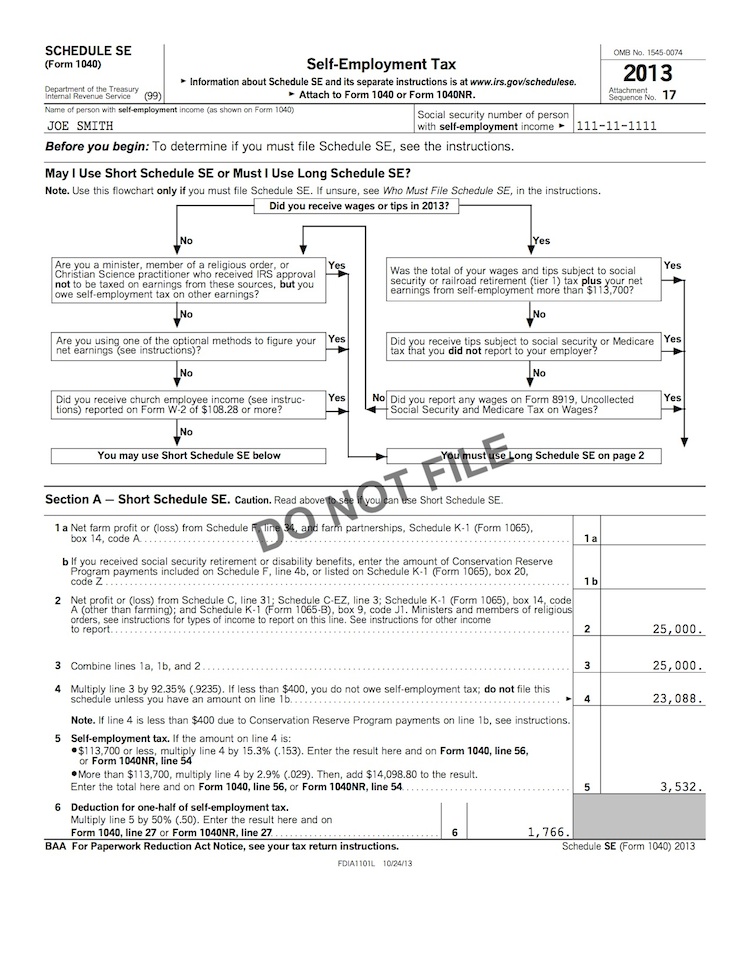

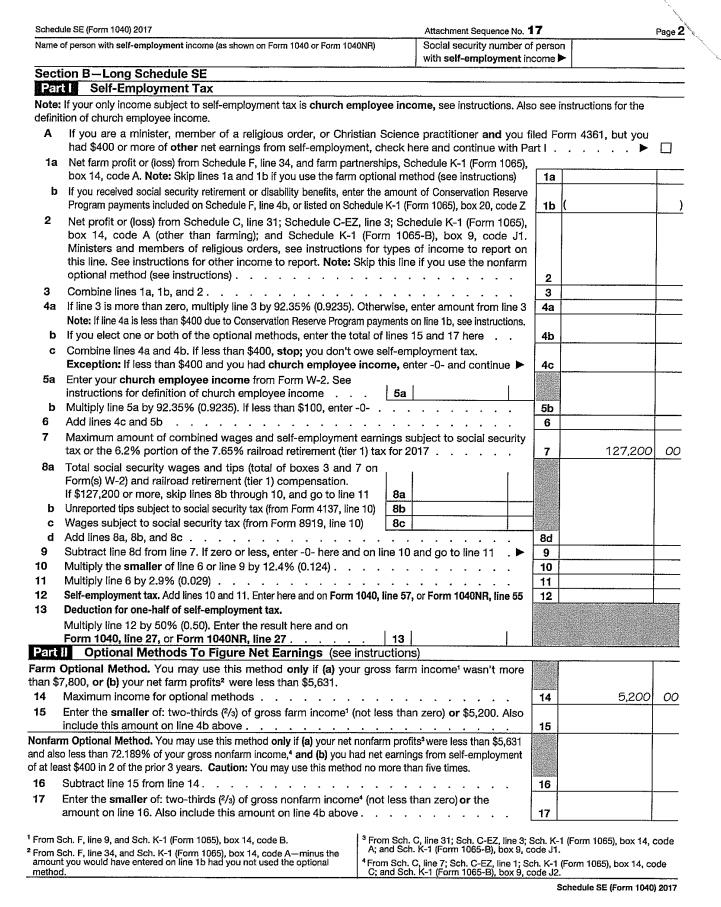

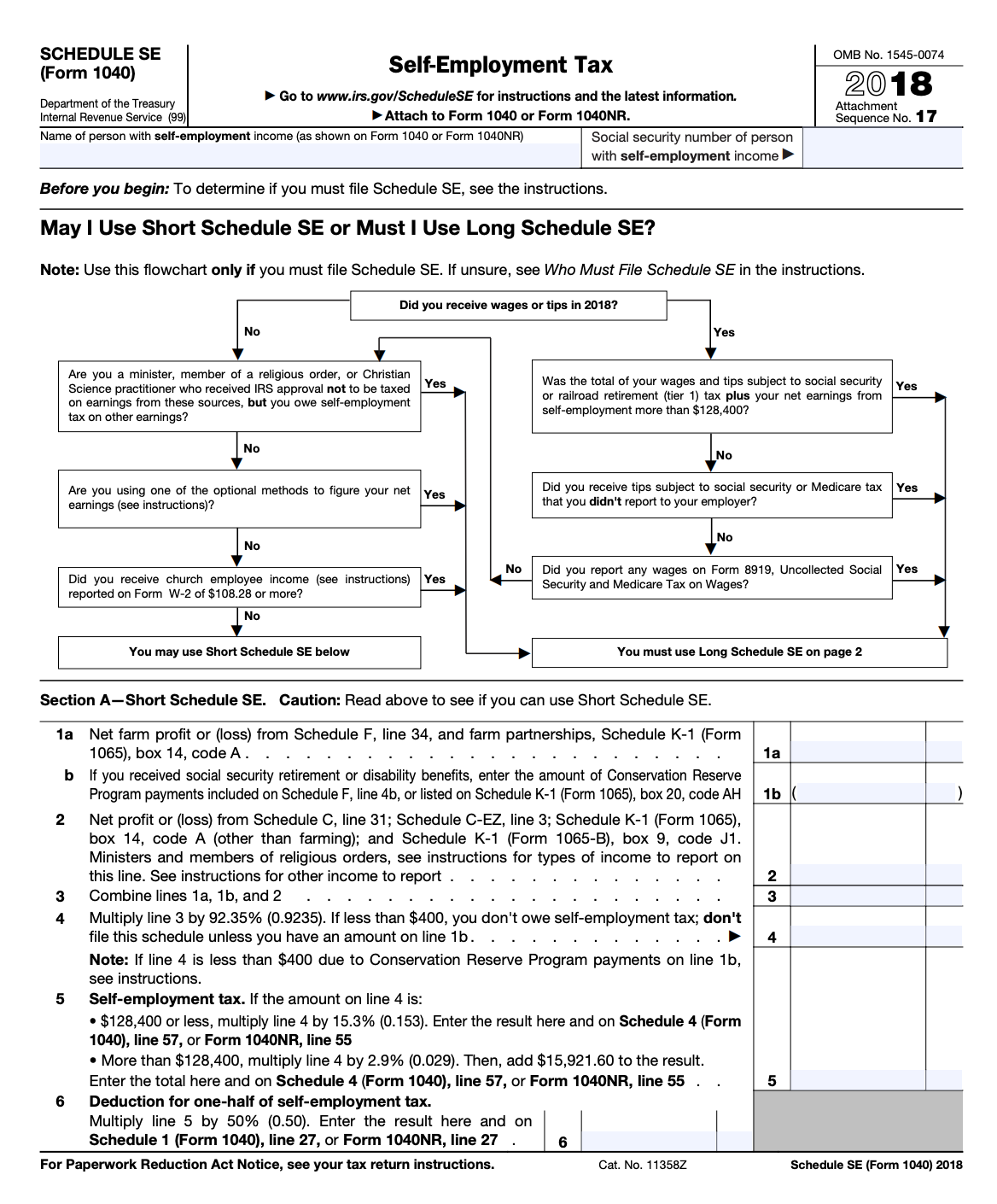

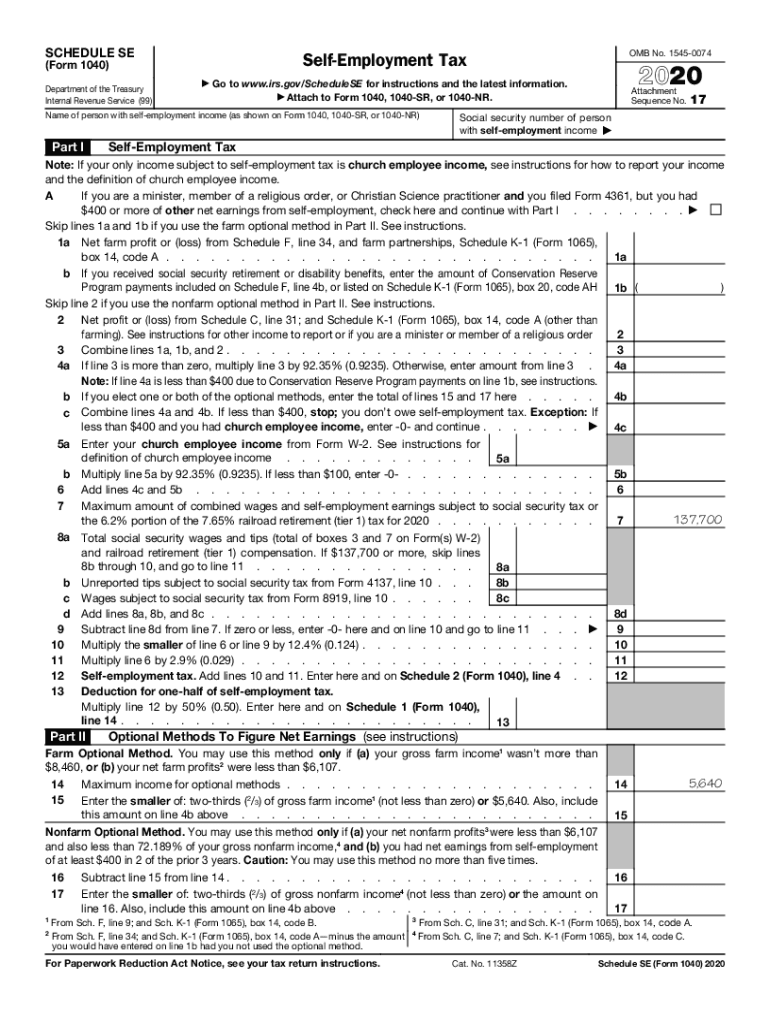

Schedule Se Form

Schedule Se Form - The social security administration uses the information from schedule se to figure your benefits under the social security program. Web a manufacturing execution system, or mes, is a comprehensive, dynamic software system that monitors, tracks, documents, and controls the process of manufacturing goods from raw materials to finished products. Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. The social security administration uses the information from schedule se to figure your benefits under the social security program. Web report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). You must file your return and pay any tax due by the personal tax return filing date of april 15. In this case, the next business day is the due date. This tax applies no matter how This date may change if it falls on a weekend or holiday;

Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. Web a manufacturing execution system, or mes, is a comprehensive, dynamic software system that monitors, tracks, documents, and controls the process of manufacturing goods from raw materials to finished products. The social security administration uses the information from schedule se to figure your benefits under the social security program. In this case, the next business day is the due date. This date may change if it falls on a weekend or holiday; The social security administration uses the information from schedule se to figure your benefits under the social security program. Web report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). You must file your return and pay any tax due by the personal tax return filing date of april 15. This tax applies no matter how

Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. Web report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). This date may change if it falls on a weekend or holiday; This tax applies no matter how The social security administration uses the information from schedule se to figure your benefits under the social security program. You must file your return and pay any tax due by the personal tax return filing date of april 15. In this case, the next business day is the due date. Web a manufacturing execution system, or mes, is a comprehensive, dynamic software system that monitors, tracks, documents, and controls the process of manufacturing goods from raw materials to finished products. The social security administration uses the information from schedule se to figure your benefits under the social security program.

Book Form 1040 Schedule SE Tax Goddess Publishing

Web report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). The social security administration uses the information from schedule se to figure your benefits under the social security program. This date may change if it falls on a weekend or holiday; In this case, the next business day.

