Schedule M Tax Form

Schedule M Tax Form - Web what is the purpose of schedule m? Web 2007010057 fein official use only pa sales tax license number pa schedule m, part i. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Classifying federal income (loss) for pa personal income tax purposes classify,. For optimal functionality, save the form to your computer before completing or printing. In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi. Web what is tax form 1040 schedule m? The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Web purpose of schedule. Web enclose with form 740 enter name(s) as shown on tax return.

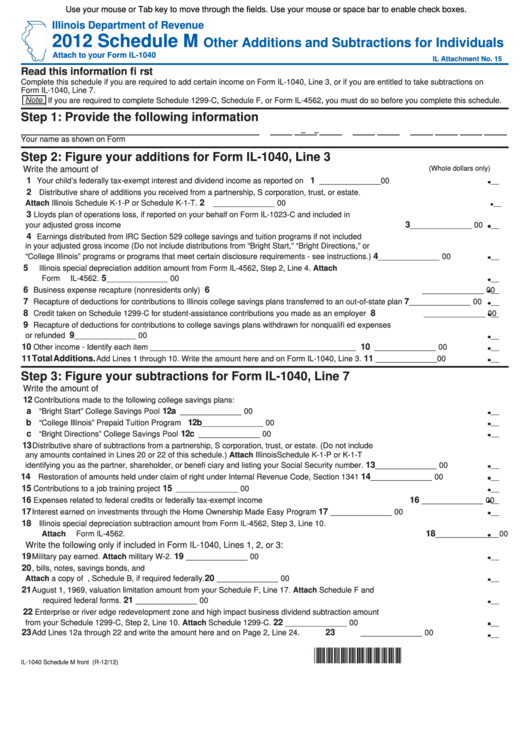

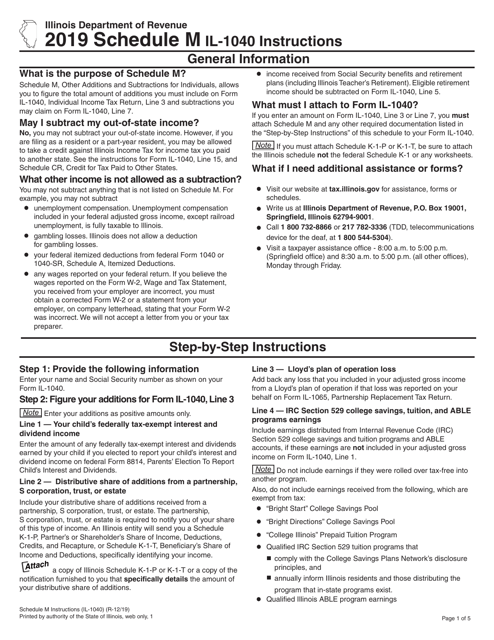

For example, the form 1040 page is at. Classifying federal income (loss) for pa personal income tax purposes classify,. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on. Nonprofit organizations that file form 990 may be required to include schedule m to. Web enclose with form 740 enter name(s) as shown on tax return. Your social security number m 2020 commonwealth of kentucky schedule department of revenue a. If your agi exceeds $75,000, then you multiply the difference by 2 percent. Web what is the purpose of schedule m? Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the 30 percent or the 50 percent special depreciation allowance or the increased section. The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you.

Your social security number m 2020 commonwealth of kentucky schedule department of revenue a. The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Web general instructions applicable schedule and instructions. Web 2007010057 fein official use only pa sales tax license number pa schedule m, part i. Web purpose of schedule. For example, the form 1040 page is at. For optimal functionality, save the form to your computer before completing or printing. Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the 30 percent or the 50 percent special depreciation allowance or the increased section. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on.

