Ohio Inheritance Tax Waiver Form

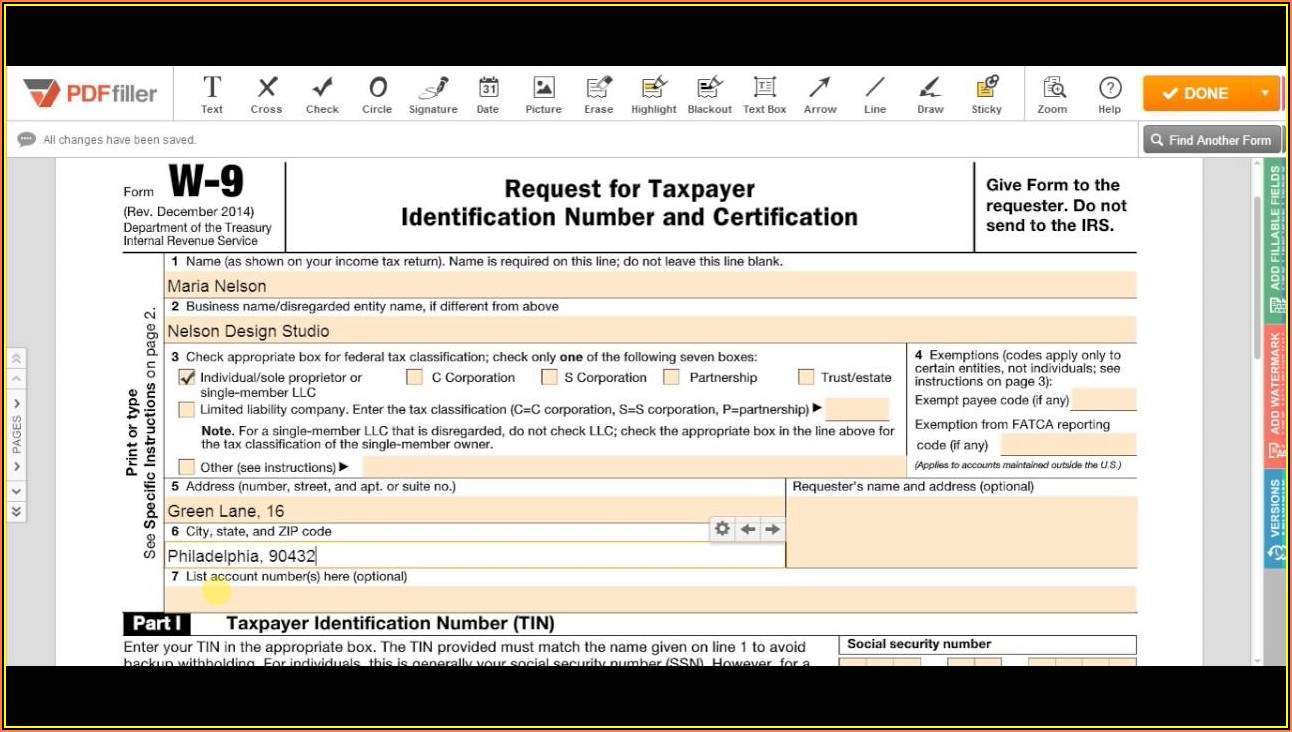

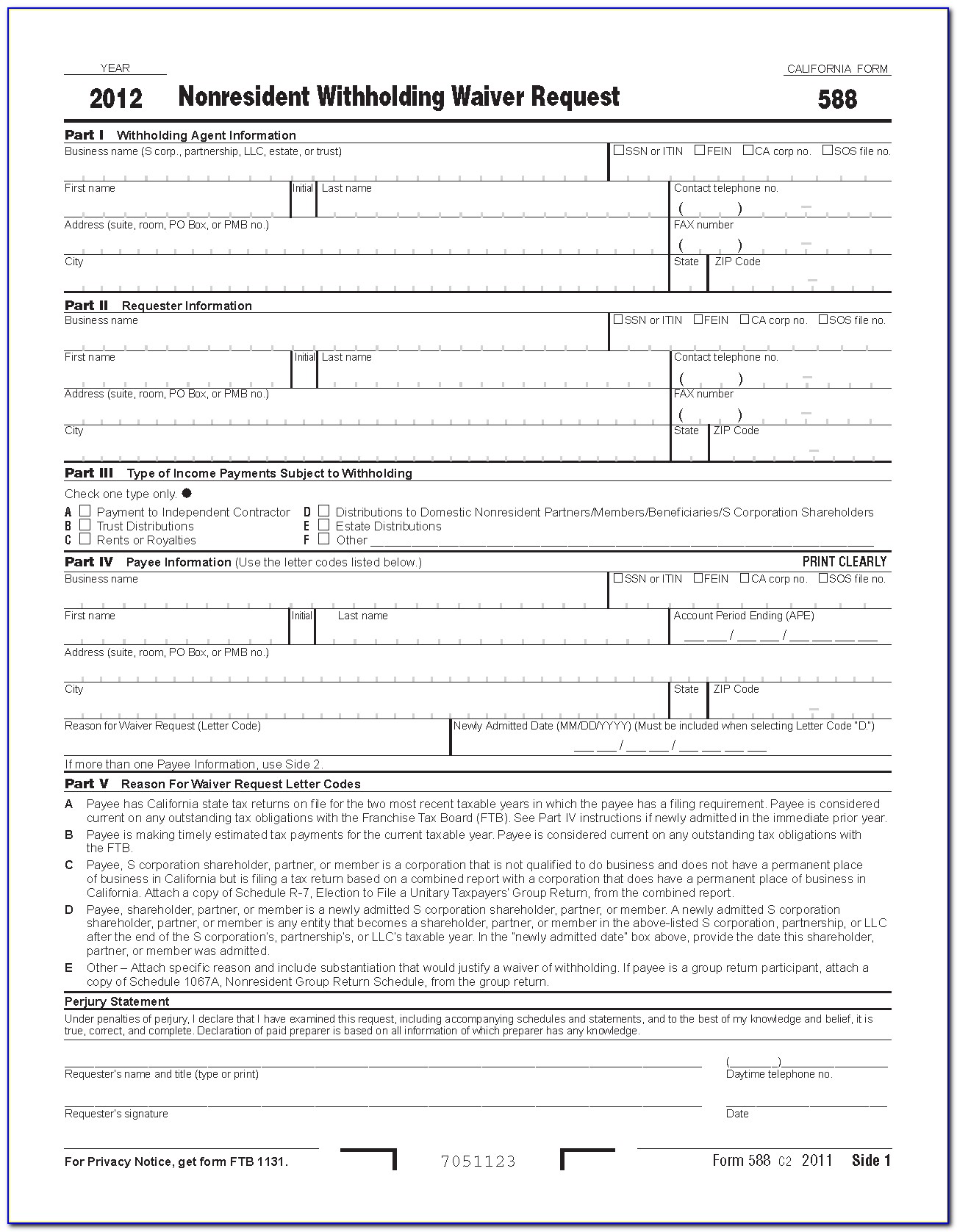

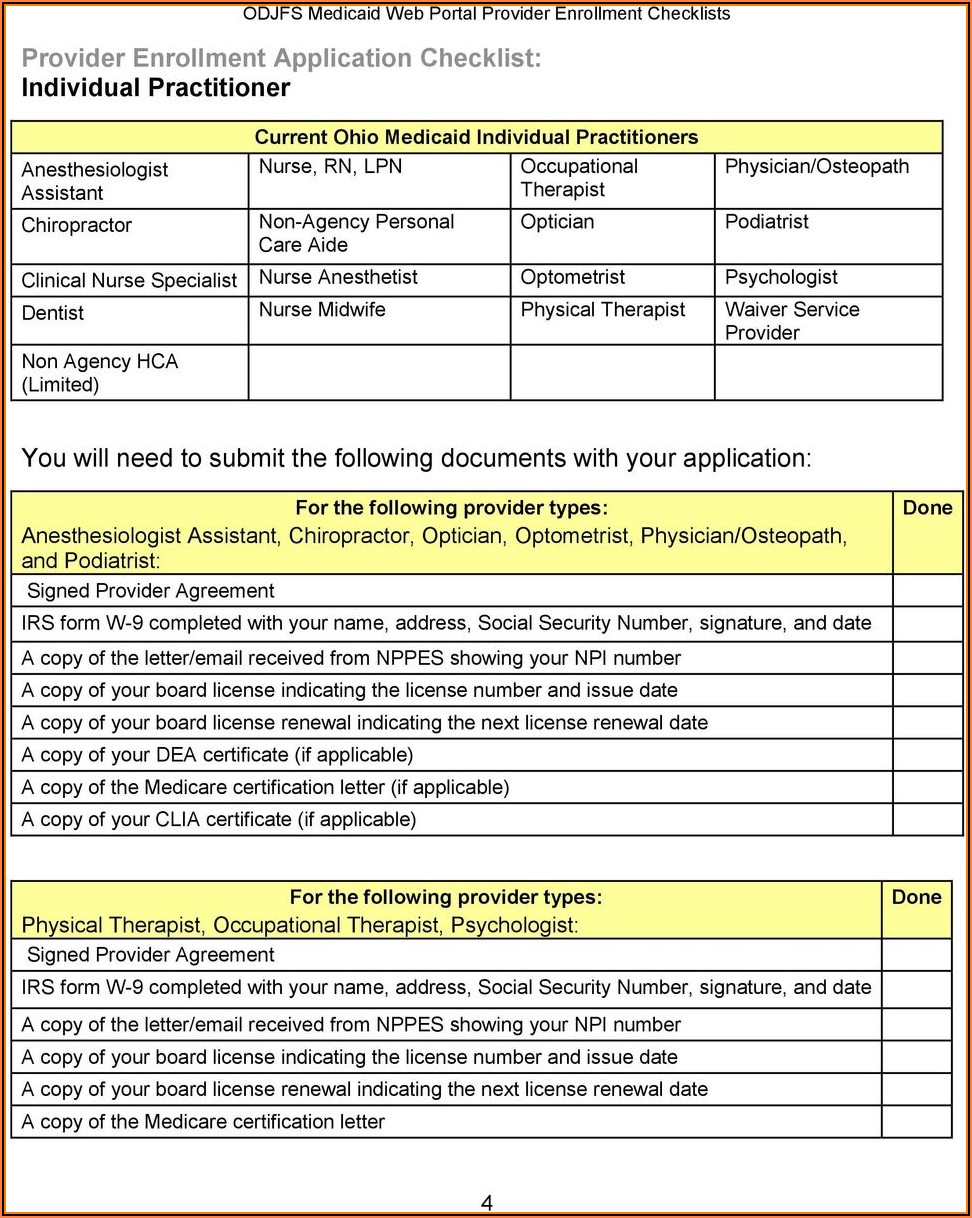

Ohio Inheritance Tax Waiver Form - 5 what are the ohio income tax obligations for an estate? Web while it’s definitely welcome news for many that ohio has no estate or inheritance taxes, that doesn’t leave you exempt from a number of other taxes you must file in the name of either the decedent or his or her estate. Certificate of service of account to heirs or beneficiaries; The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Access the forms you need to file taxes or do business in ohio. We need your social security number in order to administer this tax. Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. 6 what are the ohio school district income tax obligations for an estate? Most forms are available for download and some can be filled or filed online. Web 4 is a tax release, also commonly known as an inheritance tax waiver, required to be filed with the tax commissioner?

Web key takeaways a person inheriting money or assets may decline the inheritance with an estate waiver. Web here’s how you know ohio estate tax sunset provision 2021 ohio department of taxation 4485 northland ridge blvd., columbus, oh 43229 ohio revised code laws, rules, and rulings Notice of hearing on account; Web 4 is a tax release, also commonly known as an inheritance tax waiver, required to be filed with the tax commissioner? Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. 6 what are the ohio school district income tax obligations for an estate? 5 what are the ohio income tax obligations for an estate? Waiver of notice of hearing on account; Web us with your social security number is mandatory. The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes.