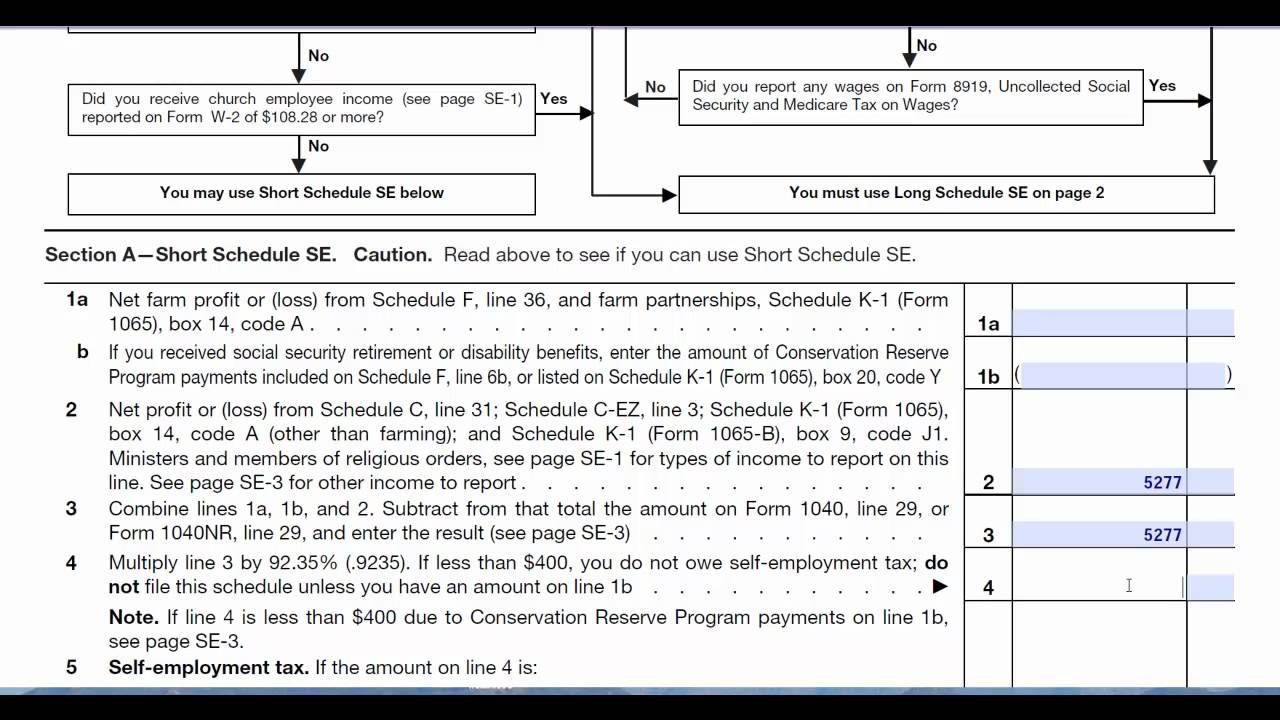

Schedule SE SelfEmployment (Form 1040) Tax return preparation YouTube

The social security administration uses the information from schedule se to figure your benefits under the social security program. The social security administration uses the information from schedule se to figure your benefits under the social security program. Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return..

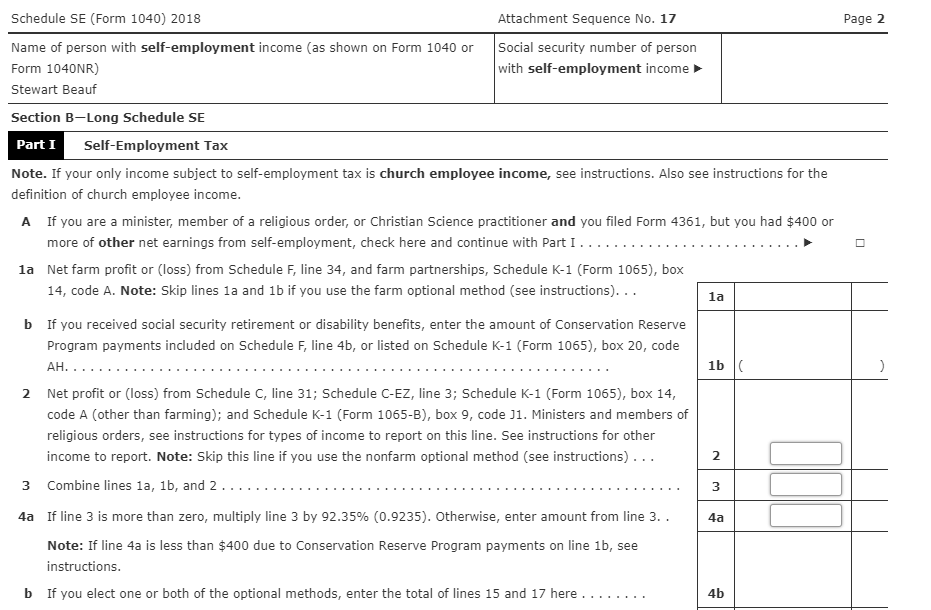

Problem 616 SelfEmployment Tax (LO 6.6) Stewart

This date may change if it falls on a weekend or holiday; In this case, the next business day is the due date. Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. The social security administration uses the information from schedule se to figure your benefits under.

