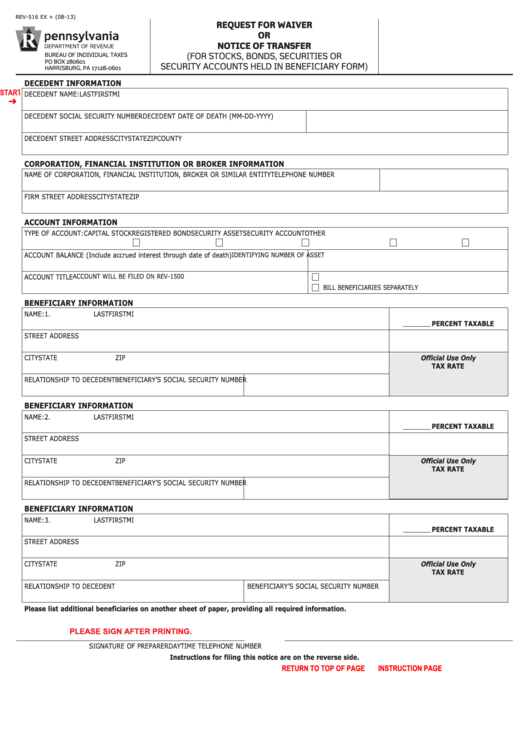

Pennsylvania Inheritance Tax Waiver Form

Pennsylvania Inheritance Tax Waiver Form - You do not need to draft another document. Of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of reporting to the department of. Web the pennsylvania inheritance tax is a tax on the total assets owned by a decedent at the time of his or her death. And 15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax. Web to effectuate the waiver you must complete the pa form rev 516; 1, 1962, can be obtained from the department of revenue, bureau of individual taxes. Corporations, financial institutions, brokers, or similar. Property owned jointly between spouses is exempt from inheritance tax. The net value subject to. Web inheritance tax forms, schedules and instructions are available at www.revenue.pa.gov.

Property owned jointly between spouses is exempt from inheritance tax. Web the pennsylvania inheritance tax is a tax on the total assets owned by a decedent at the time of his or her death. Revenue the transfer of securities. Of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of reporting to the department of. The net value subject to. In most small estates, the only asset subject to inheritance tax is the property. 12 percent on transfers to siblings; And 15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax. Web the rates for pennsylvania inheritance tax are as follows: 1, 1962, can be obtained from the department of revenue, bureau of individual taxes.

Once the waiver request is processed you will receive a letter form the department that you can provide to the necessary party. Revenue the transfer of securities. 4.5 percent on transfers to direct descendants and lineal heirs; Property owned jointly between spouses is exempt from inheritance tax. Who files the inheritance tax return? However, if you are the surviving spouse you or you have a tax clearance from the pit division that shows inheritance taxes have already been paid on this account, then you are not required to file this form. Web applicability of inheritance tax to estates of decedents who died before jan. The net value subject to. Web 12 percent on transfers to siblings; Web mail completed form to:

