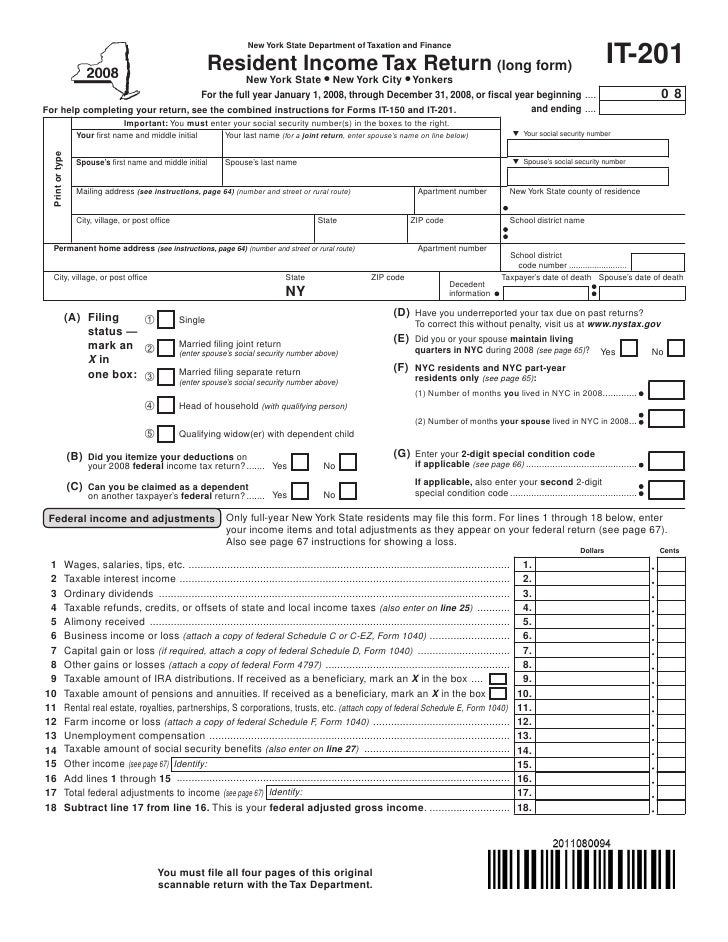

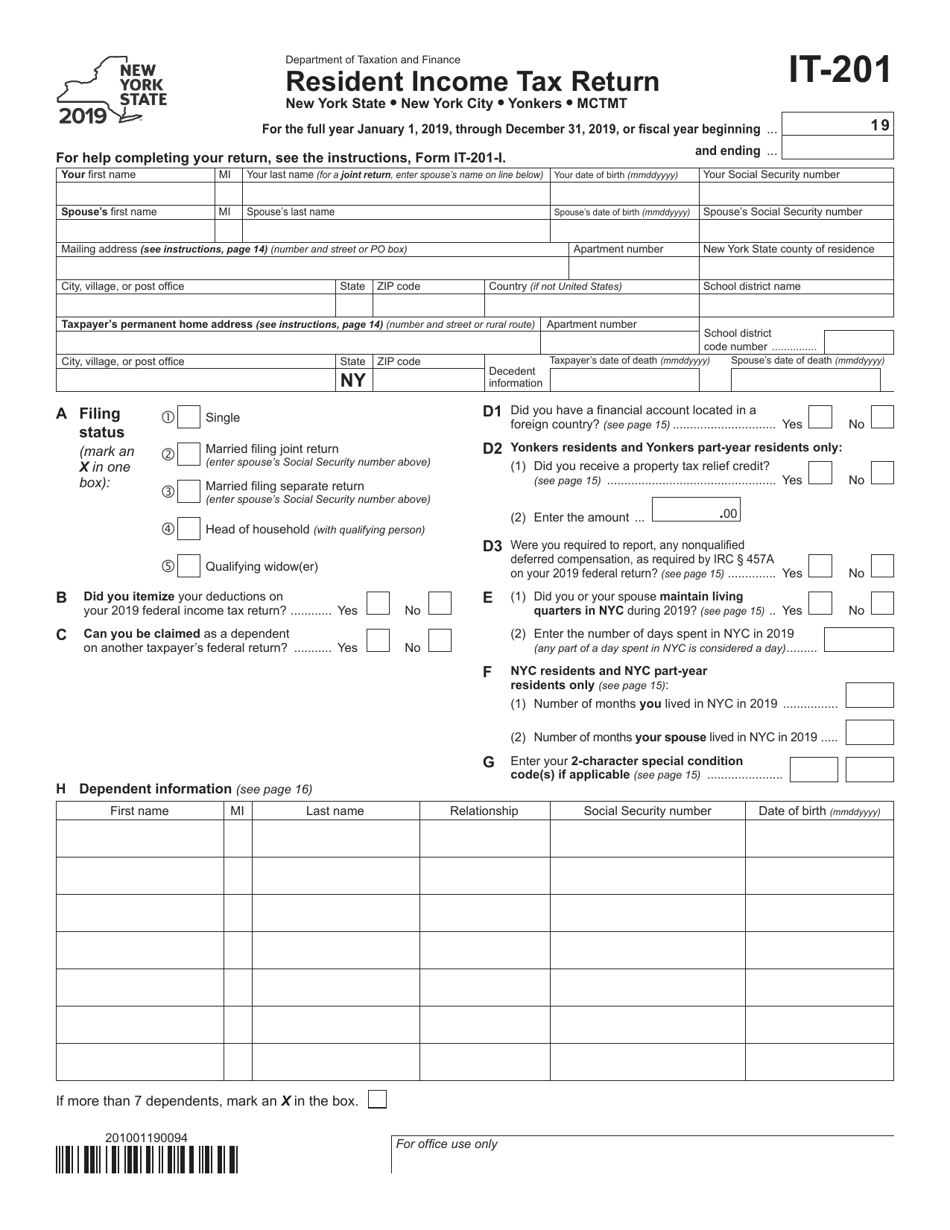

Nys Income Tax Form It-201

Nys Income Tax Form It-201 - Web find your requested refund amount by form and tax year; Web up to $40 cash back resident income tax return new york state new york city yonkers for the full year january 1, 2011, through december 31, 2011, or fiscal year beginning. This form is for income earned in tax year 2022,. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. If you filed for tax year your requested refund amount is; Web 61 total new york state, new york city, yonkers, and sales or use taxes, mctmt, and.voluntary contributions. Web you may be eligible for free file using one of the software providers below, if: Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31,. You can pay your income tax return payment directly on our website from. Web if you are a resident of new york you need to file form 201.

Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31,. We last updated the individual income tax instructions in. Web if you are a resident of new york you need to file form 201. This form is for income earned in tax year 2022,. This instruction booklet will help you to fill out and file form 201. If you filed for tax year your requested refund amount is; You can pay your income tax return payment directly on our website from. Web find your requested refund amount by form and tax year; Web 61 total new york state, new york city, yonkers, and sales or use taxes, mctmt, and.voluntary contributions. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the.

Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Web up to $40 cash back resident income tax return new york state new york city yonkers for the full year january 1, 2011, through december 31, 2011, or fiscal year beginning. You can pay your income tax return payment directly on our website from. Web if you are a resident of new york you need to file form 201. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. This form is for income earned in tax. This form is for income earned in tax year 2022,. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. This instruction booklet will help you to fill out and file form 201. We last updated the individual income tax instructions in.

Do these 2 things to get your New York state tax refund 2 weeks sooner

Web up to $40 cash back resident income tax return new york state new york city yonkers for the full year january 1, 2011, through december 31, 2011, or fiscal year beginning. Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021,.

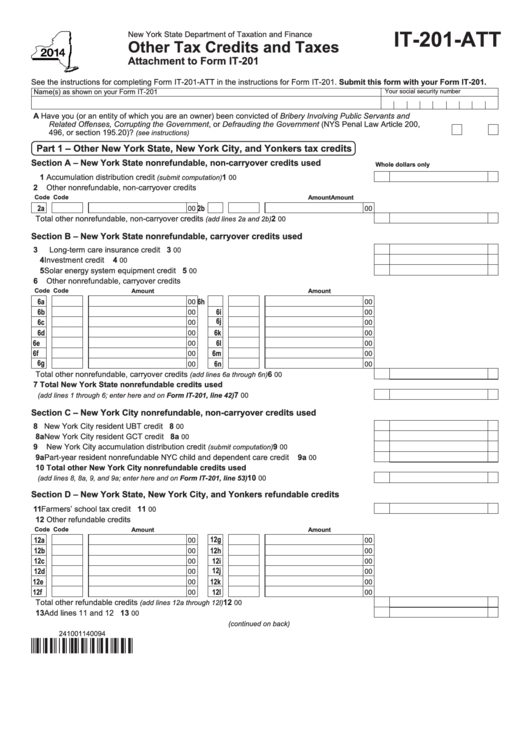

IT201ATT Other Taxes and Tax Credits Attachment to Form IT201

Web up to $40 cash back resident income tax return new york state new york city yonkers for the full year january 1, 2011, through december 31, 2011, or fiscal year beginning. Web 61 total new york state, new york city, yonkers, and sales or use taxes, mctmt, and.voluntary contributions. This instruction booklet will help you to fill out and.

