Penalty For Not Filing Form 8621

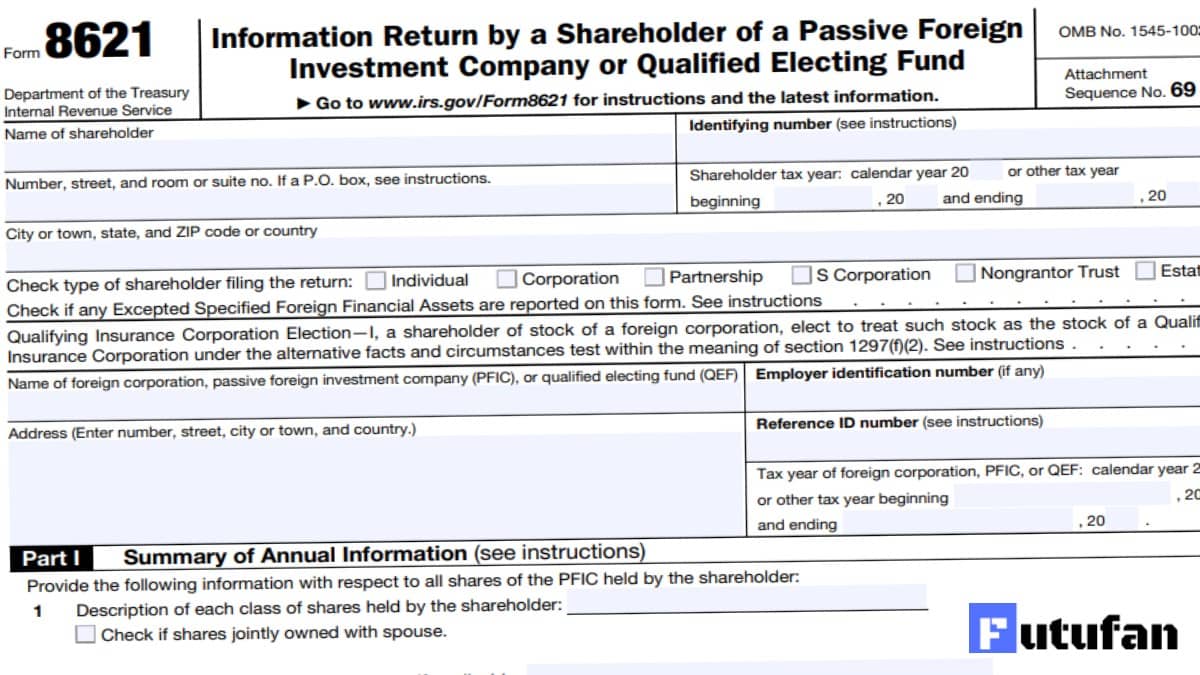

Penalty For Not Filing Form 8621 - Person is required to recognize any income under section 1291. Web you own more than $25,000 worth of pfic stock or assets. Web file form 8621 for each tax year under the following three circumstances: Web pfic (form 8621) let’s briefly look at each form and the potential penalties taxpayers may suffer for not being in compliance. As an indirect shareholder, you are required to file form 8621 if you meet the following qualifications: Form 8621 is just one of a number of informational reports that you may be required to file. Section 1298(f) and the regulations do not impose a specific penalty for failure to file form 8621. (a) the aggregate value of pfic stock owned by the u.s. Failing to file form 8621 would result in suspension of status. Receive certain direct or indirect distributions.

Yet, in case you have investments in a foreign partnership, but the partnership does not own any shares, then you are not. As an indirect shareholder, you are required to file form 8621 if you meet the following qualifications: Web so, what is a pfic and why should you care about it? Web you own more than $25,000 worth of pfic stock or assets. Web pfic (form 8621) let’s briefly look at each form and the potential penalties taxpayers may suffer for not being in compliance. Shareholder at the end of the tax year is not greater than $25,000 ($50,000 for taxpayers who are married filing. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) files form 8621 if they: Especially, when it comes to foreign. (a) the aggregate value of pfic stock owned by the u.s. Receives certain direct or indirect distributions from a pfic, 2.

Person is required to recognize any income under section 1291. Web a pfic shareholder must file form 8621 for each pfic the shareholder owns. Web beyond form 8621 filing requirements. Shareholder at the end of the tax year is not greater than $25,000 ($50,000 for taxpayers who are married filing. Web file form 8621 for each tax year under the following three circumstances: Yet, in case you have investments in a foreign partnership, but the partnership does not own any shares, then you are not. Failing to file form 8621 would result in suspension of status. If you have an ownership interest. Recognizes gain on a direct or. Web penalties for failure to file form 8621.

