Ohio Homestead Exemption Form

Ohio Homestead Exemption Form - Web visit the ohio department of taxation website and download form dte 105a. Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: Web homestead exemption department auditor homestead exemption department home property search appraisal and revaluation agricultural district cauv documents and. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. Ohio has two types of homestead exemption: Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Homestead exemption form email the auditor's office regarding homestead exemption A homestead exemption application form (“dte 105a) (link is external) is available from. Web the exemption takes the form of a credit on property tax bills. Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach it or a separate certification of disability status from.

Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach it or a separate certification of disability status from. House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. Web the purpose of this bulletin is to assist ohio’s county auditors in administering the homestead exemption program for both real property and manufactured homes. Web homestead exemption 2022 requirements qualifying income homestead exemption 2022 requirements 1. Web homestead exemption application form for military veterans evaluated at 100% disability from a service homeowners, already receiving homestead exemption, who have. Ohio has two types of homestead exemption: Web the exemption takes the form of a credit on property tax bills. 10/19 senior citizens, disabled persons and surviving spouses in order to qualify an applicant for the. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. 10/19 disabled veterans and surviving spouses real property and manufactured or mobile homes:

Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then file it with. Web visit the ohio department of taxation website and download form dte 105a. Homestead exemption form email the auditor's office regarding homestead exemption Ohio has two types of homestead exemption: Web homestead exemption department auditor homestead exemption department home property search appraisal and revaluation agricultural district cauv documents and. House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty. If you are under 65 and disabled, you also have to download form dte 105e. You can also download the. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. Web dteaddendum to the homestead exemption application for 105h rev.

What Is Ohio's Homestead Exemption? Richard P. Arthur Attorney at Law

Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: Web visit the ohio department of taxation website and download form dte 105a. To apply for the homestead exemption: Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach.

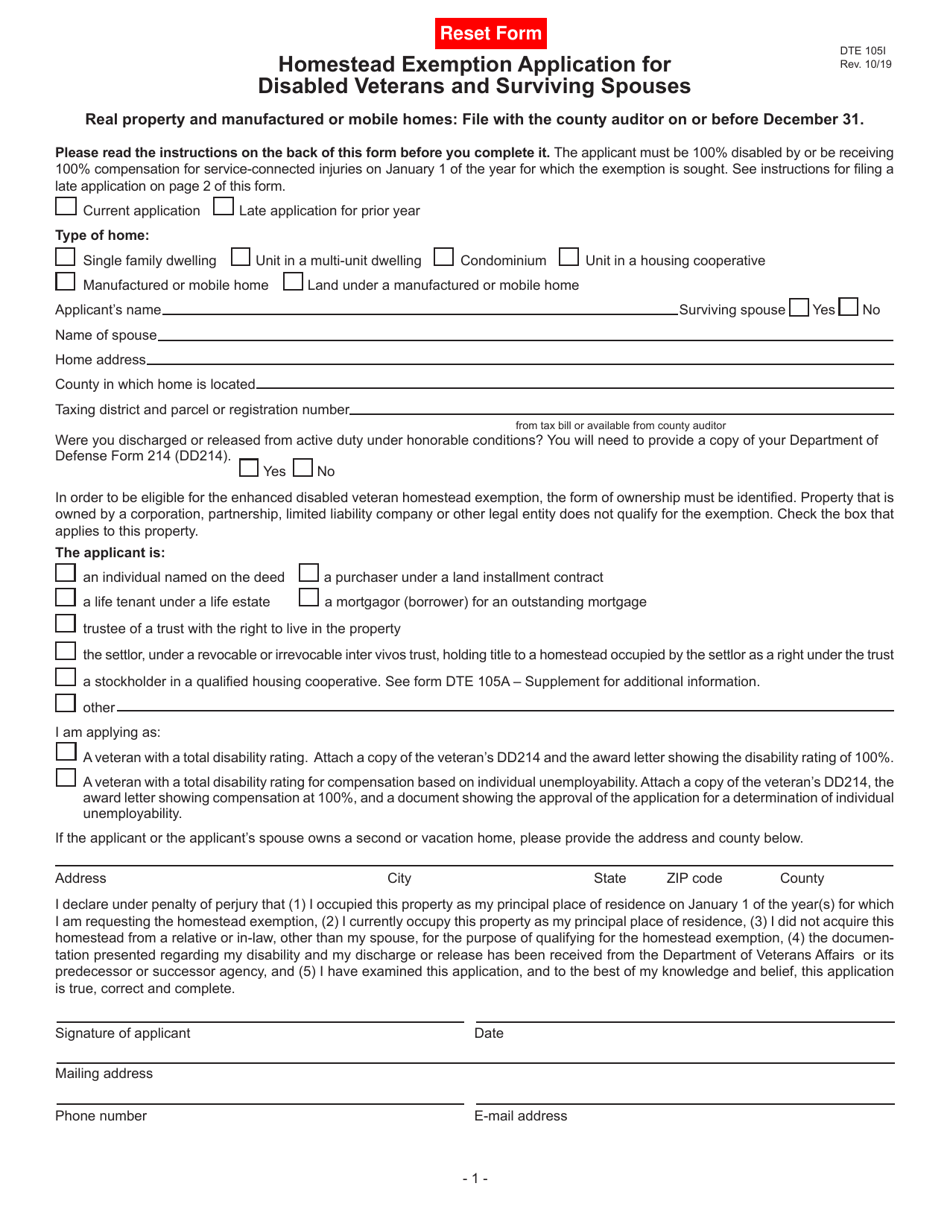

Form DTE105I Download Fillable PDF or Fill Online Homestead Exemption

Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach it or a separate certification of disability status from. Web homestead exemption 2022 requirements qualifying income homestead exemption 2022 requirements 1. Web to apply, complete the application form (dte 105a, homestead exemption application form for senior citizens, disabled persons, and surviving spouses), then.

Homestead exemption to rise The Blade

Web homestead exemption application form for military veterans evaluated at 100% disability from a service homeowners, already receiving homestead exemption, who have. Web the exemption takes the form of a credit on property tax bills. If you are under 65 and disabled, you also have to download form dte 105e. 10/19 disabled veterans and surviving spouses real property and manufactured.

