Schedule C Form 8829

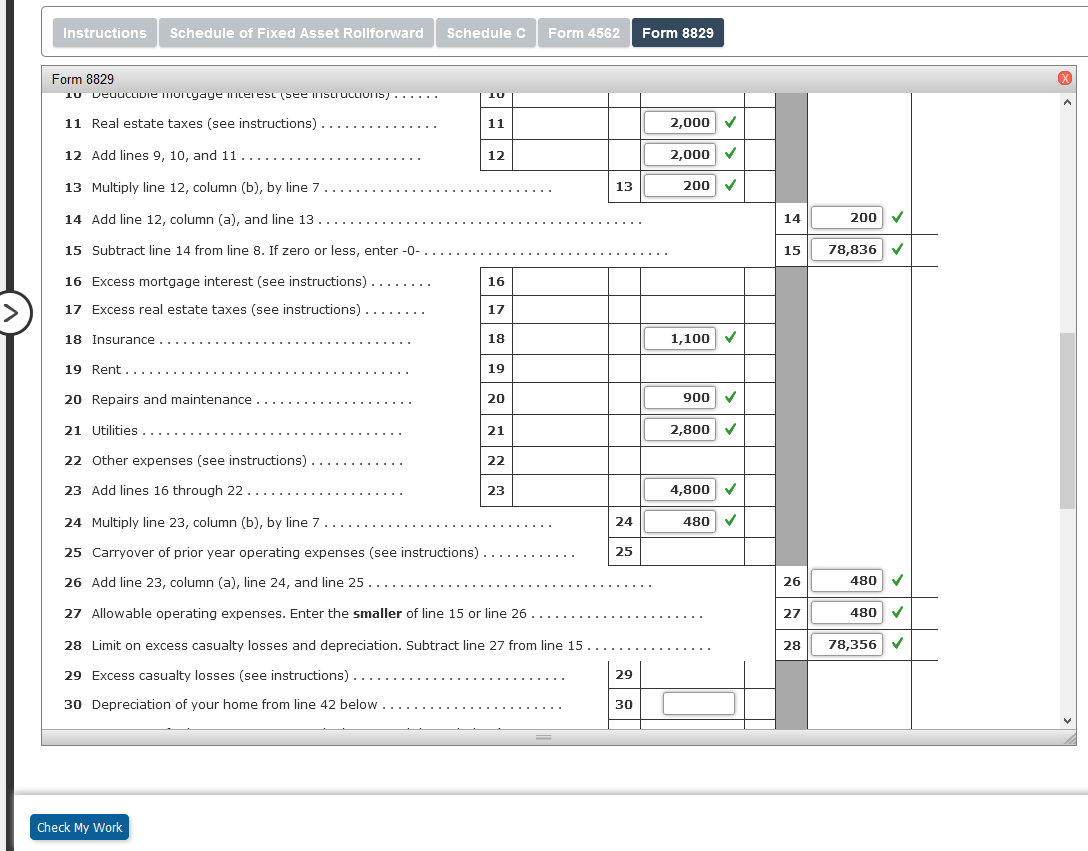

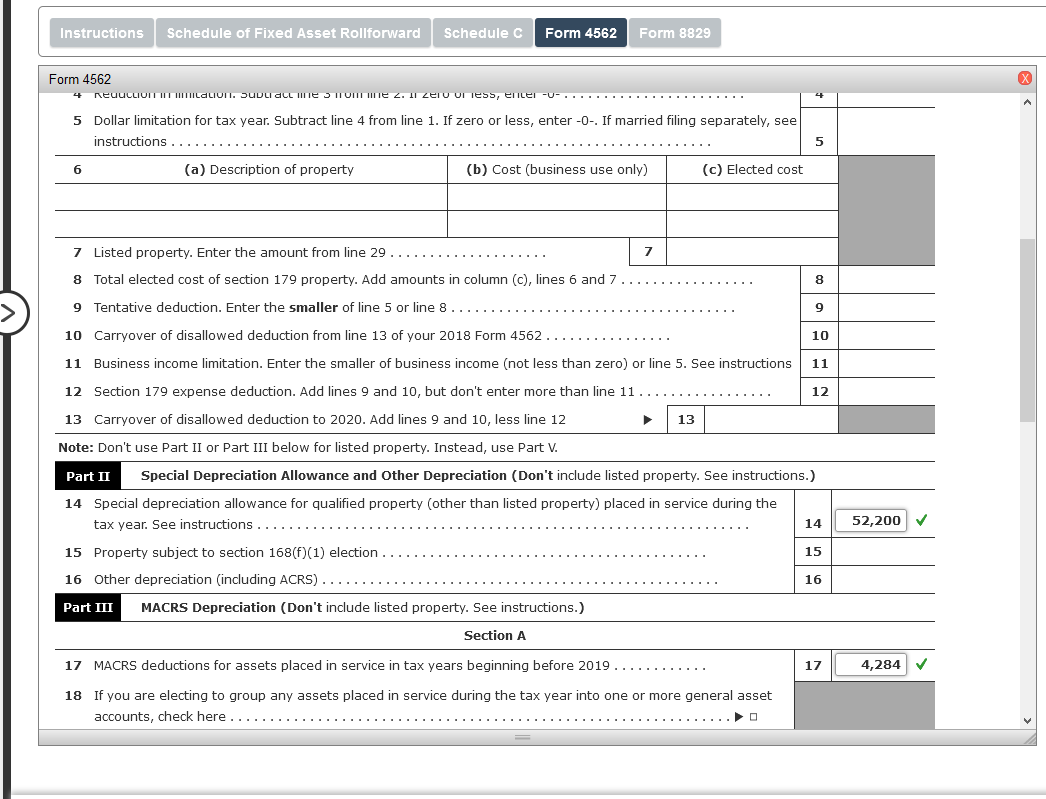

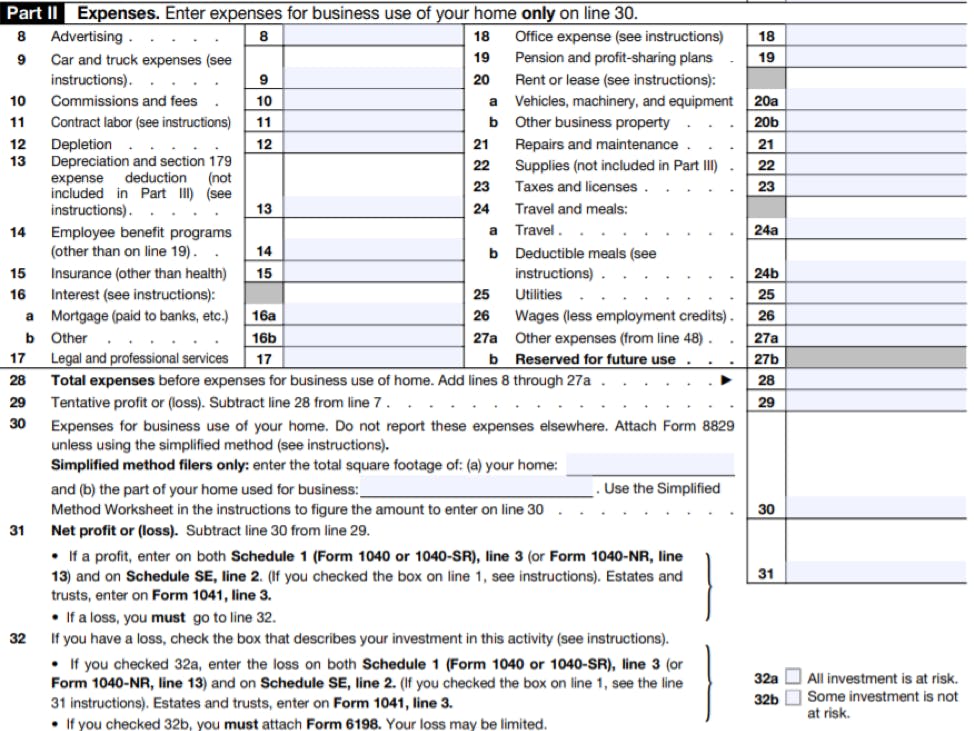

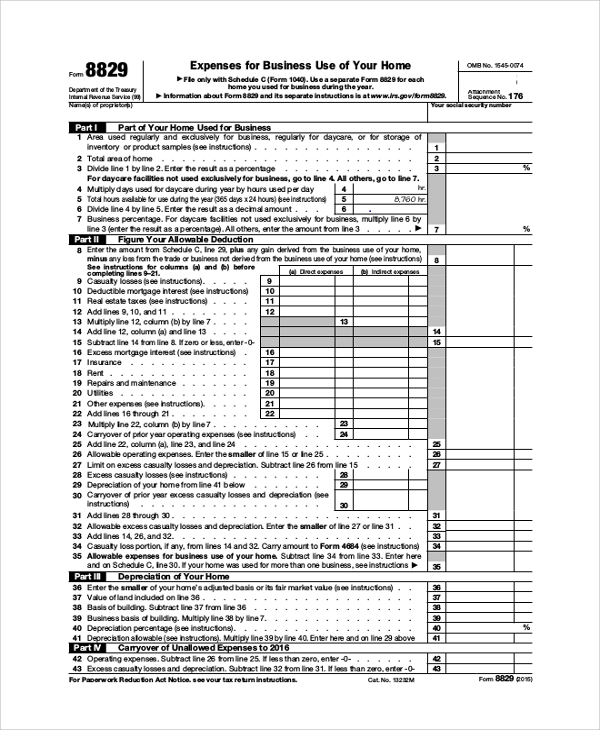

Schedule C Form 8829 - Screen 8829 also can be directed to a schedule f, form 2106 or to a k1p, in which case view/print mode produces wks 8829 rather than form 8829. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914) it gets $1,975. Which turbotax cd/download product is right for you? Home office deduction video lo. Use a separate form 8829 for each home you used for the business during the year. Web file only with schedule c (form 1040). Web use screen 8829 to report expenses associated with an office in the taxpayer's main home. How to take a home office write off. If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it to increase a business loss.

