North Carolina Pte Form

North Carolina Pte Form - 105), which includes a new elective pass. Web a return in north carolina or pay income tax to north carolina on behalf of its nonresident partners. Effective for tax year 2022, north carolina law allows an eligible s corporation and an eligible partnership to elect to pay north. An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. Web march 3, 2023 9:41 am. Pay a bill or notice (notice required). Web overview deloitte tax llp | december 2, 2021 overview on november 18, 2021, the north carolina governor signed senate bill 105 (s.b. Web when is north carolina’s taxed pte law effective? Web ptes that expect to owe taxes in the amount of $500 or more need to make estimated tax payments. The senate finance committee voted unanimously on march 1 to approve a bill containing ncacpa’s top legislative priority of this session.

Web march 3, 2023 9:41 am. 105), which includes a new elective pass. Web an eligible pte can make the taxed pte election by timely filing a nc tax return for a tax year that begins on or after january 1, 2022. Web a return in north carolina or pay income tax to north carolina on behalf of its nonresident partners. The senate finance committee voted unanimously on march 1 to approve a bill containing ncacpa’s top legislative priority of this session. (for more information on investment partnerships see 17 north carolina. Web overview deloitte tax llp | december 2, 2021 overview on november 18, 2021, the north carolina governor signed senate bill 105 (s.b. An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. Web ptes that expect to owe taxes in the amount of $500 or more need to make estimated tax payments. Web following similar legislation enacted by many other states this year, the bill gives north carolina individual taxpayers the ability to reduce the impact of the annual $10,000 limit.

(for more information on investment partnerships see 17 north carolina. Web overview deloitte tax llp | december 2, 2021 overview on november 18, 2021, the north carolina governor signed senate bill 105 (s.b. An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. Web a return in north carolina or pay income tax to north carolina on behalf of its nonresident partners. Pay a bill or notice (notice required). Web how to enter north carolina pte in lacerte solved • by intuit • 11 • updated march 28, 2023 down below we'll go over how to enter pte for north carolina. Web ptes that expect to owe taxes in the amount of $500 or more need to make estimated tax payments. Effective for tax year 2022, north carolina law allows an eligible s corporation and an eligible partnership to elect to pay north. Web down below we'll go over how to enter pte for north carolina on individual, partnership, and s corporate returns in proconnect.table of contents:‣ individual‣ p. Web when is north carolina’s taxed pte law effective?

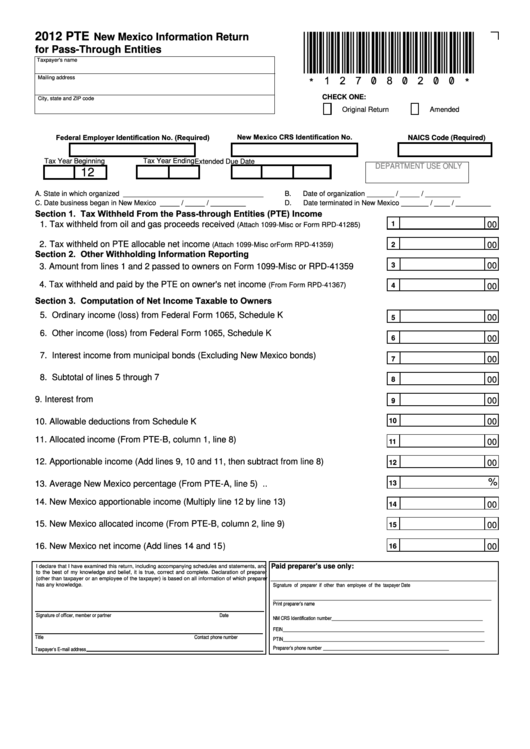

Form Pte New Mexico Information Return For PassThrough Entities

Web an eligible pte can make the taxed pte election by timely filing a nc tax return for a tax year that begins on or after january 1, 2022. Web down below we'll go over how to enter pte for north carolina on individual, partnership, and s corporate returns in proconnect.table of contents:‣ individual‣ p. Web overview deloitte tax llp.

