North Dakota Form Nd-1

North Dakota Form Nd-1 - This form is for income. Please use the link below. Credit for income tax paid to. Web this application form cannot be processed without these documents. Web use this form to calculate and pay estimated north dakota individual income tax. We last updated the individual income tax. Individual income tax return (state of north dakota) form. If you are required to pay estimated income tax to. Read across to the amount shown in the married filing jointly column. Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a.

This form is for income. Use fill to complete blank online state of. Read across to the amount shown in the married filing jointly column. Individual income tax return (state of north dakota) form. For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on. Please use the link below. If you are required to pay estimated income tax to. Web this application form cannot be processed without these documents. Individuals generally must pay their income tax in one of two ways—through the. Web use this form to calculate and pay estimated north dakota individual income tax.

We last updated the individual income tax. Individual income tax return (state of north dakota) form. This form is for income. Web here's a list of some of the most commonly used north dakota tax forms: View all 45 north dakota income tax forms disclaimer: Use fill to complete blank online state of. Web their north dakota taxable income is $49,935. Individuals generally must pay their income tax in one of two ways—through the. Web use this form to calculate and pay estimated north dakota individual income tax. Individual income tax return (state of north dakota) form 2018:

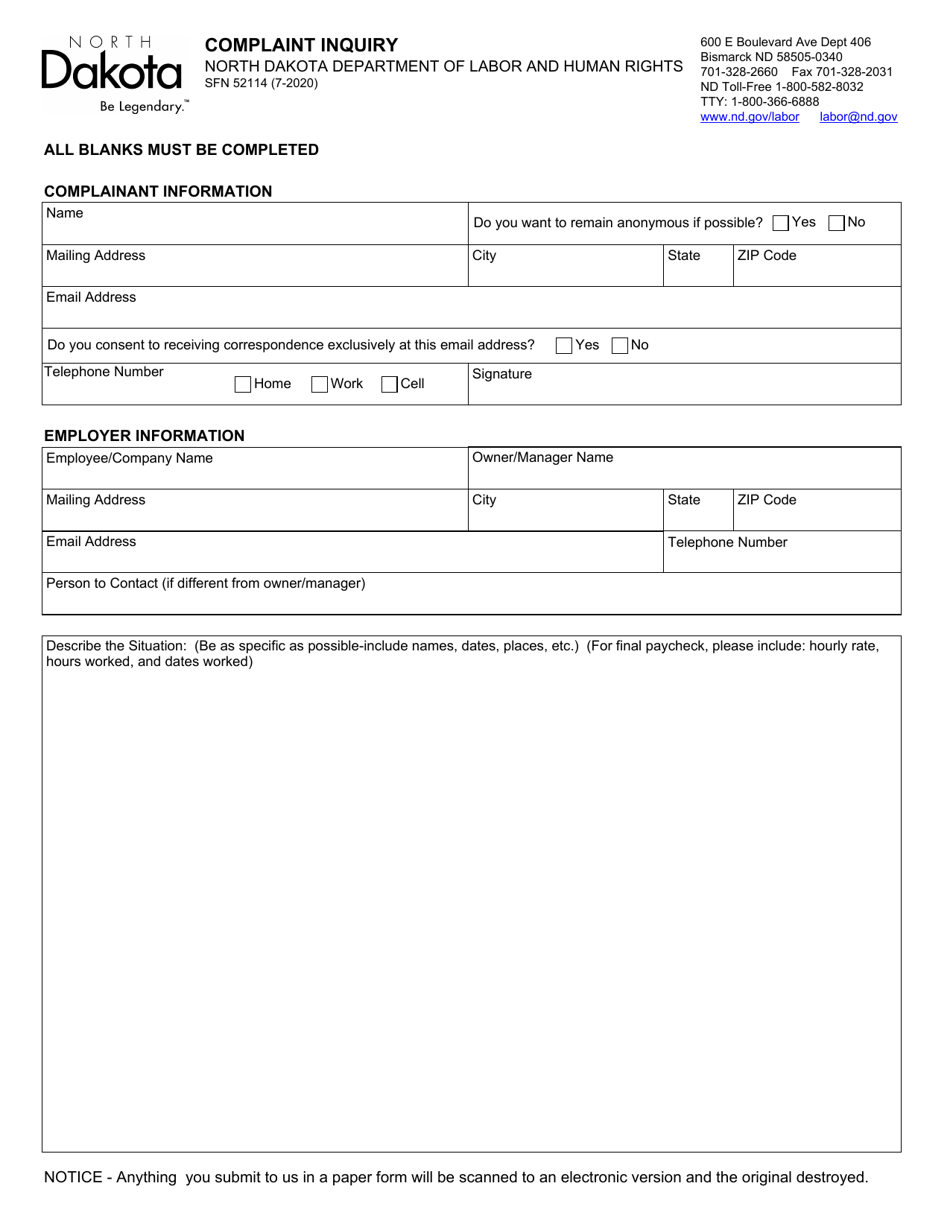

Form SFN52114 Download Fillable PDF or Fill Online Complaint Inquiry

Web their north dakota taxable income is $49,935. Individual income tax return (state of north dakota) form 2018: Use fill to complete blank online state of. Individuals generally must pay their income tax in one of two ways—through the. Read across to the amount shown in the married filing jointly column.

