported on form 1041, united states income tax return for estates and trusts. Web typically, beneficiaries of a trust pay taxes on income distributions they receive from the trust’s principal. Answered in 4 hours.

Best Tax Software For Form 1041 Form Resume Examples mL52wRnOXo

(a) the name of the. Web the executor must also attach a statement to form 1041 providing the following information for each electing trust (including the electing trust provided in item g): Web typically, beneficiaries of a trust pay taxes on income distributions they receive from the trust’s principal. Learn much more about special needs trusts on nolo.com, including whether.

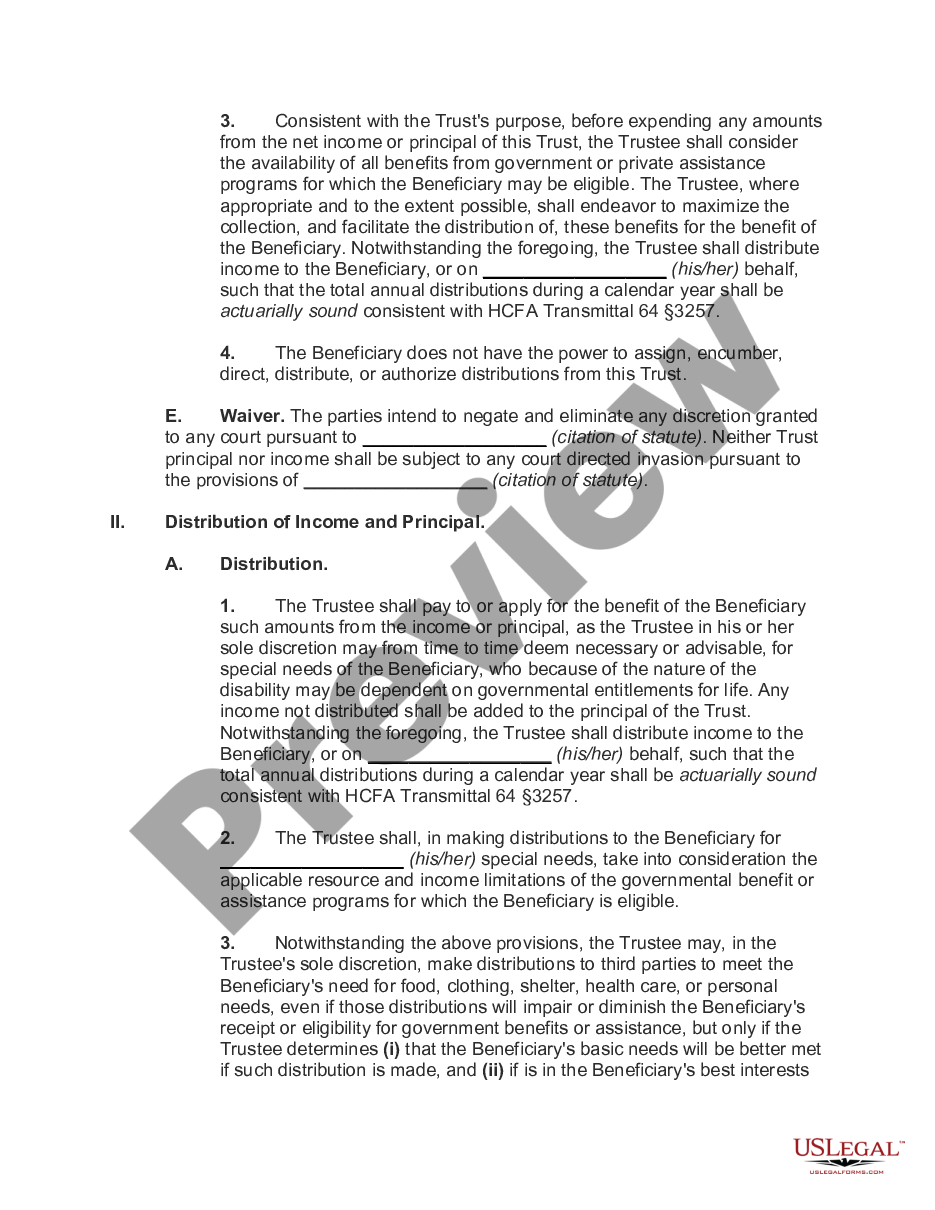

Third Party Supplemental Needs Trust Form Universal Network

When a trust makes a distribution, there is a deduction. Web tax form 1041 a disability attorney or special needs planning attorney may often collaborate with a cpa, tax attorney, or other financial professionals to help their. Web special codes are entered into the computer to perform specific functions. Minors are considered to be incapacitated as a matter of law..

