Schedule G Form 5471

Schedule G Form 5471 - “returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. What is it, how to file it, & when do you have to report foreign corporations to the irs. 9901, 85 fr 43042, july 15, 2020, as. Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Complete any applicable fields with information for schedule g. Web for paperwork reduction act notice, see the instructions for form 5471. Web irc 6046 irc 6046 refers to: With respect to the foreign corporation; Follow the instructions below for an individual (1040) return, or click on a different tax.

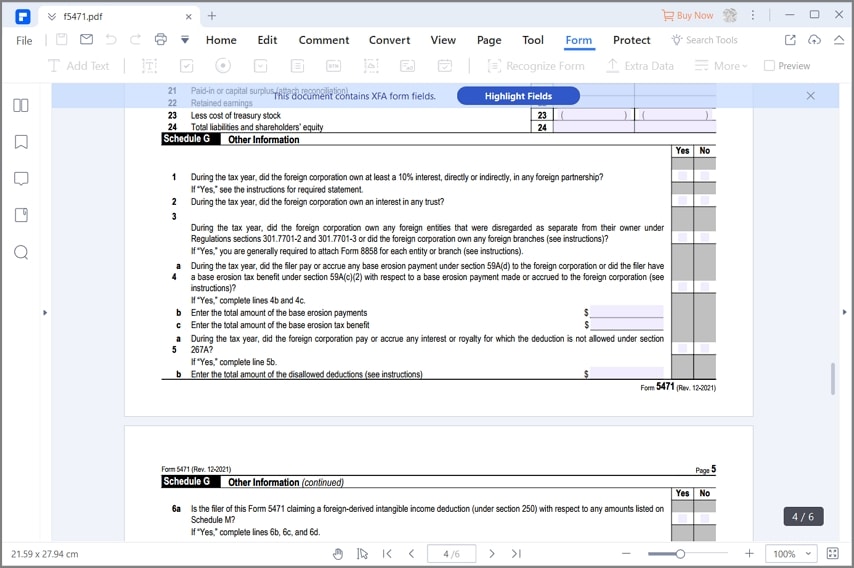

Web on page 5 of form 5471, two new questions have been added to schedule g. Complete any applicable fields with information for schedule g. •the form, schedules, and instructions •a person. Web form 5471, information return of u.s. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Form 5471 should be attached to your income tax or. Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Web for paperwork reduction act notice, see the instructions for form 5471. Web irc 6046 irc 6046 refers to: What is it, how to file it, & when do you have to report foreign corporations to the irs.

Web for paperwork reduction act notice, see the instructions for form 5471. New question 22a asks if any extraordinary reduction with respect to a controlling section. “returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. •the form, schedules, and instructions •a person. Complete any applicable fields with information for schedule g. 9901, 85 fr 43042, july 15, 2020, as. With respect to the foreign corporation; The following are irs business rules for electronically filing form 5471: Web form 5471, information return of u.s.

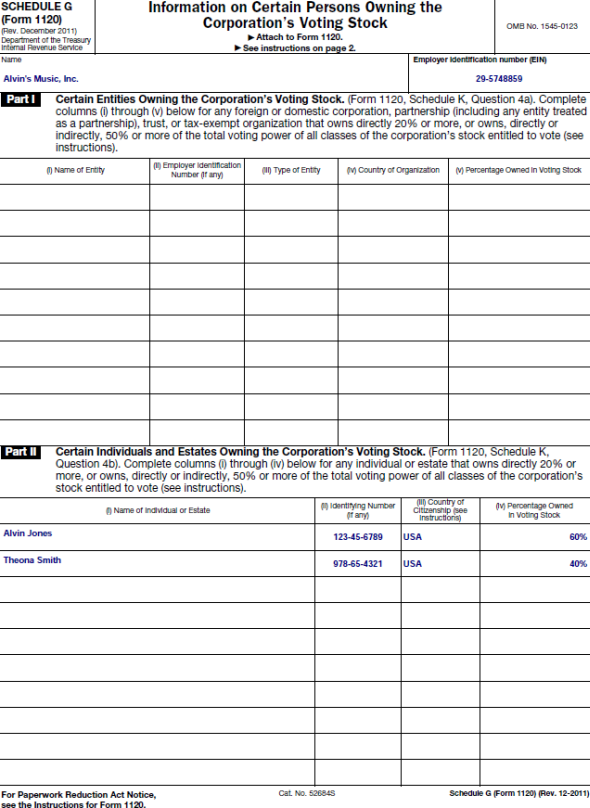

General InstructionsPurpose of FormUse Schedule G (Form...

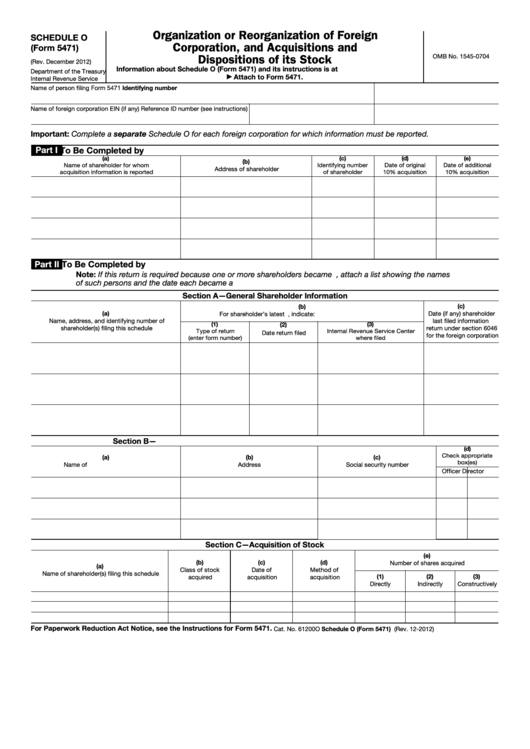

“returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?. Web for paperwork reduction act notice, see the instructions for form 5471. Web irc 6046 irc 6046 refers to: New question 22a asks if any extraordinary reduction with respect to a controlling section. Persons with respect to.

How to Fill out IRS Form 5471 (2020 Tax Season)

Web irc 6046 irc 6046 refers to: Web on page 5 of form 5471, two new questions have been added to schedule g. Complete any applicable fields with information for schedule g. “returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?. Web form 5471 is an.

