Sc Form 1040 Instructions

Sc Form 1040 Instructions - These related forms may also be needed with the south carolina form sc1040. Individual tax return form 1040 instructions; Web popular forms & instructions; You must complete sc1040tc and attach a copy of the other state's income tax return. Check if this is an amended return. Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. Form name sc use tax worksheet and payment return. Form name drycleaning facility surcharge return. Whether you file online or by paper, choose to receive your refund by direct deposit. Report all your income as though you were a resident for the entire year.

Form name sc use tax worksheet and payment return. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Web a worksheet is included in the sc1040 instructions to help you calculate and pay use tax. Individual tax return form 1040 instructions; You must complete sc1040tc and attach a copy of the other state's income tax return. These related forms may also be needed with the south carolina form sc1040. Web popular forms & instructions; Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. 1 ready for your refund? You will be allowed a credit for taxes paid on income taxed by south carolina and another state.

For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the deadline to claim a refund is april 18, 2026. Form name agricultural exemption certificate. These related forms may also be needed with the south carolina form sc1040. Web file now with turbotax related south carolina individual income tax forms: View all 69 south carolina income tax forms form sources: 1 ready for your refund? Individual tax return form 1040 instructions; Report all your income as though you were a resident for the entire year. Web free printable 2022 south carolina form sc1040 and 2022 south carolina form sc1040. Whether you file online or by paper, choose to receive your refund by direct deposit.

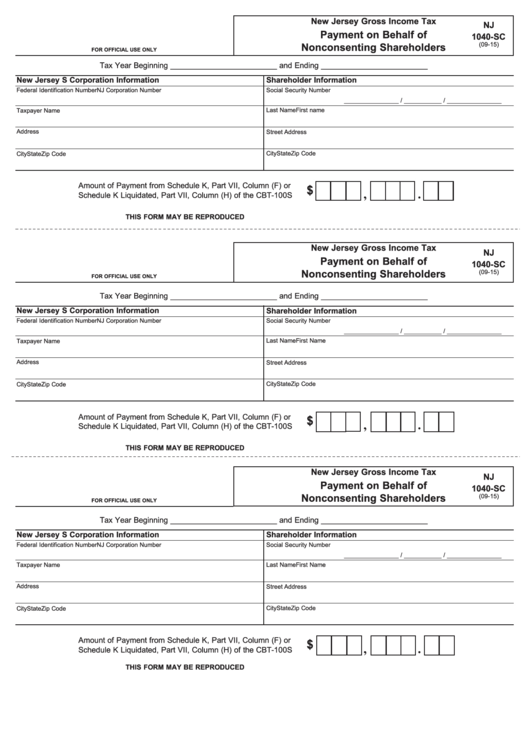

Fillable Form Nj 1040Sc Payment On Behalf Of Nonconsenting

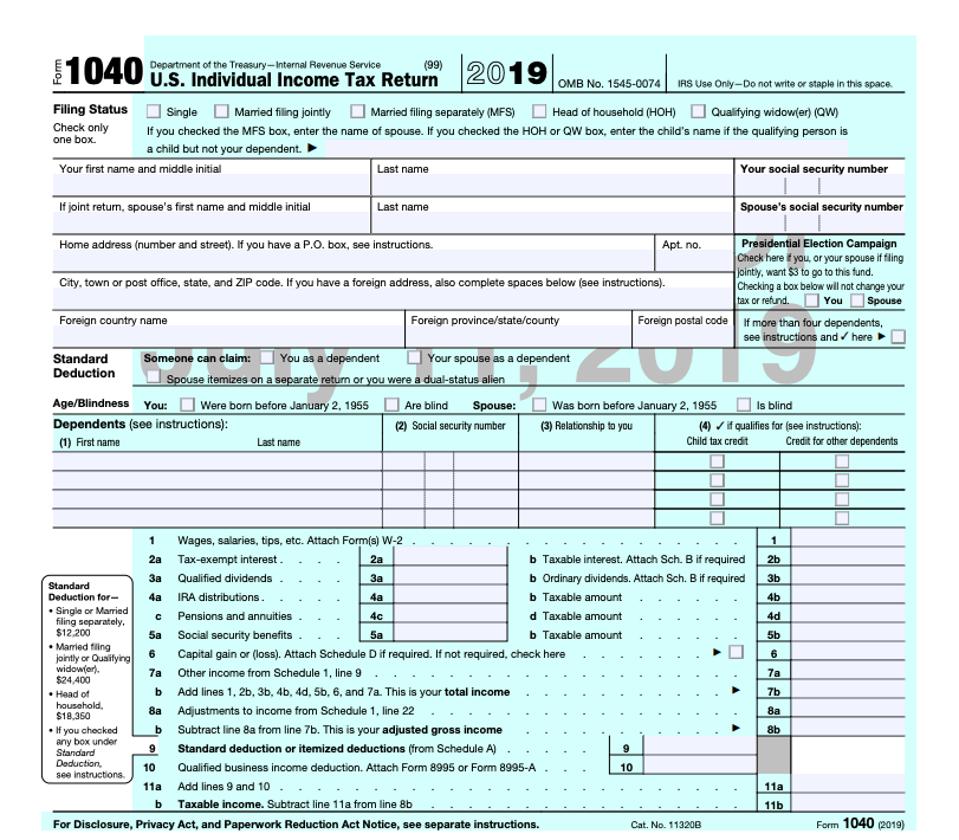

Individual tax return form 1040 instructions; Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Form name sc use tax worksheet and payment return. Check if this is an amended return. Web file now with turbotax related south carolina individual income tax forms:

1040ez Printable Form carfare.me 20192020

For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the deadline to claim a refund is april 18, 2026. You must complete sc1040tc and attach a copy of the other state's income tax return. Whether you file online or by paper, choose to receive your refund by direct deposit. Web popular forms.

IRS Instructions 1040 (Schedule SE) 2018 2019 Printable & Fillable

Report all your income as though you were a resident for the entire year. Web a worksheet is included in the sc1040 instructions to help you calculate and pay use tax. Taxformfinder has an additional 68 south carolina income tax forms that you may need, plus all federal income tax forms. These related forms may also be needed with the.

2022 Irs Instructions 1040 Editable Online Blank in PDF

1 ready for your refund? Web popular forms & instructions; For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the deadline to claim a refund is april 18, 2026. Web file now with turbotax related south carolina individual income tax forms: Taxformfinder has an additional 68 south carolina income tax forms that.

1040 Tax Tables 2018 Pdf Elcho Table 1040 Form Printable

Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Form name drycleaning facility surcharge return. Form name sc use tax worksheet and payment return. View all 69 south carolina income tax forms form sources: These related forms may also be needed with the south carolina form sc1040.

IRS Form 1040 Form 1041 Instructions DefenseTax

View all 69 south carolina income tax forms form sources: Web popular forms & instructions; Whether you file online or by paper, choose to receive your refund by direct deposit. Check if this is an amended return. Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev.

Download 1040 Instructions for Free Page 23 FormTemplate

Web free printable 2022 south carolina form sc1040 and 2022 south carolina form sc1040. Form name drycleaning facility surcharge return. Individual tax return form 1040 instructions; For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the deadline to claim a refund is april 18, 2026. Whether you file online or by paper,.

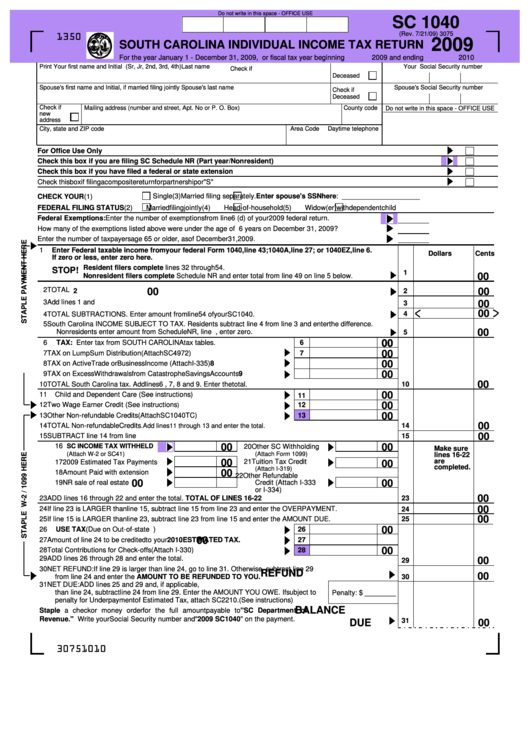

Form Sc 1040 South Carolina Individual Tax Return 2009

Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Whether you file online or by paper, choose to receive your refund by direct deposit. Web popular forms & instructions; Web a worksheet is included in the sc1040 instructions to help you calculate.

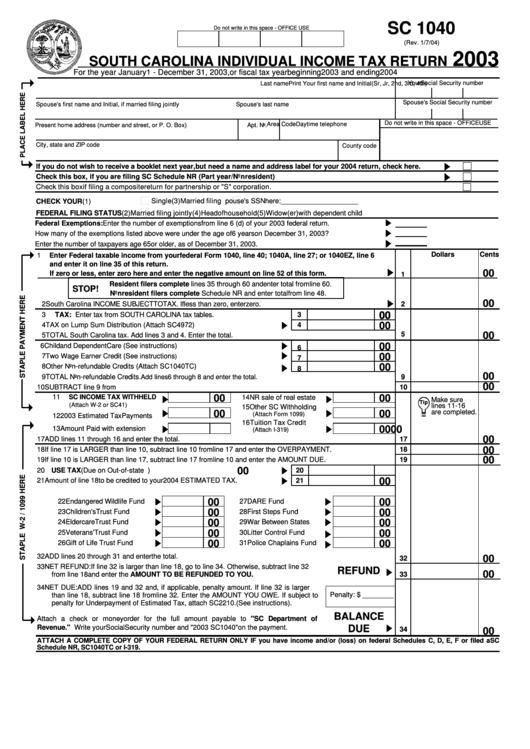

Form Sc 1040 South Carolina Individual Tax Return 2003

1 ready for your refund? It’s fast, accurate, and secure! Form name agricultural exemption certificate. Form name drycleaning facility surcharge return. Individual tax return form 1040 instructions;

How Do You Get A 1040 Tax Form Tax Walls

Web a worksheet is included in the sc1040 instructions to help you calculate and pay use tax. Form name drycleaning facility surcharge return. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: 1 ready for your refund? View all 69 south carolina income tax forms form sources:

Taxformfinder Has An Additional 68 South Carolina Income Tax Forms That You May Need, Plus All Federal Income Tax Forms.

You will be allowed a credit for taxes paid on income taxed by south carolina and another state. Web sc1040 instructions 2022 (rev 10/13/2022) things to know before you begin: Form name drycleaning facility surcharge return. Whether you file online or by paper, choose to receive your refund by direct deposit.

Web A Worksheet Is Included In The Sc1040 Instructions To Help You Calculate And Pay Use Tax.

Web popular forms & instructions; For tax year 2022, unless you have a valid extension, the due date isapril 18, 2023 and the deadline to claim a refund is april 18, 2026. View all 69 south carolina income tax forms form sources: It’s fast, accurate, and secure!

You Must Complete Sc1040Tc And Attach A Copy Of The Other State's Income Tax Return.

Form name agricultural exemption certificate. Web file now with turbotax related south carolina individual income tax forms: Individual tax return form 1040 instructions; Web state of south carolina department of revenue 2022 individual income tax return sc1040 (rev.

Web Free Printable 2022 South Carolina Form Sc1040 And 2022 South Carolina Form Sc1040.

Report all your income as though you were a resident for the entire year. These related forms may also be needed with the south carolina form sc1040. Check if this is an amended return. Form name sc use tax worksheet and payment return.