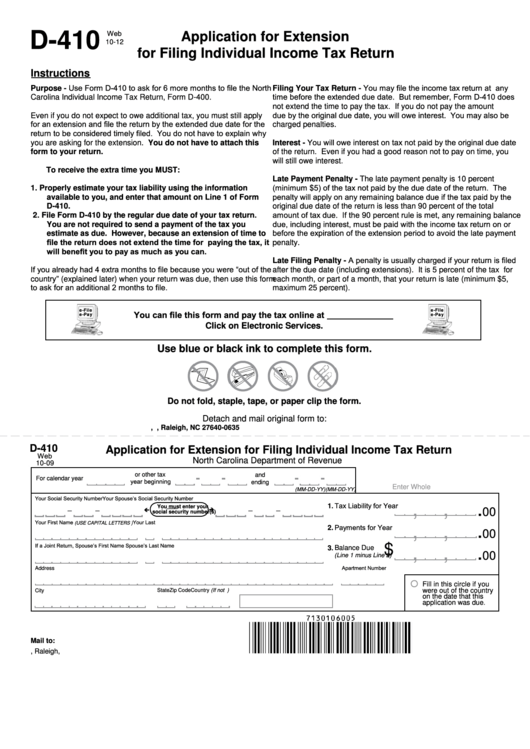

Printable Nc Form D-410

Printable Nc Form D-410 - Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Web moves section 3, reverification and rehire, to a standalone supplement that employers can print if or when rehire occurs or reverification is required; This form is not required if you were granted an automatic extension to file your federal income tax return. Apply a check mark to indicate the choice. Individual income tax refund inquiries: Experience all the advantages of completing and submitting forms online. Web the way to fill out the nc dept of revenue forms d410 online: To receive the extra time you must: North carolina department of revenue. This form is not required if you were granted an automatic extension to.

You are not required to send a payment of the tax you estimate as due. Must file the extension by the original due date of your return. If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. Type text, add images, blackout confidential details, add comments, highlights and more. Complete this web form for assistance. To start the document, utilize the fill camp; Using our solution filling in nc form d 410 usually takes a matter of minutes. Web form to your return. Apply a check mark to indicate the choice. Corporate income & franchise tax;

D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save d410 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 24 votes You are not required to send a payment of the tax you estimate as due. North carolina department of revenue. Corporate income & franchise tax; If you previously made an electronic payment but did not receive a confirmation page do not submit another payment. This form is not required if you were granted an automatic extension to. Motor carrier tax (ifta/in) privilege license tax; To receive the extra time you must: If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. Enter your official contact and identification details.

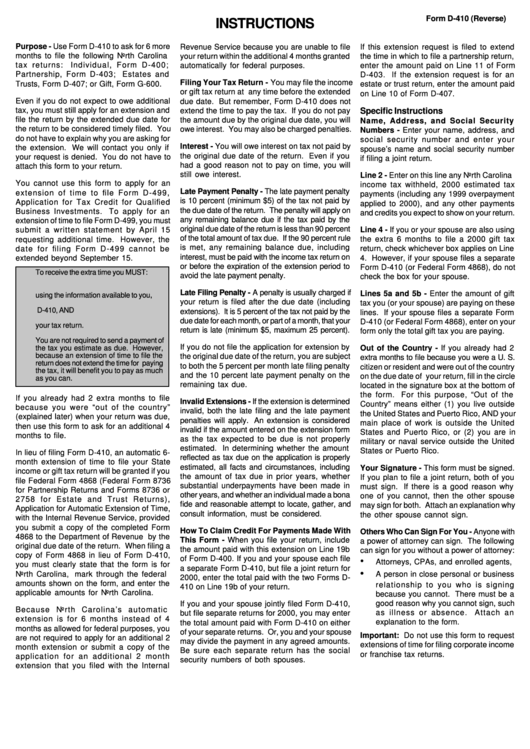

Instructions For Form D410 printable pdf download

Motor carrier tax (ifta/in) privilege license tax; If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. Pay a bill or notice (notice required). This form is for income earned in tax year 2022, with tax returns due in april 2023. Corporate income & franchise.

