Should An Author Form An Llc

Should An Author Form An Llc - Ad protect your personal assets with a free llc—just pay state filing fees. Web an llc can offer your business liability protection as well as other perks. Web naming your llc. Each state may use different regulations, you should check with your state if you. We've filed over 300,000 new businesses. Web an llc, or limited liability company, is a u.s. Many authors are best served by operating as sole proprietorships, but there are many. Web should you form an llc? Forming an llc can provide you. In this guide, we will walk you through how to start an llc in just seven simple steps.

Web an llc, or limited liability company, is a u.s. Web the legal requirements and ramifications of forming an entity as an author, and the potential tax benefits of doing so. Many authors are best served by operating as sole proprietorships, but there are many. 2023's best llc formation services. Web if you are an indie author, i recommend having an llc for your publishing company. Each state may use different regulations, you should check with your state if you. Completing your articles of organization. Ad launch your llc in 10 min online. Instead of being “john smith, llc,” you want to be “acme publishing, llc.”. We've filed over 300,000 new businesses.

Ad protect your personal assets with a free llc—just pay state filing fees. Web the legal requirements and ramifications of forming an entity as an author, and the potential tax benefits of doing so. Web probably the most obvious advantage to forming an llc is protecting your personal assets by limiting the liability to the resources of the business itself. Each state may use different regulations, you should check with your state if you. Single member llcs are by default taxed as sole proprietorships. Many authors are best served by operating as sole proprietorships, but there are many. Web although a limited liability company, or llc, isn't for every business owner, there may be good reasons why you should form an llc. Web limited liability company: There are a variety of. Web if you are an indie author, i recommend having an llc for your publishing company.

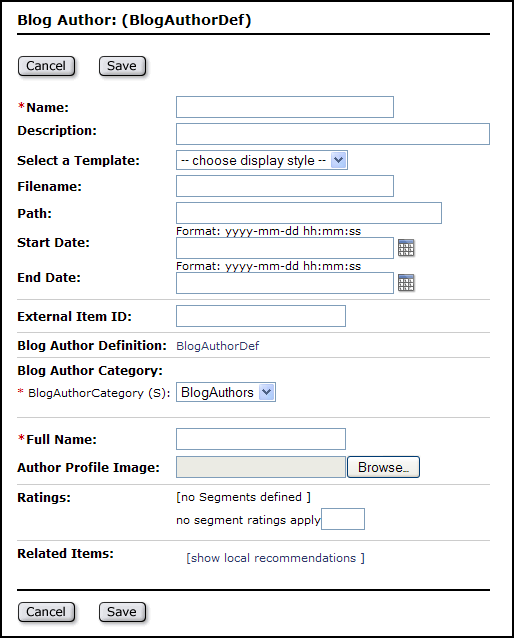

Working with Blog Authors

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. In this guide, we will walk you through how to start an llc in just seven simple steps. Many authors are best served by operating as sole proprietorships, but there are many. Web if your full name is in the name of.