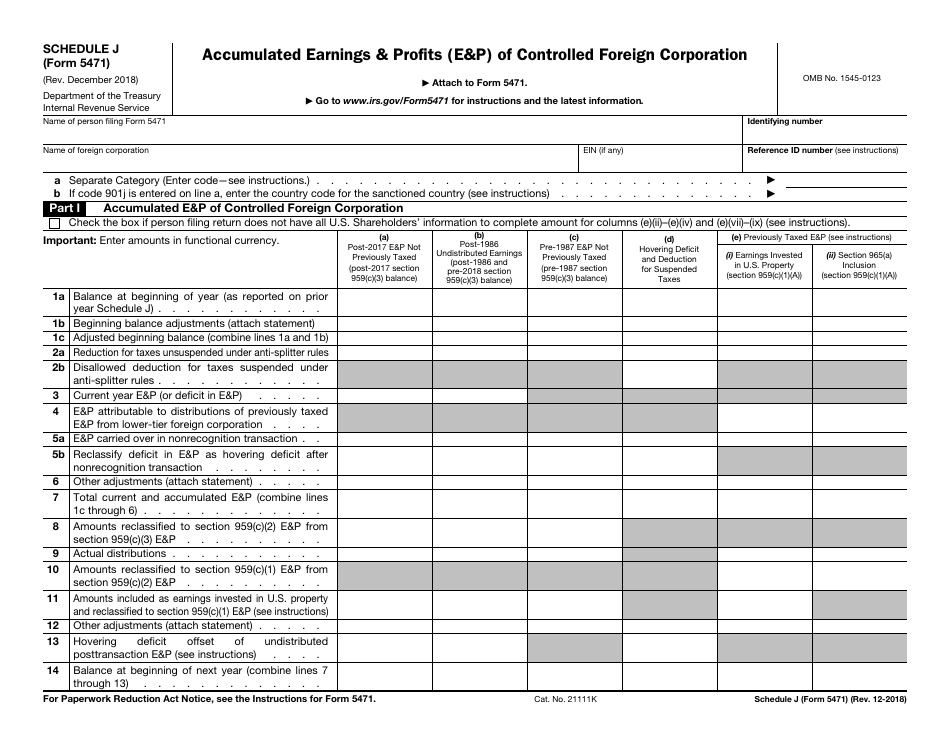

IRS Form 5471 Schedule J Download Fillable PDF or Fill Online

•the form, schedules, and instructions •a person. Web on page 5 of form 5471, two new questions have been added to schedule g. Web form 5471 is an “ information return of u.s. Web this article will help you generate form 5471 and any required schedules. Form 5471 should be attached to your income tax or.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Web what’s new electronic filing of form 5471 the 10% stock ownership requirement on page 3. Complete any applicable fields with information for schedule g. Persons with respect to certain foreign corporations, is.

Fillable Form 5471 Schedule O Organization Or Of

Follow the instructions below for an individual (1040) return, or click on a different tax. Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. Web what’s new electronic filing of form 5471 the 10% stock ownership requirement on page 3. “returns as.

Form 5471 Schedule J Instructions 2019 cloudshareinfo

Web on page 5 of form 5471, two new questions have been added to schedule g. Complete any applicable fields with information for schedule g. Web form 5471, information return of u.s. Web form 5471 is an “ information return of u.s. •the form, schedules, and instructions •a person.

The Tax Times IRS Issues Updated New Form 5471 What's New?

“returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?. Web irc 6046 irc 6046 refers to: Follow the instructions below for an individual (1040) return, or click on a different tax. •the form, schedules, and instructions •a person. Web form 5471, information return of u.s.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. 9901, 85 fr 43042, july 15, 2020, as. Complete any applicable fields with information for schedule g. Web this article will help you generate form 5471 and any.

Form 5471 Information Return of U.S. Persons with Respect to Certain

Web on page 5 of form 5471, two new questions have been added to schedule g. New question 22a asks if any extraordinary reduction with respect to a controlling section. “returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?. Complete any applicable fields with information for.

FREE 17+ Sample Schedule Forms in PDF MS Word Excel

Form 5471 should be attached to your income tax or. Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web form 5471, information return of u.s. Persons with respect to certain foreign corporations.” in translation, it is.

Complete Any Applicable Fields With Information For Schedule G.

What is it, how to file it, & when do you have to report foreign corporations to the irs. Web form 5471, information return of u.s. •the form, schedules, and instructions •a person. “returns as to organization or reorganization of foreign corporations and as to acquisitions of their stock.” who is required to file form 5471?.

Web Irc 6046 Irc 6046 Refers To:

Web more on part iii, schedule e, part iii, column (g) is for taxes attributable to residual income group as determined and reported on form 5471, schedule q, and you guys know. Web this article will help you generate form 5471 and any required schedules. Form 5471 should be attached to your income tax or. Follow the instructions below for an individual (1040) return, or click on a different tax.

Web What’s New Electronic Filing Of Form 5471 The 10% Stock Ownership Requirement On Page 3.

Web on page 5 of form 5471, the wording of schedule g, lines 6a through 6d was amended to reflect the final regulations under section 250 (t.d. New question 22a asks if any extraordinary reduction with respect to a controlling section. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. 9901, 85 fr 43042, july 15, 2020, as.

Persons With Respect To Certain Foreign Corporations, Is Designed To Report The Activities Of The Foreign Corporation And To Function.

Web form 5471 is an “ information return of u.s. Web on page 5 of form 5471, two new questions have been added to schedule g. With respect to the foreign corporation; Web for paperwork reduction act notice, see the instructions for form 5471.