Ohio Tax Withholding Form 2023

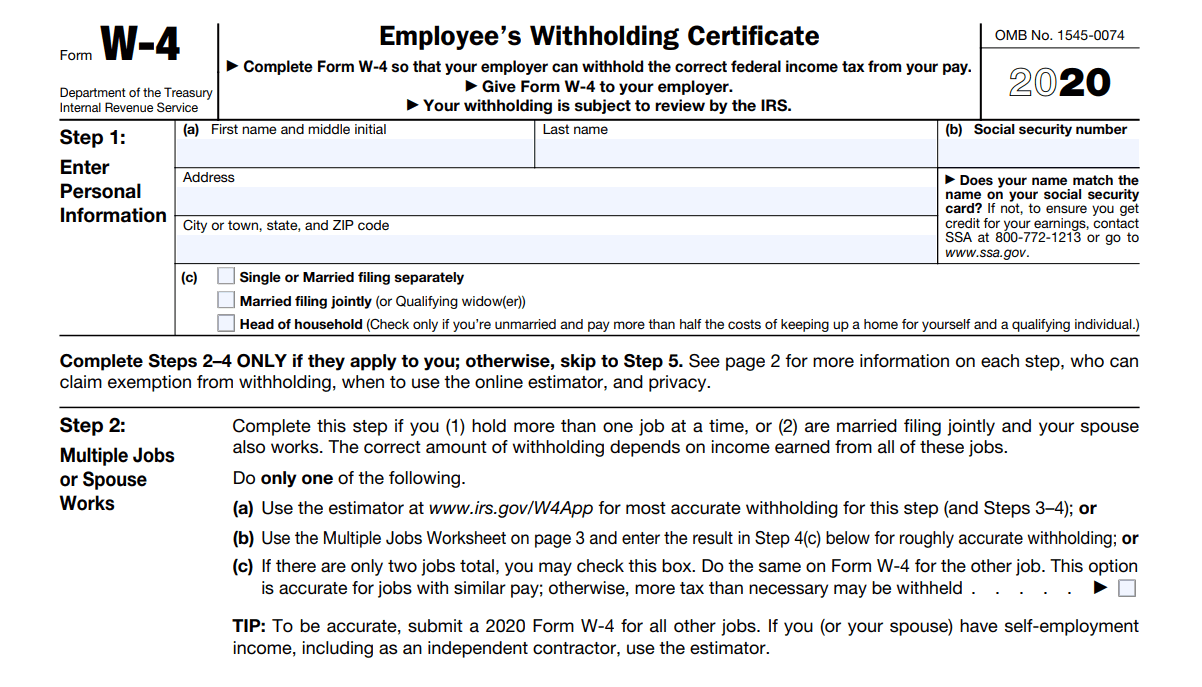

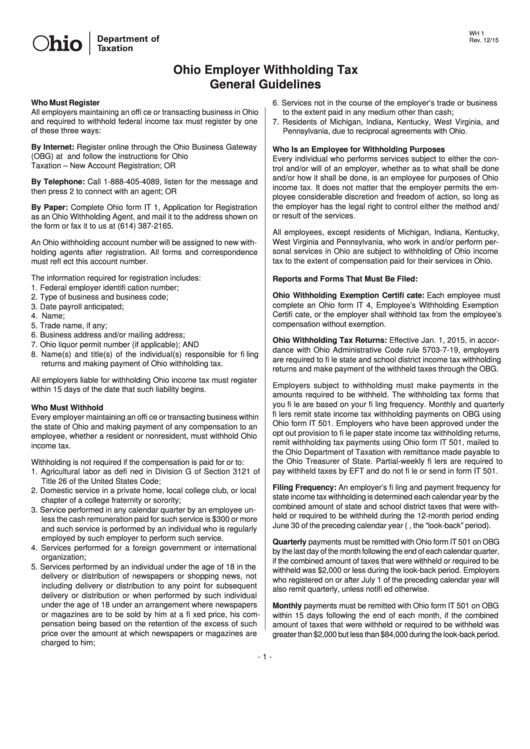

Ohio Tax Withholding Form 2023 - The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Request a state of ohio income tax form be mailed to you. Must i withhold ohio income tax from their wages? Web how to fill out ohio withholding form it 4 in 2023 + faqs. Access the forms you need to file taxes or do business in ohio. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: If applicable, your employer will also withhold school district income tax.