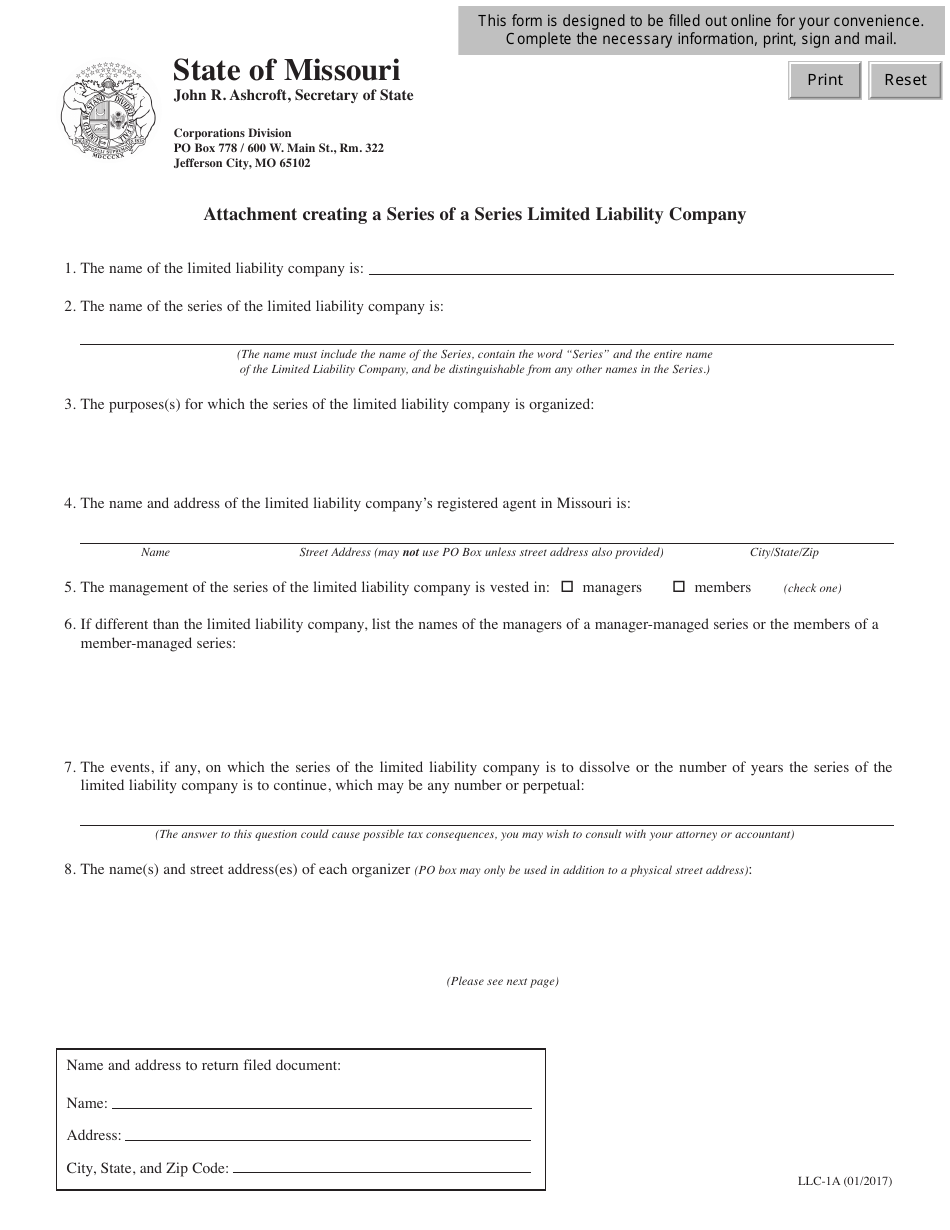

Form LLC1A Download Fillable PDF or Fill Online Attachment Creating a

Ad protect your personal assets with a free llc—just pay state filing fees. Web the court should see through this practice, and keep the case. Web the legal requirements and ramifications of forming an entity as an author, and the potential tax benefits of doing so. Web if your full name is in the name of your business (e.g. Business.

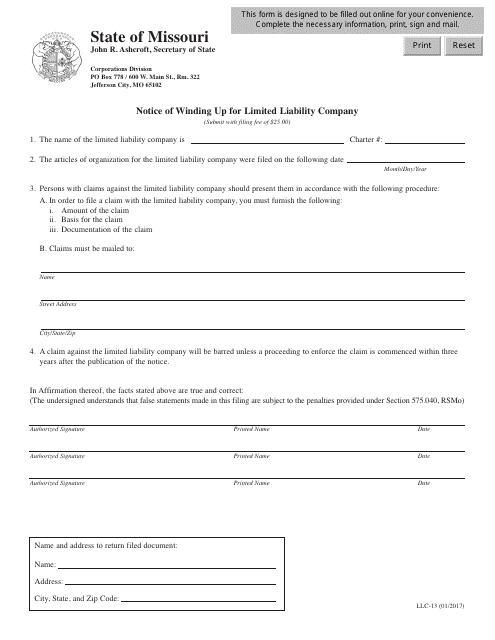

Form LLC13 Download Fillable PDF or Fill Online Notice of Winding up

Web limited liability company: As discussed in this article, llcs may be appropriate for simple businesses involving one owner or a small number of owners. Art by sylvia liu, or sylvia liu, author), you do not need to file a dba. Web the court should see through this practice, and keep the case. Web naming your llc.

Why should I form an LLC? YouTube

Local home business permit or. Of course, there will be howls (like with 303 creative ) that the court decided a fake case that was. Single member llcs are by default taxed as sole proprietorships. Web probably the most obvious advantage to forming an llc is protecting your personal assets by limiting the liability to the resources of the business.

How to Form an LLC YouTube

As its name implies, an llc offers protection from liability for an author—though less protection than would be provided by full. Web if your full name is in the name of your business (e.g. Art by sylvia liu, or sylvia liu, author), you do not need to file a dba. Web your writing career is a business, but is it.

