Non Resident Tax Form New York

Non Resident Tax Form New York - Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? If you're a nonresident of new york, but want to enter different allocations for income earned inside. Payment voucher for income tax returns. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Nonresident alien income tax return. Payment voucher for income tax returns. Were not a resident of new york state and received income during the tax. Web this form is only mandatory for employees that are not residents of new york state but are working or performing services within new york state. Web how to enter new york state income as a nonresident in turbotax.

Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Web apply to new york state or new york city personal income tax. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while. Nonresident alien income tax return. Next section when to submit. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Web this form is only mandatory for employees that are not residents of new york state but are working or performing services within new york state. Were a nonresident alien engaged in a trade or business in the.

Web nonresident forms credit claim forms other personal income tax forms extension requests estimated tax forms withholding allowance forms amended returns. Were not a resident of new york state and received income during the tax. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while. Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Nonresident alien income tax return. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Payment voucher for income tax returns. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If you're a nonresident of new york, but want to enter different allocations for income earned inside. Payment voucher for income tax returns.

Have you received one of these? Is the Tax Office asking you to pay Non

Payment voucher for income tax returns. Next section when to submit. Web this form is only mandatory for employees that are not residents of new york state but are working or performing services within new york state. Web apply to new york state or new york city personal income tax. Web how to enter new york state income as a.

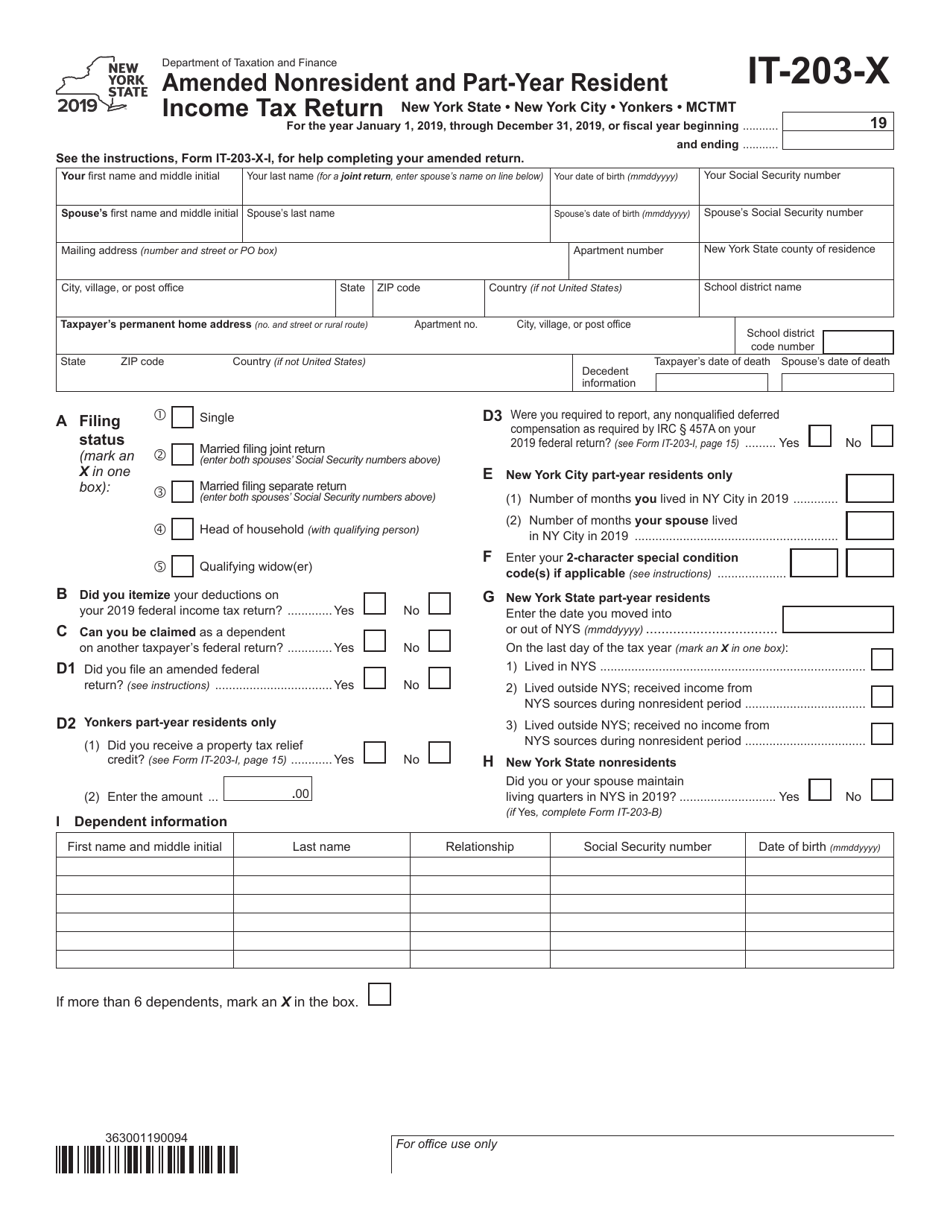

Form IT203X Download Fillable PDF or Fill Online Amended Nonresident

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Web nonresident forms credit claim forms other personal income tax forms extension requests estimated tax forms withholding allowance.

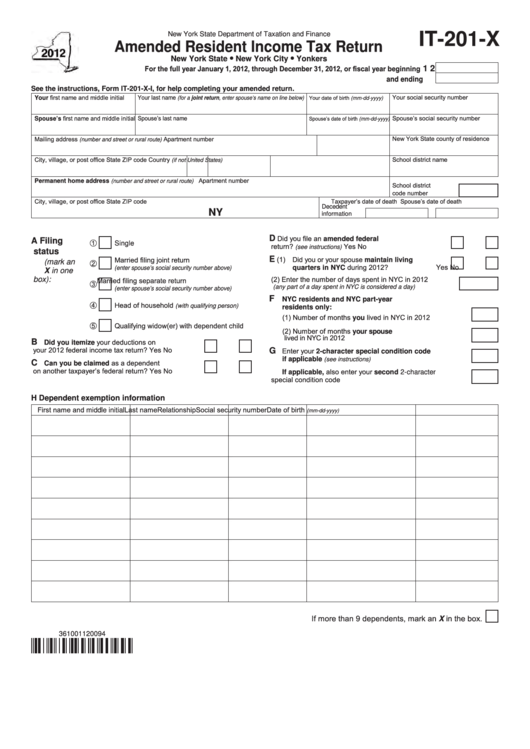

Fillable Form It201X New York Amended Resident Tax Return

Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. This instruction booklet will help you to fill out and file form 203. Were a nonresident alien engaged in a trade or business in the. Web nonresident forms credit claim forms other personal income tax forms extension.

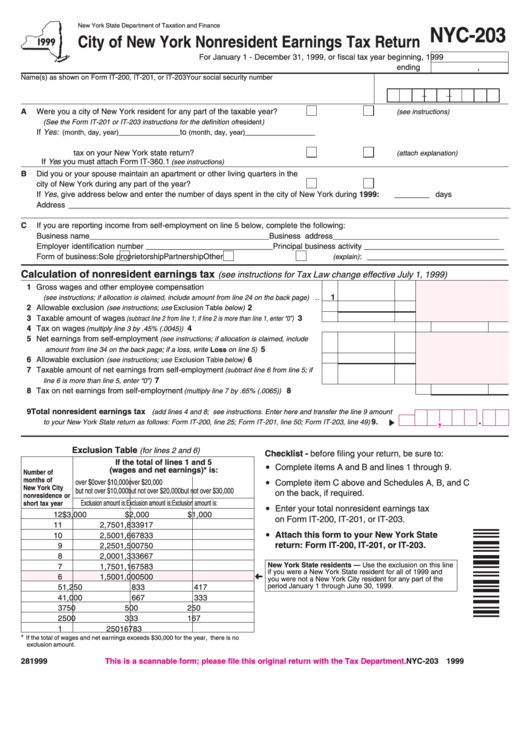

Form Nyc203 City Of New York Nonresident Earnings Tax Return 1999

Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Web nonresident forms credit claim forms other personal income tax forms extension requests estimated tax forms withholding allowance forms amended returns. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web how to enter.

