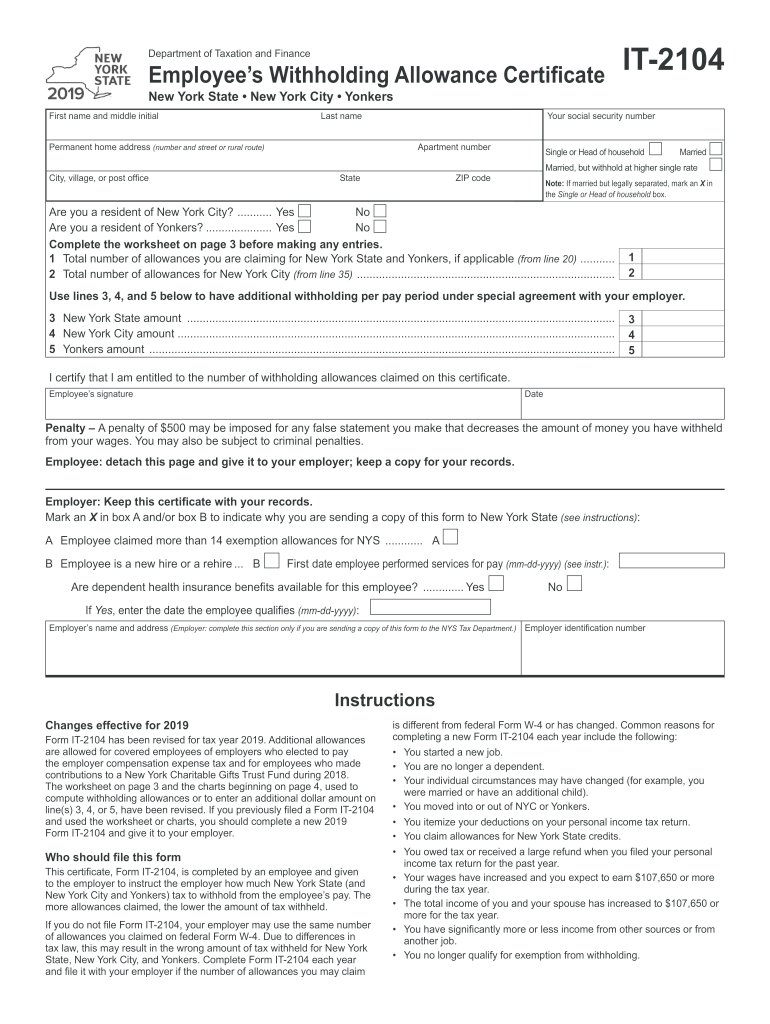

Ny It 2104 Form

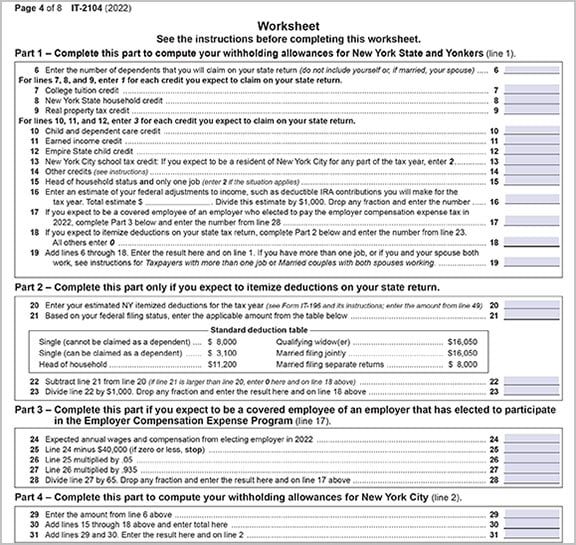

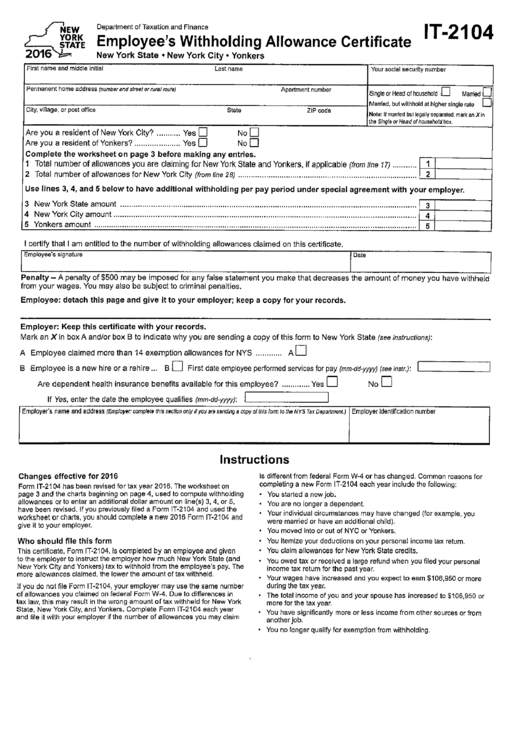

Ny It 2104 Form - Web file this form with the payer of your annuity or pension. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Employers are often unsure if they must have employees. Due to differences in tax law, this may result in the wrong. Every employee must pay federal and state taxes, unless you’re in a state that. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Web 8 rows employee's withholding allowance certificate. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. Web employee's withholding allowance certificate.

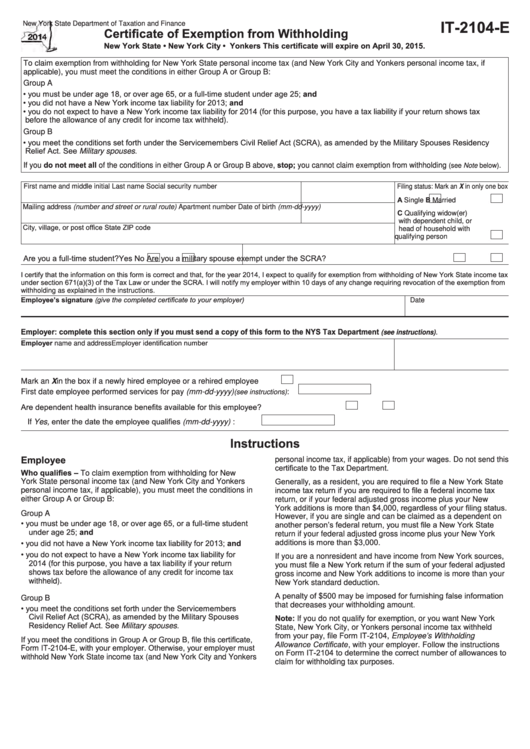

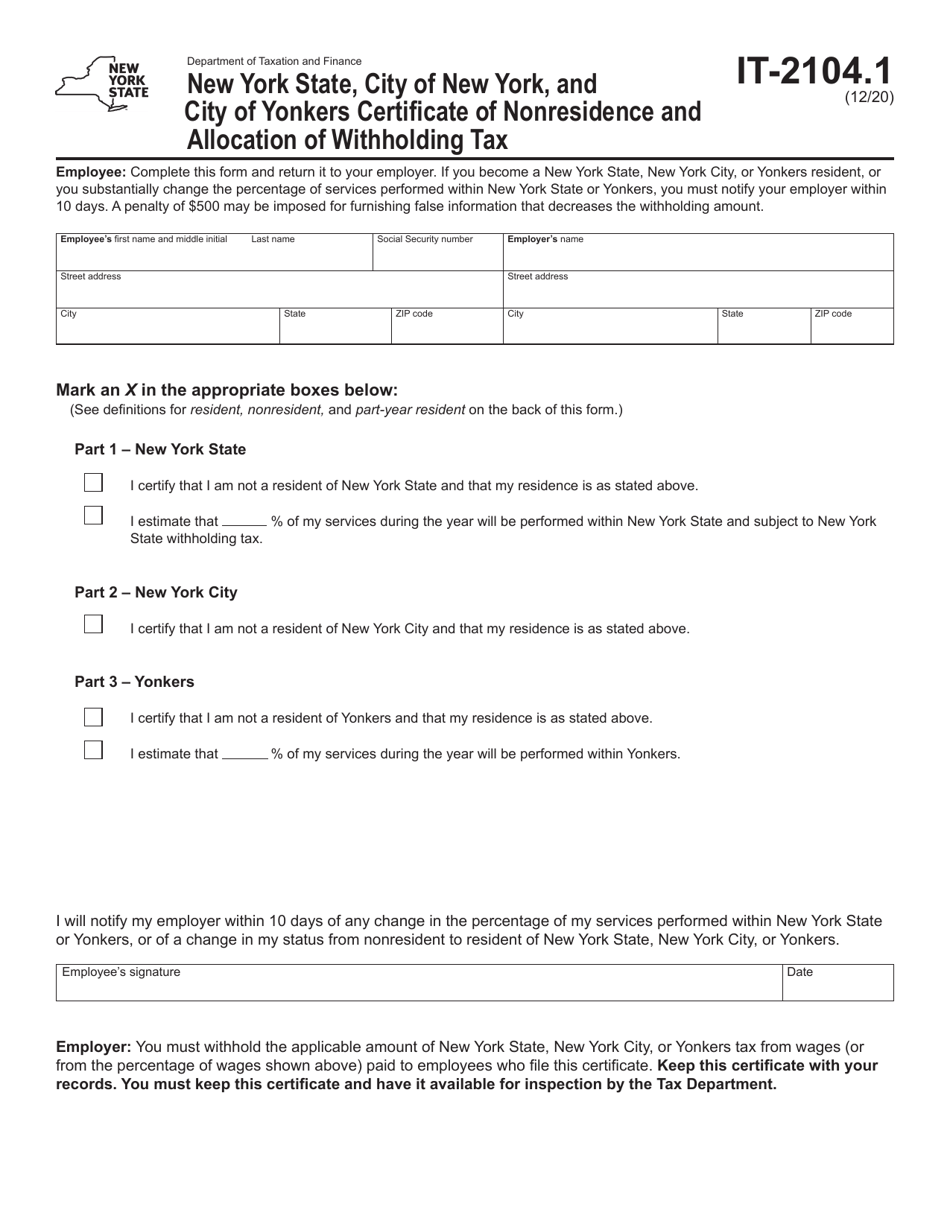

Web employee's withholding allowance certificate. Start with the worksheet one of the aspects of. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Certificate of nonresidence and allocation of withholding. New employees must submit paper. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Every employee must pay federal and state taxes, unless you’re in a state that. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Due to differences in tax law, this may result in the wrong. Certificate of exemption from withholding.

New employees must submit paper. Every employee must pay federal and state taxes, unless you’re in a state that. Web on form it‑2104 to determine the correct number of allowances to claim for withholding tax purposes. Web file this form with the payer of your annuity or pension. Web employee's withholding allowance certificate. Certificate of nonresidence and allocation of withholding. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Start with the worksheet one of the aspects of. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Web 8 rows employee's withholding allowance certificate.

Form It2104E Certificate Of Exemption From Withholding 2014

Employers are often unsure if they must have employees. Certificate of nonresidence and allocation of withholding. Web file this form with the payer of your annuity or pension. Every employee must pay federal and state taxes, unless you’re in a state that. New employees must submit paper.

2022 Form NY DTF IT2104SNY Fill Online, Printable, Fillable, Blank

Web file this form with the payer of your annuity or pension. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Certificate of exemption from withholding. Web on form.

Form IT2104.1 Download Fillable PDF or Fill Online New York State

Certificate of nonresidence and allocation of withholding. Web file this form with the payer of your annuity or pension. New employees must submit paper. Web 8 rows employee's withholding allowance certificate. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional.

NY DTF IT2104 2011 Fill out Tax Template Online US Legal Forms

New employees must submit paper. Employers are often unsure if they must have employees. Certificate of exemption from withholding. Start with the worksheet one of the aspects of. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment.

Employee Archives Page 2 of 15 PDFSimpli

The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Web file this form with the payer of your annuity or pension. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Web new york state law requires all government agencies that.

IT2104 StepbyStep Guide Baron Payroll

