Non Filer Tax Form 2022

Non Filer Tax Form 2022 - Web if you have at least one qualifying child and earned less than $24,800 as a married couple, $18,650 as a head of household, or $12,400 as a single filer, you can use the code for. Irs use only—do not write or. Enter payment info is secure, and the information entered will be safe. If you and/or your parent(s)/spouse did not and are not required by the u.s. Tax clearance, please fill out a. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Enter the total distributive or pro rata share of tax. If the net profit that you earned (your gross income,. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. You may file this return.

Web number, date of birth, and mailing addre ss from your latest tax return. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. Internal revenue service (irs) to file a 2020 federal. Tax clearance, please fill out a. If the net profit that you earned (your gross income,. Irs use only—do not write or. Web get tax records and transcripts online or by mail. Web for tax year 2022, please see the 2022 instructions. Enter payment info is secure, and the information entered will be safe. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes.

Web select this box if you are filing under an extension. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web number, date of birth, and mailing addre ss from your latest tax return. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Tax clearance, please fill out a. Irs use only—do not write or. Web get tax records and transcripts online or by mail. You may file this return. Enter payment info is secure, and the information entered will be safe.

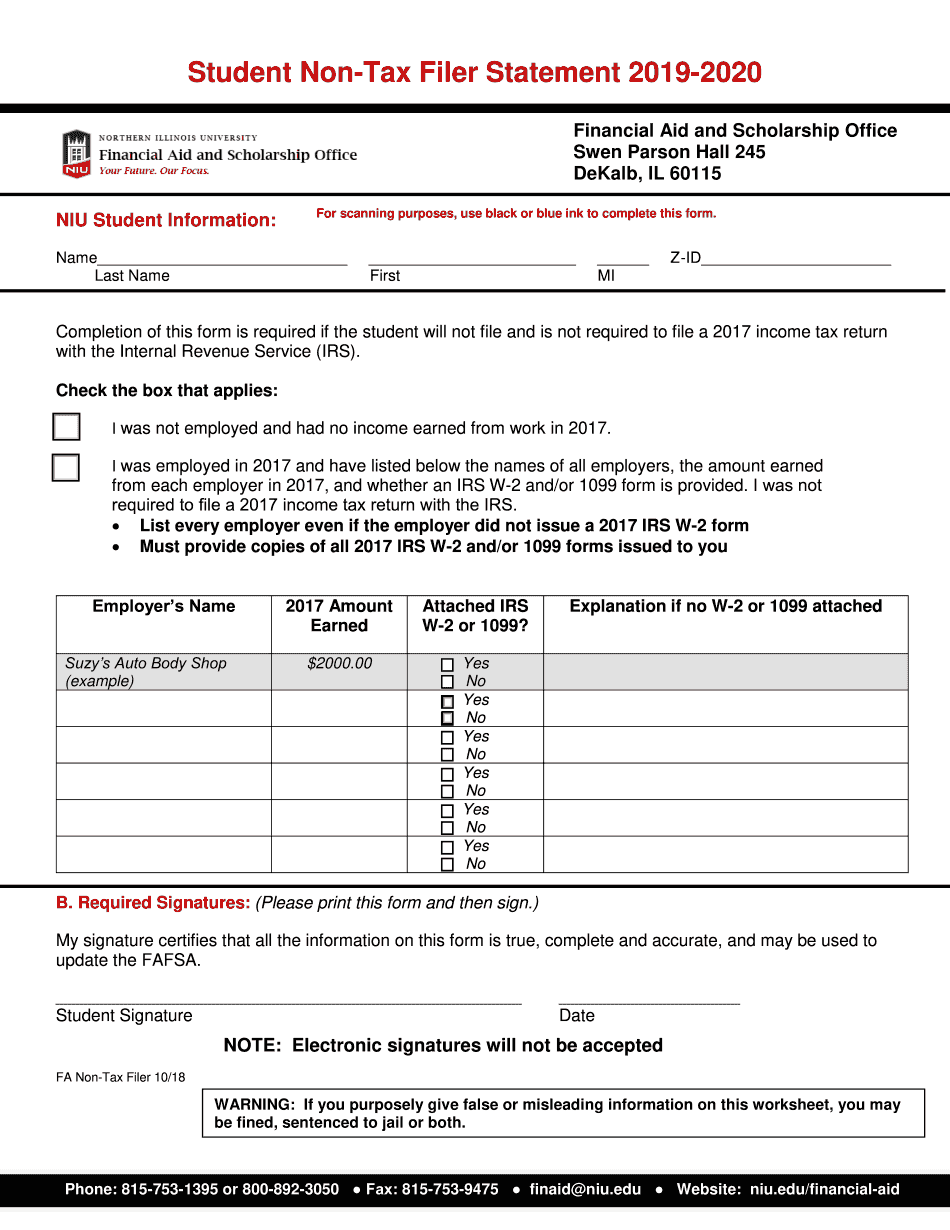

Non Tax Filer Form Fill Out and Sign Printable PDF Template signNow

The tool is based on free file fillable forms. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Web get tax records and transcripts online or by mail. Enter payment info is secure, and the information entered will be safe. If the net profit that you earned (your gross.

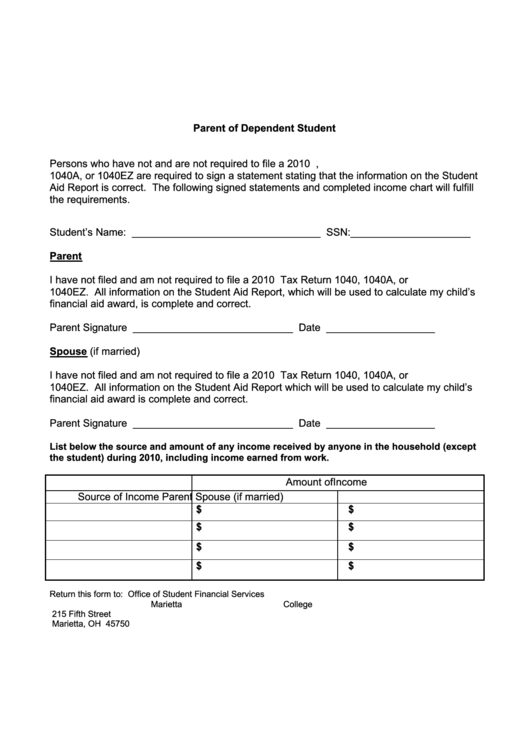

Fillable U.s. Tax NonFiler Statement Parent Of Dependent

Web for tax year 2022, please see the 2022 instructions. Irs use only—do not write or. Web number, date of birth, and mailing addre ss from your latest tax return. Enter payment info is secure, and the information entered will be safe. If the net profit that you earned (your gross income,.

NonTax Filer Statement 20182019 Fill out & sign online DocHub

Web number, date of birth, and mailing addre ss from your latest tax return. Tax clearance, please fill out a. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. Irs use only—do not write or.

2020 tax filing Tips for people who got unemployment benefits

Web get tax records and transcripts online or by mail. You may file this return. If the net profit that you earned (your gross income,. Web for tax year 2022, please see the 2022 instructions. Tax clearance, please fill out a.