Irs Form 1041 Schedule B Form Resume Examples 0ekopggDmz

Web typically, beneficiaries of a trust pay taxes on income distributions they receive from the trust’s principal. Minors are considered to be incapacitated as a matter of law. Web special codes are entered into the computer to perform specific functions. When a trust makes a distribution, there is a deduction. Answered in 4 hours by:

Irs Forms 1041 K 1 Form Resume Examples xM8pGqm3Y9

Learn much more about special needs trusts on nolo.com, including whether using a special needs trust form is. Web this filing is also made on form 1041 but, as described below, there is significantly more that goes into completing an income tax return for a complex trust or. Web where is special needs trust reported on form 1041? Web up.

special needs trust taxes The National Special Needs Network, Inc.

It is possible for a special needs trust beneficiary to be disabled, but not mentally incapacitated. The trustee will first need to determine the tax. Learn much more about special needs trusts on nolo.com, including whether using a special needs trust form is. Income tax return for estates and trusts pdf, is used by the fiduciary of a domestic decedent’s.

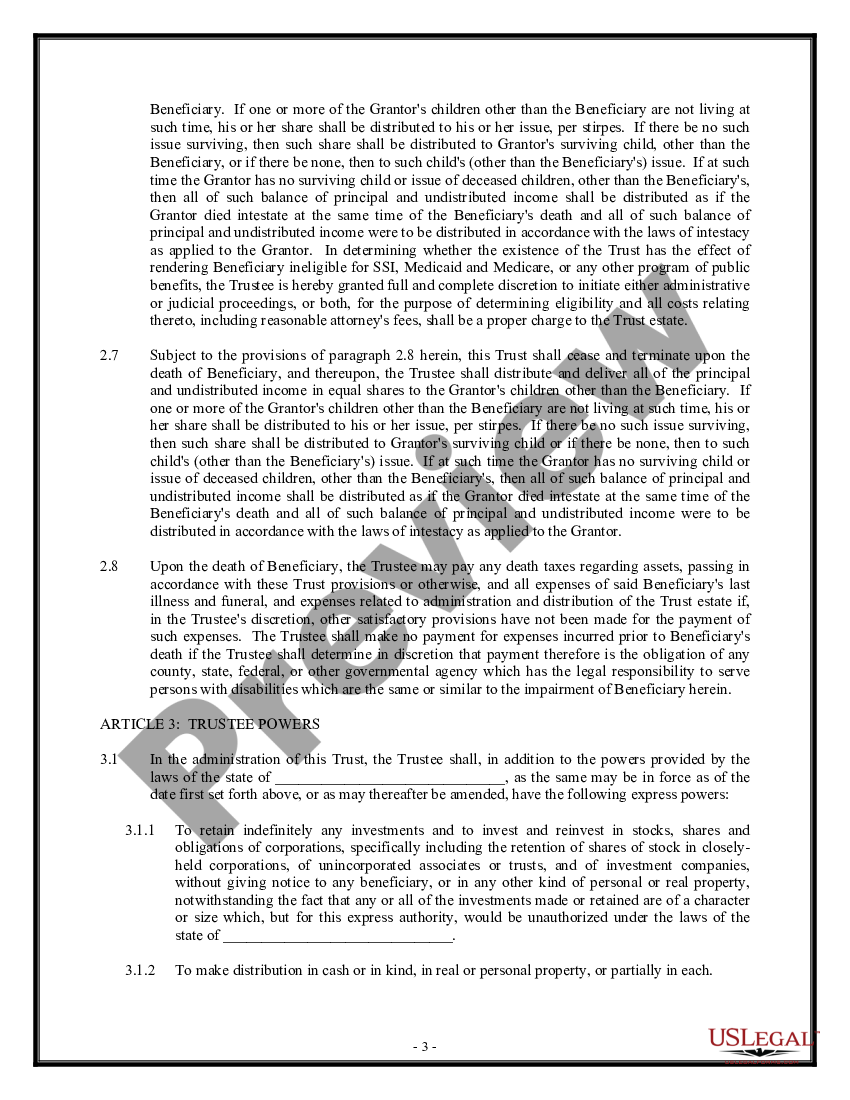

Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child

Answered in 4 hours by: Web tax form 1041 a disability attorney or special needs planning attorney may often collaborate with a cpa, tax attorney, or other financial professionals to help their. Web the executor must attach a statement to form 1041 providing the following information for each electing trust (including the electing trust provided in item g): Web snts.