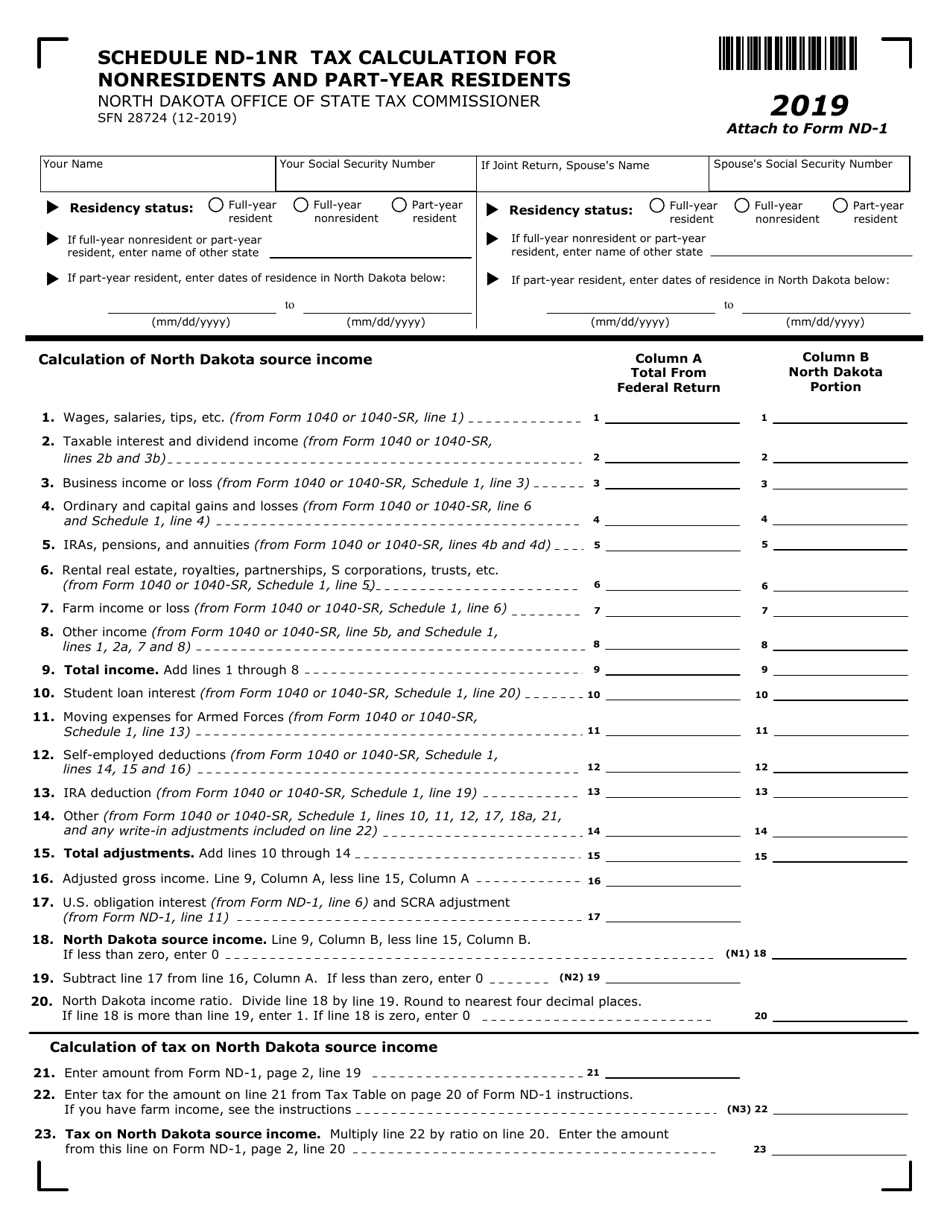

Form ND1 (SFN28724) Schedule NDN1NR Download Fillable PDF or Fill

Web use this form to calculate and pay estimated north dakota individual income tax. For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on. We last updated the individual income tax. Web this application form cannot be processed without these documents..