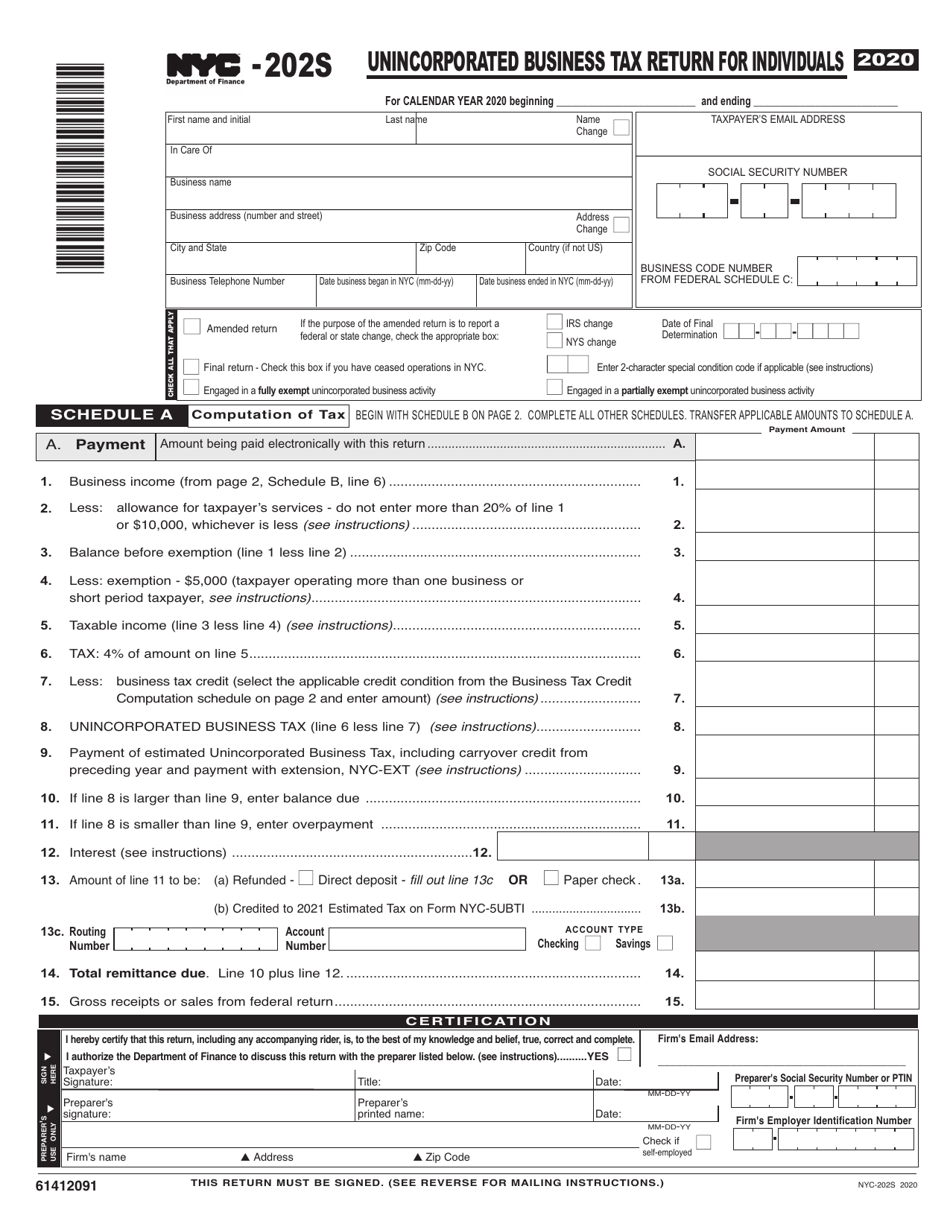

Form NYC202S Download Printable PDF or Fill Online Unincorporated

Nonresident alien income tax return. If you do not meet the requirements to be a resident, you may still owe new. Were not a resident of new york state and received income during the tax. Web how to enter new york state income as a nonresident in turbotax. You are not required to file a ny return since the company.

Monday Monday NonResident vs. Resident Taxes The J1 Visa Explained

Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Next section when to submit. Payment voucher for income tax returns. Web nonresident forms credit claim forms other personal income tax forms extension requests estimated tax forms withholding allowance forms amended returns. If.

The Complete J1 Student Guide to Tax in the US

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If you're a nonresident of new york, but want to enter different allocations for income earned inside. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while. Web if i’m not domiciled.

Amended NonResident & Part Year Resident Tax Return

Web how to enter new york state income as a nonresident in turbotax. Nonresident alien income tax return. This instruction booklet will help you to fill out and file form 203. Who must file if you became an employee of the city of new york on or after january 4, 1973, and if, while. Were not a resident of new.

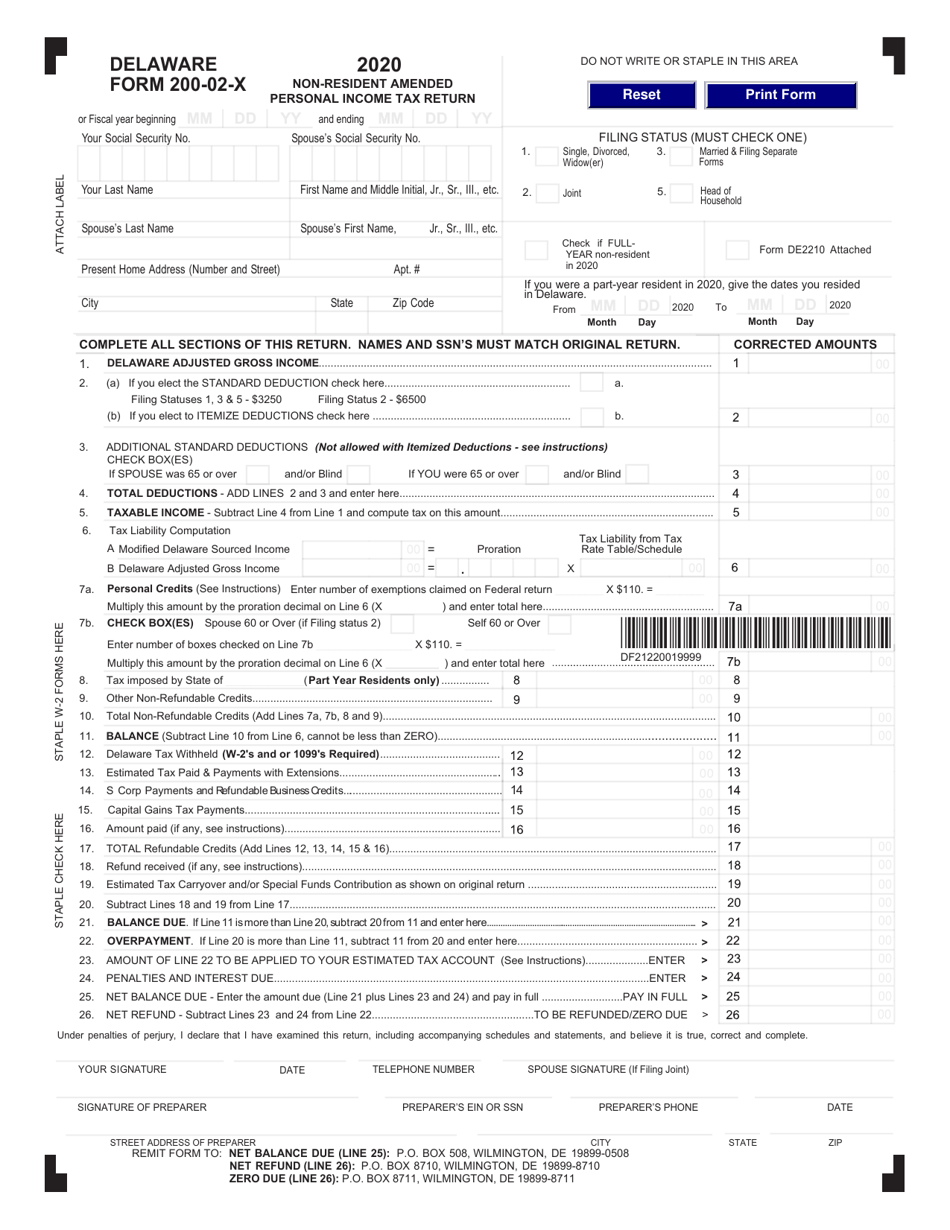

Form 20002X Download Fillable PDF or Fill Online Nonresident Amended

If you do not meet the requirements to be a resident, you may still owe new. Payment voucher for income tax returns. Next section when to submit. Were a nonresident alien engaged in a trade or business in the. Web nonresident forms credit claim forms other personal income tax forms extension requests estimated tax forms withholding allowance forms amended returns.