Web here’s how you know ohio estate tax sunset provision 2021 ohio department of taxation 4485 northland ridge blvd., columbus, oh 43229 ohio revised code laws, rules, and rulings Web while it’s definitely welcome news for many that ohio has no estate or inheritance taxes, that doesn’t leave you exempt from a number of other taxes you must file in the name of either the decedent or his or her estate. Ohio revised code sections 5703.05, 5703.057 and 5747.08 authorize us to request this information. In order to make sure you pay any estate or inheritance taxes, the bank or other institution holding assets you’re set to inherit won’t release the assets to you until they receive the waiver. Web key takeaways a person inheriting money or assets may decline the inheritance with an estate waiver. Most forms are available for download and some can be filled or filed online. 6 what are the ohio school district income tax obligations for an estate? Notice of hearing on account; Waiver of notice of hearing on account; Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Web here’s how you know ohio estate tax sunset provision 2021 ohio department of taxation 4485 northland ridge blvd., columbus, oh 43229 ohio revised code laws, rules, and rulings 6 what are the ohio school district income tax obligations for an.

State Of Il Inheritance Tax Waiver Form Form Resume Examples

Ohio revised code sections 5703.05, 5703.057 and 5747.08 authorize us to request this information. Web 4 is a tax release, also commonly known as an inheritance tax waiver, required to be filed with the tax commissioner? Access the forms you need to file taxes or do business in ohio. In order to make sure you pay any estate or inheritance.

Inheritance Tax Illinois ellieldesign

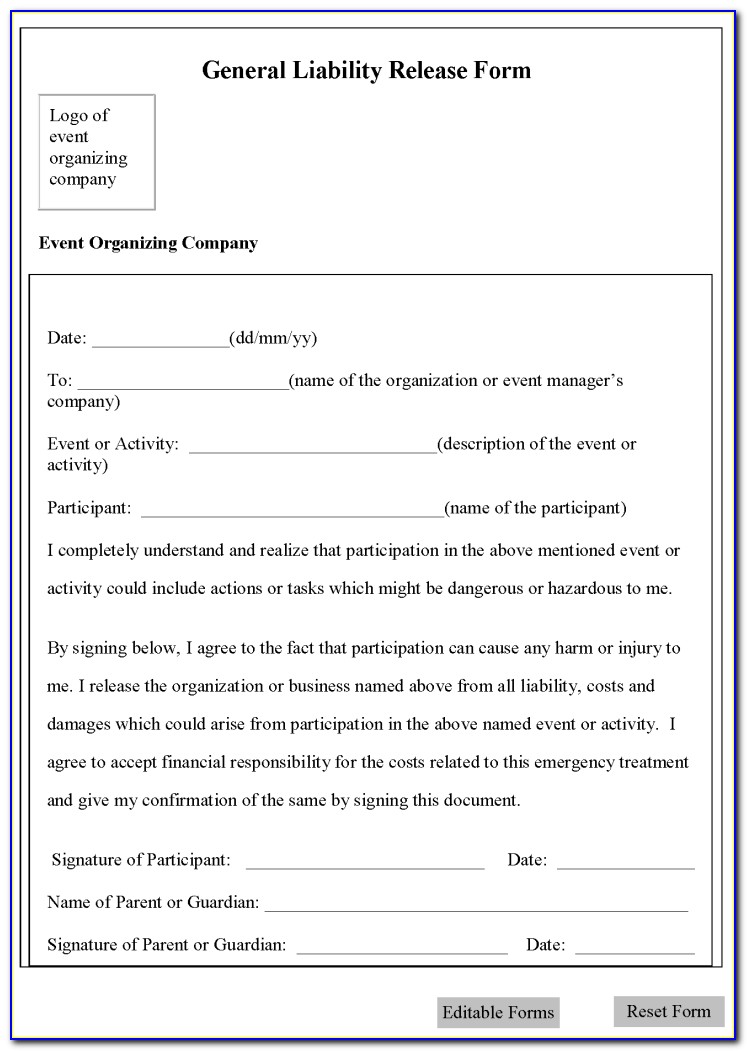

State laws govern the specifics of the waiver. Web here’s how you know ohio estate tax sunset provision 2021 ohio department of taxation 4485 northland ridge blvd., columbus, oh 43229 ohio revised code laws, rules, and rulings The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Notice of hearing on account; Waiver of.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

