Should Independent Contractors Form An Llc

Should Independent Contractors Form An Llc - Our business specialists help you incorporate your business. Both will bring you skills and help to grow your business, but. Ad top 5 llc services online (2023). Llcs are generally cheap to form,. Below, you’ll find a complete breakdown of why it may be in their best. But this can be tough to do,. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Web an llc has two options to choose from: Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Web exempt charitable, religious, and educational entities, or political subdivisions will present the purchasing contractor a copy of the exempt organization's missouri sales and use.

Web an independent contractor, on the other hand, cannot be fired so long as the independent contractor produces a result that meets the contract specifications. But this can be tough to do,. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Web the biggest difference between independent contractors and llcs is that llc members have limited liability protection to safeguard their personal assets from the liabilities of. You can trust us to file your llc! Web sole proprietorships, partnerships, llcs, and corporations are all business structures that independent contractors should explore when starting their business. Hire llc employees or hire independent contractors. Ad covers contractors, food service, retail stores, auto service, transportation, & more. Ad top 5 llc services online (2023).

2023's best llc filing services. Ad we've filed over 300,000 new businesses. Web before the next fiscal year, independent contractors should look into forming an llc. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. The main reason independent contractors form a limited liability company (llc) is to protect their assets. Web the biggest difference between independent contractors and llcs is that llc members have limited liability protection to safeguard their personal assets from the liabilities of. Web now, with all of that said…. It is believed that the majority of independent contractors never obtain business licenses. Web employed by a contractor providing contract services (such as employee leasing or temporary agencies) and are providing labor to you; Web exempt charitable, religious, and educational entities, or political subdivisions will present the purchasing contractor a copy of the exempt organization's missouri sales and use.

28 Independent Contractor Billing Template in 2020 Invoice template

But this can be tough to do,. Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Ad we've filed over 300,000 new businesses. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Ad.

Managing Independent Contractors Tracking, Classification, and

Ad covers contractors, food service, retail stores, auto service, transportation, & more. Web now, with all of that said…. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Web up to 24% cash back 2 min read. Web.

Should Independent Contractors Form LoanOut Companies, or Not? MGA

But we are most assuredly not advising you. Web the biggest difference between independent contractors and llcs is that llc members have limited liability protection to safeguard their personal assets from the liabilities of. Get exactly what you want at the best price. Ad top 5 llc services online (2023). Web an llc has two options to choose from:

Independent Contractor Agreement Template Free Agreement Templates

Web professional independent contractors such as accountants, lawyers, or dentists can form a professional llc or pllc. Web before the next fiscal year, independent contractors should look into forming an llc. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. You can trust us to file your llc! Web exempt charitable, religious, and educational entities, or.

How Are Independent Contractors Classified in the US? The Final Ruling

Ad incorporate your llc today to enjoy tax advantages and protect your personal assets. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. It is believed that the majority of independent contractors never obtain business licenses. If you.

Should independent contractors form a LLC? YouTube

Web sole proprietorships, partnerships, llcs, and corporations are all business structures that independent contractors should explore when starting their business. Web an llc has two options to choose from: The main reason independent contractors form a limited liability company (llc) is to protect their assets. Web exempt charitable, religious, and educational entities, or political subdivisions will present the purchasing contractor.

5 Key Differences Between an Employee and an Independent Contractor Do

Llcs are generally cheap to form,. Both will bring you skills and help to grow your business, but. Web now, with all of that said…. It is believed that the majority of independent contractors never obtain business licenses. 24/7 expert llc formation guidance.

Independent Contractors Stock Photo Download Image Now iStock

Web an independent contractor, on the other hand, cannot be fired so long as the independent contractor produces a result that meets the contract specifications. Ad protect your personal assets with a free llc—just pay state filing fees. But we are most assuredly not advising you. Web sole proprietorships, partnerships, llcs, and corporations are all business structures that independent contractors.