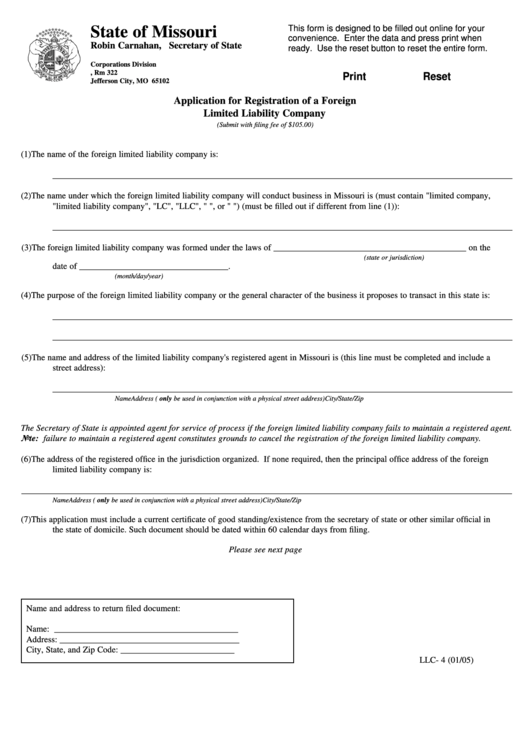

Fillable Form Llc 4 Application For Registration Of A Foreign

Art by sylvia liu, or sylvia liu, author), you do not need to file a dba. Web although a limited liability company, or llc, isn't for every business owner, there may be good reasons why you should form an llc. Web limited liability company: Ad get exactly what you want at the best price. Ad protect your personal assets with.

How to Form an LLC YouTube

Forming an llc can provide you. Ad launch your llc in 10 min online. Web probably the most obvious advantage to forming an llc is protecting your personal assets by limiting the liability to the resources of the business itself. Instead of being “john smith, llc,” you want to be “acme publishing, llc.”. Web if you are an indie author,.

Author Release Form Template Fill and Sign Printable Template Online

Local home business permit or. Web a limited liability company (llc) is a business structure allowed by state statute. Web if your full name is in the name of your business (e.g. Forming an llc can provide you. Web should you form an llc?

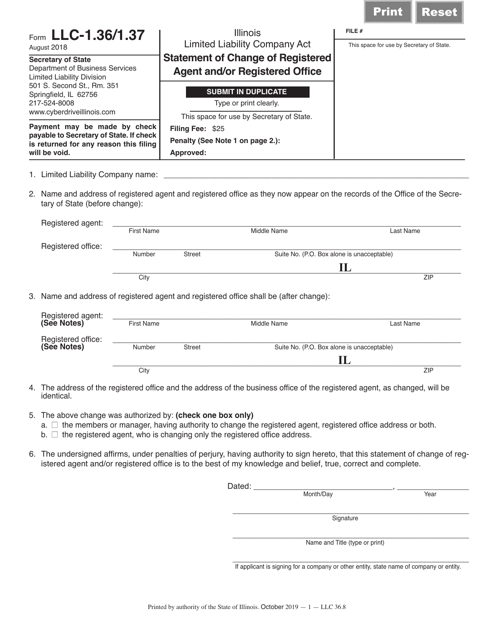

Form LLC1.36/1.37 Download Fillable PDF or Fill Online Statement of

Business structure that combines the simplicity, flexibility and tax advantages of a partnership with the personal. 2023's best llc formation services. Ad protect your personal assets with a free llc—just pay state filing fees. Web probably the most obvious advantage to forming an llc is protecting your personal assets by limiting the liability to the resources of the business itself..

2016 Form CA LLC1A Fill Online, Printable, Fillable, Blank pdfFiller

Web a limited liability company (llc) is a business structure allowed by state statute. Business structure that combines the simplicity, flexibility and tax advantages of a partnership with the personal. Web an llc, or limited liability company, is a u.s. Each state may use different regulations, you should check with your state if you. Web an llc can offer your.

Completing Your Articles Of Organization.

Single member llcs are by default taxed as sole proprietorships. Of course, there will be howls (like with 303 creative ) that the court decided a fake case that was. Web the court should see through this practice, and keep the case. Keep your llc compliant w/ a registered agent, operating agreement, and business licenses.

There Are A Variety Of.

Web your writing career is a business, but is it beneficial to incorporate? Instead of being “john smith, llc,” you want to be “acme publishing, llc.”. Web an llc can offer your business liability protection as well as other perks. Each state may use different regulations, you should check with your state if you.

Forming An Llc Can Provide You.

Many authors are best served by operating as sole proprietorships, but there are many. Web limited liability company: Web an llc, or limited liability company, is a u.s. Art by sylvia liu, or sylvia liu, author), you do not need to file a dba.

Web The Legal Requirements And Ramifications Of Forming An Entity As An Author, And The Potential Tax Benefits Of Doing So.

Web if you are an indie author, i recommend having an llc for your publishing company. 2023's best llc formation services. Ad protect your personal assets with a free llc—just pay state filing fees. As its name implies, an llc offers protection from liability for an author—though less protection than would be provided by full.