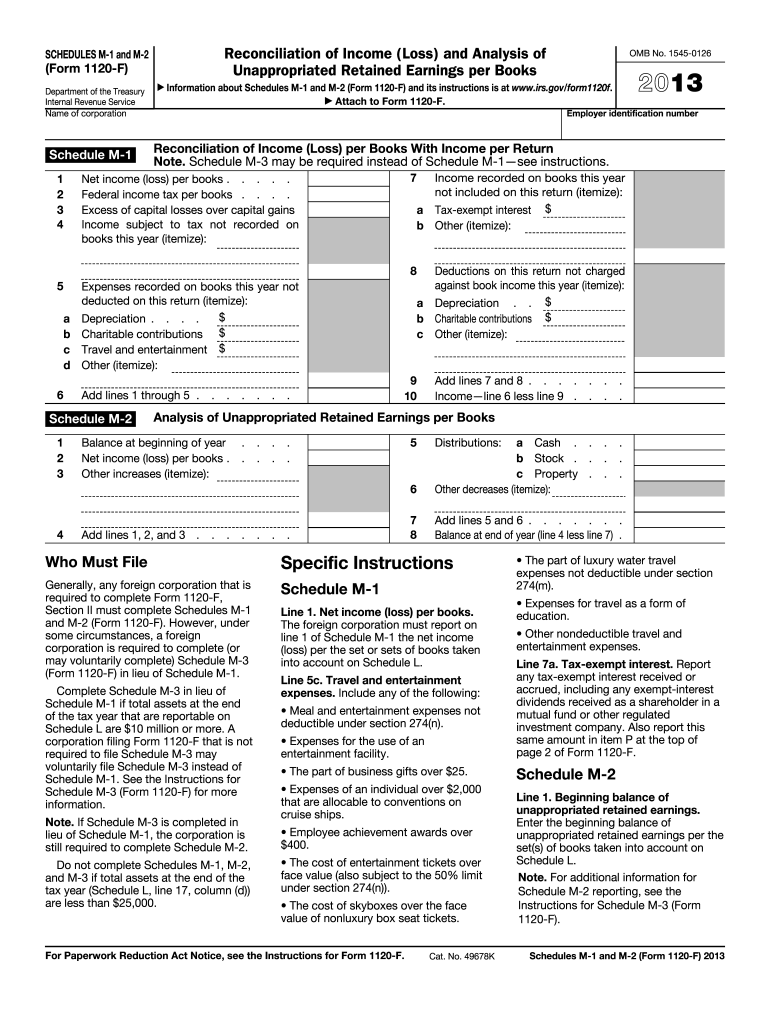

IRS 1120F Schedule M1 & M2 2013 Fill out Tax Template Online

The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the 30 percent or the 50 percent special depreciation allowance or the increased section. Web general instructions.

Fillable Schedule M Other Additions And Subtractions For Individuals

Web 2007010057 fein official use only pa sales tax license number pa schedule m, part i. Web what is the purpose of schedule m? For example, the form 1040 page is at. If your agi exceeds $75,000, then you multiply the difference by 2 percent. Web schedule m, lines 3 and 12 only if you have elected for federal income.

3.11.15 Return of Partnership Internal Revenue Service

Classifying federal income (loss) for pa personal income tax purposes classify,. If your agi exceeds $75,000, then you multiply the difference by 2 percent. Web what is the purpose of schedule m? The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Web general instructions applicable.

Download Instructions for Form IL1040 Schedule M Other Additions and

Web general instructions applicable schedule and instructions. Web purpose of schedule. If your agi exceeds $75,000, then you multiply the difference by 2 percent. In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi. The making work pay credit is scheduled to end this year,.

Don't make checks out to 'IRS' for federal taxes, or your payment could

Web enclose with form 740 enter name(s) as shown on tax return. The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Web 2007010057 fein official use only pa sales tax license number pa schedule m, part i. Web almost every form and publication has a.