Form 1040, Schedule SE SelfEmployment Tax

The social security administration uses the information from schedule se to figure your benefits under the social security program. This tax applies no matter how Web a manufacturing execution system, or mes, is a comprehensive, dynamic software system that monitors, tracks, documents, and controls the process of manufacturing goods from raw materials to finished products. Web schedule se is one.

Schedule Se Form With 1040 Form Taxact Software 1040 Form Printable

Web a manufacturing execution system, or mes, is a comprehensive, dynamic software system that monitors, tracks, documents, and controls the process of manufacturing goods from raw materials to finished products. Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. The social security administration uses the information from.

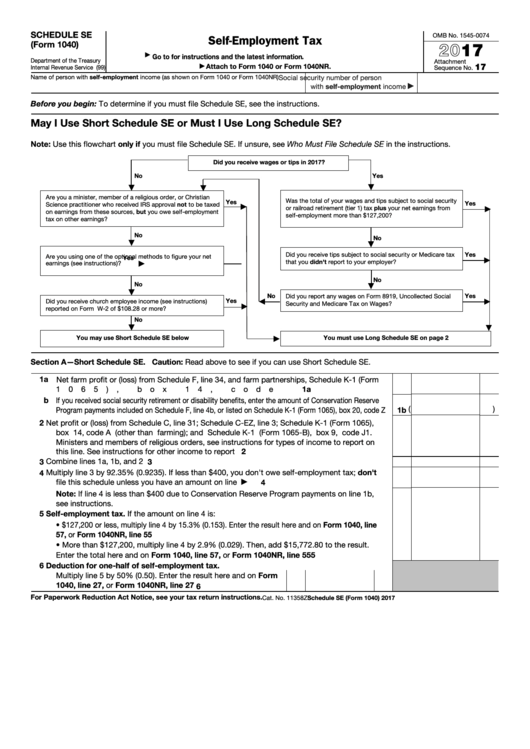

Schedule SE YouTube

Web report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). The social security administration uses the information from schedule se to figure your benefits under the social security program. Web schedule se is one of many schedules of form 1040, the form you use to file your individual.

(Need help with Schedule SE form 1040) Federal

This date may change if it falls on a weekend or holiday; Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. The social security administration uses the information from schedule se to figure your benefits under the social security program. Web report your income and expenses from.

533FilledIn Form Examples

Web schedule se is one of many schedules of form 1040, the form you use to file your individual income tax return. You must file your return and pay any tax due by the personal tax return filing date of april 15. This date may change if it falls on a weekend or holiday; The social security administration uses the.

Schedule SE A Simple Guide to Filing the SelfEmployment Tax Form

Web report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). You must file your return and pay any tax due by the personal tax return filing date of april 15. The social security administration uses the information from schedule se to figure your benefits under the social security.

2020 Form IRS 1040 Schedule SE Fill Online, Printable, Fillable

The social security administration uses the information from schedule se to figure your benefits under the social security program. The social security administration uses the information from schedule se to figure your benefits under the social security program. This tax applies no matter how This date may change if it falls on a weekend or holiday; Web schedule se is.

The Social Security Administration Uses The Information From Schedule Se To Figure Your Benefits Under The Social Security Program.

Web a manufacturing execution system, or mes, is a comprehensive, dynamic software system that monitors, tracks, documents, and controls the process of manufacturing goods from raw materials to finished products. This date may change if it falls on a weekend or holiday; This tax applies no matter how The social security administration uses the information from schedule se to figure your benefits under the social security program.

Web Schedule Se Is One Of Many Schedules Of Form 1040, The Form You Use To File Your Individual Income Tax Return.

Web report your income and expenses from your sole proprietorship on schedule c (form 1040), profit or loss from business (sole proprietorship). You must file your return and pay any tax due by the personal tax return filing date of april 15. In this case, the next business day is the due date.