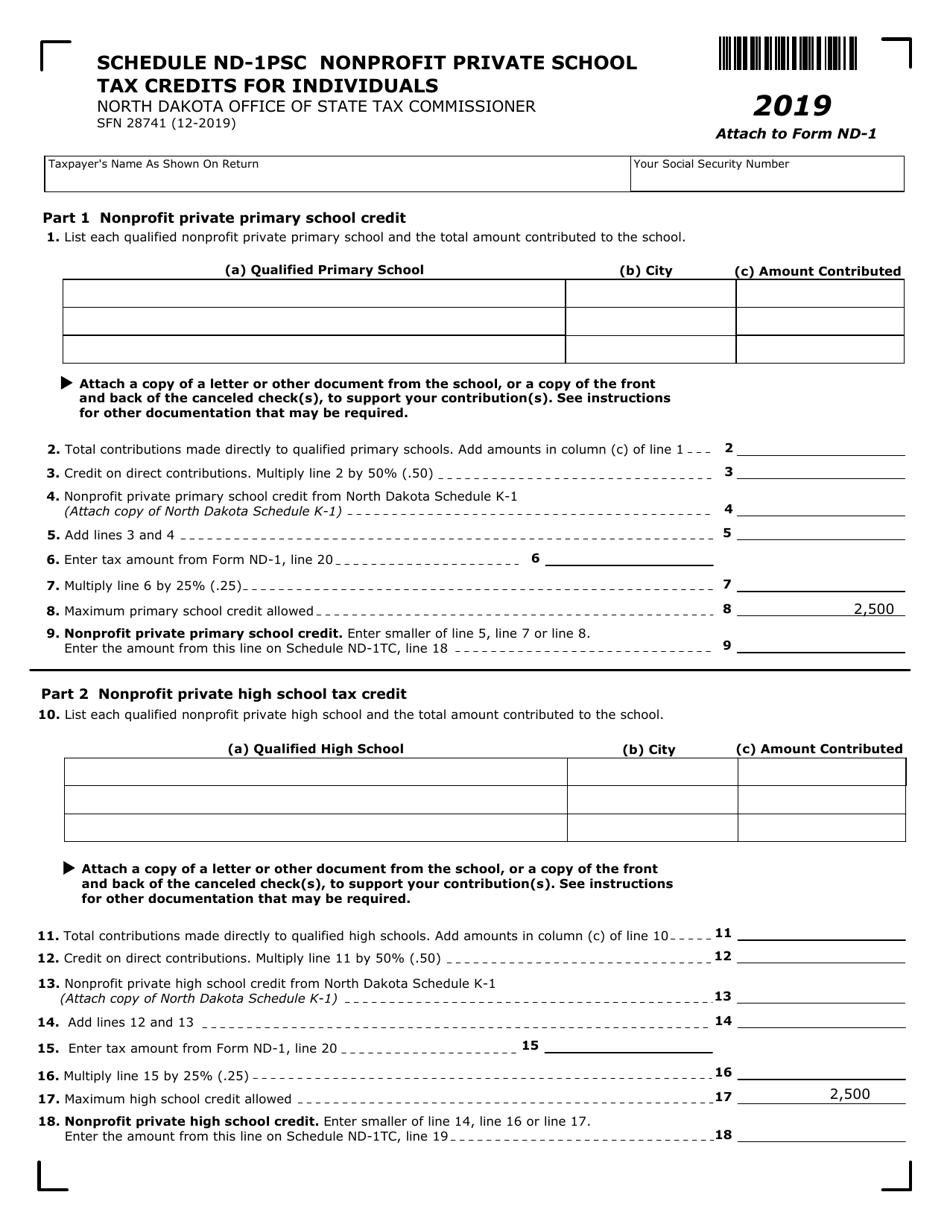

Form ND1 (SFN28741) Schedule ND1PSC Download Fillable PDF or Fill

Individual income tax return (state of north dakota) form. Web their north dakota taxable income is $49,935. For more information about the north. Web here's a list of some of the most commonly used north dakota tax forms: Credit for income tax paid to.

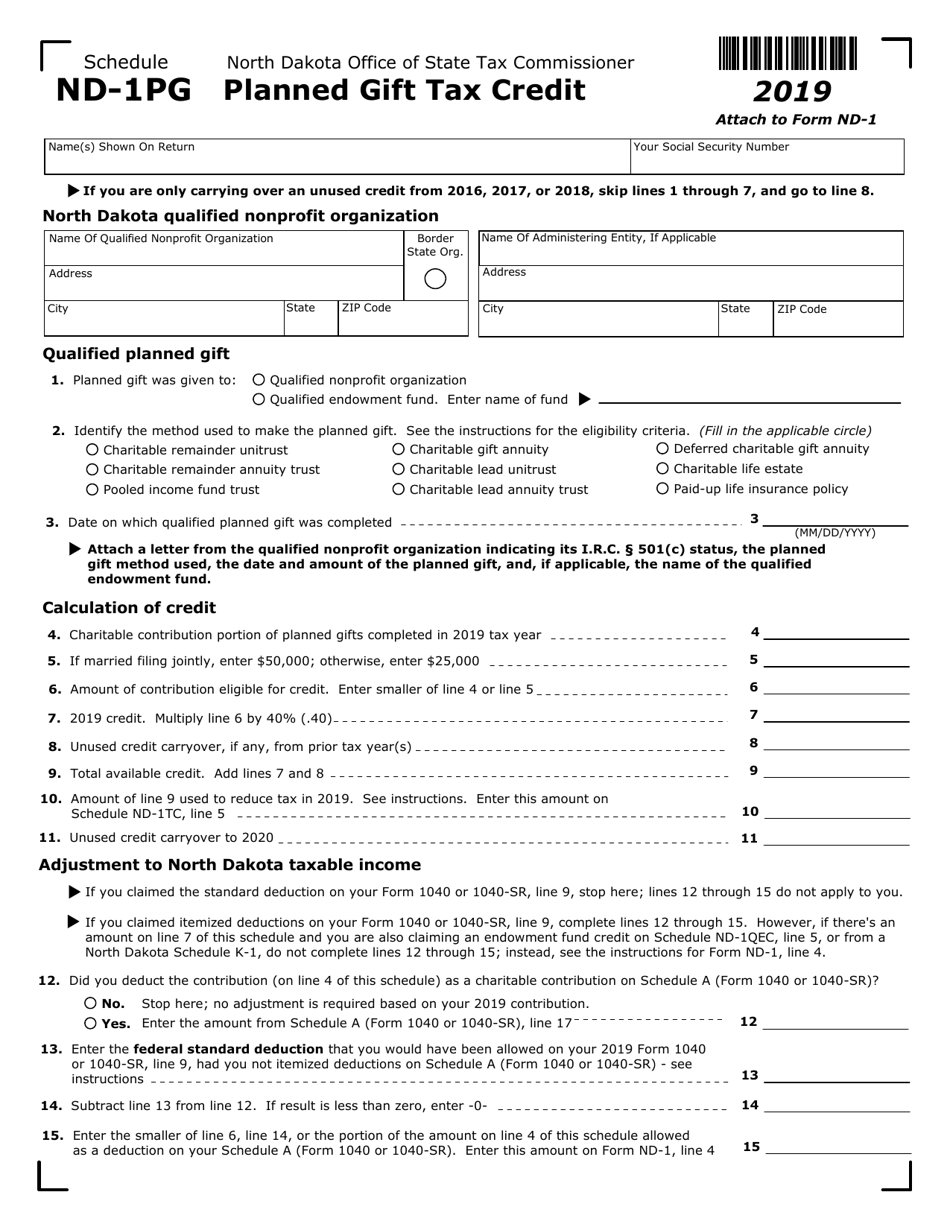

Form ND1 (SFN28705) Schedule ND1PG Download Fillable PDF or Fill

Web their north dakota taxable income is $49,935. Use fill to complete blank online state of. This form is for income. Web here's a list of some of the most commonly used north dakota tax forms: We last updated the individual income tax.

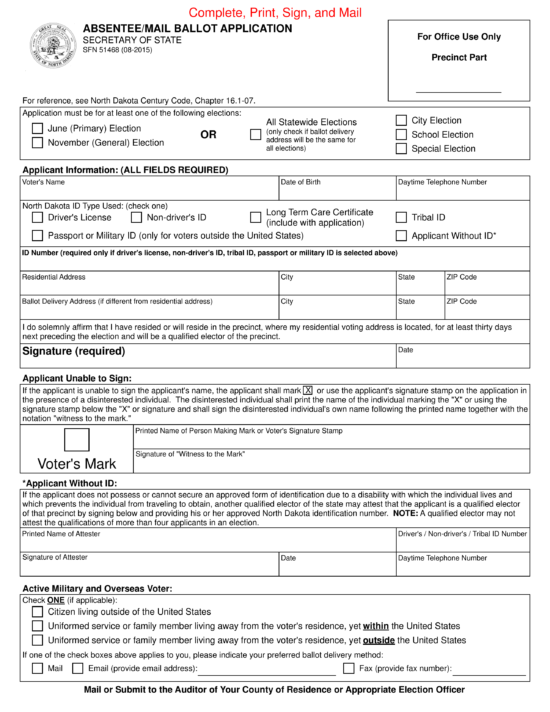

Free North Dakota Voter Registration Form Register to Vote in ND

Web this application form cannot be processed without these documents. Individual income tax return (state of north dakota) form 2018: Credit for income tax paid to. If you are required to pay estimated income tax to. View all 45 north dakota income tax forms disclaimer:

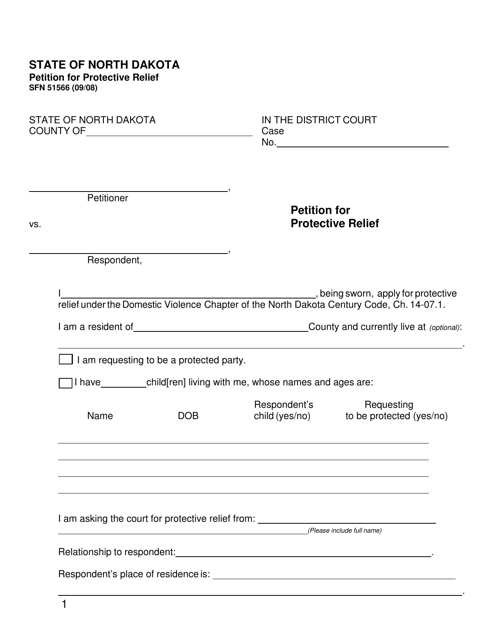

Form SFN51566 Download Fillable PDF or Fill Online Petition for

View all 45 north dakota income tax forms disclaimer: Web their north dakota taxable income is $49,935. Individuals generally must pay their income tax in one of two ways—through the. Individual income tax return (state of north dakota) form. For more information about the north.

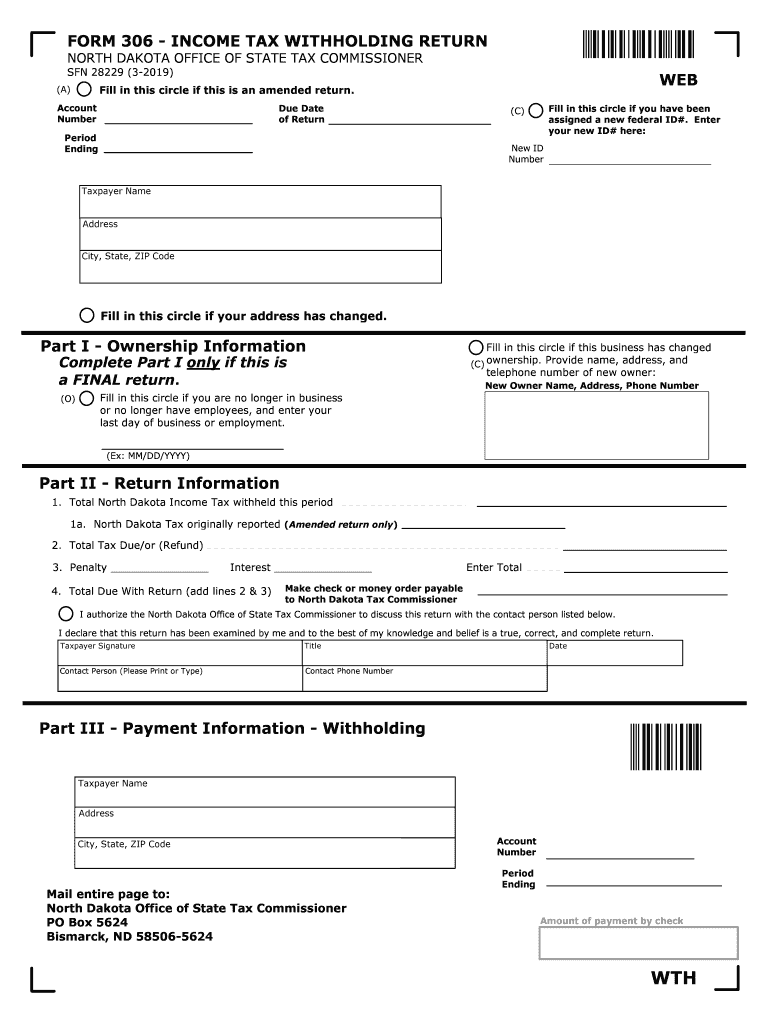

Nd Form 306 Fill Out and Sign Printable PDF Template signNow

Web here's a list of some of the most commonly used north dakota tax forms: Read across to the amount shown in the married filing jointly column. View all 45 north dakota income tax forms disclaimer: Individuals generally must pay their income tax in one of two ways—through the. Web this application form cannot be processed without these documents.

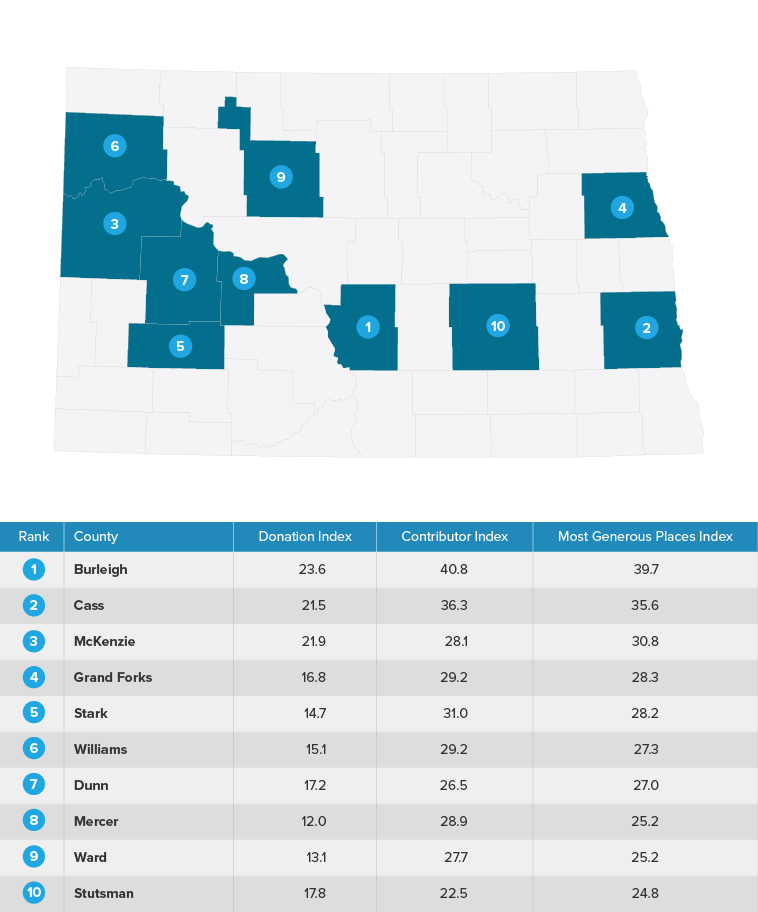

Most Generous Counties 2019 Edition North Dakota SmartAdvisor Match

Web this application form cannot be processed without these documents. Credit for income tax paid to. Web use this form to calculate and pay estimated north dakota individual income tax. Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a. If you are required to pay estimated income tax to.

Fill Free fillable forms State of North Dakota

Evidence that the operation holds a valid organic certification to the usda organic regulations issued by a. If you are required to pay estimated income tax to. Credit for income tax paid to. Web this application form cannot be processed without these documents. Individual income tax return (state of north dakota) form 2018:

Fill Free fillable forms State of North Dakota

Individual income tax return (state of north dakota) form 2018: If you are required to pay estimated income tax to. Web use this form to calculate and pay estimated north dakota individual income tax. Web this application form cannot be processed without these documents. Individual income tax return (state of north dakota) form.

Enter Your North Dakota Taxable Income From Line 18 Of Page 1 21.

Individual income tax return (state of north dakota) form. For more information about the north. For tax years 2013 and after, an individual does not have to pay estimated north dakota income tax if the previous year's tax liability or the tax due on. Individual income tax return (state of north dakota) form 2018:

Evidence That The Operation Holds A Valid Organic Certification To The Usda Organic Regulations Issued By A.

Read across to the amount shown in the married filing jointly column. Use fill to complete blank online state of. Web their north dakota taxable income is $49,935. Web use this form to calculate and pay estimated north dakota individual income tax.

Individuals Generally Must Pay Their Income Tax In One Of Two Ways—Through The.

Web here's a list of some of the most commonly used north dakota tax forms: If you are required to pay estimated income tax to. This form is for income. Credit for income tax paid to.

We Last Updated The Individual Income Tax.

View all 45 north dakota income tax forms disclaimer: Web this application form cannot be processed without these documents. Please use the link below.