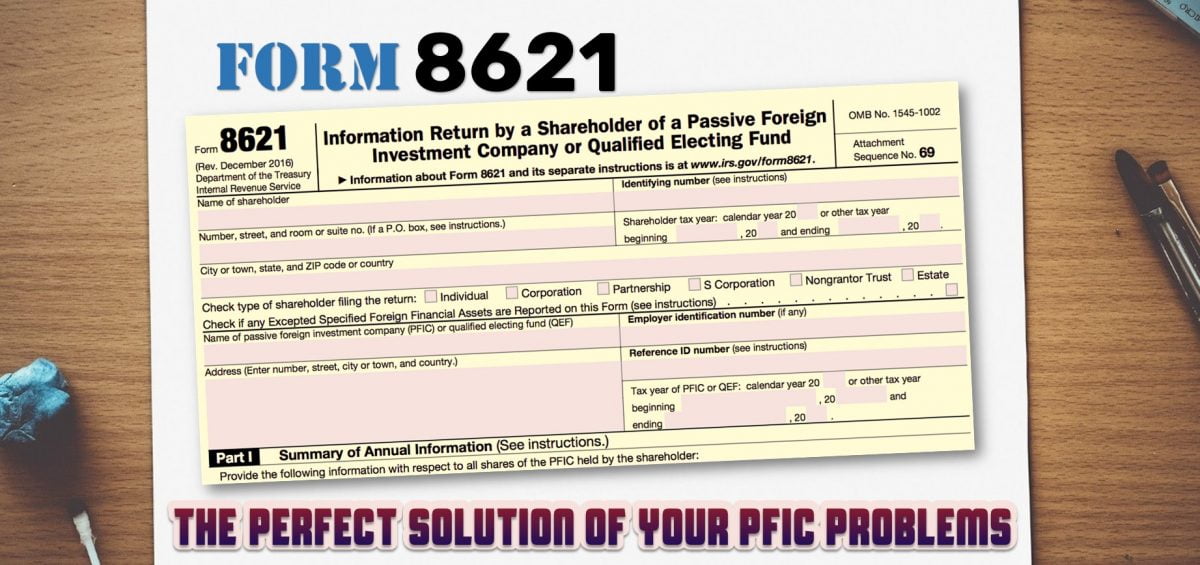

All about Form 8621 SDG Accountant

Yet, in case you have investments in a foreign partnership, but the partnership does not own any shares, then you are not. Receive certain direct or indirect distributions. Web you own more than $25,000 worth of pfic stock or assets. Web irc 1298(f) and the applicable regulations do not provide for a specific penalty in case of failure to file.