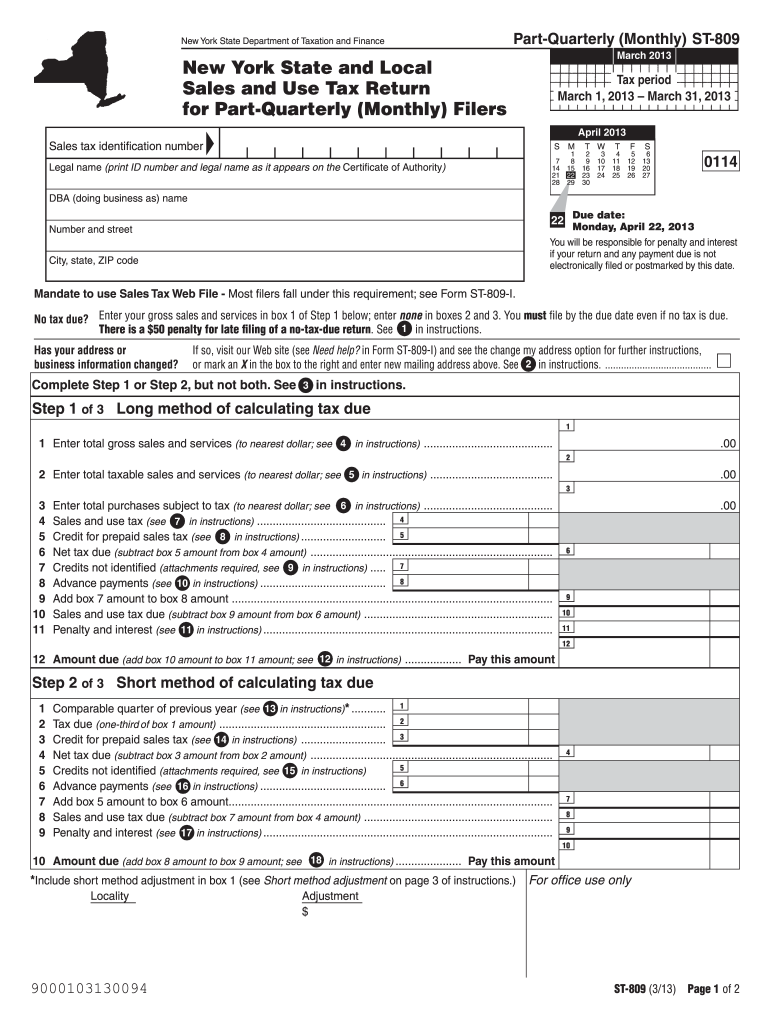

NY ST809 20202022 Fill out Tax Template Online US Legal Forms

You can pay your income tax return payment directly on our website from. Web up to $40 cash back department of taxation and financeit201i(u pdated on 1/12/2023)instr uctions for form it201 full year resident income tax returned york state new york city. Web you may be eligible for free file using one of the software providers below, if: This instruction.

Form IT201 Download Fillable PDF or Fill Online Resident Tax

Web find your requested refund amount by form and tax year; Web if you are a resident of new york you need to file form 201. We last updated the individual income tax instructions in. Web 61 total new york state, new york city, yonkers, and sales or use taxes, mctmt, and.voluntary contributions. This form is for income earned in.

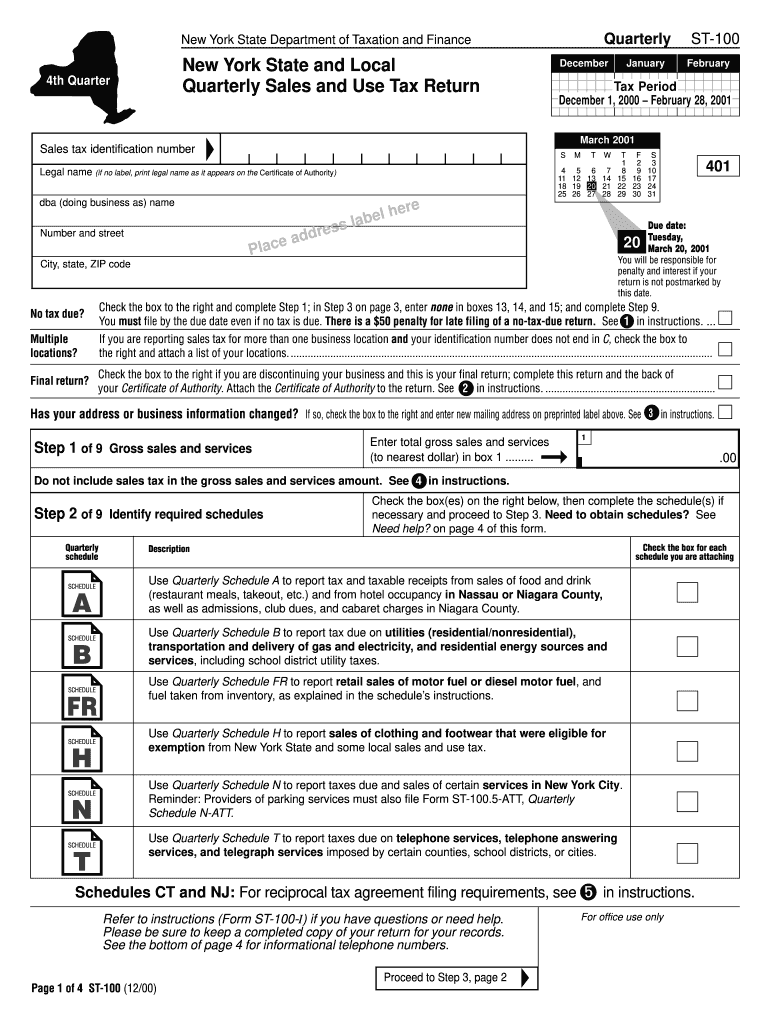

New York State Sales Tax Form St 100 Dec 12 Feb 13 Fill Out and Sign

You can pay your income tax return payment directly on our website from. Web up to $40 cash back department of taxation and financeit201i(u pdated on 1/12/2023)instr uctions for form it201 full year resident income tax returned york state new york city. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax.

Pay Nys Tax Online

If you filed for tax year your requested refund amount is; Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. Web 61 total new york state, new york city, yonkers, and sales or use taxes, mctmt, and.voluntary contributions. Web if you are a resident of new york.

Fillable Form It201Att New York Other Tax Credits And Taxes 2014

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Web up to $40 cash back resident income tax return new york state new york city yonkers for the full year january 1, 2011, through december 31, 2011, or fiscal year beginning. This instruction booklet will help you to fill out and.

9 Best Images of Tax Deduction Worksheet Business Tax Deductions

Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. You can pay your income tax return payment directly on our website from. This form is for income earned in tax. This instruction booklet will help you to fill out and file form 201. Your federal adjusted gross income (agi) is $41,000.

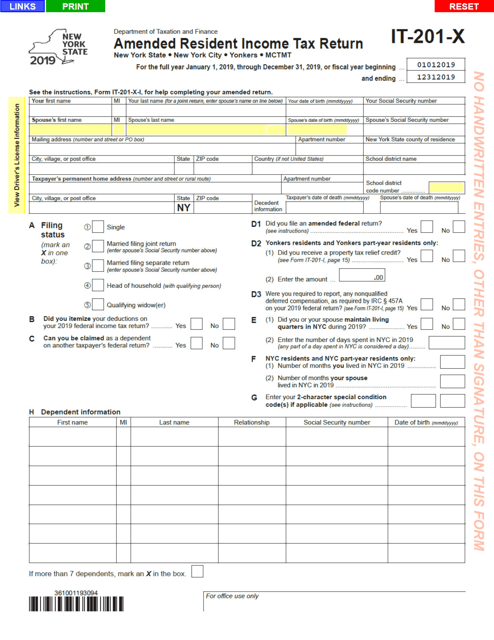

Form IT201X Download Fillable PDF or Fill Online Amended Resident

Web 61 total new york state, new york city, yonkers, and sales or use taxes, mctmt, and.voluntary contributions. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the. Web if you are a resident of new york you need to file form 201. This instruction booklet will help you to fill out.

2013 Form NY DTF IT201X Fill Online, Printable, Fillable, Blank

Web department of taxation and finance resident income tax return new york state • new york city • yonkers • mctmt for the full year january 1, 2021, through december 31,. Web you may be eligible for free file using one of the software providers below, if: If you filed for tax year your requested refund amount is; You can.

This Instruction Booklet Will Help You To Fill Out And File Form 201.

Web you may be eligible for free file using one of the software providers below, if: You can pay your income tax return payment directly on our website from. This form is for income earned in tax year 2022,. We last updated the individual income tax instructions in.

Web Department Of Taxation And Finance Resident Income Tax Return New York State • New York City • Yonkers • Mctmt For The Full Year January 1, 2021, Through December 31,.

Web 61 total new york state, new york city, yonkers, and sales or use taxes, mctmt, and.voluntary contributions. Web up to $40 cash back department of taxation and financeit201i(u pdated on 1/12/2023)instr uctions for form it201 full year resident income tax returned york state new york city. If you filed for tax year your requested refund amount is; Web up to $40 cash back resident income tax return new york state new york city yonkers for the full year january 1, 2011, through december 31, 2011, or fiscal year beginning.

Payment Vouchers Are Provided To Accompany Checks Mailed To Pay Off Tax Liabilities, And Are Used By The.

Web if you are a resident of new york you need to file form 201. Your federal adjusted gross income (agi) is $41,000 or less regardless of age, or. Electronic filing is the fastest, safest way to file—but if you must file a paper resident income tax return, use our enhanced. Web find your requested refund amount by form and tax year;