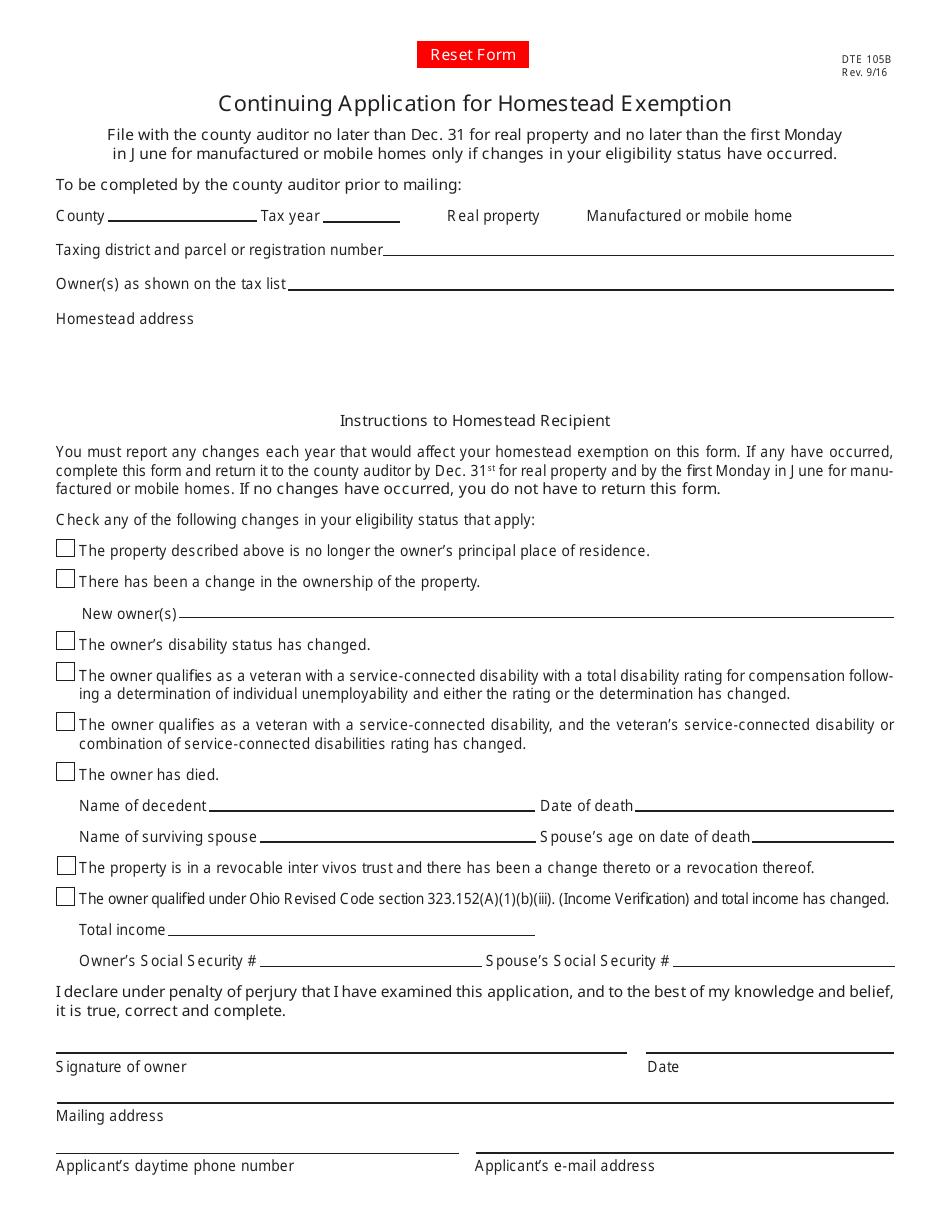

Form DTE105B Download Fillable PDF or Fill Online Continuing

Web any information regarding the homestead exemption program may be obtained from the lake county auditor’s office by mail, by phone or in person. You can also download the. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. Web the purpose of this bulletin is.

Homestead Exemption (Explained) YouTube

Web the homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does. If you are under 65 and disabled, you also have to download form dte 105e. Web visit the ohio department of taxation website and download form dte 105a. Web the exemption takes the.

How To Apply For Homestead Tax Credit In Ohio PRORFETY

Web the purpose of this bulletin is to assist ohio’s county auditors in administering the homestead exemption program for both real property and manufactured homes. Web dteaddendum to the homestead exemption application for 105h rev. Web the exemption takes the form of a credit on property tax bills. Web homestead exemption department auditor homestead exemption department home property search appraisal.

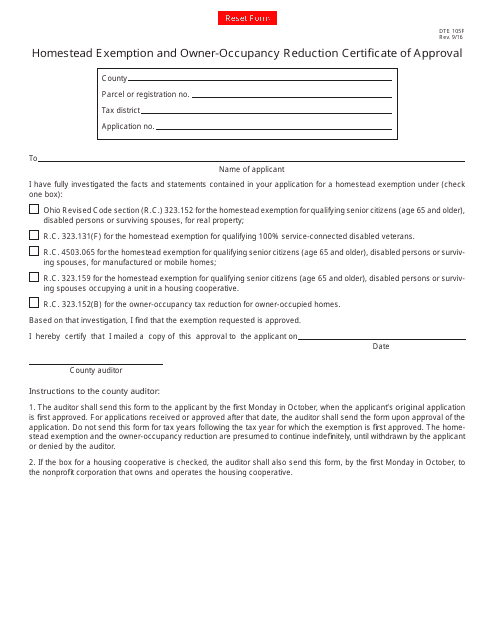

Form DTE105F Download Fillable PDF or Fill Online Homestead Exemption

Web any information regarding the homestead exemption program may be obtained from the lake county auditor’s office by mail, by phone or in person. To apply for the homestead exemption: Web what is ohio’s homestead exemption? Web the exemption takes the form of a credit on property tax bills. You can also download the.