But that is not correct. Go to www.irs.gov/form8829 for instructions and the latest information. Web check schedule c, line 29, tentative profit or (loss). How to take a home office write off. Web file only with schedule c (form 1040). If line 29 is zero or if it shows a loss, stop, you may not take the home office deduction or use it to increase a business loss. Use a separate form 8829 for each home you used for the business during the year. When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914) it gets $1,975. Partnerships must generally file form 1065. Different programs may use different entry lines.

Please see the following turbotax website for a list of forms available in each version of turbotax: If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. Go to www.irs.gov/form8829 for instructions and the latest information. Web check schedule c, line 29, tentative profit or (loss). Web use screen 8829 to report expenses associated with an office in the taxpayer's main home. Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. Use a separate form 8829 for each home you used for business during the year. But that is not correct. 176 name(s) of proprietor(s) your social security number part i part of your home used for business 1 Which turbotax cd/download product is right for you?

I NEED HELP WITH THE BLANKS PLEASE. """ALL

If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. Web file only with schedule c (form 1040). Use a separate form 8829 for each home you used for business during the year. How to take a home office write off. When the online turbotax se system multiplies line 41 (2.5641%) x.

The New York Times > Business > Image > Form 8829

When the online turbotax se system multiplies line 41 (2.5641%) x line 40 ($75,914) it gets $1,975. Go to www.irs.gov/form8829 for instructions and the latest information. Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. If line 29 is zero or if it shows a loss, stop,.

Schedule C Profit or Loss From Business Definition

Web schedule c, income and expenses, and form 8829 are available in turbotax home and business cd/download. If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. Use a separate form 8829 for each home you used for the business during the year. Form 8829 is produced only when directed to a.

I NEED HELP WITH THE BLANKS PLEASE. """ALL

Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. 176 name(s) of proprietor(s) your social security number part i part of your home used for business 1 Please see the following turbotax website for a list of forms available in each version of turbotax: But that is.

Working for Yourself? What to Know about IRS Schedule C Credit Karma

But that is not correct. Use a separate form 8829 for each home you used for business during the year. How to take a home office write off. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web schedule c, income and.

FREE 9+ Sample Schedule C Forms in PDF MS Word

176 name(s) of proprietor(s) your social security number part i part of your home used for business 1 Which turbotax cd/download product is right for you? Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Screen 8829 also can be directed to.

Irs 1040 Form C Checklist For Irs Schedule C Profit Of Loss From

Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a.

Solved Required Complete Trish's Schedule C, Form 8829, and

Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Partnerships must generally file form 1065. Web check schedule c, line 29, tentative profit or (loss). But that is not correct. When the online turbotax se system multiplies line 41 (2.5641%) x line.

Solved Required Complete Trish's Schedule C, Form 8829, and

Web check schedule c, line 29, tentative profit or (loss). Partnerships must generally file form 1065. Go to www.irs.gov/form8829 for instructions and the latest information. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. Screen 8829 also can be directed to a schedule f, form 2106.

Form 8829 Expenses for Business Use of Your Home (2015) Free Download

Go to www.irs.gov/form8829 for instructions and the latest information. Web file only with schedule c (form 1040). Different programs may use different entry lines. Which turbotax cd/download product is right for you? How to take a home office write off.

Web File Only With Schedule C (Form 1040).

Web check schedule c, line 29, tentative profit or (loss). Screen 8829 also can be directed to a schedule f, form 2106 or to a k1p, in which case view/print mode produces wks 8829 rather than form 8829. Home office deduction video lo. Web go to www.irs.gov/schedulec for instructions and the latest information.

Web Information About Form 8829, Expenses For Business Use Of Your Home, Including Recent Updates, Related Forms And Instructions On How To File.

But that is not correct. Web home office deduction and your taxes.form 1040, schedule c, form 8829home office expense. If schedule c, line 29 shows a tentative profit, complete form 8829 to compute the home office deduction. 176 name(s) of proprietor(s) your social security number part i part of your home used for business 1

If Line 29 Is Zero Or If It Shows A Loss, Stop, You May Not Take The Home Office Deduction Or Use It To Increase A Business Loss.

Form 8829 is produced only when directed to a schedule c using the for drop list at the top of the screen. Use a separate form 8829 for each home you used for business during the year. Web schedule c, income and expenses, and form 8829 are available in turbotax home and business cd/download. Go to www.irs.gov/form8829 for instructions and the latest information.

Web Use Screen 8829 To Report Expenses Associated With An Office In The Taxpayer's Main Home.

Please see the following turbotax website for a list of forms available in each version of turbotax: Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web march 1, 2022 10:47 am 0 reply bookmark icon lmcolton level 2 i found what i believe is a calculation error on form 8829. Different programs may use different entry lines.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

:max_bytes(150000):strip_icc()/Screenshot58-cb1ceaa73b884957a1108ca88b1c2da8.png)