Quickbooks Online Form 1065

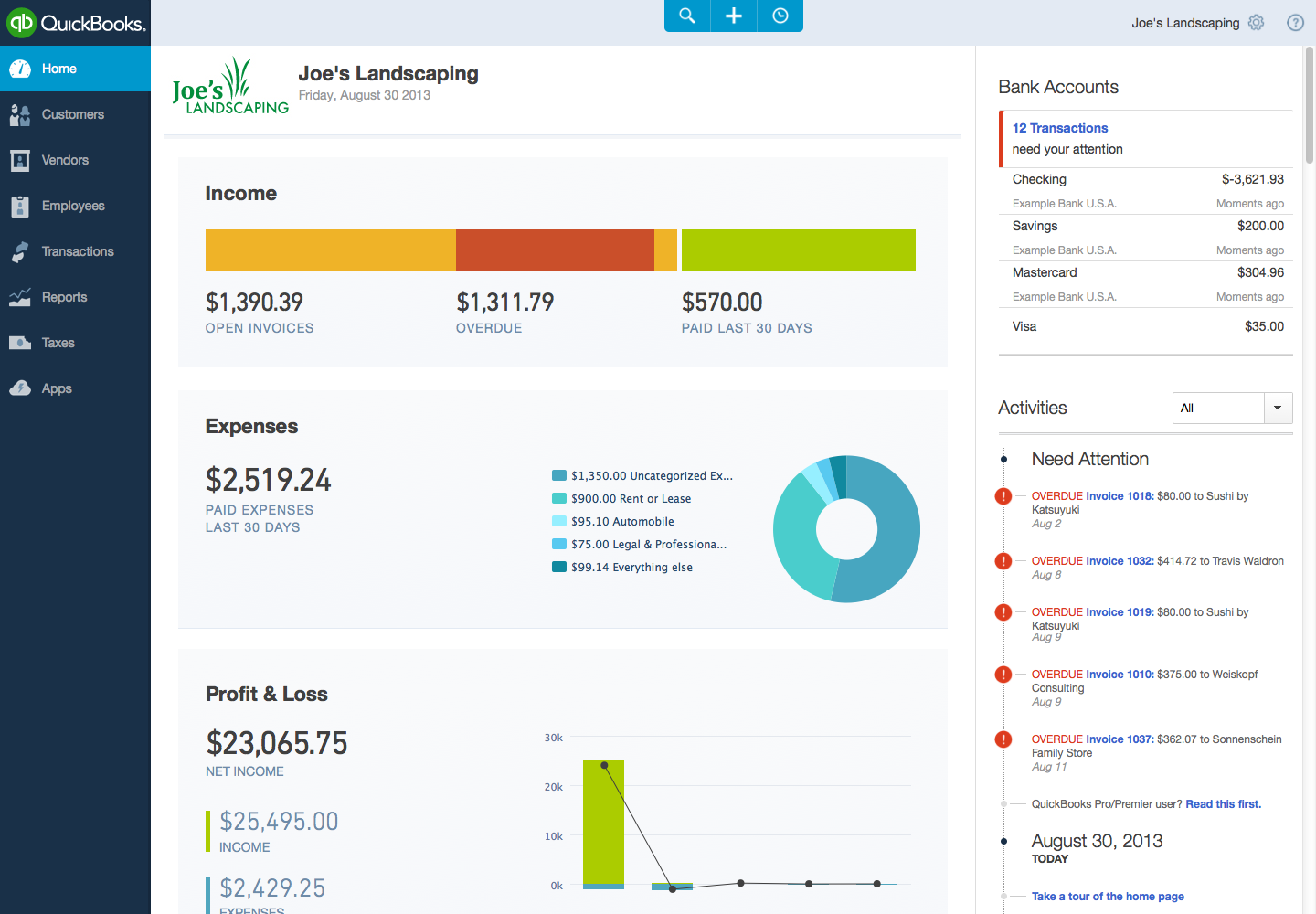

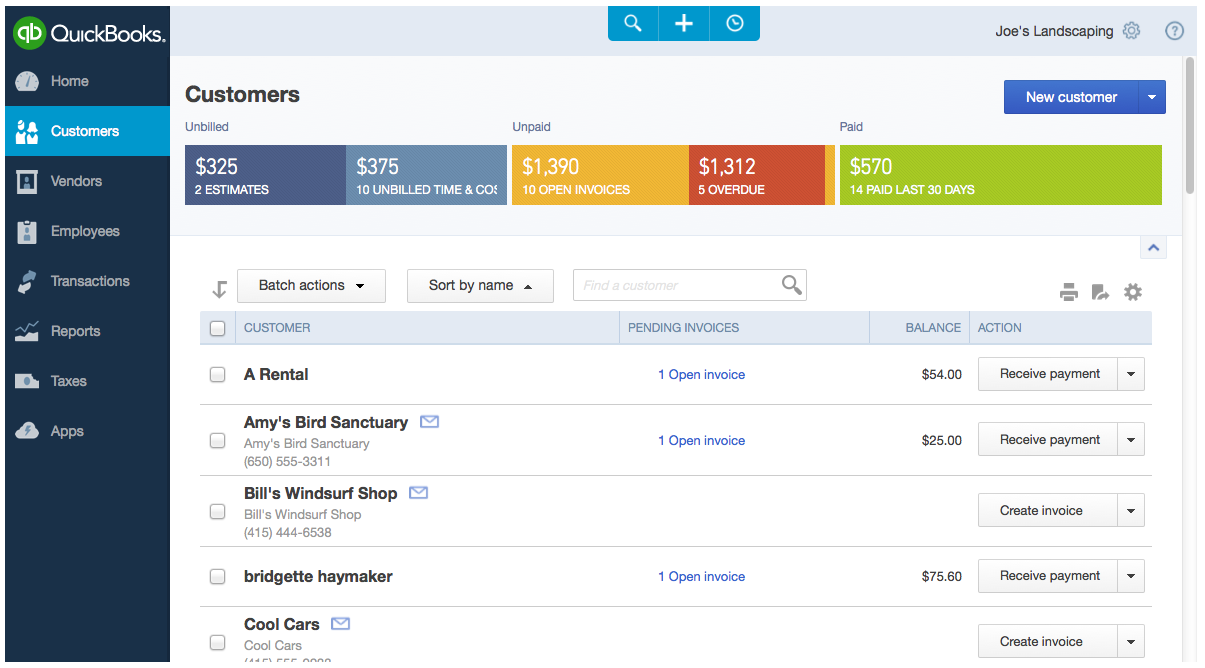

Quickbooks Online Form 1065 - Web solved•by turbotax•1930•updated january 13, 2023. Entering and specially allocating capital accounts for a 1065 return. Simple setup, seamless integration, and secure transactions. Web based on this guidance and the updated instructions for form 1065 and form 1120s, you may notice a few changes to how qbi appears on your returns. Web we have a fast and simple way to pay contractors and create 1099s using quickbooks contractor payments. Web update january 2023: Ad you don’t need an accounting degree to keep your books organized. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Select guaranteed payments (deductions) from the left menu.; Web quickbooks makes online accounting easy.

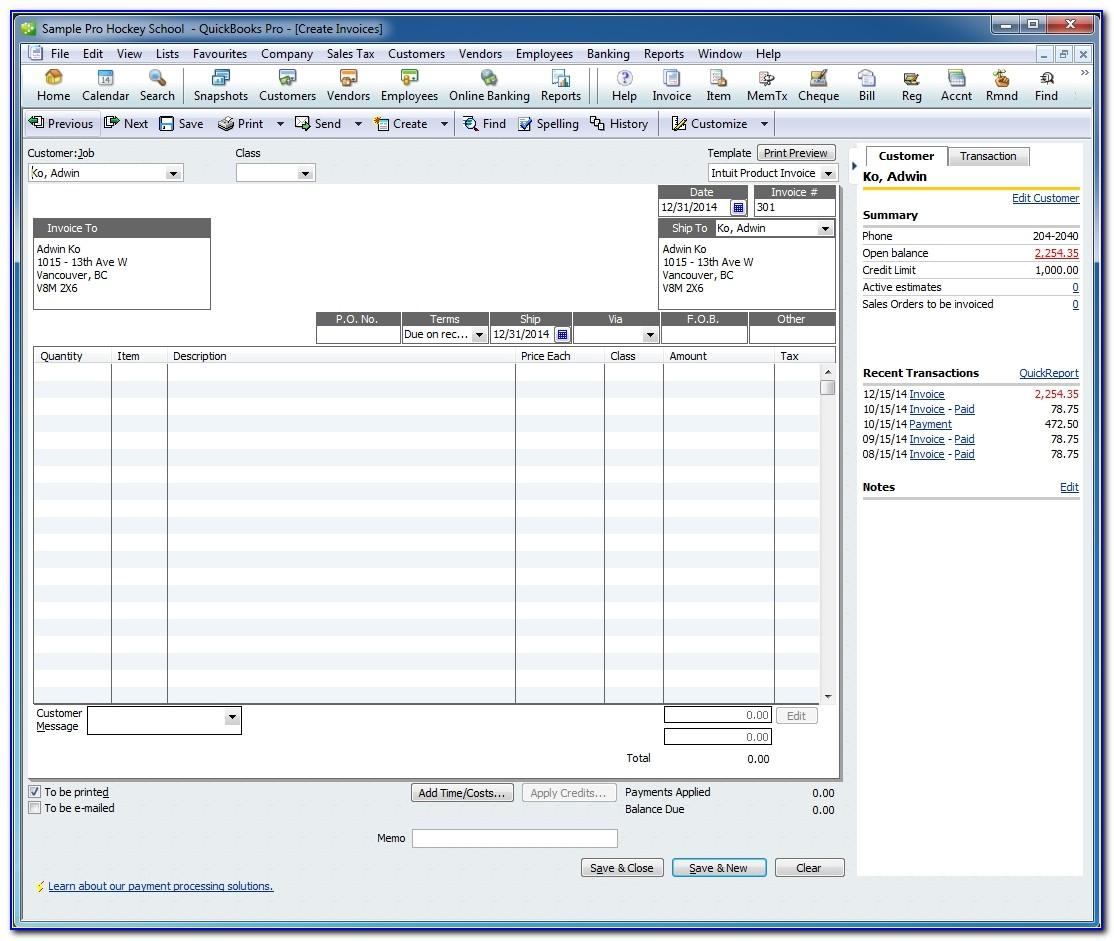

Log in to your quickbooks online account to keep track of the money you spend and to see how much money you're making. Web update january 2023: Web quickbooks makes online accounting easy. The easy to use software your business needs to invoice + get paid faster. Web based on this guidance and the updated instructions for form 1065 and form 1120s, you may notice a few changes to how qbi appears on your returns. Web select the special allocations tab from the top menu.; Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. March 03, 2021 02:37 pm. Web learn how to prepare and file your federal 1099s with quickbooks desktop or quickbooks desktop for mac. Enter the amount ($) for each partner, or select.

Entering and specially allocating capital accounts for a 1065 return. Make it easy to get paid. I'm here to share some details on how to file the amended 1065 form. Ad you don’t need an accounting degree to keep your books organized. Web based on this guidance and the updated instructions for form 1065 and form 1120s, you may notice a few changes to how qbi appears on your returns. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from. Tax practice of the future. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The easy to use software your business needs to invoice + get paid faster. Ad track, organize & manage your business with quickbooks® payments.

Intuit Overhauls QuickBooks Online Jason Del Rey News AllThingsD

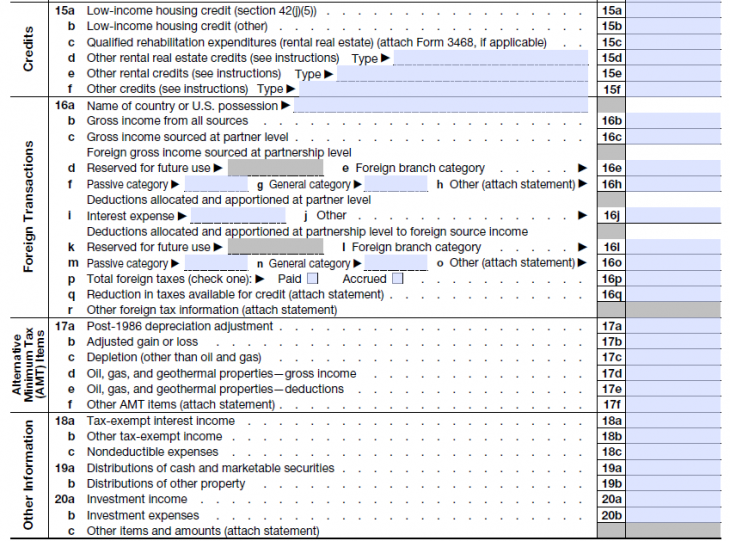

Simple setup, seamless integration, and secure transactions. Make it easy to get paid. Department of the treasury internal revenue service. Make it easy to get paid. Web quickbooks supports many business tax forms, including the 1040, 1120, and 1065, and the steps outlined here apply to all small business tax filers using quickbooks pro,.

QuickBooks TipHow To Add a Logo and Customize Your Forms QuickBooks

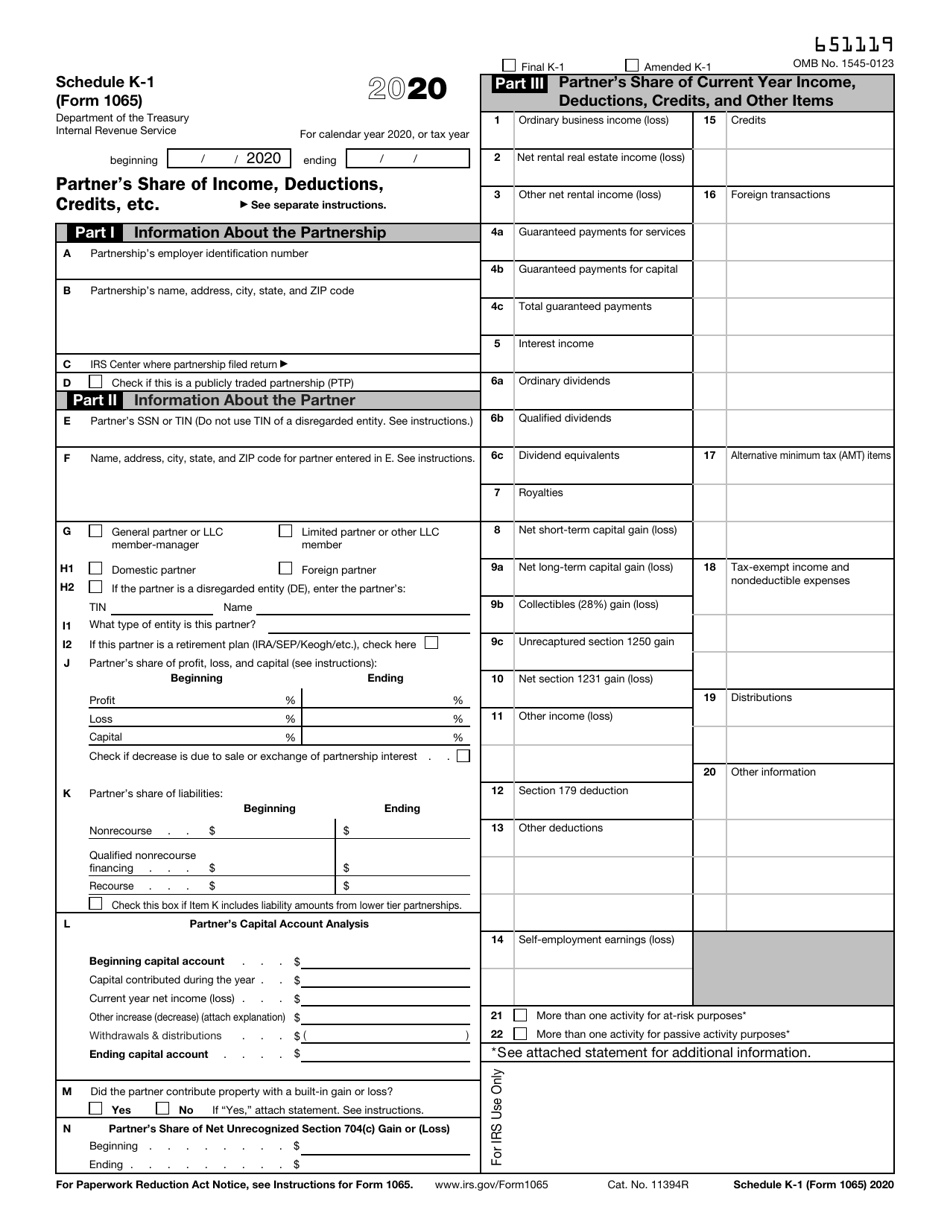

Entering and specially allocating capital accounts for a 1065 return. Ad you don’t need an accounting degree to keep your books organized. I'm here to share some details on how to file the amended 1065 form. Tax practice of the future. For a fiscal year or a short tax year, fill in the tax year.

IRS Form 1065 Schedule K1 Download Fillable PDF or Fill Online Partner

Web update january 2023: Follow the steps below to create and file your 1099s. Entering and specially allocating capital accounts for a 1065 return. Ad track, organize & manage your business with quickbooks® payments. Web how to amend a partnership return (form 1065) in the proconnect tax online program.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Follow the steps below to create and file your 1099s. Make it easy to get paid. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web solved•by turbotax•1930•updated january 13, 2023. For a fiscal year or a short tax year, fill in the tax year.

IRS Form 1065 (Schedule D) 2018 2019 Fill out and Edit Online PDF

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web select the special allocations tab from the top menu.; March 03, 2021 02:37 pm. Ad track, organize & manage your business with quickbooks® payments. Web we have a fast and simple way to pay contractors and create 1099s using quickbooks contractor payments.

MiniOffice QuickBooks Online Connector Wisetronic Shop

Web quickbooks supports many business tax forms, including the 1040, 1120, and 1065, and the steps outlined here apply to all small business tax filers using quickbooks pro,. Web select the special allocations tab from the top menu.; For a fiscal year or a short tax year, fill in the tax year. Web we have a fast and simple way.

Llc Tax Form 1065 Universal Network

Web learn how to prepare and file your federal 1099s with quickbooks desktop or quickbooks desktop for mac. Make it easy to get paid. Ad you don’t need an accounting degree to keep your books organized. Tax practice of the future. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

Learn How to Fill the Form 1065 Return of Partnership YouTube