Trust Agreement Family Special Needs Trust Special US Legal Forms

(a) the name of the. Learn much more about special needs trusts on nolo.com, including whether using a special needs trust form is. The trustee will first need to determine the tax. Web tax form 1041 a disability attorney or special needs planning attorney may often collaborate with a cpa, tax attorney, or other financial professionals to help their. Web.

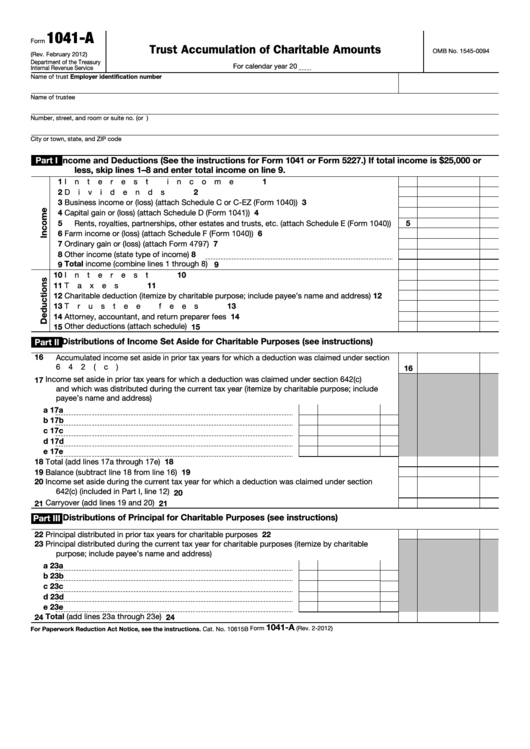

Fillable Form 1041A U.s. Information Return Trust Accumulation Of

It is possible for a special needs trust beneficiary to be disabled, but not mentally incapacitated. Web special codes are entered into the computer to perform specific functions. Web the executor must also attach a statement to form 1041 providing the following information for each electing trust (including the electing trust provided in item g): Web overview an estate or.

Special Needs Trust Template Free Download

Deductions, credits, and alternative minimum taxable income from the estate or trust. Answered in 4 hours by: Learn much more about special needs trusts on nolo.com, including whether using a special needs trust form is. Web snts are designed to supplement and protect public benefits eligibility for persons with disabilities. Income tax return for estates and trusts pdf, is used.

Deductions, Credits, And Alternative Minimum Taxable Income From The Estate Or Trust.

Web overview an estate or trust can generate income that gets reported on form 1041, united states income tax return for estates and trusts. Web special codes are entered into the computer to perform specific functions. Web typically, beneficiaries of a trust pay taxes on income distributions they receive from the trust’s principal. The trustee will first need to determine the tax.

Web This Filing Is Also Made On Form 1041 But, As Described Below, There Is Significantly More That Goes Into Completing An Income Tax Return For A Complex Trust Or.

Web up to 25% cash back learn more about special needs trusts. Web tax form 1041 a disability attorney or special needs planning attorney may often collaborate with a cpa, tax attorney, or other financial professionals to help their. (a) the name of the. Web this filing is also made on form 1041 but, as described below, there is significantly more that goes into completing an income tax return for a complex trust or.

Web Snts Are Designed To Supplement And Protect Public Benefits Eligibility For Persons With Disabilities.

Learn much more about special needs trusts on nolo.com, including whether using a special needs trust form is. Answered in 4 hours by: Income tax return for estates and trusts pdf, is used by the fiduciary of a domestic decedent’s estate, trust,. Web the executor must also attach a statement to form 1041 providing the following information for each electing trust (including the electing trust provided in item g):

Web In Accordance With Irs Regulation Sec.

It is possible for a special needs trust beneficiary to be disabled, but not mentally incapacitated. When a trust makes a distribution, there is a deduction. Minors are considered to be incapacitated as a matter of law. Web where is special needs trust reported on form 1041?