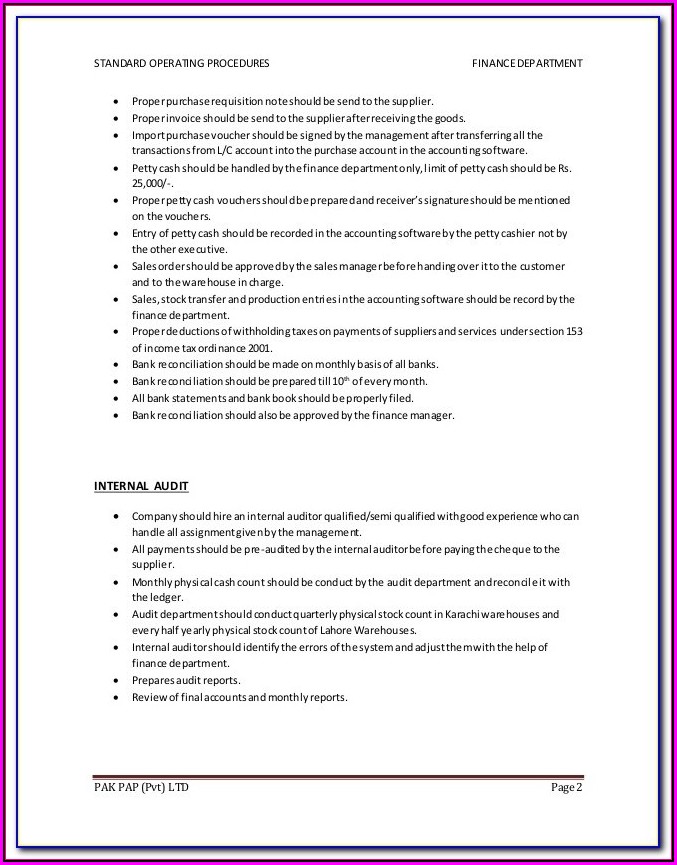

The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Most forms are available for download and some can be filled or filed online. Access the forms you need to file taxes or do business in ohio. 5 what are the ohio income tax obligations for an estate? In such cases, the executor of.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Notice of hearing on account; Certificate of service of account to heirs or beneficiaries; It’s usually issued by a state tax authority. Paid preparers who prepare more than 11 ohio income tax returns for the calendar year must electronically file all returns. State laws govern the specifics of the waiver.

Inheritance Tax Waiver Form Illinois Form Resume Examples XV8o6xN3zD

Notice of hearing on account; Access the forms you need to file taxes or do business in ohio. It’s usually issued by a state tax authority. In order to make sure you pay any estate or inheritance taxes, the bank or other institution holding assets you’re set to inherit won’t release the assets to you until they receive the waiver..

Illinois Inheritance Tax Waiver Form Form Resume Examples aEDvNW1D1Y

Waiver of notice of hearing on account; Web while it’s definitely welcome news for many that ohio has no estate or inheritance taxes, that doesn’t leave you exempt from a number of other taxes you must file in the name of either the decedent or his or her estate. In order to make sure you pay any estate or inheritance.