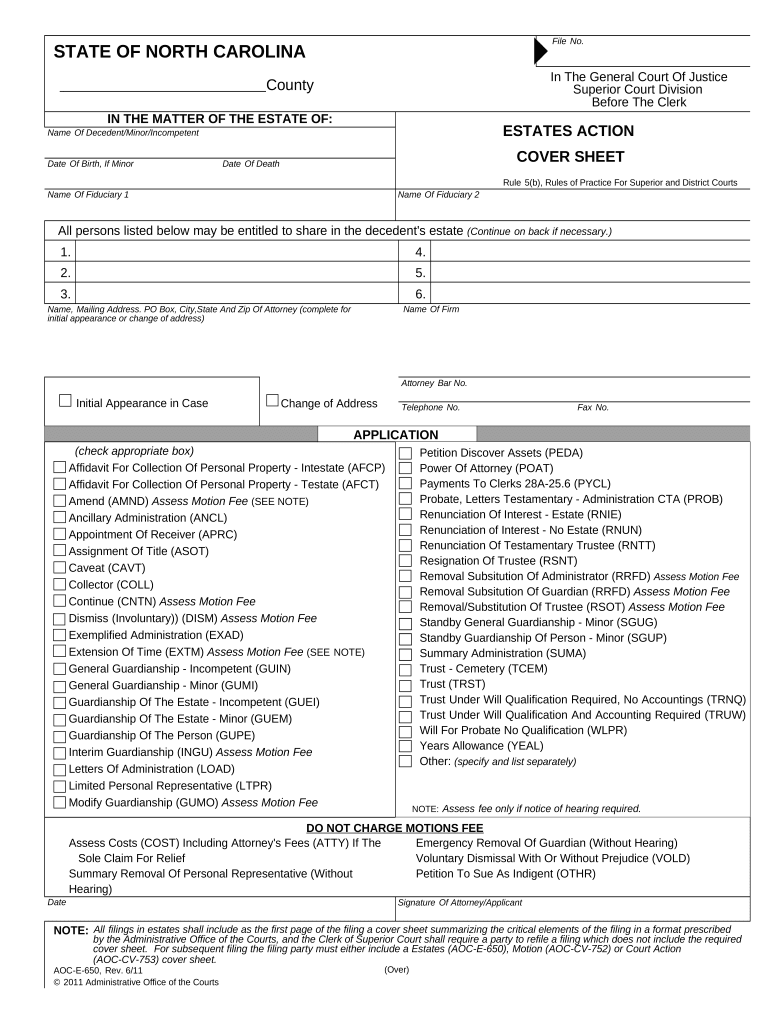

Nc Form Probate Fill Out and Sign Printable PDF Template signNow

105), which includes a new elective pass. An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. The senate finance committee voted unanimously on march 1 to approve a bill containing ncacpa’s top legislative priority of this session. Effective for tax year 2022, north carolina law allows.

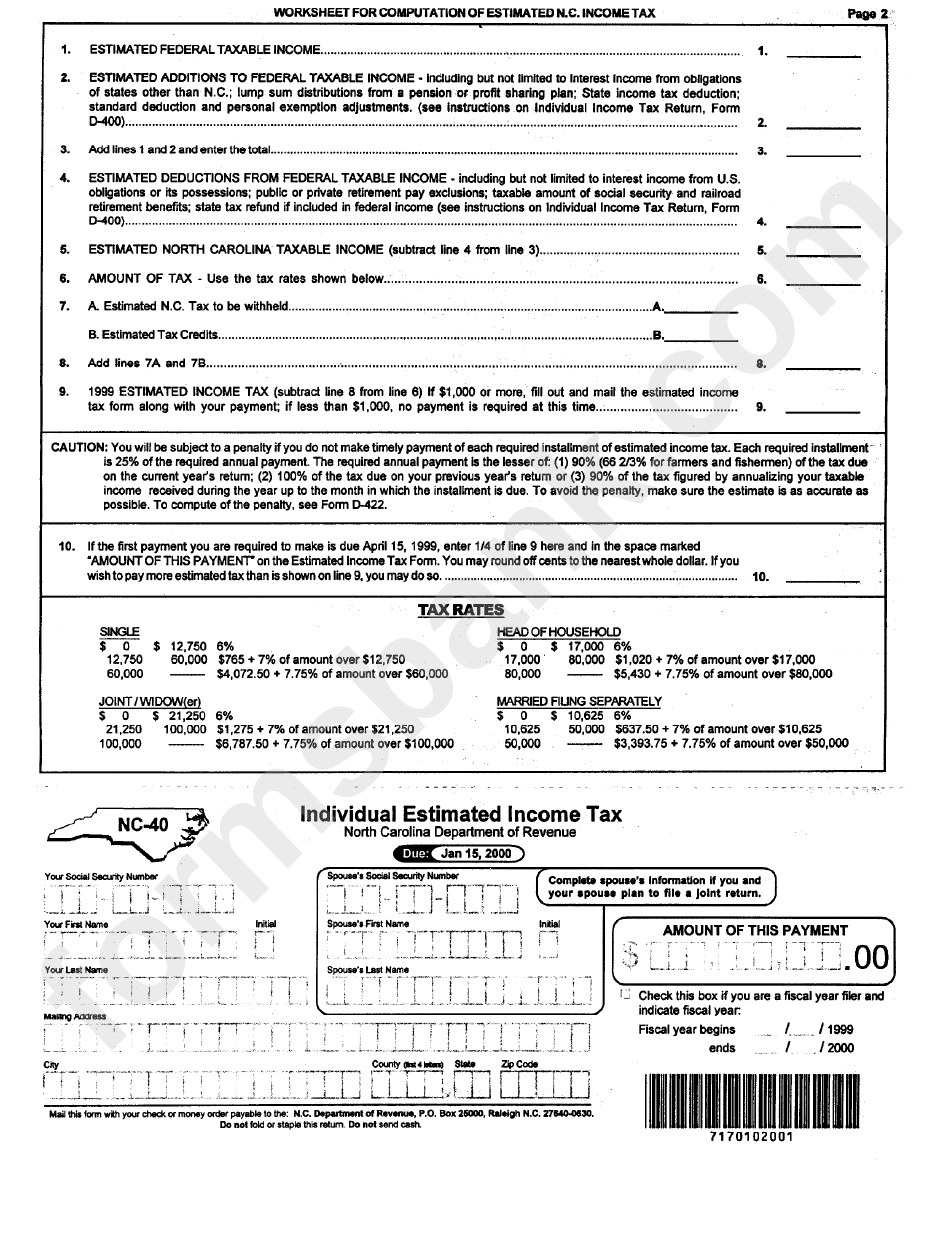

Fillable Form Nc40 Individual Estimated Tax printable pdf

Pay a bill or notice (notice required). Web a return in north carolina or pay income tax to north carolina on behalf of its nonresident partners. Web when is north carolina’s taxed pte law effective? (for more information on investment partnerships see 17 north carolina. Web an eligible pte can make the taxed pte election by timely filing a nc.

1+ North Carolina Do Not Resuscitate Form Free Download

An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. Web following similar legislation enacted by many other states this year, the bill gives north carolina individual taxpayers the ability to reduce the impact of the annual $10,000 limit. Web a return in north carolina or pay.

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

105), which includes a new elective pass. Web march 3, 2023 9:41 am. Effective for tax year 2022, north carolina law allows an eligible s corporation and an eligible partnership to elect to pay north. Web an eligible pte can make the taxed pte election by timely filing a nc tax return for a tax year that begins on or.

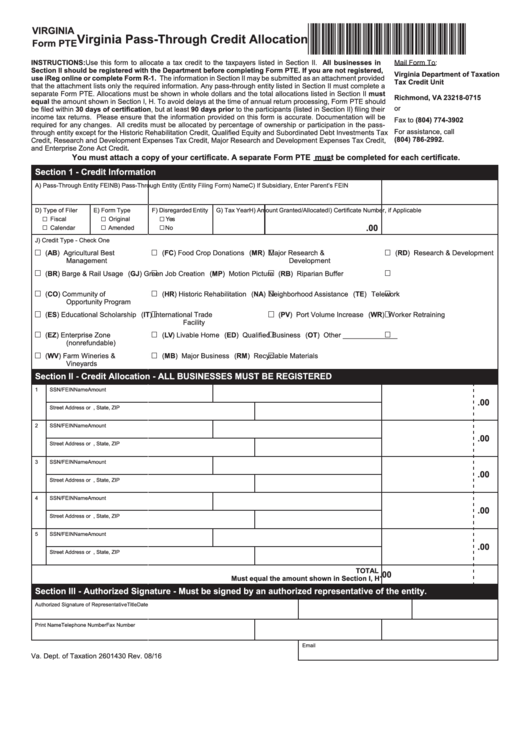

Fillable Virginia Form Pte Virginia PassThrough Credit Allocation

Web how to enter north carolina pte in lacerte solved • by intuit • 11 • updated march 28, 2023 down below we'll go over how to enter pte for north carolina. An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. Pay a bill or notice.

1+ North Carolina Do Not Resuscitate Form Free Download

An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. Web how to enter north carolina pte in lacerte solved • by intuit • 11 • updated march 28, 2023 down below we'll go over how to enter pte for north carolina. Web when is north carolina’s.

Download North Carolina Form NC4 for Free Page 3 FormTemplate

Web march 3, 2023 9:41 am. 105), which includes a new elective pass. An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that. Web overview deloitte tax llp | december 2, 2021 overview on november 18, 2021, the north carolina governor signed senate bill 105 (s.b. Web.

Loan Application Forms Pdf

Web an eligible pte can make the taxed pte election by timely filing a nc tax return for a tax year that begins on or after january 1, 2022. Web march 3, 2023 9:41 am. Effective for tax year 2022, north carolina law allows an eligible s corporation and an eligible partnership to elect to pay north. 105), which includes.

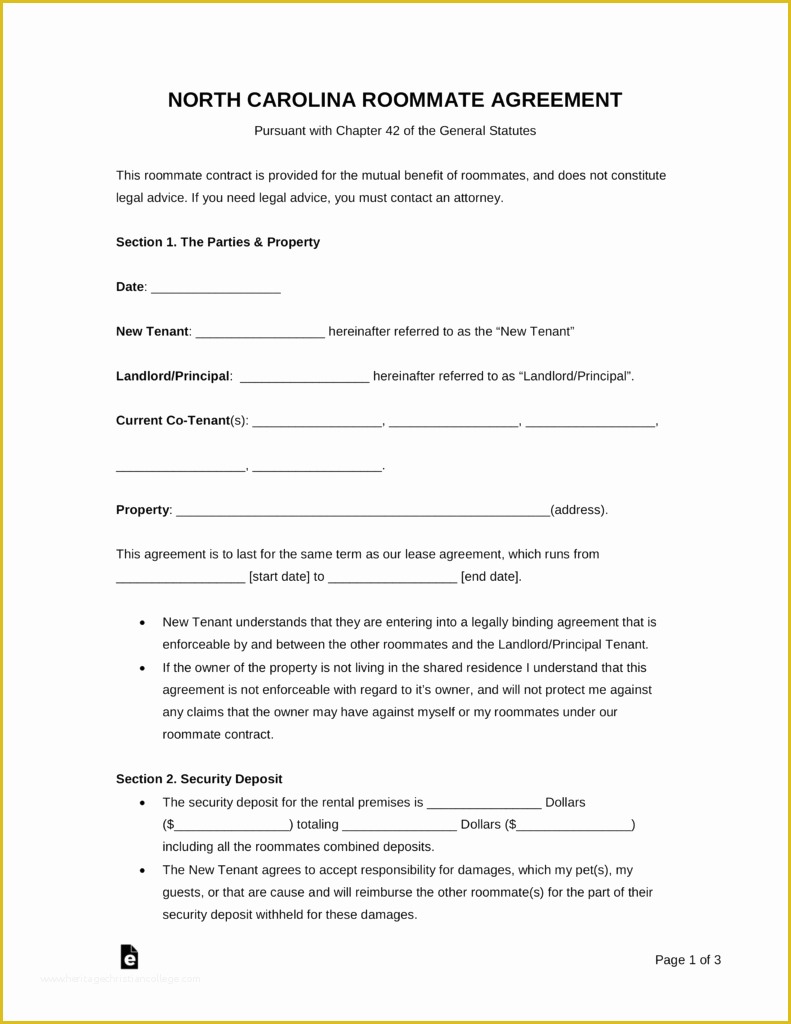

Free Nc Will Template Of Free north Carolina Roommate Agreement form

Web march 3, 2023 9:41 am. Web an eligible pte can make the taxed pte election by timely filing a nc tax return for a tax year that begins on or after january 1, 2022. Web following similar legislation enacted by many other states this year, the bill gives north carolina individual taxpayers the ability to reduce the impact of.

105), Which Includes A New Elective Pass.

Web how to enter north carolina pte in lacerte solved • by intuit • 11 • updated march 28, 2023 down below we'll go over how to enter pte for north carolina. (for more information on investment partnerships see 17 north carolina. Web ptes that expect to owe taxes in the amount of $500 or more need to make estimated tax payments. An eligible pte can make the taxed pte e lection by timely filing a n nc tax return for a tax year that.

Pay A Bill Or Notice (Notice Required).

Web following similar legislation enacted by many other states this year, the bill gives north carolina individual taxpayers the ability to reduce the impact of the annual $10,000 limit. Web when is north carolina’s taxed pte law effective? The senate finance committee voted unanimously on march 1 to approve a bill containing ncacpa’s top legislative priority of this session. Web overview deloitte tax llp | december 2, 2021 overview on november 18, 2021, the north carolina governor signed senate bill 105 (s.b.

Web March 3, 2023 9:41 Am.

Effective for tax year 2022, north carolina law allows an eligible s corporation and an eligible partnership to elect to pay north. Web an eligible pte can make the taxed pte election by timely filing a nc tax return for a tax year that begins on or after january 1, 2022. Web down below we'll go over how to enter pte for north carolina on individual, partnership, and s corporate returns in proconnect.table of contents:‣ individual‣ p. Web a return in north carolina or pay income tax to north carolina on behalf of its nonresident partners.