Web department oftaxation employee’s withholding exemption certificate it 4 rev. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022) due dates and payment schedule (2022) Most forms are available for download and some can be. Web how to fill out ohio withholding form it 4 in 2023 + faqs. If applicable, your employer will also withhold school district income tax. File the ohio it 942 on ohio business gateway. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. Learn about this form and how to fill it out correctly to ensure your employer withholds the correct amount of money from your paycheck for income taxes.

If you live or work in ohio, you may need to complete an ohio form it 4. View bulk orders tax professional bulk orders download. Web department oftaxation employee’s withholding exemption certificate it 4 rev. Most forms are available for download and some can be. Request a state of ohio income tax form be mailed to you. 2 where do i find paper employer withholding and school district withholding tax forms? Access the forms you need to file taxes or do business in ohio. Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022) due dates and payment schedule (2022) Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: Must i withhold ohio income tax from their wages?

Ohio Department Of Taxation Employee Withholding Form 2023

If you live or work in ohio, you may need to complete an ohio form it 4. File the ohio it 942 on ohio business gateway. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): View bulk orders tax professional bulk orders download. 2 where do i find paper employer withholding and school district withholding tax.

Ohio Employee Tax Withholding Form 2022 2023

Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): If applicable, your employer will also withhold school district income tax. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources: File the ohio it 942 on ohio business gateway. Ohio employer and school.

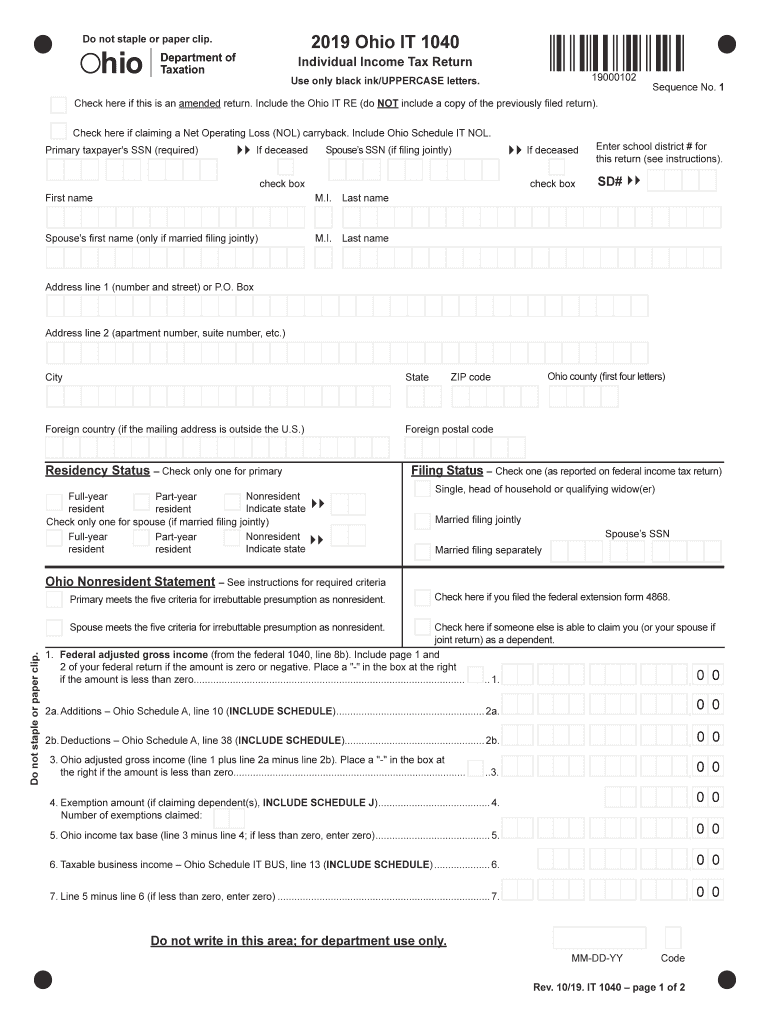

2019 Ohio It 1040 Fill Out and Sign Printable PDF Template signNow

Eft filers do not file the ohio it 941. If you live or work in ohio, you may need to complete an ohio form it 4. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. File the ohio it 942.