Fillable Form Rev516 Pennsylvania Request For Waiver Or Notice Of

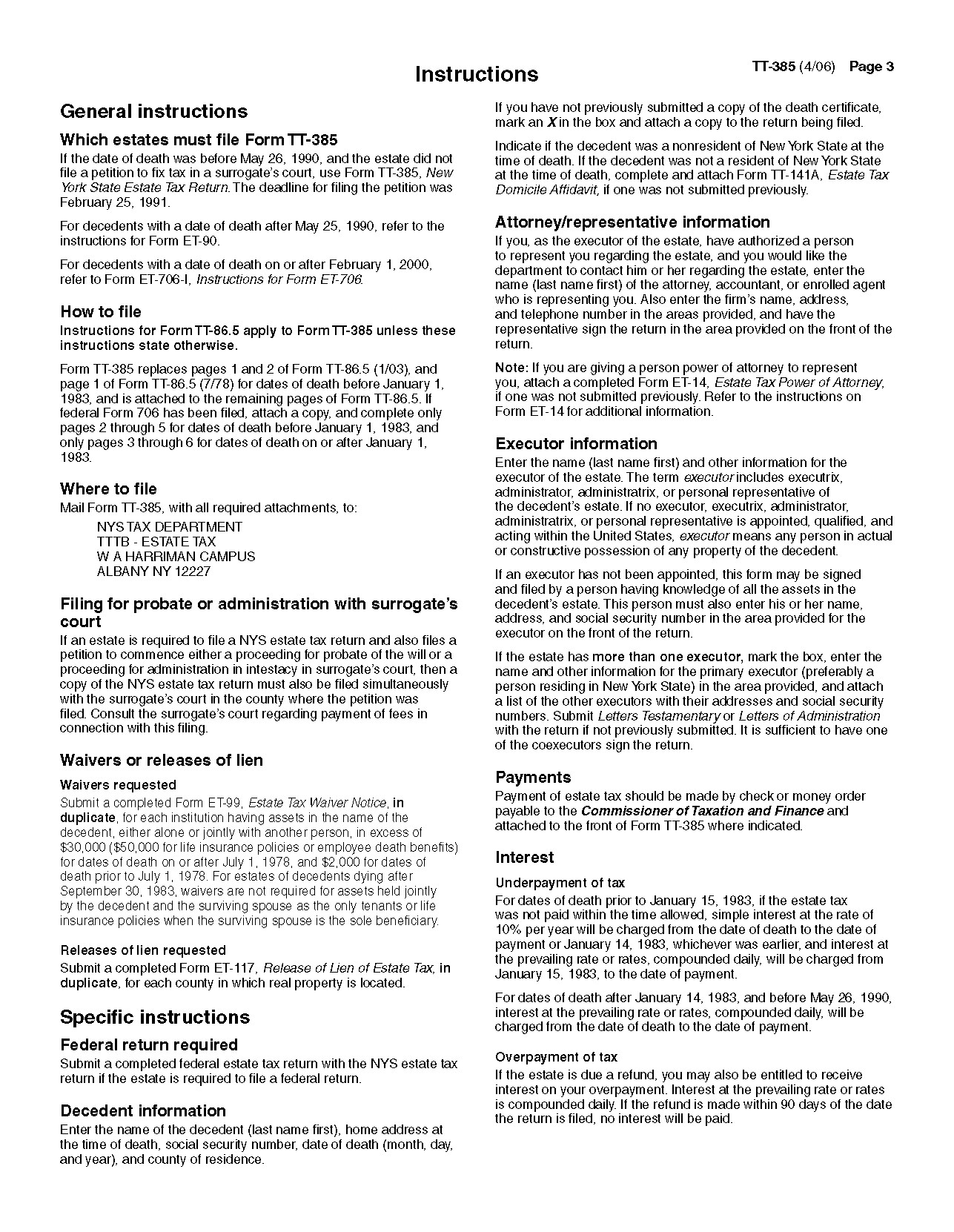

Web 12 percent on transfers to siblings; Web the rates for pennsylvania inheritance tax are as follows: Corporations, financial institutions, brokers, or similar. 12 percent on transfers to siblings; Web applicability of inheritance tax to estates of decedents who died before jan.

Inheritance Tax Waiver Form Nj Form Resume Examples o7Y3qWE2BN

Web inheritance tax forms, schedules and instructions are available at www.revenue.pa.gov. Who files the inheritance tax return? In most small estates, the only asset subject to inheritance tax is the property. 4.5 percent on transfers to direct descendants and lineal heirs; Web applicability of inheritance tax to estates of decedents who died before jan.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

The net value subject to. Of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of reporting to the department of. Who files the inheritance tax return? Revenue the transfer of securities. Web mail completed form to:

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

Property owned jointly between spouses is exempt from inheritance tax. Web mail completed form to: However, if you are the surviving spouse you or you have a tax clearance from the pit division that shows inheritance taxes have already been paid on this account, then you are not required to file this form. Web applicability of inheritance tax to estates.

Inheritance Tax Waiver Form Pa Form Resume Examples kLYrL0326a

Web to effectuate the waiver you must complete the pa form rev 516; However, if you are the surviving spouse you or you have a tax clearance from the pit division that shows inheritance taxes have already been paid on this account, then you are not required to file this form. And 15 percent on transfers to other heirs, except.

Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

Web to effectuate the waiver you must complete the pa form rev 516; Of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of reporting to the department of. Web applicability of inheritance tax to estates of decedents who died before jan. The net value subject to. 4.5 percent on transfers to.

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

12 percent on transfers to siblings; Corporations, financial institutions, brokers, or similar. Web inheritance tax forms, schedules and instructions are available at www.revenue.pa.gov. In most small estates, the only asset subject to inheritance tax is the property. Web the pennsylvania inheritance tax is a tax on the total assets owned by a decedent at the time of his or her.

REV516 Request for Waiver or Notice of Transfer Free Download

Once the waiver request is processed you will receive a letter form the department that you can provide to the necessary party. 1, 1962, can be obtained from the department of revenue, bureau of individual taxes. And 15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax. Web applicability of inheritance tax.

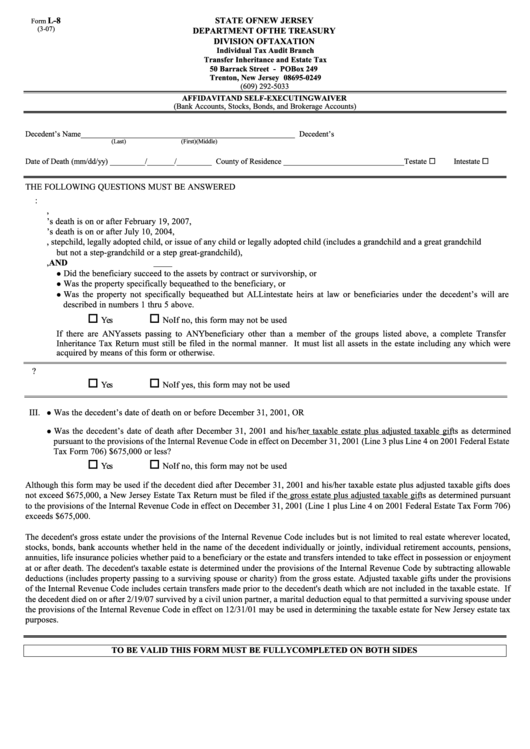

Fillable Form L8 Individual Tax Audit Branch Transfer Inheritance And

Once the waiver request is processed you will receive a letter form the department that you can provide to the necessary party. Web applicability of inheritance tax to estates of decedents who died before jan. 4.5 percent on transfers to direct descendants and lineal heirs; However, if you are the surviving spouse you or you have a tax clearance from.

Inheritance Tax Waiver Form Nj Form Resume Examples o7Y3qWE2BN

Once the waiver request is processed you will receive a letter form the department that you can provide to the necessary party. The net value subject to. However, if you are the surviving spouse you or you have a tax clearance from the pit division that shows inheritance taxes have already been paid on this account, then you are not.

Web To Effectuate The Waiver You Must Complete The Pa Form Rev 516;

Web the rates for pennsylvania inheritance tax are as follows: Web the pennsylvania inheritance tax is a tax on the total assets owned by a decedent at the time of his or her death. 4.5 percent on transfers to direct descendants and lineal heirs; Revenue the transfer of securities.

Who Files The Inheritance Tax Return?

Web inheritance tax forms, schedules and instructions are available at www.revenue.pa.gov. You do not need to draft another document. And 15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax. In most small estates, the only asset subject to inheritance tax is the property.

Corporations, Financial Institutions, Brokers, Or Similar.

Web applicability of inheritance tax to estates of decedents who died before jan. 12 percent on transfers to siblings; Of the probate, estates and fiduciaries code (title 20, chapter 64, pennsylvania consolidated statutes) sets forth the requirement of reporting to the department of. Property owned jointly between spouses is exempt from inheritance tax.

Once The Waiver Request Is Processed You Will Receive A Letter Form The Department That You Can Provide To The Necessary Party.

Web mail completed form to: The net value subject to. Web 12 percent on transfers to siblings; 0 percent on transfers to a surviving spouse, to a parent from a child aged 21 or younger, and to or for the use of a child aged 21 or younger from a parent;