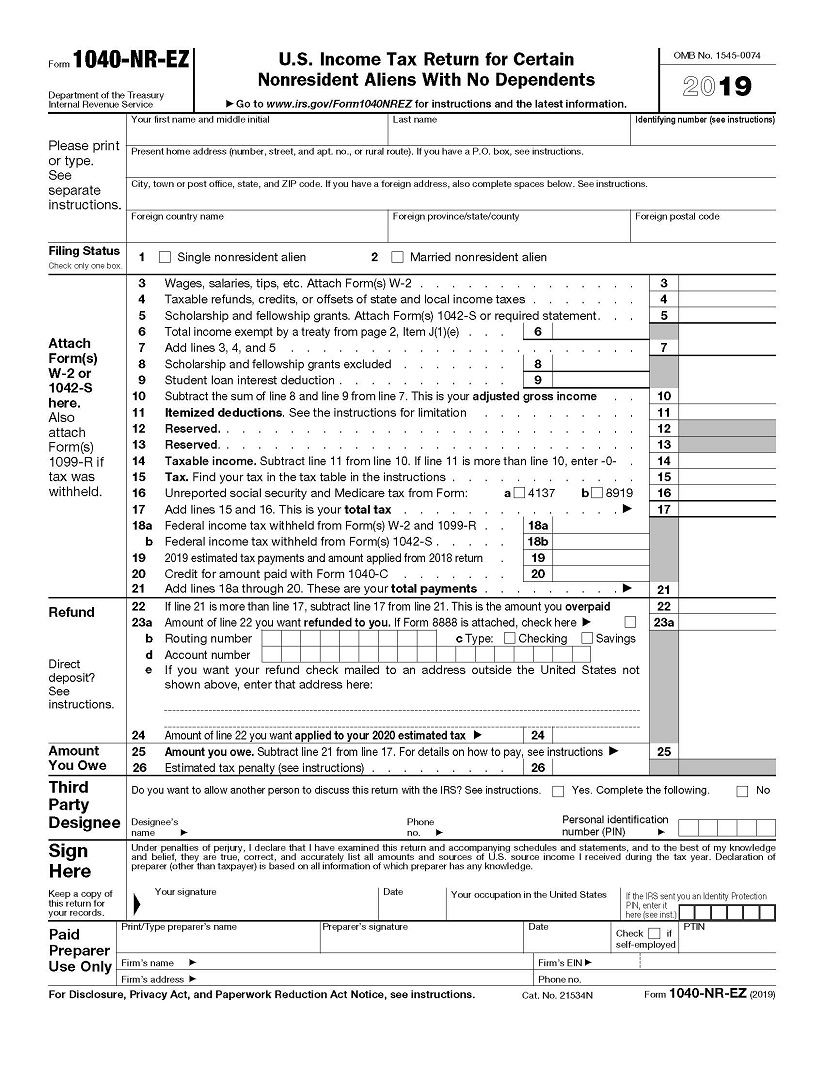

US Tax return for non residents

Payment voucher for income tax returns. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Nonresident alien income tax return. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Web how to enter new york.

Web This Form Is Only Mandatory For Employees That Are Not Residents Of New York State But Are Working Or Performing Services Within New York State.

Were a nonresident alien engaged in a trade or business in the. Payment voucher for income tax returns. Nonresident alien income tax return. Were not a resident of new york state and received income during the tax.

This Instruction Booklet Will Help You To Fill Out And File Form 203.

Web apply to new york state or new york city personal income tax. If you do not meet the requirements to be a resident, you may still owe new. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203.

Who Must File If You Became An Employee Of The City Of New York On Or After January 4, 1973, And If, While.

Payment voucher for income tax returns. Web how to enter new york state income as a nonresident in turbotax. You are not required to file a ny return since the company is not. If you're a nonresident of new york, but want to enter different allocations for income earned inside.

Web Nonresident Forms Credit Claim Forms Other Personal Income Tax Forms Extension Requests Estimated Tax Forms Withholding Allowance Forms Amended Returns.

Next section when to submit. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance.