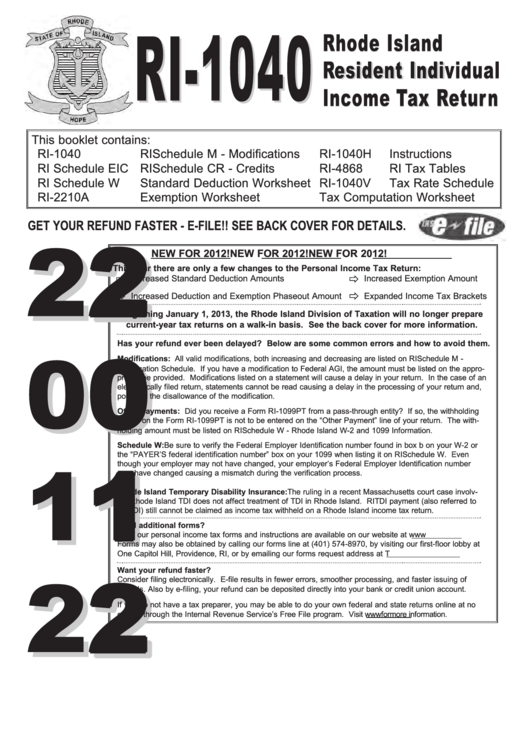

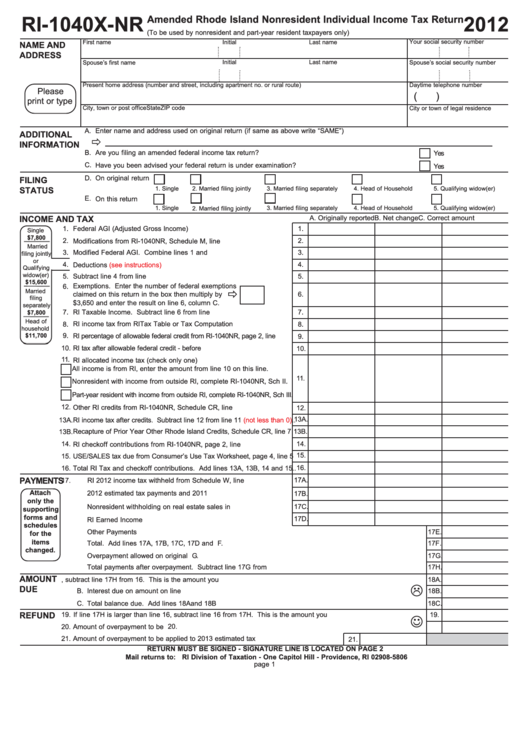

Rhode Island Part Year Resident Tax Form

Rhode Island Part Year Resident Tax Form - Those under 65 who are not disabled do not qualify for the credit. Web personal income tax. What if one spouse is a resident and. Complete, edit or print tax forms instantly. Complete your 2022 federal income tax. Complete your 2021 federal income tax return first. Complete your 2020 federal income tax return first. Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr. Complete, edit or print tax forms instantly. Edit, sign and print tax forms on any device with signnow.

We last updated the resident tax return. Web individual mandate penalty (see instructions). What if one spouse is a resident and. Edit, sign and print tax forms on any device with signnow. Complete your 2021 federal income tax return first. Check to certify full year coverage. 15b 16 rhode island income tax after credits. Resident forms and instructions are available upon request at the rhode island. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. This does not include temporary absences.

Web personal income tax. Complete your 2019 federal income tax return first. Edit, sign and print tax forms on any device with signnow. Complete your 2022 federal income tax. Resident forms and instructions are available upon request at the rhode island. 15b 16 rhode island income tax after credits. We last updated the resident tax return. If you did not earn any income outside the state of rhode island while you were living in rhode. Web individual mandate penalty (see instructions). Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr.

Form Ri1040 Rhode Island Resident Individual Tax Return

Complete your 2020 federal income tax return first. Complete, edit or print tax forms instantly. Nonresident real estate withholding tax forms; Resident forms and instructions are available upon request at the rhode island. If you did not earn any income outside the state of rhode island while you were living in rhode.

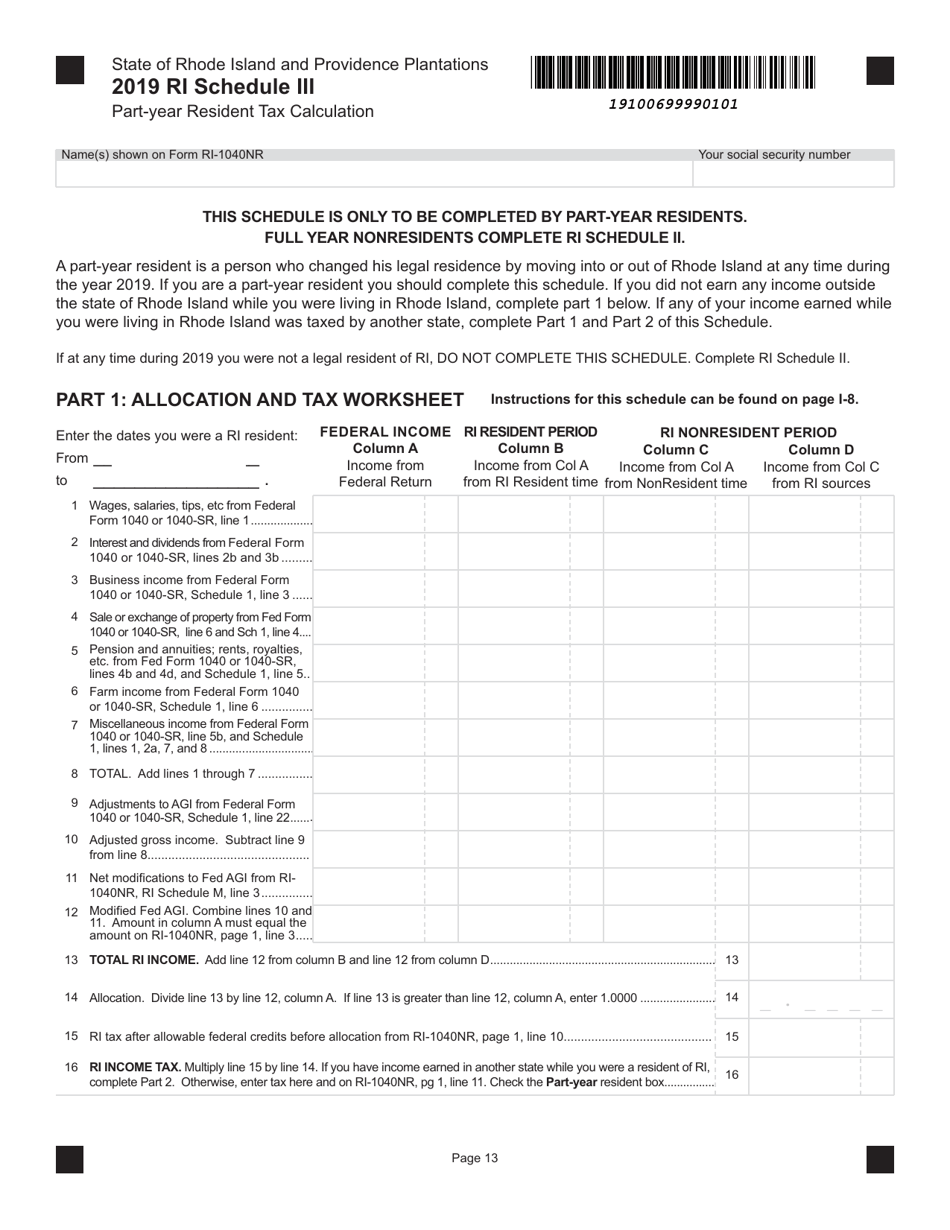

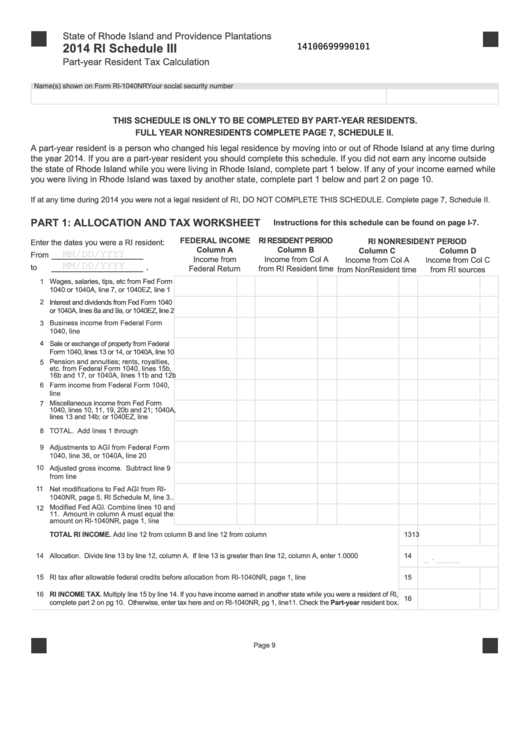

Schedule III Download Fillable PDF or Fill Online PartYear Resident

Full year resident taxpayers will file their individual income tax returns on form ri. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in. Complete your 2020 federal income tax return first. This does not include temporary absences. Complete your 2019 federal income tax.

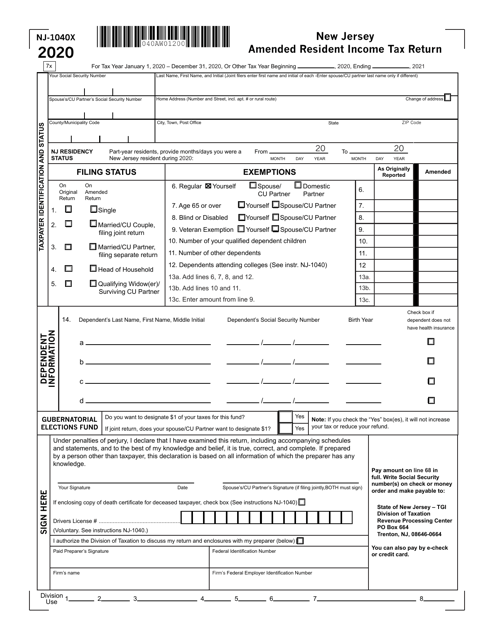

Form NJ1040X Download Fillable PDF or Fill Online New Jersey Amended

Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr. 15b 16 rhode island income tax after credits. This does not include temporary absences. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have.

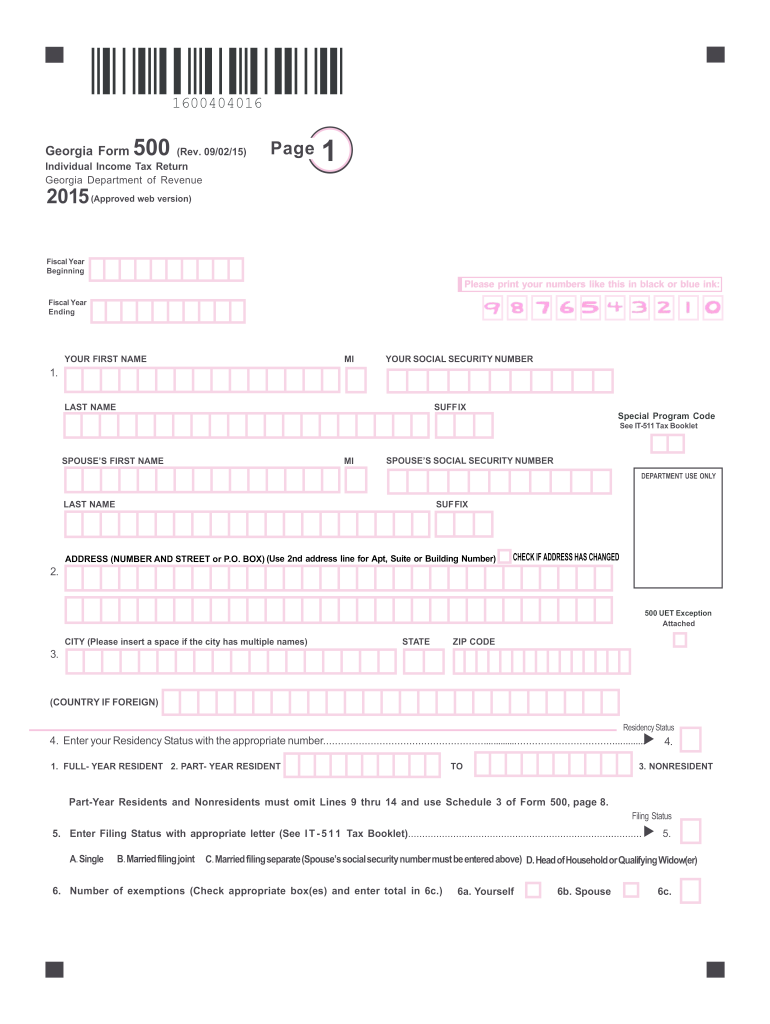

500 Tax Form Fill Out and Sign Printable PDF Template signNow

This does not include temporary absences. Complete your 2021 federal income tax return first. Complete your 2022 federal income tax. Resident forms and instructions are available upon request at the rhode island. Complete, edit or print tax forms instantly.

Fillable Form Ri1040xNr Amended Rhode Island Nonresident Individual

Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr. A personal income tax is imposed for each taxable year (which is the same as the taxable year for federal income tax purposes) on the. If you did not earn any income outside the state of.

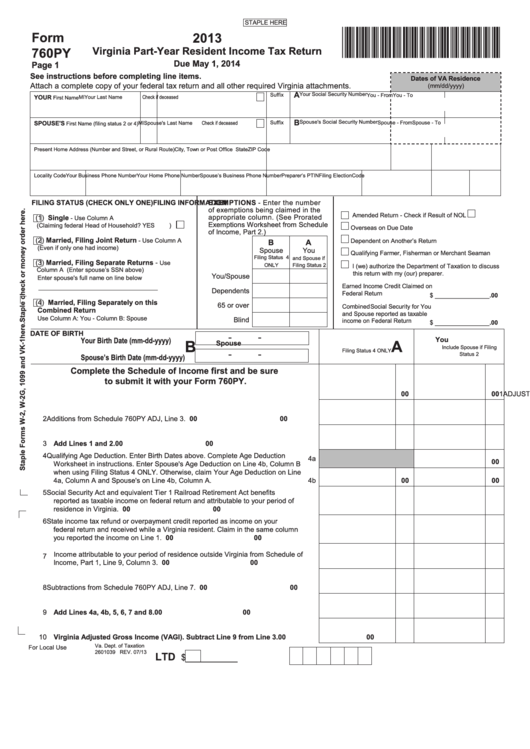

Top 22 Virginia Form 760 Templates free to download in PDF format

If you did not earn any income outside the state of rhode island while you were living in rhode. Resident forms and instructions are available upon request at the rhode island. This does not include temporary absences. Subtract line 12 from line 11 (not less than zero). A personal income tax is imposed for each taxable year (which is the.

Solved I'm being asked for "Prior Year Rhode Island Tax"

A personal income tax is imposed for each taxable year (which is the same as the taxable year for federal income tax purposes) on the. 15b 16 rhode island income tax after credits. Edit, sign and print tax forms on any device with signnow. Complete, edit or print tax forms instantly. Complete your 2022 federal income tax.

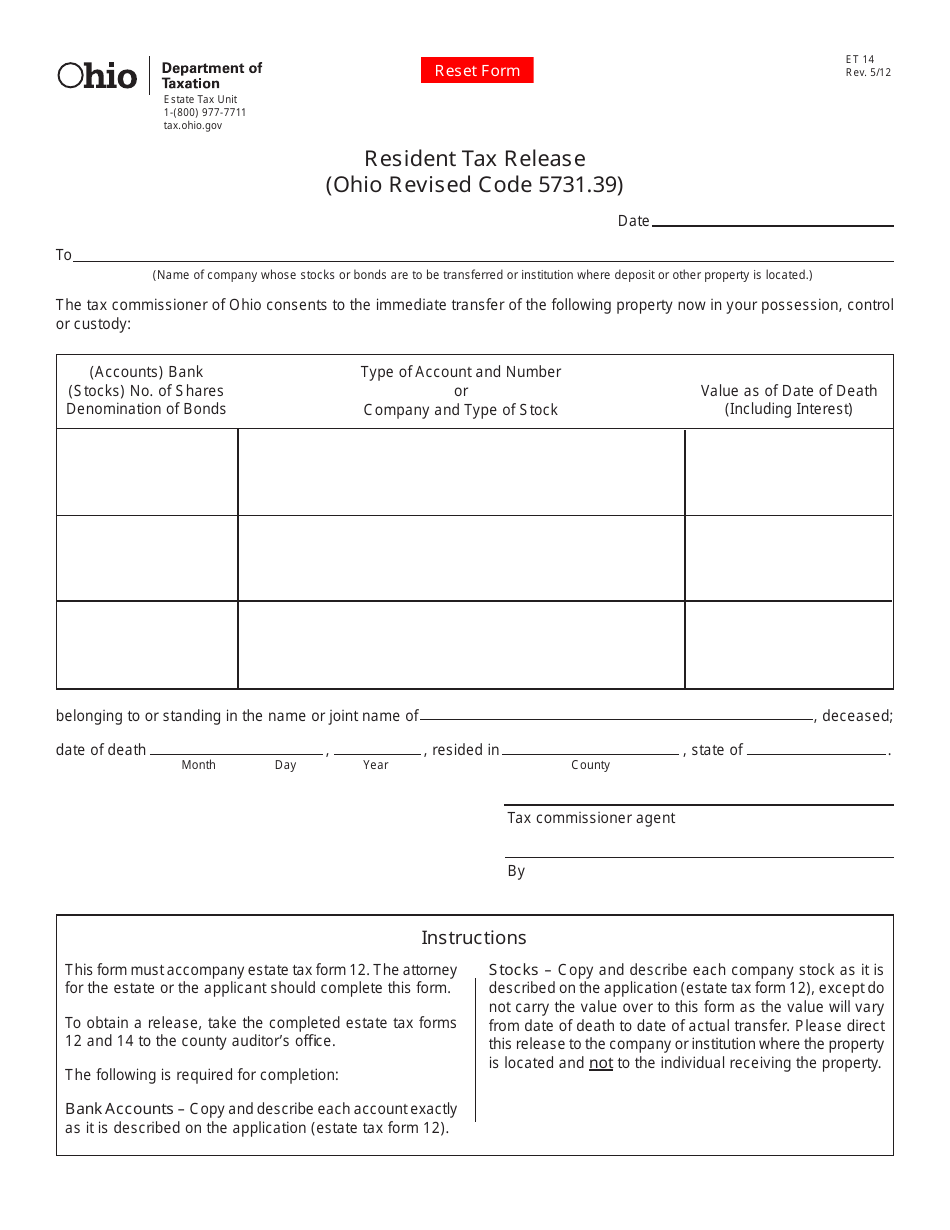

Form ET14 Download Fillable PDF or Fill Online Resident Tax Release

Complete your 2021 federal income tax return first. Complete your 2022 federal income tax. Nonresident real estate withholding tax forms; Complete your 2019 federal income tax return first. Check to certify full year coverage.

Louisiana Tax Return Nonresident And PartYear Resident Form

This does not include temporary absences. Check to certify full year coverage. Resident forms and instructions are available upon request at the rhode island. We last updated the resident tax return. Complete your 2019 federal income tax return first.

Fillable Schedule Iii Rhode Island PartYear Resident Tax Calculation

Complete, edit or print tax forms instantly. This does not include temporary absences. Complete your 2019 federal income tax return first. Edit, sign and print tax forms on any device with signnow. We last updated the resident tax return.

What If One Spouse Is A Resident And.

Complete your 2019 federal income tax return first. Nonresident real estate withholding tax forms; Check to certify full year coverage. Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr.

Those Under 65 Who Are Not Disabled Do Not Qualify For The Credit.

Resident forms and instructions are available upon request at the rhode island. Edit, sign and print tax forms on any device with signnow. If you did not earn any income outside the state of rhode island while you were living in rhode. This does not include temporary absences.

Complete Your 2021 Federal Income Tax Return First.

For tax year 2021, the property tax relief credit amount increases to $415 from $400. Complete your 2022 federal income tax. A personal income tax is imposed for each taxable year (which is the same as the taxable year for federal income tax purposes) on the. Web the rhode island tax forms are listed by tax year below and all ri back taxes for previous years would have to be mailed in.

Full Year Resident Taxpayers Will File Their Individual Income Tax Returns On Form Ri.

Web personal income tax. We last updated the resident tax return. Complete, edit or print tax forms instantly. Web individual mandate penalty (see instructions).