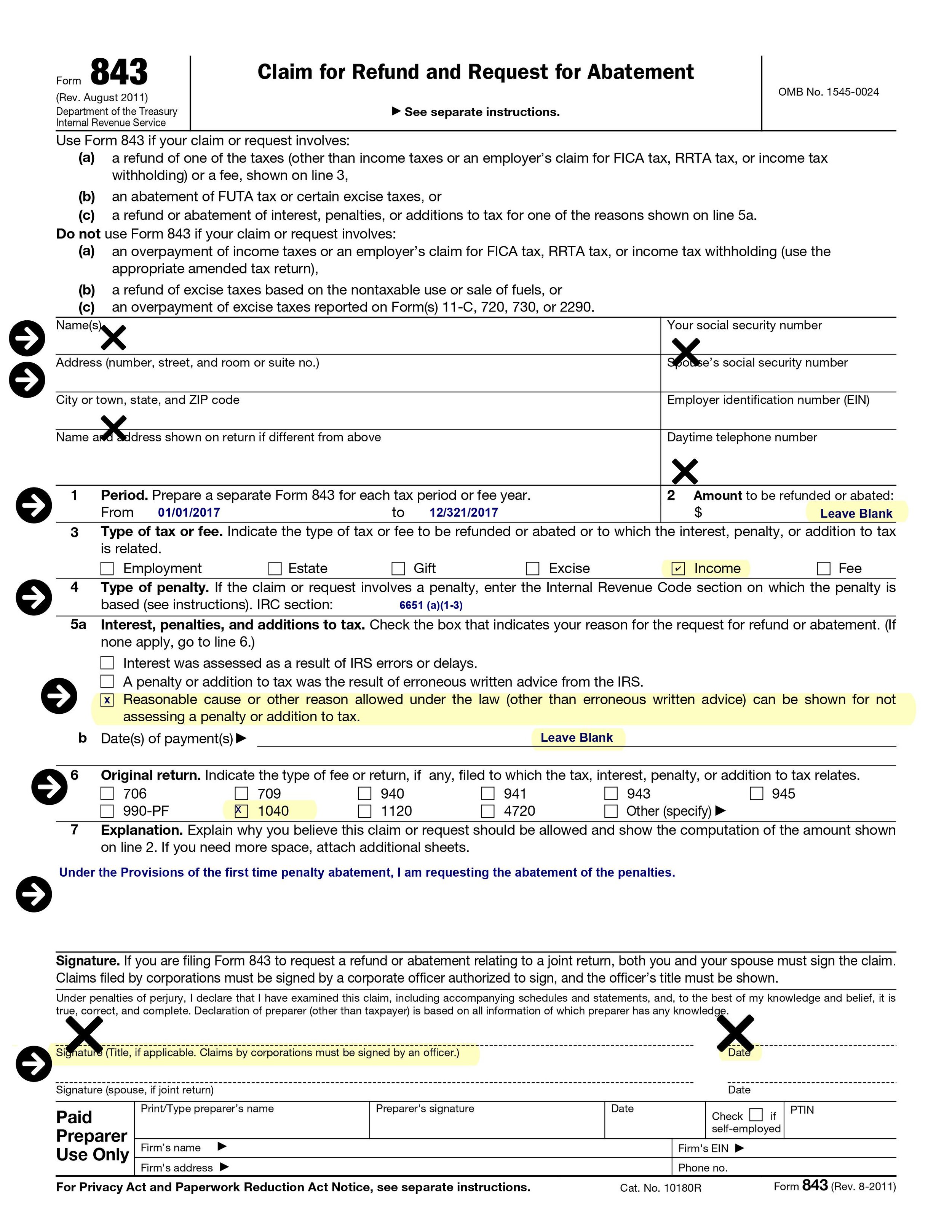

Sales Tax Penalty Waiver Sample Letter Irs Letter 1277 Penalty

The consequence of failing to file form. Shareholder at the end of the tax year is not greater than $25,000 ($50,000 for taxpayers who are married filing. Person is required to recognize any income under section 1291. Form 8621 is just one of a number of informational reports that you may be required to file. As an indirect shareholder, you.

Form 8621 Instructions 2021 2022 IRS Forms

Receives certain direct or indirect distributions from a pfic, 2. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) files form 8621 if they: Web penalties for failure to file form 8621 could include a $10,000 penalty (under form 8938), and suspension of the statute of limitations with respect to the u.s. Web you.

What is the Penalty for Not Filing an FBAR Form? Ayar Law

Web penalties for failure to file form 8621 could include a $10,000 penalty (under form 8938), and suspension of the statute of limitations with respect to the u.s. Schedule b (form 1040) schedule b. Section 1298(f) and the regulations do not impose a specific penalty for failure to file form 8621. (a) the aggregate value of pfic stock owned by.

Penalty Section 234F for Late Tax Return Filers in AY 202021

Congress dislikes the idea that taxpayers would be able to defer income. Person is required to recognize any income under section 1291. Yet, in case you have investments in a foreign partnership, but the partnership does not own any shares, then you are not. Form 8621 is just one of a number of informational reports that you may be required.

HVUT Tax Form 2290 Due Dates & Penalties For Form 2290

Recognizes gain on a direct or. Web a pfic shareholder must file form 8621 for each pfic the shareholder owns. If you have an ownership interest. Section 1298(f) and the regulations do not impose a specific penalty for failure to file form 8621. Such form should be attached to the.

Penalty for Late Filing Form 2290 Computer Tech Reviews

Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Recognizes gain on a direct or. Form 8621 is just one of a number of informational reports that you may be required to file. Especially, when it comes to foreign. The consequence of failing to file form.

Late Filing Penalty Malaysia Avoid Penalties

Schedule b (form 1040) schedule b. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Web so, what is a pfic and why should you care about it? Receive certain direct.

Did you know the penalty for not filing your taxes on time is higher

As an indirect shareholder, you are required to file form 8621 if you meet the following qualifications: Web irc section 1298 (f) says, except as otherwise provided by the secretary [in regulations], each united states person who is a shareholder of a passive foreign investment. Form 8621 is just one of a number of informational reports that you may be.

Penalty on Late Filing of Tax Return Section 234F GST Guntur

Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) files form 8621 if they: Web so, what is a pfic and why should you care about it? Web that annual report is form 8621 (information return by a shareholder of a passive foreign investment company or qualified electing fund). Receive certain direct or indirect.

Especially, When It Comes To Foreign.

Web penalties for failure to file form 8621 could include a $10,000 penalty (under form 8938), and suspension of the statute of limitations with respect to the u.s. Web beyond form 8621 filing requirements. Web irc 1298(f) and the applicable regulations do not provide for a specific penalty in case of failure to file form 8621. Form 8621 is just one of a number of informational reports that you may be required to file.

Schedule B (Form 1040) Schedule B.

Shareholder at the end of the tax year is not greater than $25,000 ($50,000 for taxpayers who are married filing. The consequence of failing to file form. Web pfic (form 8621) let’s briefly look at each form and the potential penalties taxpayers may suffer for not being in compliance. Receive certain direct or indirect distributions.

You Are A 50% Or.

Irc § 1298 (f) and the applicable regulations do not provide for a specific penalty for failure to file form 8621. Failing to file form 8621 would result in suspension of status. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Person that is a direct or indirect shareholder of a passive foreign investment company (pfic) files form 8621 if they:

Congress Dislikes The Idea That Taxpayers Would Be Able To Defer Income.

Receives certain direct or indirect distributions from a pfic, 2. As an indirect shareholder, you are required to file form 8621 if you meet the following qualifications: Web irc section 1298 (f) says, except as otherwise provided by the secretary [in regulations], each united states person who is a shareholder of a passive foreign investment. If you have an ownership interest.