Tax practice of the future. I'm here to share some details on how to file the amended 1065 form. Select guaranteed payments (deductions) from the left menu.; Enter the amount ($) for each partner, or select. Make it easy to get paid.

Which Accounting Software Is Better? Compare Freshbooks & Quickbooks

Department of the treasury internal revenue service. Ad track, organize & manage your business with quickbooks® payments. Web we have a fast and simple way to pay contractors and create 1099s using quickbooks contractor payments. Web how to amend a partnership return (form 1065) in the proconnect tax online program. Web select the special allocations tab from the top menu.;

Quickbooks Online Purchase Order Template

The easy to use software your business needs to invoice + get paid faster. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web solved•by turbotax•1930•updated january 13, 2023. I'm here to share some details on how to file the amended 1065 form. Web we have a fast and simple way to pay contractors and.

Make It Easy To Get Paid.

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web update january 2023: Make it easy to get paid. Form 1065 is an information return used to report the income, gains, losses, deductions, credits, etc., from.

Web How To Amend A Partnership Return (Form 1065) In The Proconnect Tax Online Program.

Ad you don’t need an accounting degree to keep your books organized. 1099s produced by intuit for quickbooks online, quickbooks. I'm here to share some details on how to file the amended 1065 form. Ad track, organize & manage your business with quickbooks® payments.

Web Solved•By Turbotax•1930•Updated January 13, 2023.

Select guaranteed payments (deductions) from the left menu.; Web based on this guidance and the updated instructions for form 1065 and form 1120s, you may notice a few changes to how qbi appears on your returns. March 03, 2021 02:37 pm. Simple setup, seamless integration, and secure transactions.

Log In To Your Quickbooks Online Account To Keep Track Of The Money You Spend And To See How Much Money You're Making.

Enter the amount ($) for each partner, or select. Web select the special allocations tab from the top menu.; The easy to use software your business needs to invoice + get paid faster. For a fiscal year or a short tax year, fill in the tax year.