Profit And Loss Account And Balance Sheet

Profit And Loss Account And Balance Sheet - That net income becomes a retained earnings. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A balance sheet is a statement that discloses the. All income and expenses are added together to gather the net income, which reports as retained earnings. The p&l statement is one of three. Web profit and loss account. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. A p&l statement provides information about whether a company can. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. Web the profit and loss statement:

That net income becomes a retained earnings. A balance sheet is a statement that discloses the. Web the profit and loss statement: A p&l statement provides information about whether a company can. Web profit and loss account. All income and expenses are added together to gather the net income, which reports as retained earnings. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The p&l statement is one of three.

That net income becomes a retained earnings. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The p&l statement is one of three. Web profit and loss account. Web the profit and loss statement: Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. A p&l statement provides information about whether a company can. A balance sheet is a statement that discloses the. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. All income and expenses are added together to gather the net income, which reports as retained earnings.

Difference Between Profit & Loss Account and Balance Sheet

That net income becomes a retained earnings. The p&l statement is one of three. Web the profit and loss statement: Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides.

FREE 14+ Sample Balance Sheet Templates in PDF MS Word Excel

Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A p&l statement provides information about whether a company can. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. That net income becomes a retained earnings..

Difference Between Balance Sheet and Profit & Loss Account (with

Web the profit and loss statement: The p&l statement is one of three. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A balance sheet is a statement that discloses the. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses.

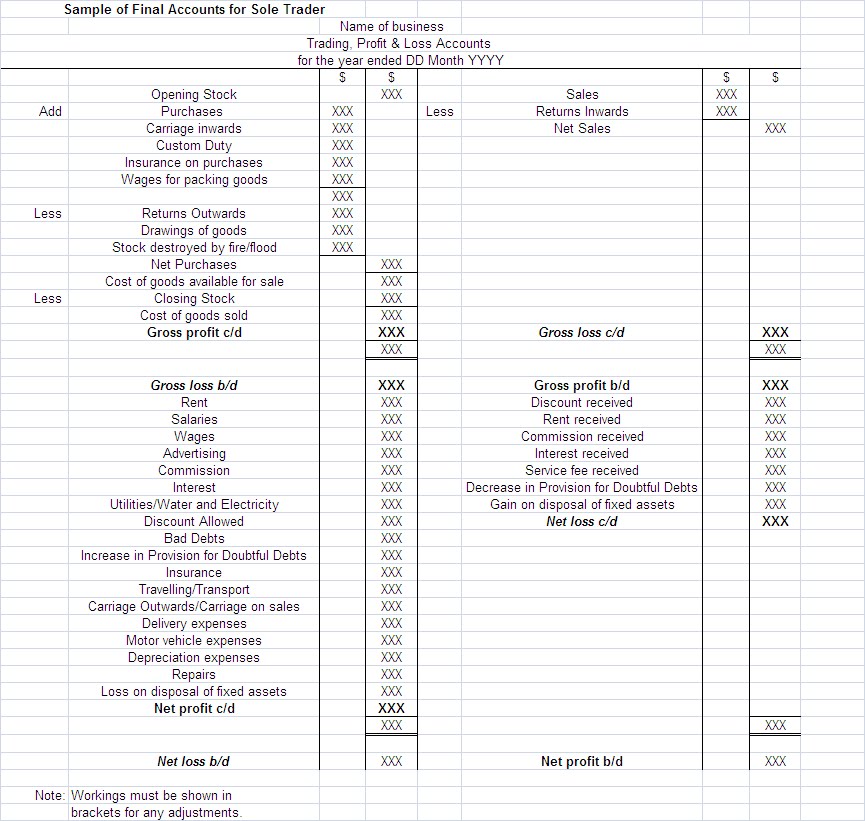

Profit and Loss Accounts + Balance Sheets Monique Lowes' IB Blog

Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. A balance sheet is a statement that discloses the. A p&l statement provides information about whether a company can. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report.

Profit and Loss Accounts + Balance Sheets Monique Lowes' IB Blog

Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. That net income becomes a retained earnings. A balance sheet is a statement that discloses the. The.

The Difference Between a Balance Sheet and P&L Infographic

All income and expenses are added together to gather the net income, which reports as retained earnings. A p&l statement provides information about whether a company can. Web a profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A balance sheet is a statement that discloses the. That net income becomes.

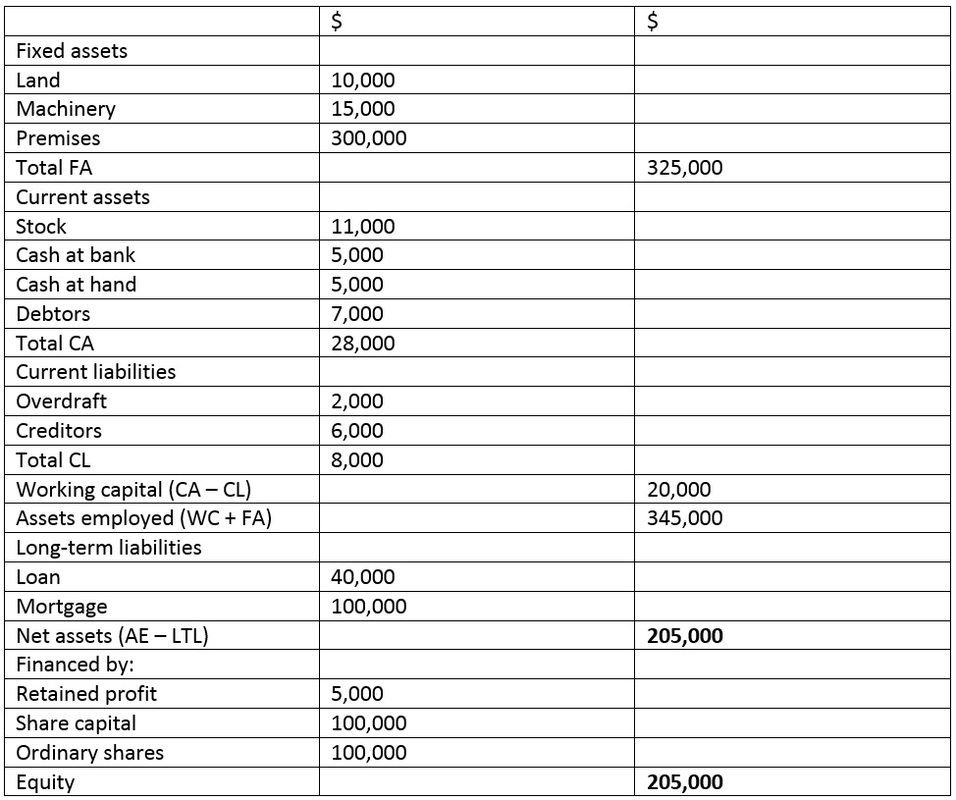

POA Balance sheet

A balance sheet is a statement that discloses the. All income and expenses are added together to gather the net income, which reports as retained earnings. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of.

Balance Sheet vs. Profit and Loss Account [2023]

Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. A balance sheet is a statement that discloses the. Web the profit and loss statement: Web a profit and loss (p&l) statement summarizes the revenues,.

Outrageous Balance Sheet Gross Up Asset And Liabilities Format

Web the profit and loss statement: That net income becomes a retained earnings. A p&l statement provides information about whether a company can. Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. Web profit and loss account.

I will make business loss and profit, balance sheet in 24 hour Kashif

Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The p&l statement is one of three. A p&l statement provides information about whether a company can. All income and expenses are added together to gather the net income, which reports as retained earnings. Web profit and.

Web A Profit And Loss (P&L) Statement Summarizes The Revenues, Costs And Expenses Incurred During A Specific Period Of Time.

Web the profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. The p&l statement is one of three. That net income becomes a retained earnings. Web the profit and loss statement:

A Balance Sheet Is A Statement That Discloses The.

Web profit and loss account. A p&l statement provides information about whether a company can. Web a profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. All income and expenses are added together to gather the net income, which reports as retained earnings.

![Balance Sheet vs. Profit and Loss Account [2023]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)