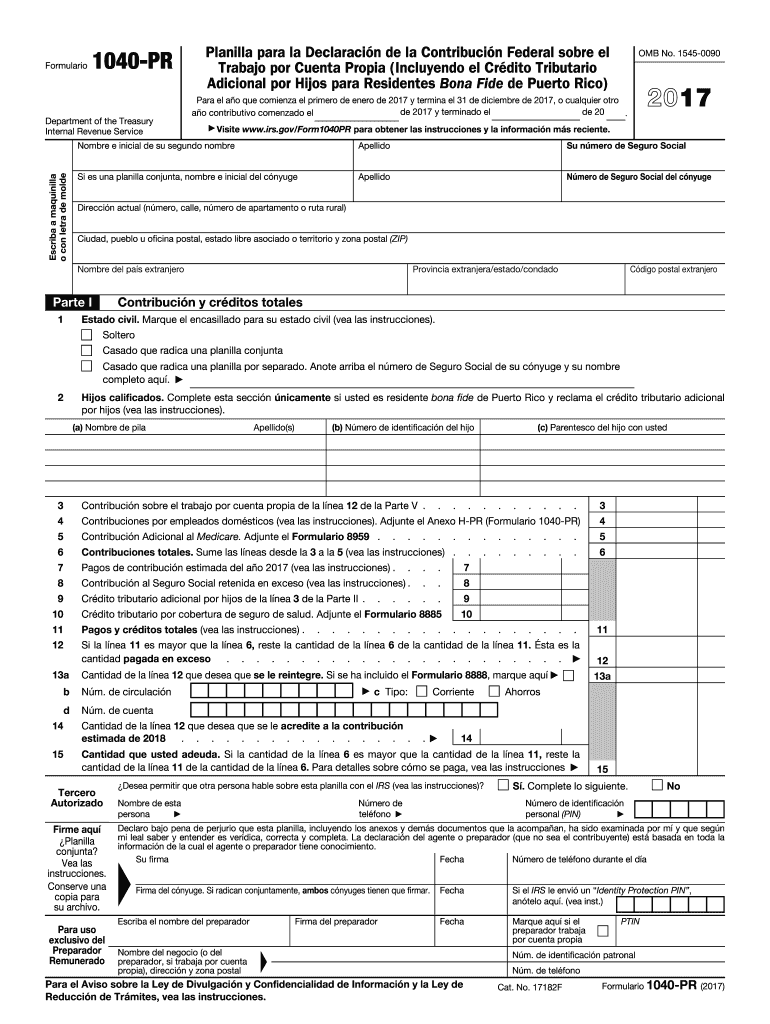

2017 Form IRS 1040PR Fill Online, Printable, Fillable, Blank pdfFiller

Web for tax year 2022, please see the 2022 instructions. If the net profit that you earned (your gross income,. Web get tax records and transcripts online or by mail. Nonresident alien income tax return. Tax clearance, please fill out a.

How Many Child Tax Credits Can You Claim

If the net profit that you earned (your gross income,. Web select this box if you are filing under an extension. Nonresident alien income tax return. Enter payment info is secure, and the information entered will be safe. Tax clearance, please fill out a.

20192023 Form Stony Brook University Verification of for Parent

Enter the total distributive or pro rata share of tax. If the net profit that you earned (your gross income,. Enter payment info is secure, and the information entered will be safe. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Irs use only—do not write or.