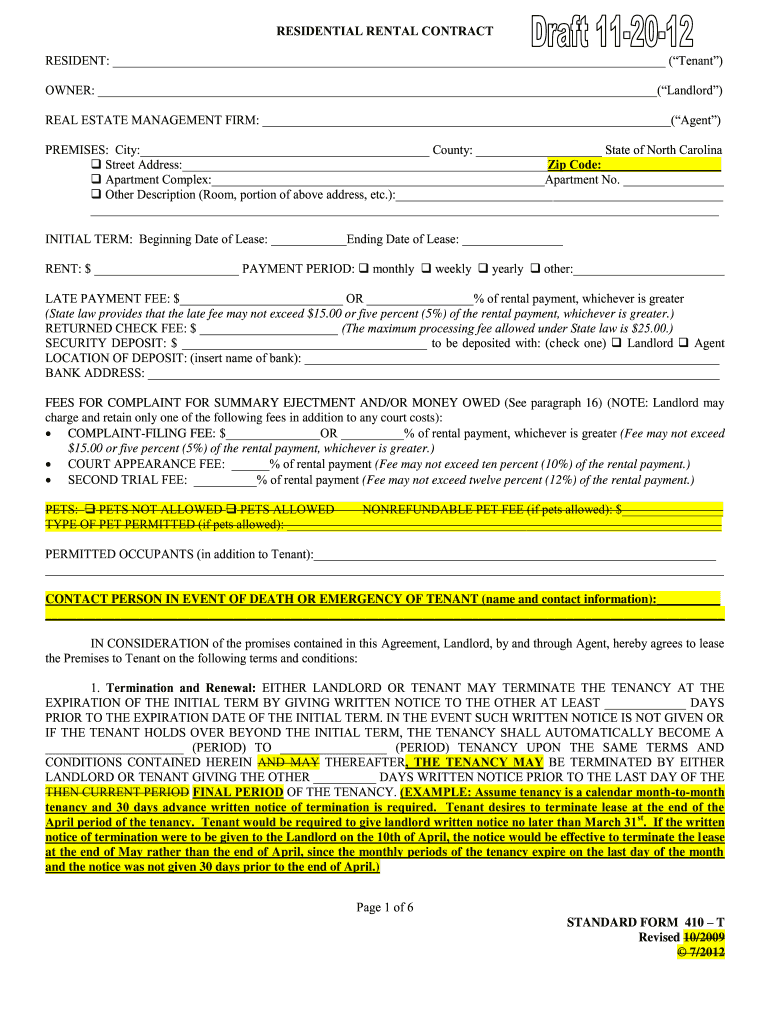

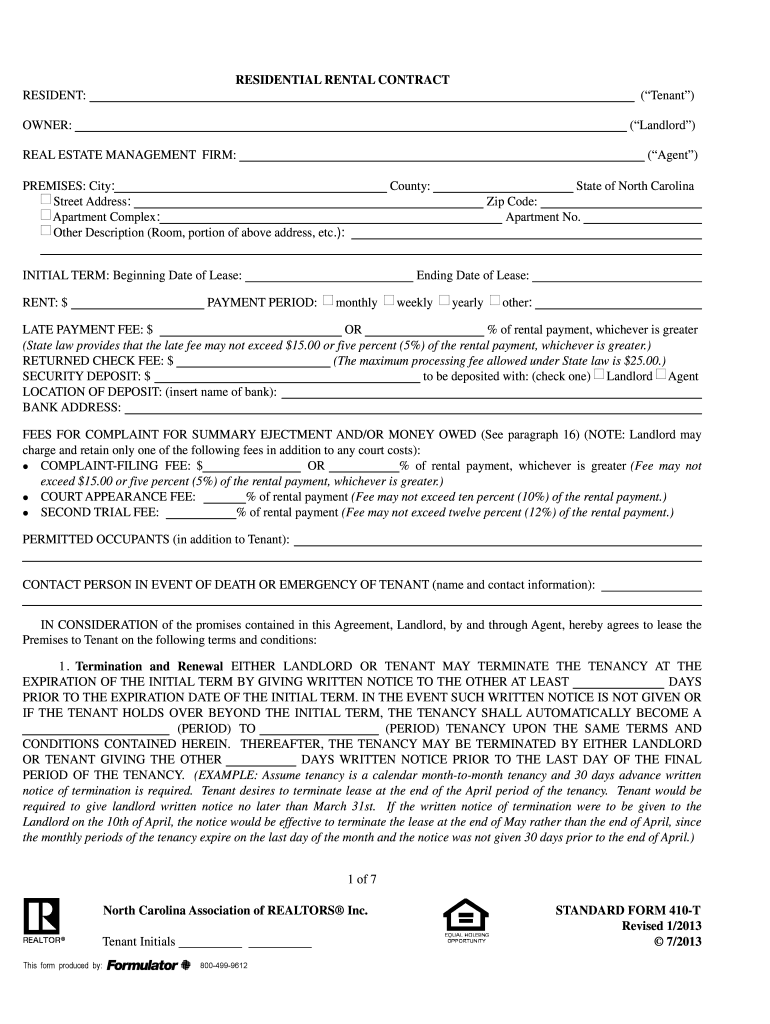

410 In Standard Form Fill Out and Sign Printable PDF Template signNow

Beginning with tax year 2019, a taxpayer that receives an automatic extension to file a federal individual income tax return will be granted an automatic state extension to file the n.c. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Get your online template and fill it in using progressive features. Web.