Ohio Weekly Paycheck Calculator

2 where do i find paper employer withholding and school district withholding tax forms? Must i withhold ohio income tax from their wages? Eft filers do not file the ohio it 941. All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. Access the forms you need to file taxes or do business in ohio.

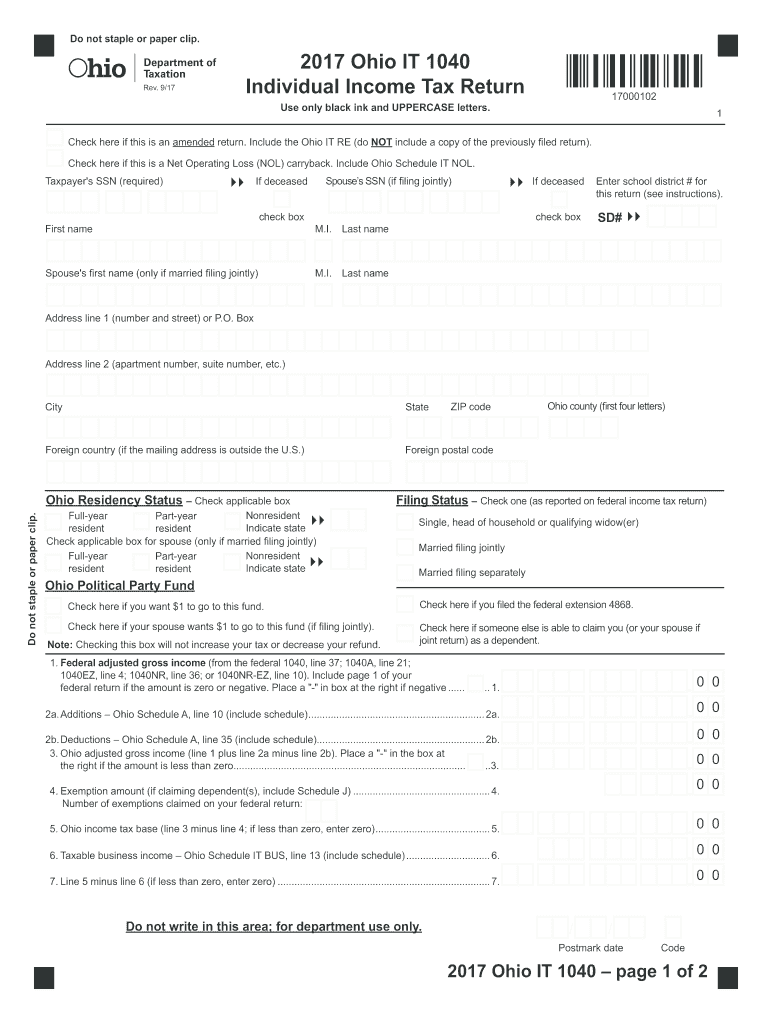

Ohio Tax Forms Fill Out and Sign Printable PDF Template signNow

Request a state of ohio income tax form be mailed to you. 2 where do i find paper employer withholding and school district withholding tax forms? Eft filers do not file the ohio it 941. If applicable, your employer will also withhold school district income tax. Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022).

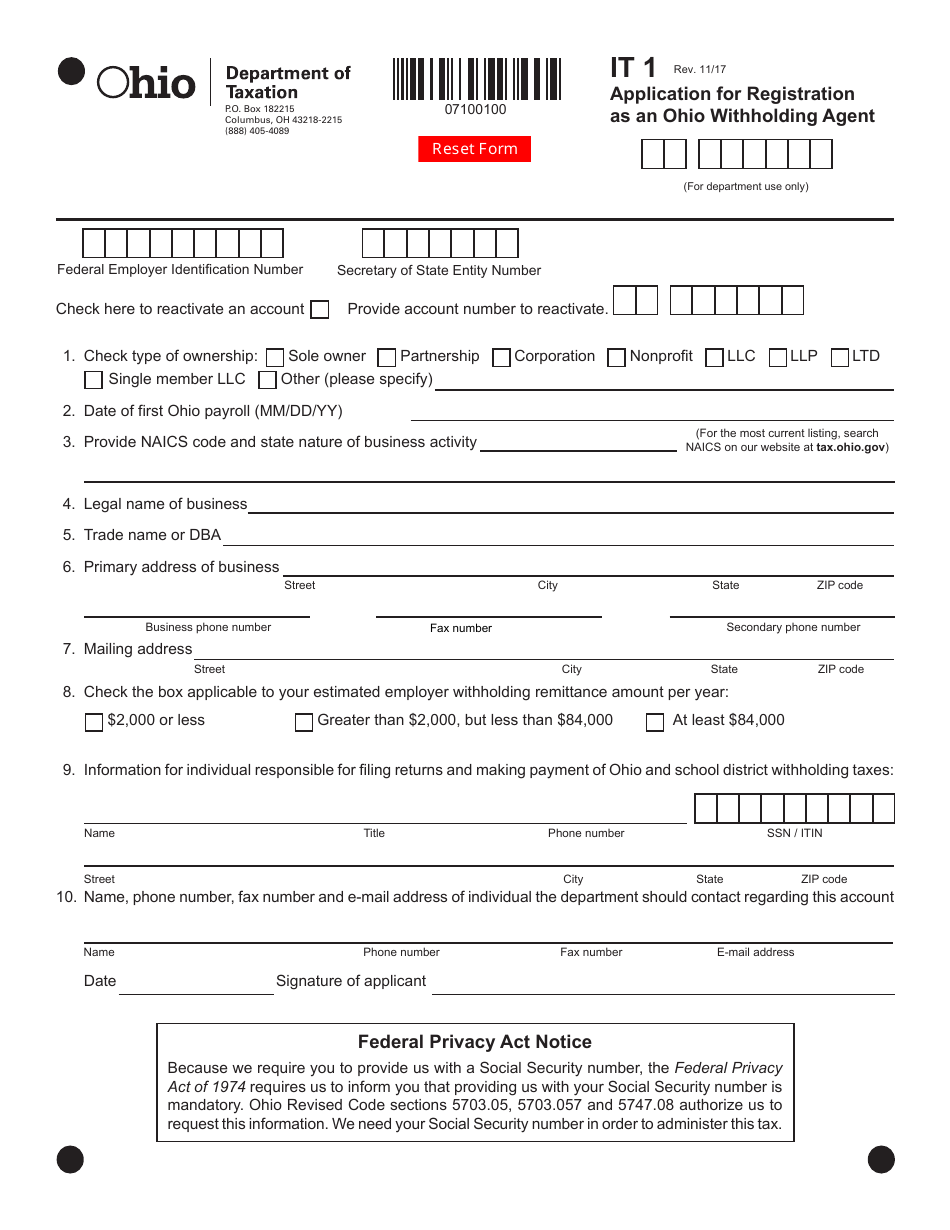

Ohio Withholding Business Registration Subisness

Access the forms you need to file taxes or do business in ohio. Web department oftaxation employee’s withholding exemption certificate it 4 rev. Eft filers do not file the ohio it 941. File the ohio it 942 on ohio business gateway. Most forms are available for download and some can be.

Ca W4 2021 Printable 2022 W4 Form

Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022) due dates and payment schedule (2022) All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Eft filers do not file the ohio it 941..

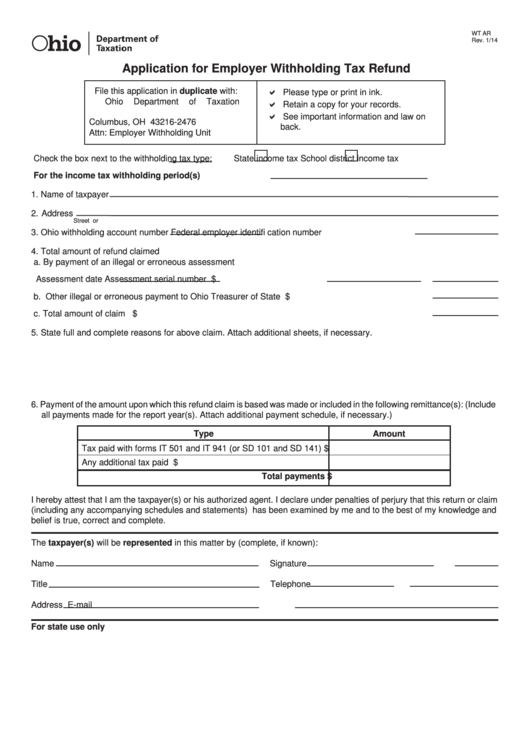

Ohio Employer Withholding Tax printable pdf download

2 where do i find paper employer withholding and school district withholding tax forms? All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): 12/20 submit form it 4 to your employer on or before the start date of employment so your.

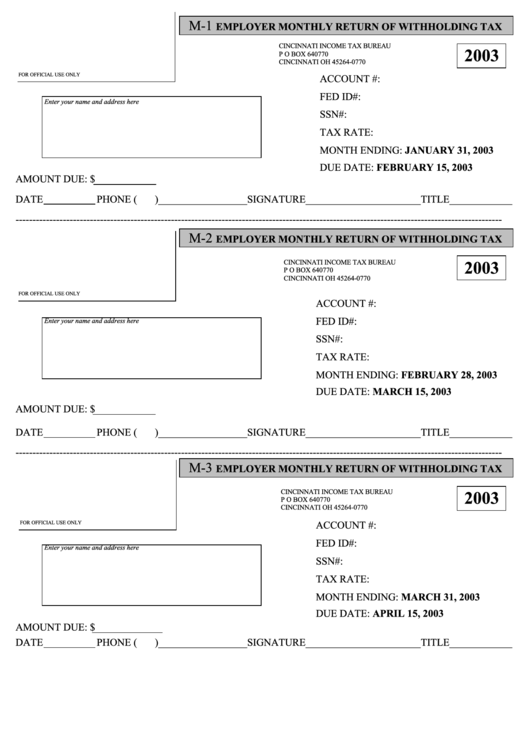

Form M1 Employer Monthly Return Of Withholding Tax (2003

If applicable, your employer will also withhold school district income tax. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. 2 where do i find paper employer withholding and school district withholding tax forms? Required returns and forms ohio it.

Fillable Heap Form Printable Forms Free Online

Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. 2 where do i find paper employer withholding and school district withholding tax forms? Access the forms you need to.

Learn About This Form And How To Fill It Out Correctly To Ensure Your Employer Withholds The Correct Amount Of Money From Your Paycheck For Income Taxes.

If you live or work in ohio, you may need to complete an ohio form it 4. 12/20 submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your compensation. Each employee must complete an ohio it 4, employee’s withholding exemption certificate, or the employer must withhold tax based on the employee claiming zero exemptions. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes.

Web How To Fill Out Ohio Withholding Form It 4 In 2023 + Faqs.

Web department oftaxation employee’s withholding exemption certificate it 4 rev. Access the forms you need to file taxes or do business in ohio. All ohio municipalities assess payroll withholding tax on “qualifying wages” as defined in section 718. Must i withhold ohio income tax from their wages?

2 Where Do I Find Paper Employer Withholding And School District Withholding Tax Forms?

Ohio employer and school district withholding tax filing guidelines (2022) school district rates (2022) due dates and payment schedule (2022) Required returns and forms ohio it 4 employee’s withholding exemption certificate (employee form): If applicable, your employer will also withhold school district income tax. Ohio employer and school district withholding tax filing guidelines (2023) school district rates (2023) due dates and payment schedule (2023) 2022 withholding resources:

File The Ohio It 942 On Ohio Business Gateway.

Request a state of ohio income tax form be mailed to you. Eft filers do not file the ohio it 941. View bulk orders tax professional bulk orders download. Most forms are available for download and some can be.