Web 8 rows employee's withholding allowance certificate. Every employee must pay federal and state taxes, unless you’re in a state that. Start with the worksheet one of the aspects of. Enter on the front the whole dollar amount(s) that you want withheld from each annuity or pension payment. Web the wrong amount of tax withheld for new york state, new.

Maria Noivas Fashion NY 2104

Web 8 rows employee's withholding allowance certificate. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. New employees must submit paper. Web file this form with the payer of your annuity or pension. Web the wrong amount of tax withheld for new york state, new york city, and.

Form It2104 Employee'S Withholding Allowance Certificate 2016

Web 8 rows employee's withholding allowance certificate. Web on form it‑2104 to determine the correct number of allowances to claim for withholding tax purposes. Every employee must pay federal and state taxes, unless you’re in a state that. New employees must submit paper. Web new york state law requires all government agencies that maintain a system of records to provide.

It 2104 Fill Out and Sign Printable PDF Template signNow

Web employee's withholding allowance certificate. Start with the worksheet one of the aspects of. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. New employees must submit paper. Every employee must pay federal and state taxes, unless you’re in a state that.

Download NY IT2104 Employee's Withholding Allowance Form for Free

Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. Due to differences in tax law, this may result in the wrong. Web the wrong amount of tax withheld for new york state, new york city, and yonkers. Every employee must pay federal and state taxes, unless you’re in.

Web 8 Rows Employee's Withholding Allowance Certificate.

Web the wrong amount of tax withheld for new york state, new york city, and yonkers. New employees must submit paper. The worksheet on page 3 and the charts beginning on page 4, used to compute withholding allowances or to enter an additional. Certificate of nonresidence and allocation of withholding.

Enter On The Front The Whole Dollar Amount(S) That You Want Withheld From Each Annuity Or Pension Payment.

Web file this form with the payer of your annuity or pension. Web new york state law requires all government agencies that maintain a system of records to provide notification of the legal. Web on form it‑2104 to determine the correct number of allowances to claim for withholding tax purposes. Employers are often unsure if they must have employees.

Web Employee's Withholding Allowance Certificate.

Every employee must pay federal and state taxes, unless you’re in a state that. Start with the worksheet one of the aspects of. Certificate of exemption from withholding. Due to differences in tax law, this may result in the wrong.