NC DoR D400 2015 Fill out Tax Template Online US Legal Forms

This form is not required if you were granted an automatic extension to. Complete this web form for assistance. Apply a check mark to indicate the choice. Individual income tax refund inquiries: Sign it in a few clicks.

Printable Nc Form D 410 Printable Word Searches

Sign online button or tick the preview image of the form. Complete this web form for assistance. Web follow the simple instructions below: Individual income tax refund inquiries: Web moves section 3, reverification and rehire, to a standalone supplement that employers can print if or when rehire occurs or reverification is required;

Top 5 Form 410 Templates free to download in PDF format

North carolina department of revenue. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. Using our solution filling in nc form d 410 usually takes a matter of minutes. Individual income tax refund inquiries: To start the document, utilize the fill camp;

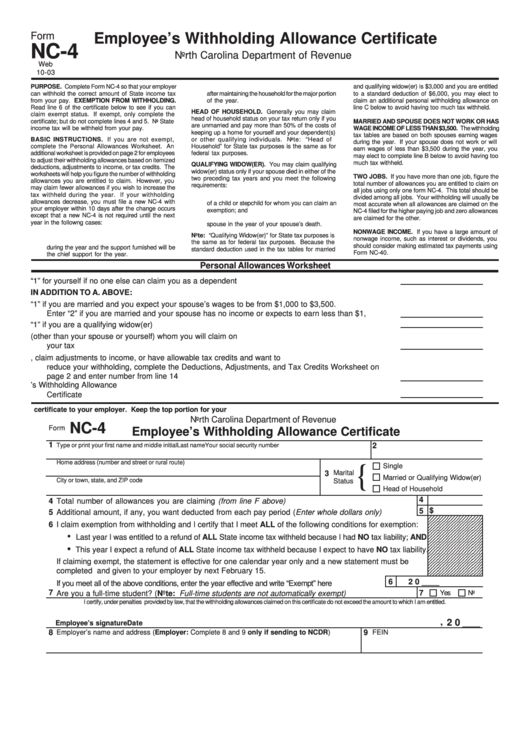

Form Nc 4 2003 Employee S Withholding Allowance Certificate Printable

Underpayment of estimated tax d. Using our solution filling in nc form d 410 usually takes a matter of minutes. Must file the extension by the original due date of your return. This form is not required if you were granted an automatic extension to file your federal income tax return. Web form to your return.