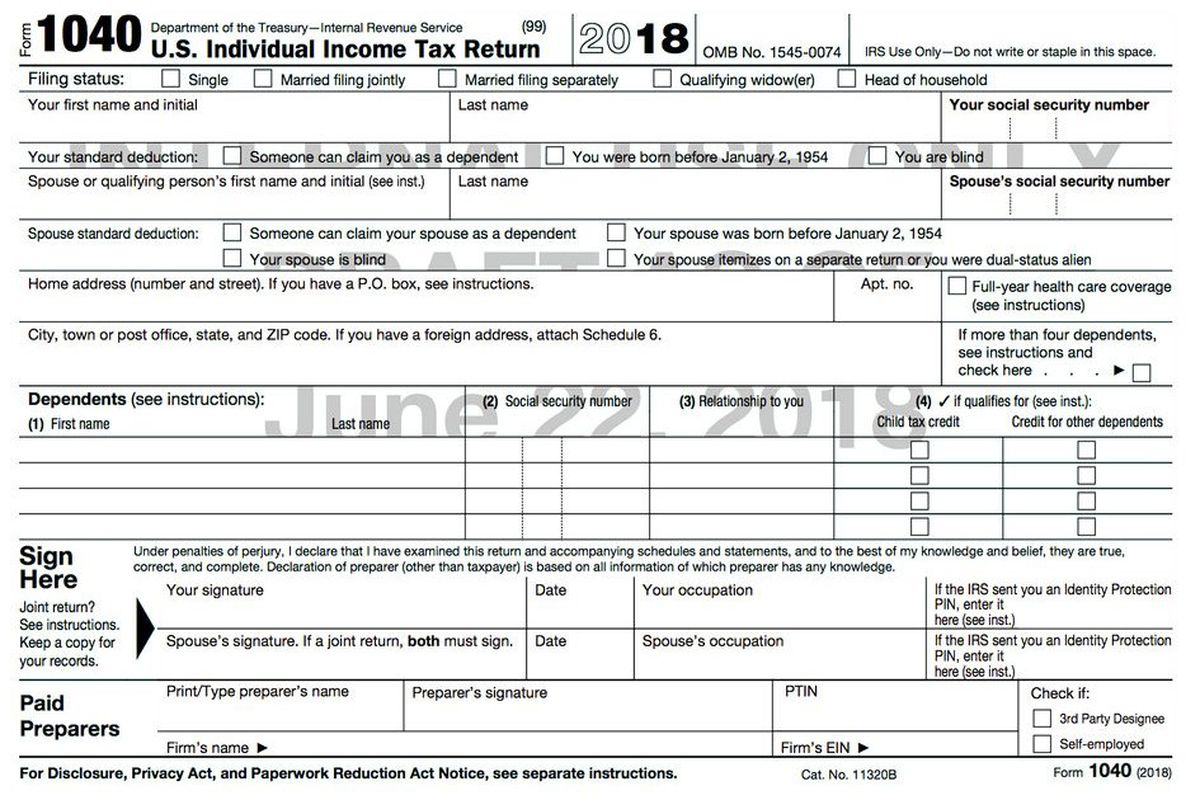

The IRS Shrinks The 1040 Tax Form But The Workload Stays 1040 Form

If the net profit that you earned (your gross income,. Nonresident alien income tax return. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Web for tax year.

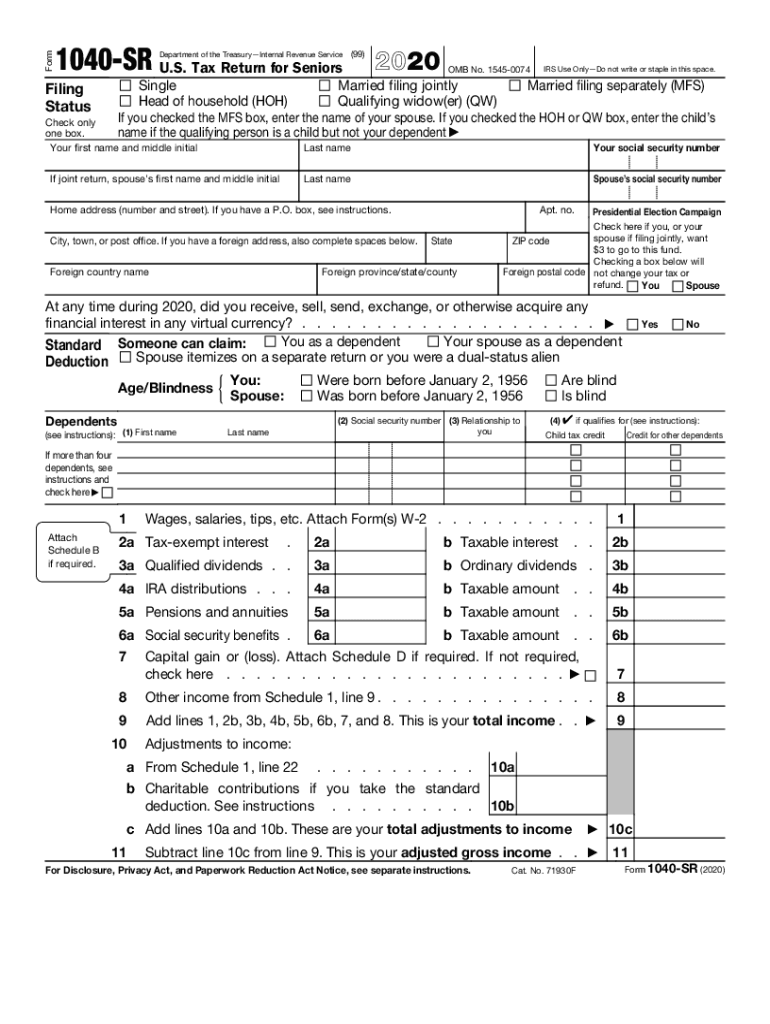

IRS 1040SR 20202022 Fill out Tax Template Online US Legal Forms

Web get tax records and transcripts online or by mail. Nonresident alien income tax return. Irs use only—do not write or. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web for those who don't normally file a tax return, the process is simple and only takes a few minutes.

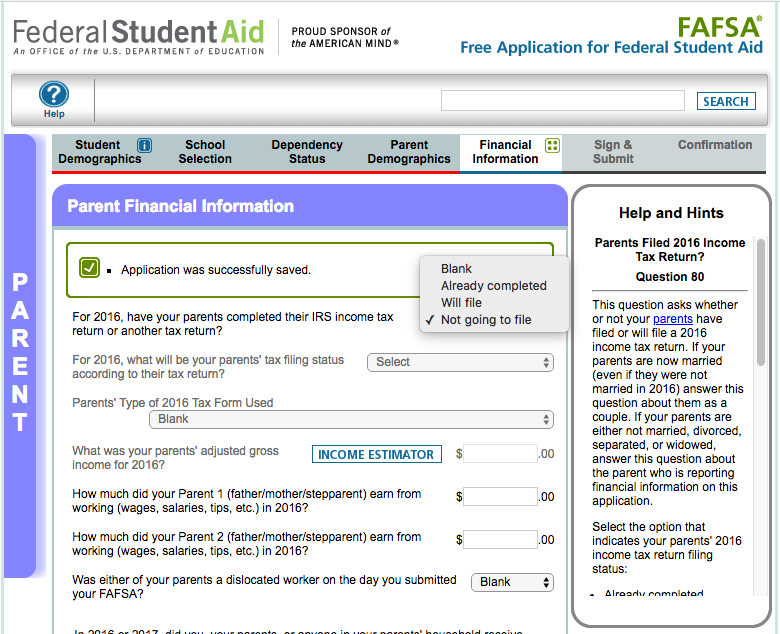

Frequently Asked Questions (FAQs) Scholarships » Office of Admissions

Web for tax year 2022, please see the 2022 instructions. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) If you and/or your parent(s)/spouse did not and are not required by the u.s. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Web.

Web Select This Box If You Are Filing Under An Extension.

Internal revenue service (irs) to file a 2020 federal. The tool is based on free file fillable forms. List below your and/or your parent(s)’/spouse's employers and/or sources of income and the amount of income. Irs use only—do not write or.

Enter The Total Distributive Or Pro Rata Share Of Tax.

You may file this return. Enter payment info is secure, and the information entered will be safe. Web if you have at least one qualifying child and earned less than $24,800 as a married couple, $18,650 as a head of household, or $12,400 as a single filer, you can use the code for. Tax clearance, please fill out a.

Nonresident Alien Income Tax Return.

If you and/or your parent(s)/spouse did not and are not required by the u.s. If the net profit that you earned (your gross income,. Web for those who don't normally file a tax return, the process is simple and only takes a few minutes. Web number, date of birth, and mailing addre ss from your latest tax return.

Web Get Tax Records And Transcripts Online Or By Mail.

Enter payment info here. then provide basic information including social security number, name, address, and. The pte must file form 511 electronically to pass on a business tax credit from form 500cr or from form 502s. Web for tax year 2022, please see the 2022 instructions. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)