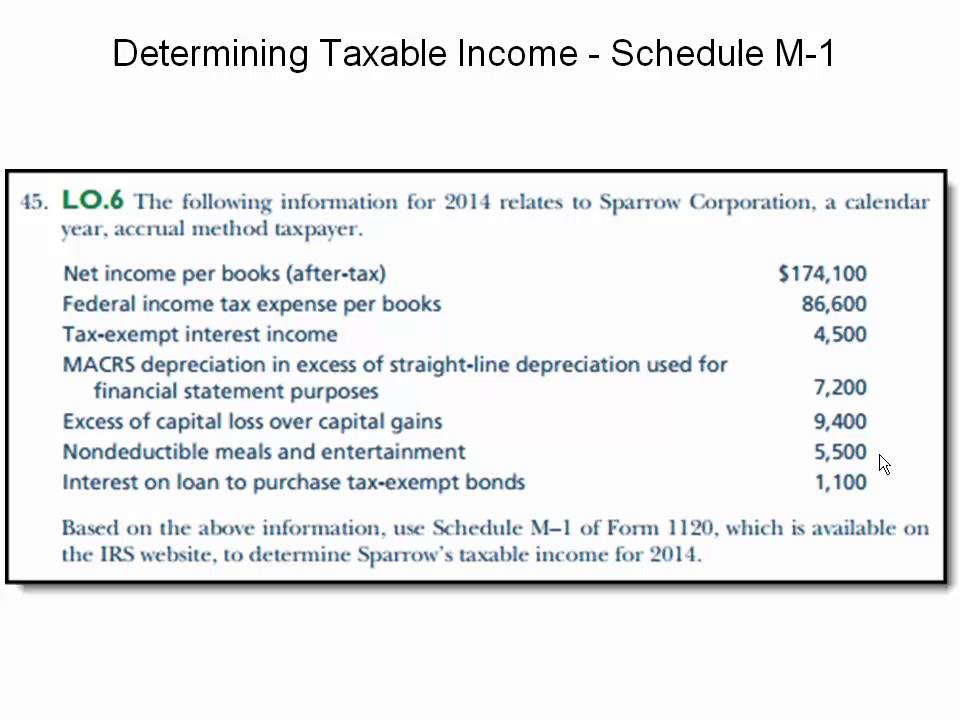

Taxable Schedule M1 Form 1120 YouTube

Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the 30 percent or the 50 percent special depreciation allowance or the increased section. Web enclose with form 740 enter name(s) as shown on tax return. Web general instructions applicable schedule and instructions. Web what is tax form 1040 schedule m?.

schedule m 2 fashion online magazine

Web in form 1065, u.s. Web general instructions applicable schedule and instructions. Nonprofit organizations that file form 990 may be required to include schedule m to. If your agi exceeds $75,000, then you multiply the difference by 2 percent. For example, the form 1040 page is at.

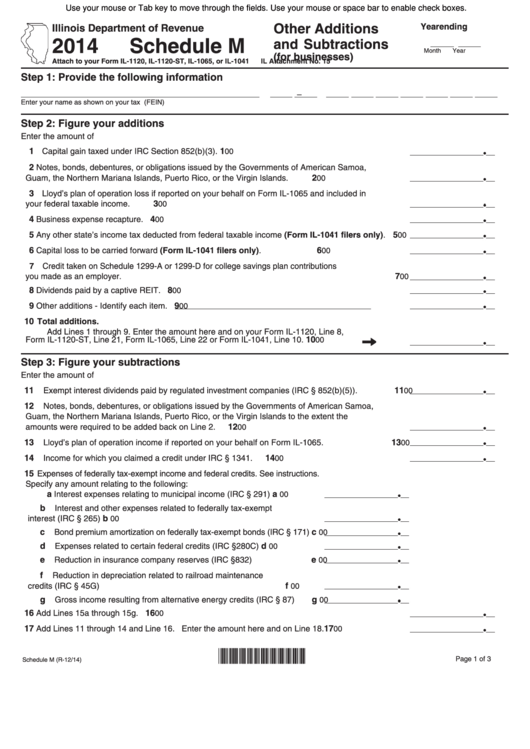

Fillable Schedule M Illinois Other Additions And Subtractions (For

The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Nonprofit organizations that file form 990 may be required to include schedule m to. Reconciliation of income (loss) per books with analysis of net income (loss) per return. Web almost every form and publication has a.

2019 Form IRS 990 Schedule M Fill Online, Printable, Fillable, Blank

For example, the form 1040 page is at. Web purpose of schedule. For optimal functionality, save the form to your computer before completing or printing. If your agi exceeds $75,000, then you multiply the difference by 2 percent. Web what is the purpose of schedule m?

Form 8858 (Schedule M) Transactions between Foreign Disregarded

Classifying federal income (loss) for pa personal income tax purposes classify,. The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Web in form 1065, u.s. Web schedule m, lines 3 and 12 only if you have elected for federal income tax purposes to take the.

Nonprofit Organizations That File Form 990 May Be Required To Include Schedule M To.

For optimal functionality, save the form to your computer before completing or printing. Your social security number m 2020 commonwealth of kentucky schedule department of revenue a. Web purpose of schedule. Reconciliation of income (loss) per books with analysis of net income (loss) per return.

Web In Form 1065, U.s.

Web what is tax form 1040 schedule m? Web what is the purpose of schedule m? Web almost every form and publication has a page on irs.gov with a friendly shortcut. Web general instructions applicable schedule and instructions.

For Example, The Form 1040 Page Is At.

Classifying federal income (loss) for pa personal income tax purposes classify,. Web 2007010057 fein official use only pa sales tax license number pa schedule m, part i. If your agi exceeds $75,000, then you multiply the difference by 2 percent. Schedule m, other additions and subtractions, allows you to figure the total amount of “other additions and subtractions” you must include on.

Web Schedule M, Lines 3 And 12 Only If You Have Elected For Federal Income Tax Purposes To Take The 30 Percent Or The 50 Percent Special Depreciation Allowance Or The Increased Section.

The making work pay credit is scheduled to end this year, but if you know what tax form 1040 schedule m is, then you. Web enclose with form 740 enter name(s) as shown on tax return. In 2010, if your gross wages are more than $6,451, or $12,903 when filing a joint return, then you first subtract $75,000 from your agi.