Non Resident New York Tax Form

Non Resident New York Tax Form - Nonresident alien income tax return, you may be. Web which form to file if you have new york source income, you may be required to file a new york state income tax return. Web who are residents of new york state at the time of the sale or transfer. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Additionally, the requirement may not apply to certain sales or transfers of real property even if the. If you do not meet the requirements to be a resident, you may still owe. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s.

Web who are residents of new york state at the time of the sale or transfer. Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Were not a resident of new york state and received income during the tax. Web if you are a u.s. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? This instruction booklet will help you to fill out and file form 203. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Additionally, the requirement may not apply to certain sales or transfers of real property even if the. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203.

Were not a resident of new york state and received income during the tax. If you do not meet the requirements to be a resident, you may still owe. Web which form to file if you have new york source income, you may be required to file a new york state income tax return. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Web who are residents of new york state at the time of the sale or transfer. Additionally, the requirement may not apply to certain sales or transfers of real property even if the. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

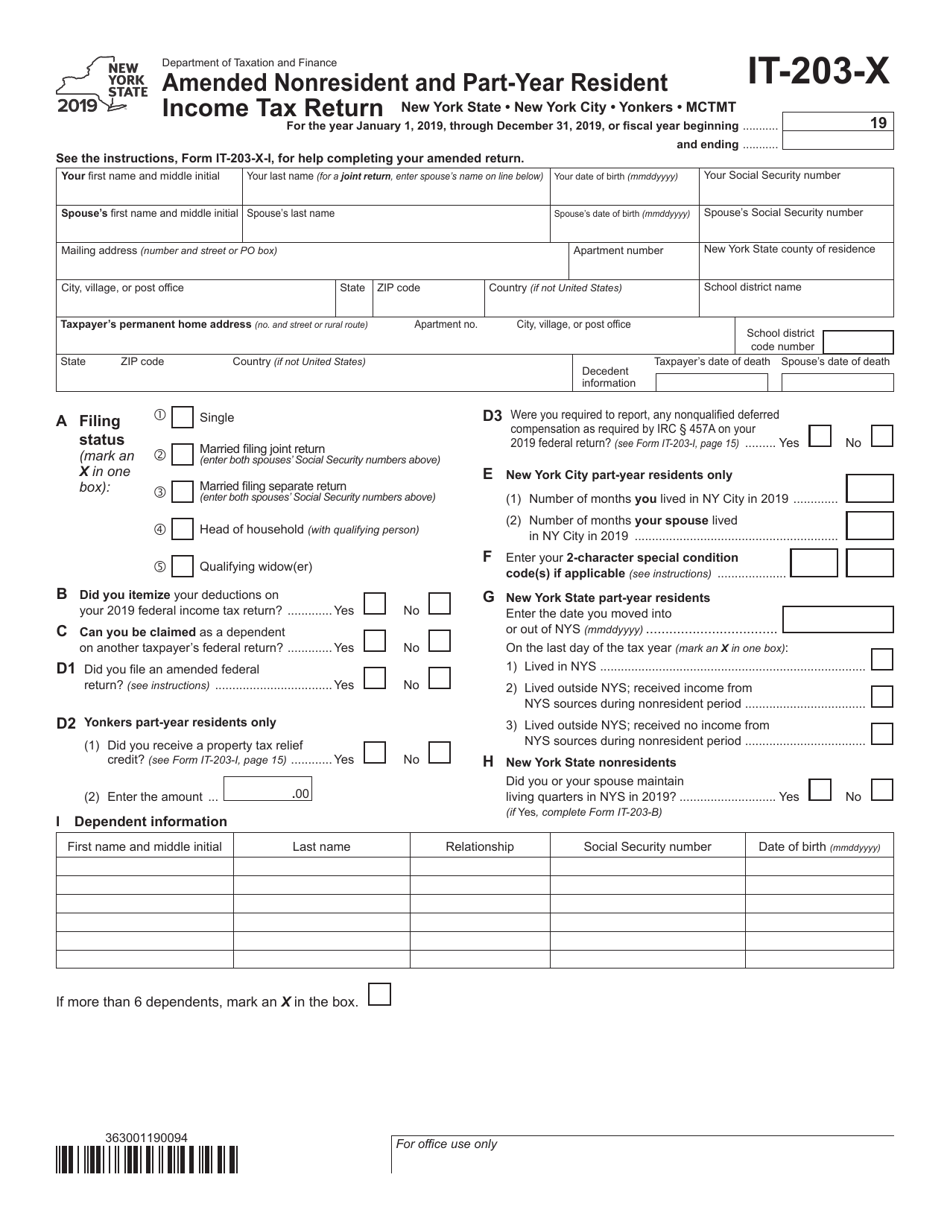

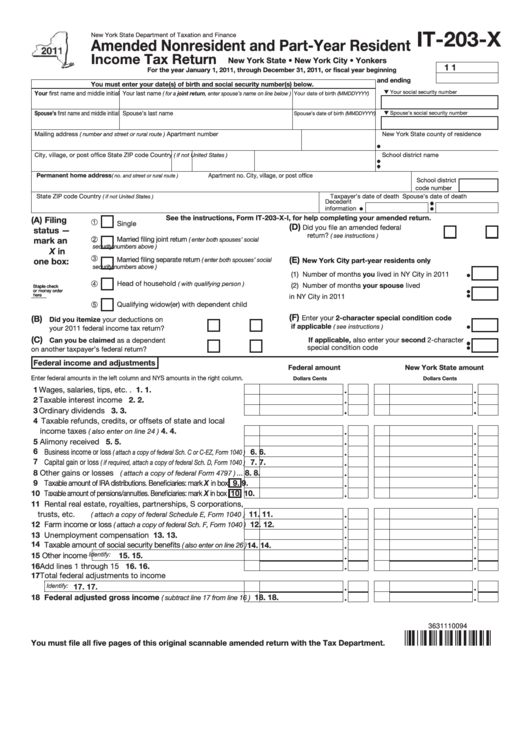

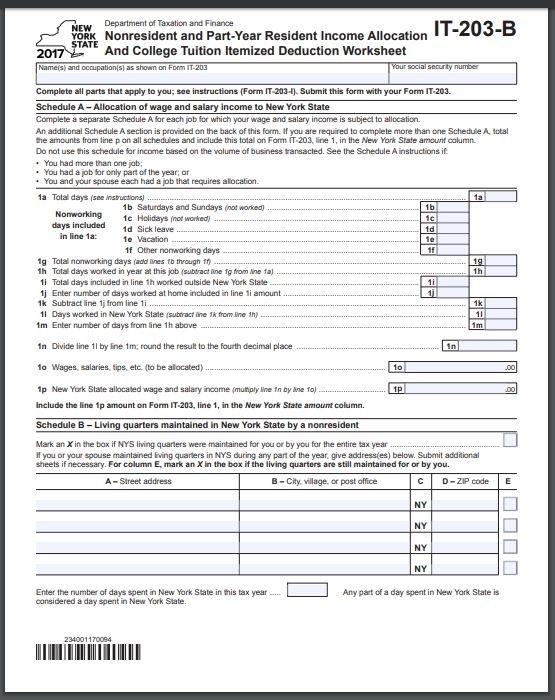

Form IT203X Download Fillable PDF or Fill Online Amended Nonresident

Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Web which form to file if you have new york source income, you may be required to file a new york state income tax return. Additionally, the requirement may not apply to certain sales or transfers of real property even if the. Web if.

Fillable Form It203X Amended Nonresident And PartYear Resident

Web who are residents of new york state at the time of the sale or transfer. Web if you are a u.s. Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. This instruction booklet will help you to fill out and file.

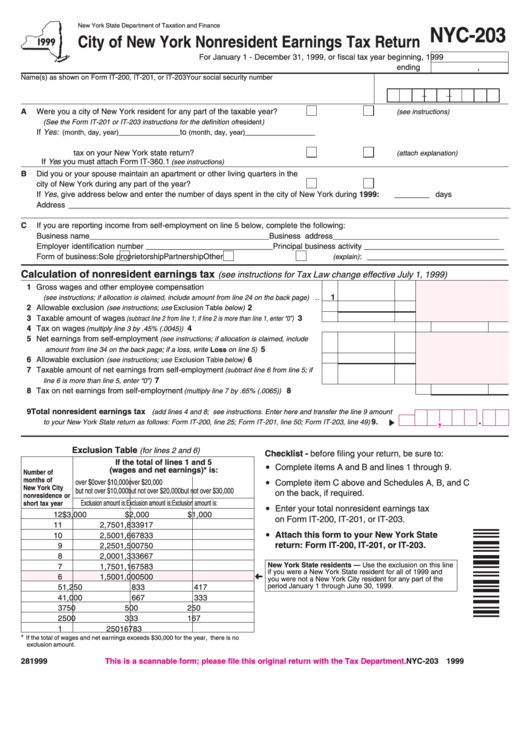

Form Nyc203 City Of New York Nonresident Earnings Tax Return 1999

If you do not meet the requirements to be a resident, you may still owe. Additionally, the requirement may not apply to certain sales or transfers of real property even if the. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Web who are residents of new york state at the time of.

Ny Tax Exempt Form Fill and Sign Printable Template Online US Legal

Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Nonresident alien.

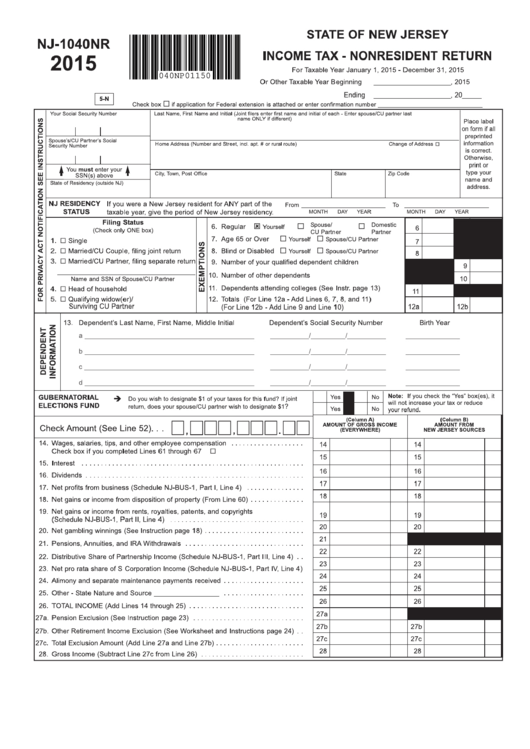

Fillable Form Nj1040nr NonResident Tax Return 2015

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Web if i’m not domiciled in.

Non Resident Individual US Tax Compliance

Web who are residents of new york state at the time of the sale or transfer. Nonresident alien income tax return, you may be. Web if you are a u.s. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? This instruction booklet will help you to fill out and.

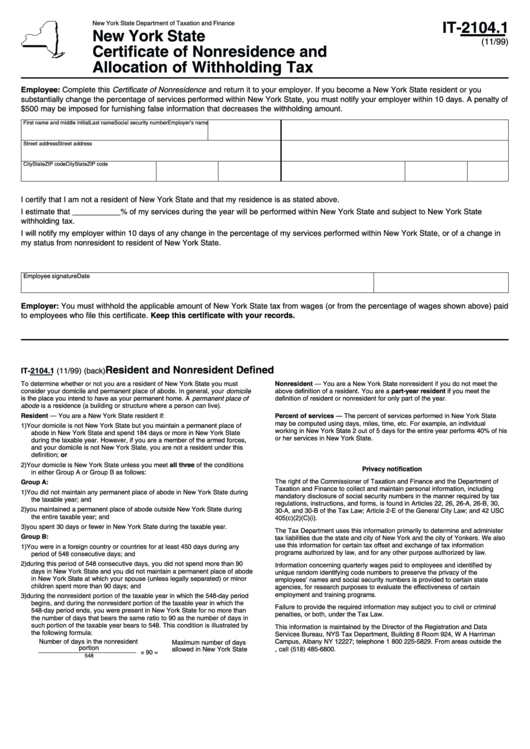

Fillable Form It2104.1 Certificate Of Nonresidence And Allocation Of

Web which form to file if you have new york source income, you may be required to file a new york state income tax return. Additionally, the requirement may not apply to certain sales or transfers of real property even if the. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Were not.

Do these 2 things to get your New York state tax refund 2 weeks sooner

Were not a resident of new york state and received income during the tax. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Nonresident alien income tax return, you may be. If you do not meet the requirements to be a resident, you may still owe. Additionally, the requirement may not apply to.

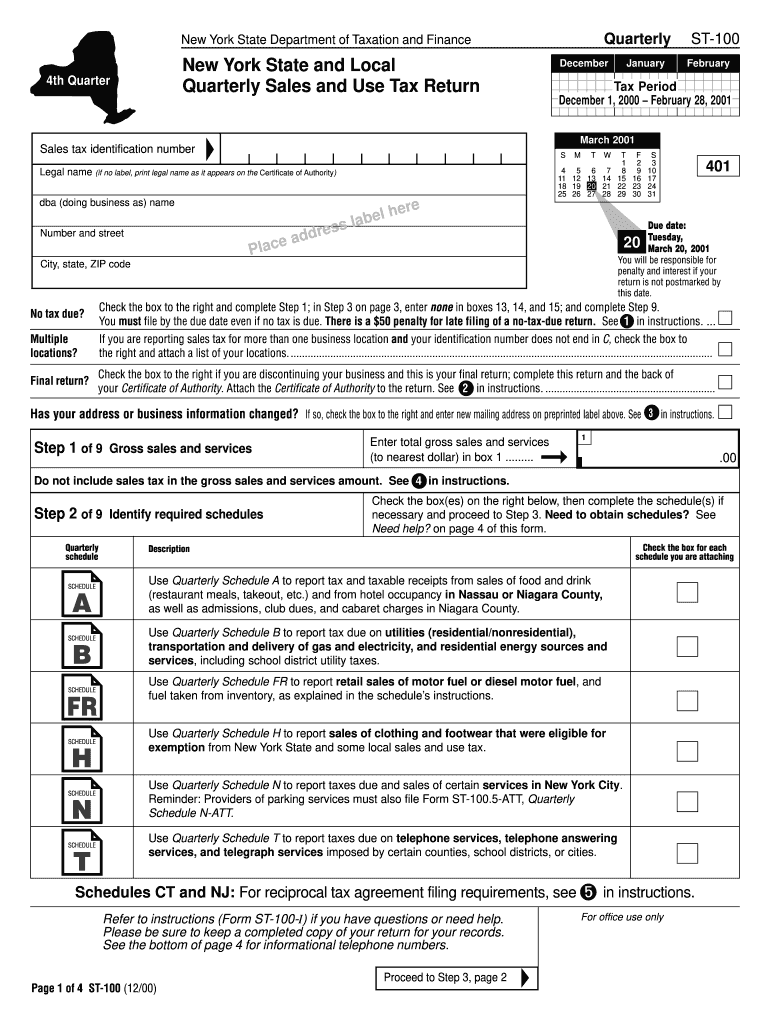

New York State Sales Tax Form St 100 Dec 12 Feb 13 Fill Out and Sign

Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s. Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new.

2017 Nys Payroll Tax Tables Elcho Table

Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax? Web who are residents of new york state at the time of the.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Were not a resident of new york state and received income during the tax. If you do not meet the requirements to be a resident, you may still owe. Web which form to file if you have new york source income, you may be required to file a new york state income tax return. Nonresident noncitizen for federal income tax purposes and are required to file federal form 1040nr, u.s.

Web Who Are Residents Of New York State At The Time Of The Sale Or Transfer.

Web if you are a nonresident of new york who needs to file income taxes with the state, you must file form 203. Web new york has a state income tax that ranges between 4% and 8.82% , which is administered by the new york department of taxation and finance. This instruction booklet will help you to fill out and file form 203. Web if i’m not domiciled in new york and i’m not a resident, do i owe new york income tax?

Web If You Are A U.s.

Nonresident alien income tax return, you may be. Additionally, the requirement may not apply to certain sales or transfers of real property even if the.