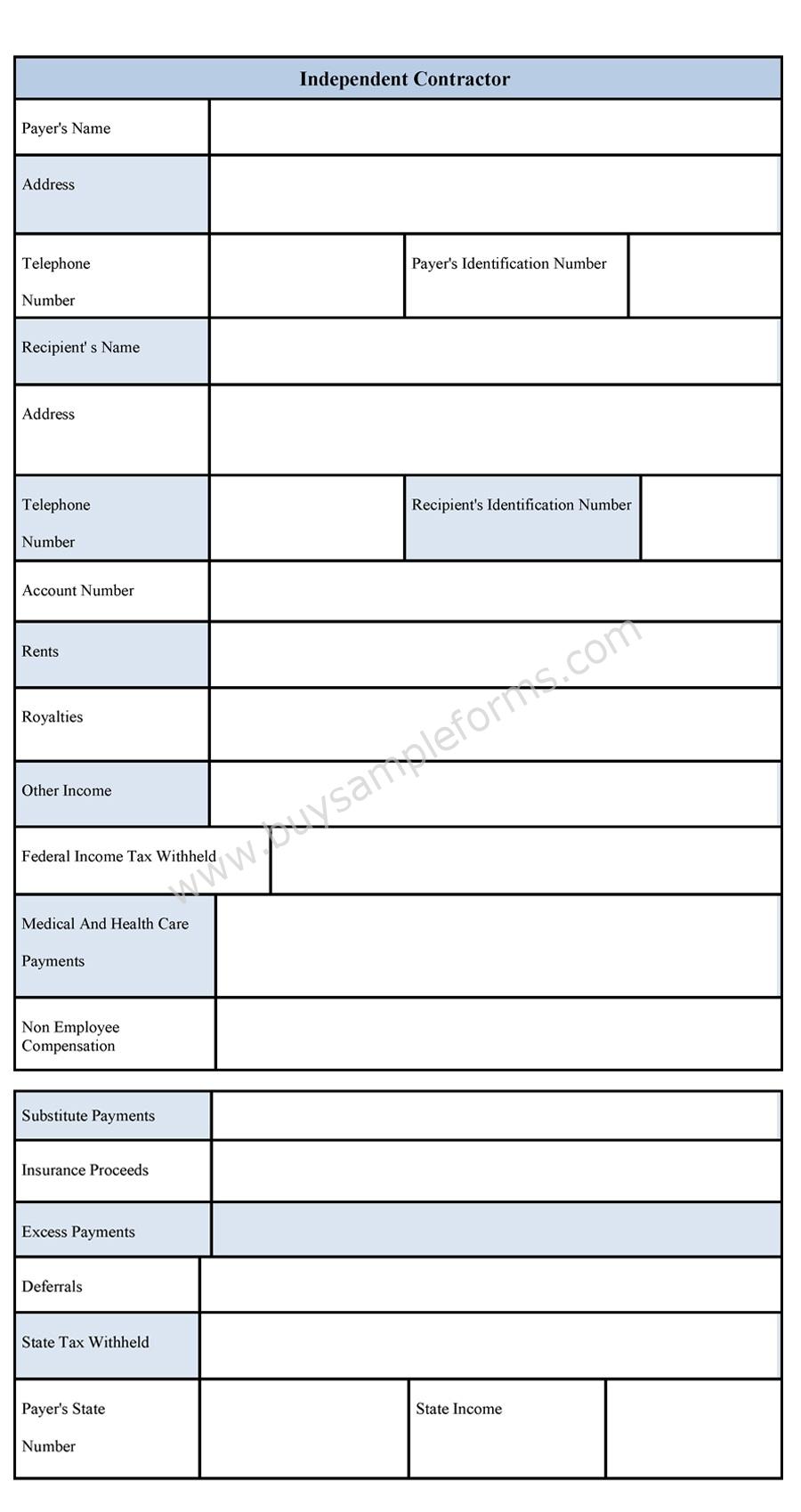

Independent Contractor Form Sample Forms

Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. Below, you’ll find a complete breakdown of why it may be in their best. Web professional independent contractors such as accountants, lawyers, or dentists can form a professional llc or pllc. 24/7 expert llc formation guidance. Web sole proprietorships, partnerships, llcs, and corporations are all business structures.

What Employers Should Understand about Independent Contractors

Hire llc employees or hire independent contractors. Web up to 24% cash back 2 min read. Web an llc has two options to choose from: Web sole proprietorships, partnerships, llcs, and corporations are all business structures that independent contractors should explore when starting their business. Web exempt charitable, religious, and educational entities, or political subdivisions will present the purchasing contractor.

Ad We've Filed Over 300,000 New Businesses.

But we are most assuredly not advising you. Web up to 24% cash back 2 min read. 24/7 expert llc formation guidance. Web an independent contractor, on the other hand, cannot be fired so long as the independent contractor produces a result that meets the contract specifications.

Llcs Are Generally Cheap To Form,.

Web exempt charitable, religious, and educational entities, or political subdivisions will present the purchasing contractor a copy of the exempt organization's missouri sales and use. Ad protect your personal assets with a free llc—just pay state filing fees. Web an llc independent contractor, or 1099 employee, is someone who completes work for a limited liability company but does not meet the definition of an. It is believed that the majority of independent contractors never obtain business licenses.

The Main Reason Independent Contractors Form A Limited Liability Company (Llc) Is To Protect Their Assets.

Keep your llc compliant w/ a registered agent, operating agreement, and business licenses. The tax rate for medicare is 1.45 percent each for. Web sole proprietorships, partnerships, llcs, and corporations are all business structures that independent contractors should explore when starting their business. You can trust us to file your llc!

Web Jul 20, 2022 | Business If You Are A Sole Proprietor Working As An Independent Contractor, There Are Lots Of Advantages To Setting Up Your Business As An.

Web now, with all of that said…. Web “should an independent contractor form an llc?” is easy, as the answer is a definite “yes.” not only will an llc help you separate your personal holdings from your business. Our business specialists help you incorporate your business. Web an llc has two options to choose from: