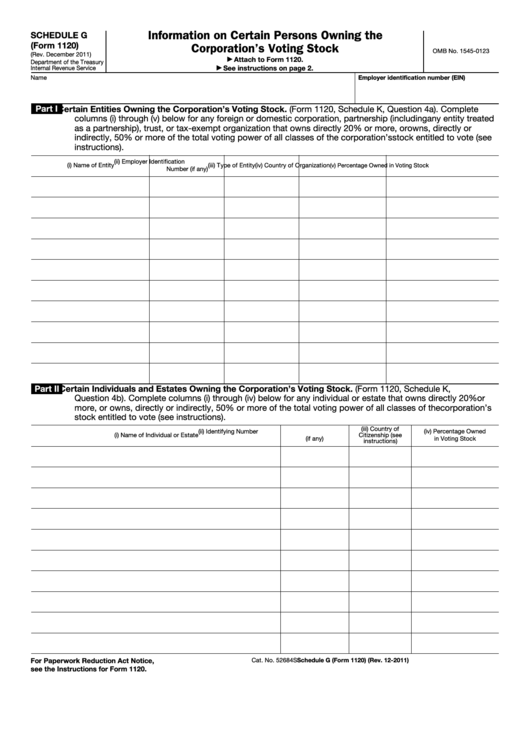

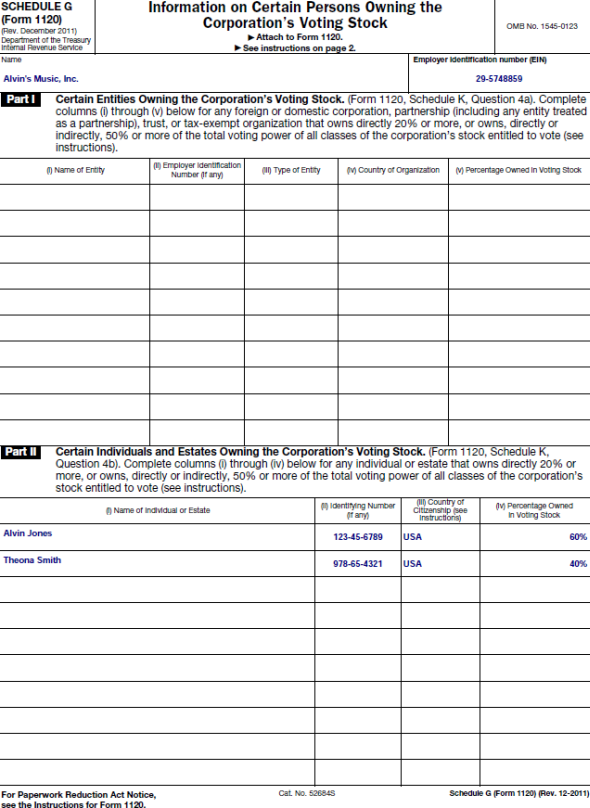

Schedule G Form

Schedule G Form - Executory contracts and unexpired leases (individuals) download form (pdf, 56.41 kb) form number: Line 10—2022 estimated tax payments and amount applied from 2021 return; December 2011) department of the treasury internal revenue service information on. Complete as many entries as needed to report all leases in. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Web schedule g (form 5500) department of treasury internal revenue service department of labor employee benefits security administration financial transaction schedules. Secretary of state vehicle services department commercial. Web form 8978 worksheet—schedule g, part i, line 8; Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Web purpose of schedule.

Ad access irs tax forms. Get ready for this year's tax season quickly and safely with pdffiller! Get ready for tax season deadlines by completing any required tax forms today. Keep track of all the latest moves in the standings here. Secretary of state vehicle services department commercial. Web los angeles rams guard logan bruss missed his entire rookie season to injury in 2022, but is back in top form for this year's training camp Executory contracts and unexpired leases page 1 of ___ official form 206g schedule g: Line 10—2022 estimated tax payments and amount applied from 2021 return; Complete as many entries as needed to report all leases in. Generally, you have 4 years from the later of the due date of your tax return or the date.

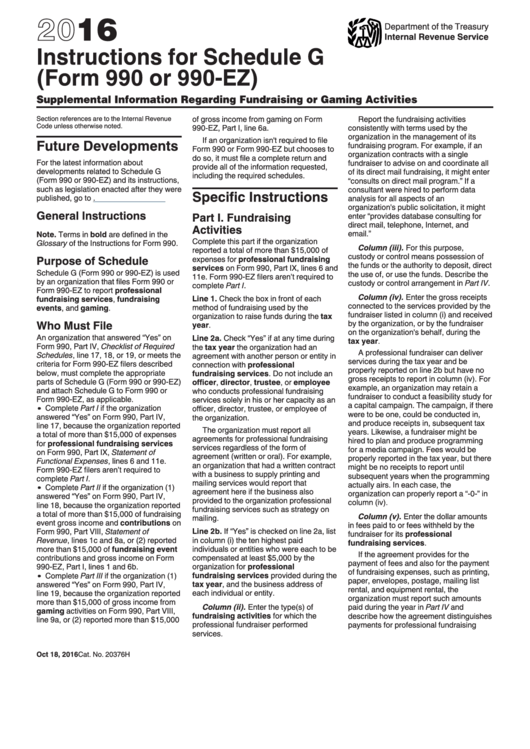

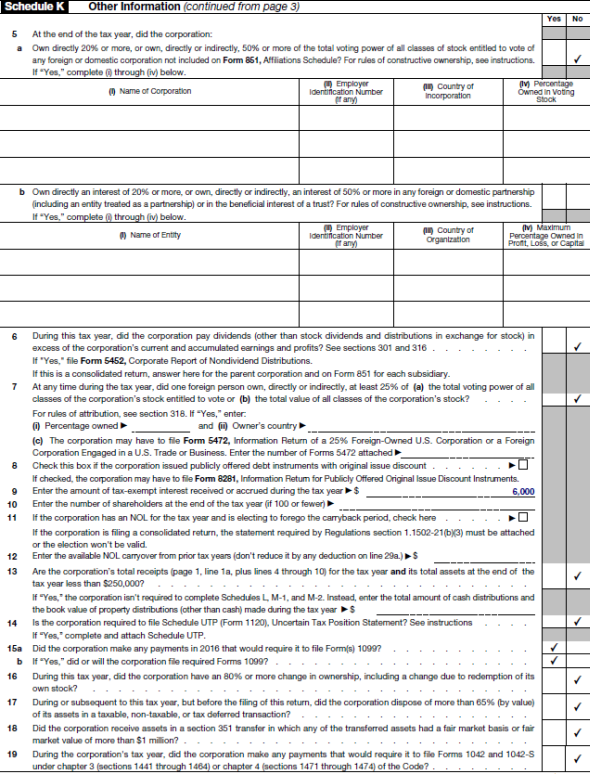

Web schedule g (form 5500) department of treasury internal revenue service department of labor employee benefits security administration financial transaction schedules. December 2021) department of the treasury internal revenue service. Executory contracts and unexpired leases page 1 of ___ official form 206g schedule g: Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web purpose of schedule. Web schedule g (form 1120) (rev. Generally, you have 4 years from the later of the due date of your tax return or the date. Ad access irs tax forms. Statement of application of the gain deferral method under section.

Fillable Schedule G (Form 1120) Information On Certain Persons Owning

Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Executory contracts and unexpired leases 12/15 be as. Generally, you have 4 years from the later of the due date of your tax return or the date. Web schedule g (form 5500) 2020 page. December 2011) department of the treasury.

General InstructionsPurpose of FormUse Schedule G (Form...

Executory contracts and unexpired leases (individuals) download form (pdf, 56.41 kb) form number: Web schedule g (form 8865) (rev. December 2011) department of the treasury internal revenue service information on. Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20%. Complete if the organization answered “yes” on form 990, part iv,.

Instructions For Schedule G (Form 990 Or 990Ez) Supplemental

Ad access irs tax forms. Executory contracts and unexpired leases page 1 of ___ official form 206g schedule g: Executory contracts and unexpired leases 12/15 be as. Web los angeles rams guard logan bruss missed his entire rookie season to injury in 2022, but is back in top form for this year's training camp December 2011) department of the treasury.

Form G1041 Edit, Fill, Sign Online Handypdf

Get ready for tax season deadlines by completing any required tax forms today. Keep track of all the latest moves in the standings here. Complete as many entries as needed to report all leases in. Ad access irs tax forms. Web purpose of schedule.

General InstructionsPurpose of FormUse Schedule G (Form...

Line 10—2022 estimated tax payments and amount applied from 2021 return; Generally, you have 4 years from the later of the due date of your tax return or the date. Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Statement of application of the gain deferral method under section..

Form 1120 (Schedule G) Information on Certain Persons Owning the

Executory contracts and unexpired leases 12/15 be as. Web schedule g (form 5500) department of treasury internal revenue service department of labor employee benefits security administration financial transaction schedules. Web los angeles rams guard logan bruss missed his entire rookie season to injury in 2022, but is back in top form for this year's training camp Secretary of state vehicle.

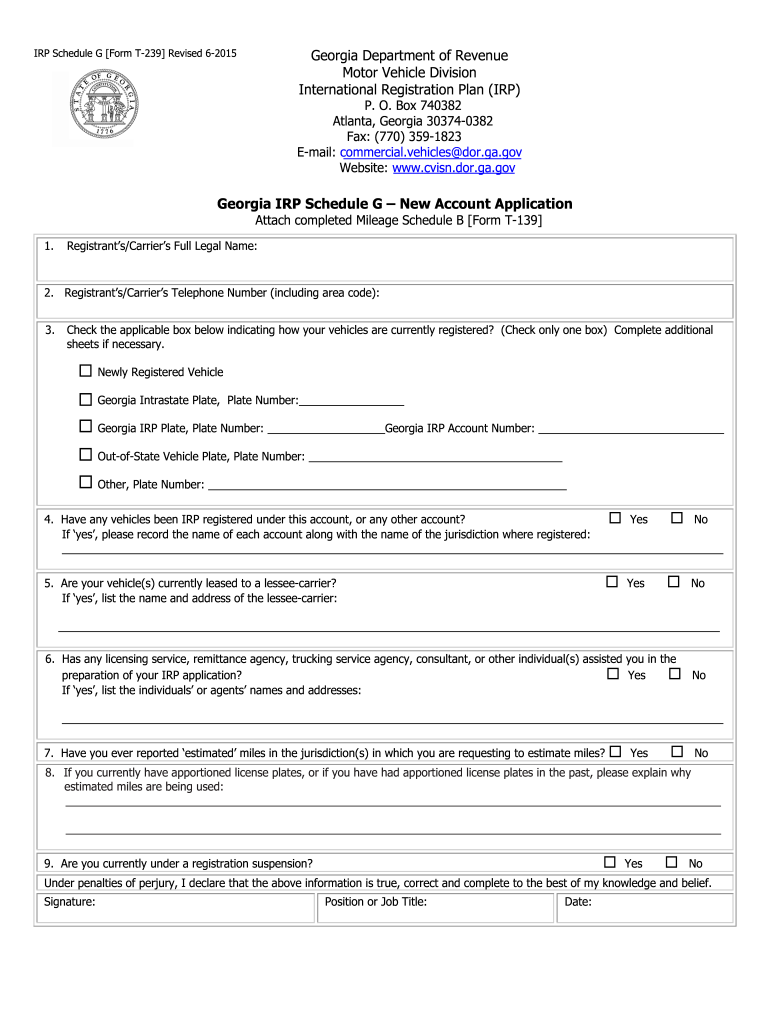

20152019 Form GA T239 IRP Schedule G Fill Online, Printable

Ad access irs tax forms. Web purpose of schedule. Complete as many entries as needed to report all leases in. Statement of application of the gain deferral method under section. Web the women's world cup is underway and australia faces a tough battle to make it out of group b.

IRS Form 1120 Schedule G

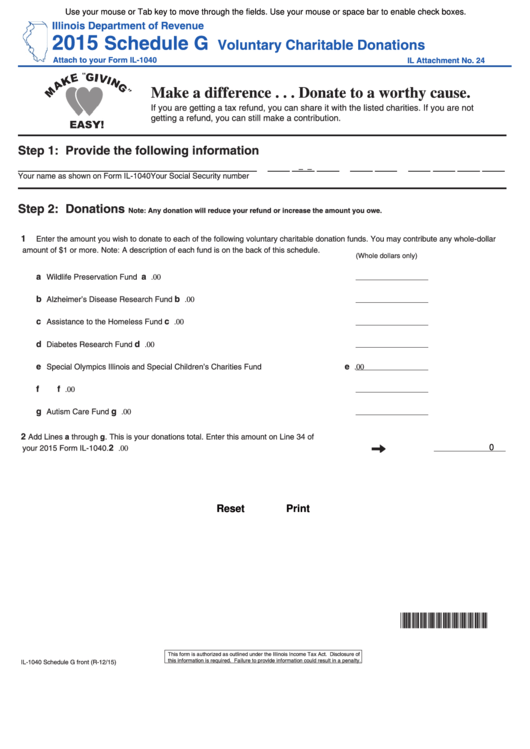

Complete, edit or print tax forms instantly. Get ready for this year's tax season quickly and safely with pdffiller! Web schedule g (form 1120) (rev. Web purpose of schedule. Web schedule g (form 990) 2023 page 2 part ii fundraising events.

irs form 1120 schedule g

December 2021) department of the treasury internal revenue service. Web purpose of schedule. Complete if the organization answered “yes” on form 990, part iv, line 18, or reported more than. Get ready for this year's tax season quickly and safely with pdffiller! Web schedule g (form 1120) (rev.

Fillable Schedule G (Form Il1040) Illinois Voluntary Charitable

Executory contracts and unexpired leases (individuals) download form (pdf, 56.41 kb) form number: Use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own, directly, 20%. December 2021) department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Executory contracts and unexpired leases page 1 of ___ official form 206g.

Web Form 8978 Worksheet—Schedule G, Part I, Line 8;

Executory contracts and unexpired leases (individuals) download form (pdf, 56.41 kb) form number: Line 10—2022 estimated tax payments and amount applied from 2021 return; Executory contracts and unexpired leases 12/15 be as. Complete as many entries as needed to report all leases in.

December 2011) Schedule G (Form 1120) (Rev.

Web for a trust return what is a schedule g and where do i find it? that is the tax computations section located on page 2 of your 1041. December 2011) department of the treasury internal revenue service information on. Web los angeles rams guard logan bruss missed his entire rookie season to injury in 2022, but is back in top form for this year's training camp Web schedule g (form 5500) 2020 page.

December 2021) Department Of The Treasury Internal Revenue Service.

Secretary of state vehicle services department commercial. Web the women's world cup is underway and australia faces a tough battle to make it out of group b. Executory contracts and unexpired leases page 1 of ___ official form 206g schedule g: Web purpose of schedule.

Use Schedule G (Form 1120) To Provide Information Applicable To Certain Entities, Individuals, And Estates That Own, Directly, 20%.

Part ii schedule of leases in default or classified as uncollectible. Generally, you have 4 years from the later of the due date of your tax return or the date. Get ready for tax season deadlines by completing any required tax forms today. Statement of application of the gain deferral method under section.