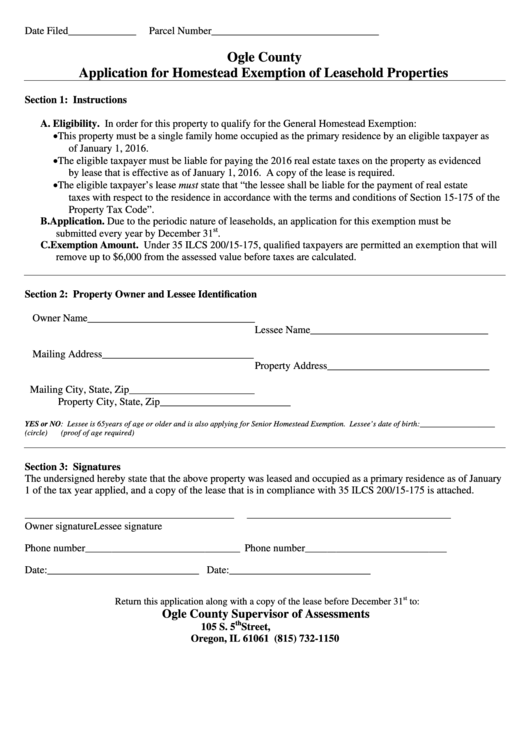

Fillable Application For Homestead Exemption Of Leasehold Properties

Web visit the ohio department of taxation website and download form dte 105a. Web dte 105i homestead exemption application for rev. Homestead exemption form email the auditor's office regarding homestead exemption Web dteaddendum to the homestead exemption application for 105h rev. A homestead exemption application form (“dte 105a) (link is external) is available from.

How To Apply For Homestead Tax Credit In Ohio PRORFETY

Web homestead exemption 2022 requirements qualifying income homestead exemption 2022 requirements 1. Web dte 105i homestead exemption application for rev. (1) senior and disabled persons homestead exemption and (2) disabled veterans. Web homestead exemption department auditor homestead exemption department home property search appraisal and revaluation agricultural district cauv documents and. House bill 17 became effective, allowing a homestead exemption for.

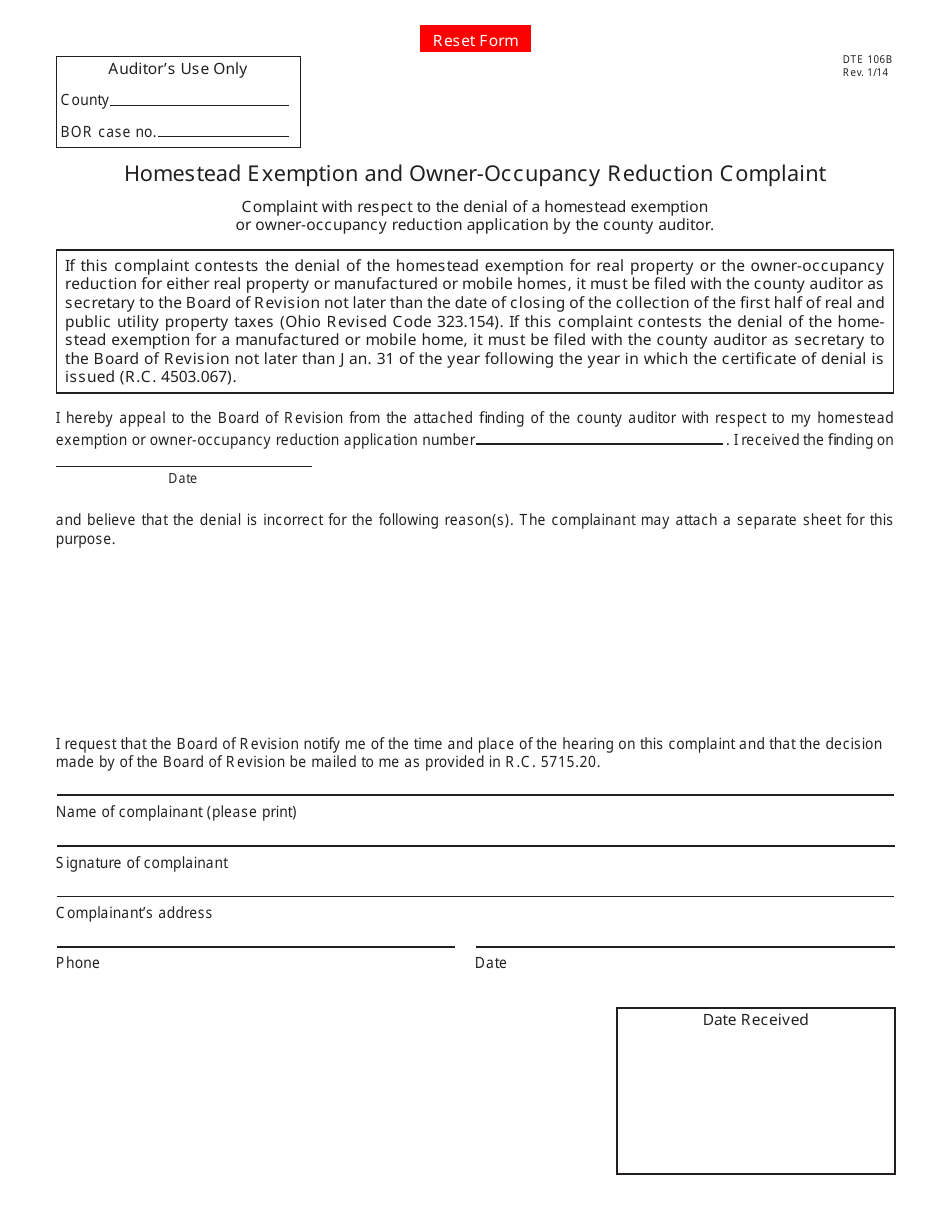

Form DTE106A Download Fillable PDF or Fill Online Homestead Exemption

Web disabled applicants must complete form dte 105e, certificate of disability for the homestead exemption, and attach it or a separate certification of disability status from. Web disability exemptions must include a certificate of disability form (dte105e) or other available certifications. Own your home as your principal place of residence. Ohio has two types of homestead exemption: Web any information.

If You Are Under 65 And Disabled, You Also Have To Download Form Dte 105E.

Web visit the ohio department of taxation website and download form dte 105a. To apply for the homestead exemption: Web the exemption takes the form of a credit on property tax bills. A homeowner is entitled the reduction on only one home.

10/19 Disabled Veterans And Surviving Spouses Real Property And Manufactured Or Mobile Homes:

Web homestead exemption 2022 requirements qualifying income homestead exemption 2022 requirements 1. Homestead exemption form email the auditor's office regarding homestead exemption Web homestead exemption if you are a homeowner who meets one of the requirements below, you may be eligible for a valuable tax reduction: Web the purpose of this bulletin is to assist ohio’s county auditors in administering the homestead exemption program for both real property and manufactured homes.

You Can Also Download The.

Web the homestead exemption is available to all homeowners 65 and older and all totally and permanently disabled homeowners with a previous year's household income that does. Web attach this form to the homestead exemption application (form dte 105a) if the applicant is requesting the homestead exemption based on disability status. A homestead exemption application form (“dte 105a) (link is external) is available from. The homestead exemption for senior and disabled persons allows eligible homeowners to exempt the first $25,000.

(1) Senior And Disabled Persons Homestead Exemption And (2) Disabled Veterans.

Web homestead exemption department auditor homestead exemption department home property search appraisal and revaluation agricultural district cauv documents and. Web disability exemptions must include a certificate of disability form (dte105e) or other available certifications. Web dteaddendum to the homestead exemption application for 105h rev. House bill 17 became effective, allowing a homestead exemption for a surviving spouse of a public service officer killed in the line of duty.