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

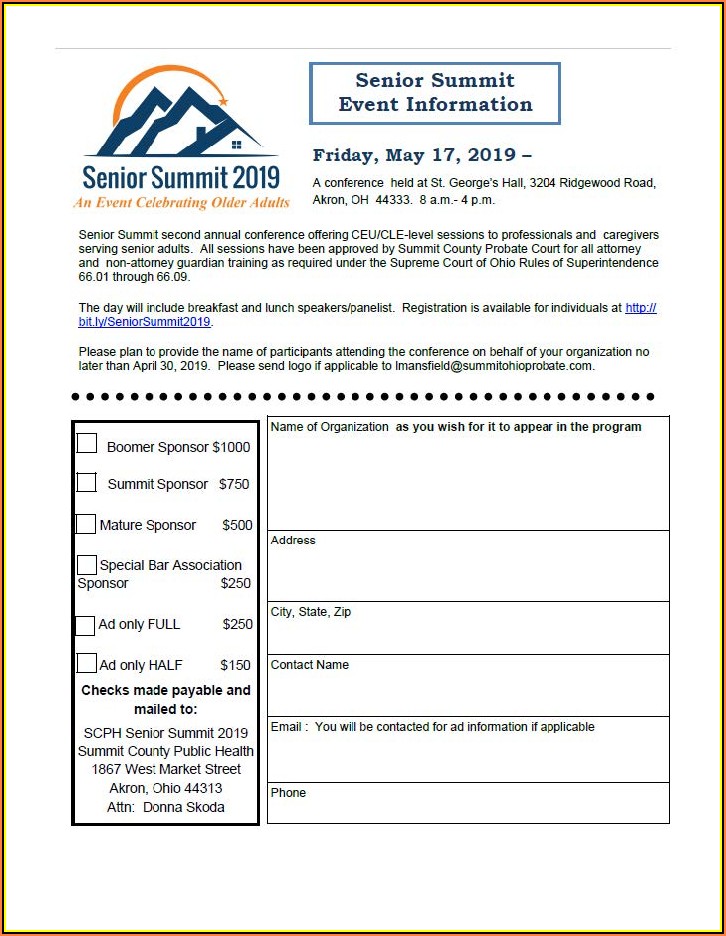

Web here’s how you know ohio estate tax sunset provision 2021 ohio department of taxation 4485 northland ridge blvd., columbus, oh 43229 ohio revised code laws, rules, and rulings Paid preparers who prepare more than 11 ohio income tax returns for the calendar year must electronically file all returns. Notice of hearing on account; The ohio department of taxation provides.

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

Paid preparers who prepare more than 11 ohio income tax returns for the calendar year must electronically file all returns. Waiver of notice of hearing on account; In order to make sure you pay any estate or inheritance taxes, the bank or other institution holding assets you’re set to inherit won’t release the assets to you until they receive the.

Inheritance Tax Waiver Form Missouri Form Resume Examples P32EdpZVJ8

Certificate of service of account to heirs or beneficiaries; In such cases, the executor of the will. Web 4 is a tax release, also commonly known as an inheritance tax waiver, required to be filed with the tax commissioner? We need your social security number in order to administer this tax. It’s usually issued by a state tax authority.

Notice Of Hearing On Account;

The ohio department of taxation provides a searchable repository of individual tax forms for multiple purposes. Web while it’s definitely welcome news for many that ohio has no estate or inheritance taxes, that doesn’t leave you exempt from a number of other taxes you must file in the name of either the decedent or his or her estate. Certificate of service of account to heirs or beneficiaries; Access the forms you need to file taxes or do business in ohio.

Web Key Takeaways A Person Inheriting Money Or Assets May Decline The Inheritance With An Estate Waiver.

Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Web here’s how you know ohio estate tax sunset provision 2021 ohio department of taxation 4485 northland ridge blvd., columbus, oh 43229 ohio revised code laws, rules, and rulings In such cases, the executor of the will. 5 what are the ohio income tax obligations for an estate?

Web Us With Your Social Security Number Is Mandatory.

Web 4 is a tax release, also commonly known as an inheritance tax waiver, required to be filed with the tax commissioner? Waiver of notice of hearing on account; State laws govern the specifics of the waiver. In order to make sure you pay any estate or inheritance taxes, the bank or other institution holding assets you’re set to inherit won’t release the assets to you until they receive the waiver.

6 What Are The Ohio School District Income Tax Obligations For An Estate?

Paid preparers who prepare more than 11 ohio income tax returns for the calendar year must electronically file all returns. It’s usually issued by a state tax authority. Ohio revised code sections 5703.05, 5703.057 and 5747.08 authorize us to request this information. Most forms are available for download and some can be filled or filed online.