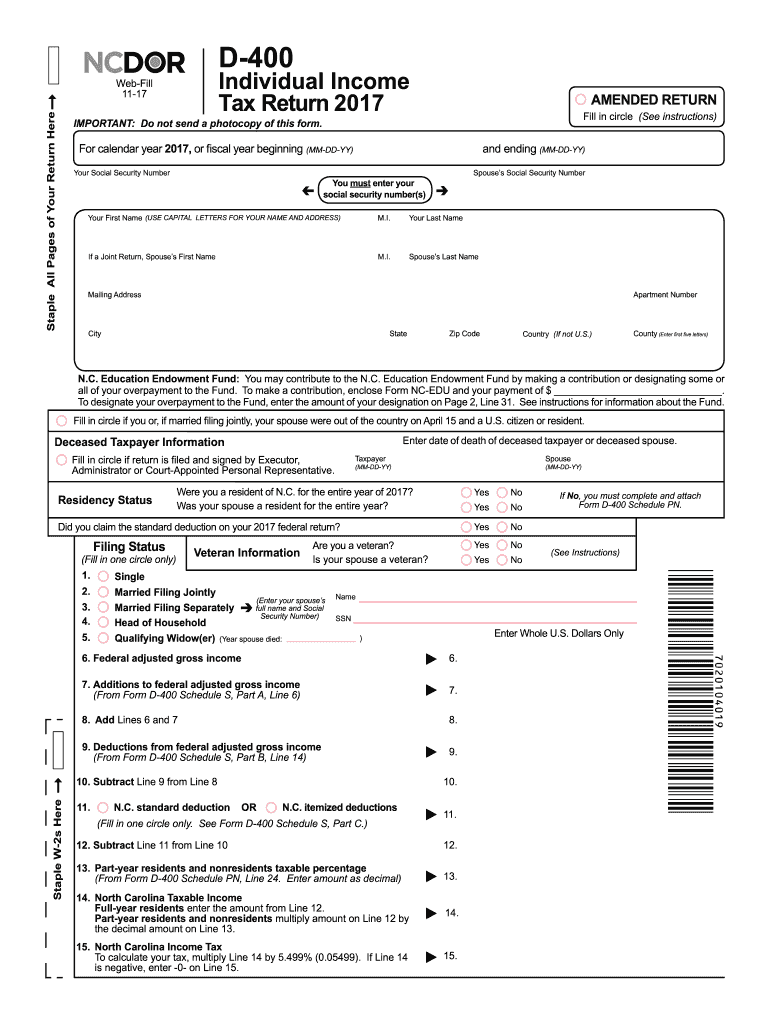

2017 Form NC DoR D400 Fill Online, Printable, Fillable, Blank pdfFiller

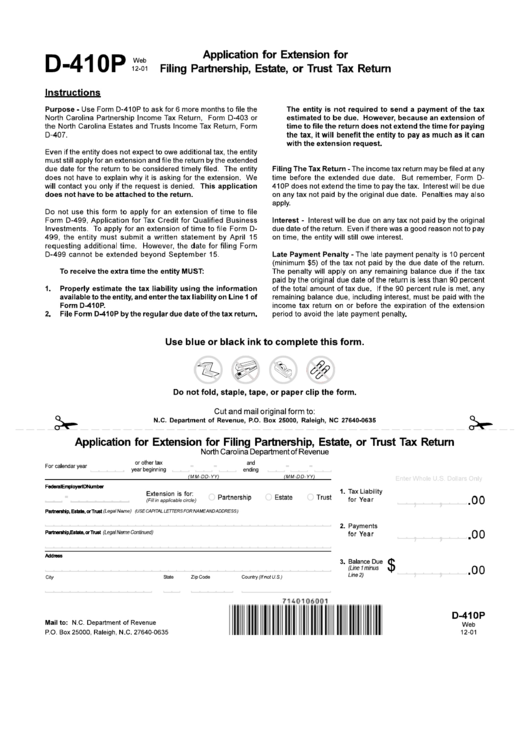

To receive the extra time you must: Edit your nc d 410p online. Sign online button or tick the preview image of the form. North carolina department of revenue. This form is not required if you were granted an automatic extension to.

Fillable Form D410 Application For Extension For Filing Individual

D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save d410 form rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 24 votes Motor carrier tax (ifta/in) privilege license tax;.

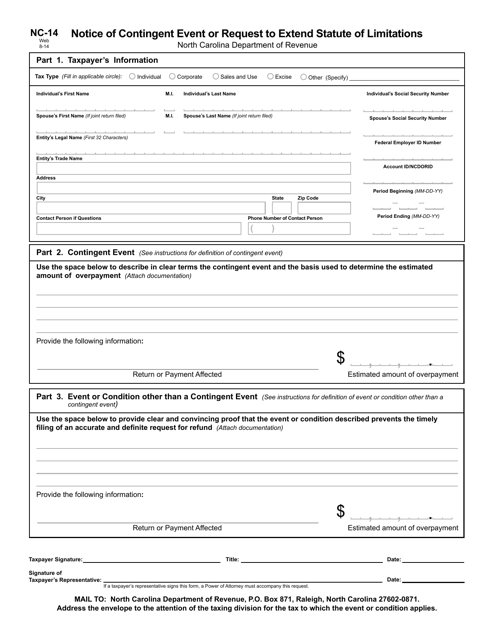

Form NC14 Download Printable PDF or Fill Online Notice of Contingent

To start the document, utilize the fill camp; Web the way to fill out the nc dept of revenue forms d410 online: Pay a bill or notice (notice required). You are not required to send a payment of the tax you estimate as due. This form is for income earned in tax year 2022, with tax returns due in april.

Standard Form 410 T 2021 Fill Out and Sign Printable PDF Template

North carolina department of revenue. Get your online template and fill it in using progressive features. Must file the extension by the original due date of your return. To receive the extra time you must: D410 nc tax extension get d410 nc tax extension how it works open form follow the instructions easily sign the form with your finger send.

North Carolina Department Of Revenue.

Web follow the simple instructions below: If the entity was granted an automatic extension to file its federal income tax return, federal form 1065 or 1041, it does not have to Experience all the advantages of completing and submitting forms online. Enter your official contact and identification details.

Individual Income Tax Refund Inquiries:

Web the way to fill out the nc dept of revenue forms d410 online: If you were granted an automatic extension to file your federal income tax return, federal form 1040, you do not have to file form d. You are not required to send a payment of the tax you estimate as due. Using our solution filling in nc form d 410 usually takes a matter of minutes.

D410 Nc Tax Extension Get D410 Nc Tax Extension How It Works Open Form Follow The Instructions Easily Sign The Form With Your Finger Send Filled & Signed Form Or Save D410 Form Rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 Satisfied 24 Votes

Corporate income & franchise tax; Underpayment of estimated tax d. This form is not required if you were granted an automatic extension to. Sign it in a few clicks.

Apply A Check Mark To Indicate The Choice.

This form is not required if you were granted an automatic extension to file your federal income tax return. Web moves section 3, reverification and rehire, to a standalone supplement that employers can print if or when rehire occurs or reverification is required; This form is for income earned in tax year 2022, with tax returns due in april 2023. Sign online button or tick the preview image of the form.