Nj Solar Tax Credit Form

Nj Solar Tax Credit Form - Web new jersey solar programs. Web form 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Web njdep solar array. Web the hearing was particularly timely, because the u.s. One of the biggest questions potential customers have for us is whether they will qualify for a solar tax credit. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system. Web on july 10, 2019 (amended august 7, 2019), the board issued an order regarding the calculation of the community solar energy pilot program bill credit. Database of state incentives for renewables & efficiency (dsire) department of energy (doe). Nj solar power strives to produce the best results and can. Is facing intensifying urgency to stop the worsening fentanyl epidemic.

Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. Web federal solar tax credit. Web the hearing was particularly timely, because the u.s. Web the nj solar tax credit, also known as the solar investment tax credit (itc), is a federal tax incentive that allows you to deduct 26 percent of the cost of. This page has been updated to include 2023 new jersey solar incentives, rebates, and tax credits. Web get quote new jersey solar tax credits and rebates new jersey solar incentives support clean energy growth by encouraging homeowners to convert to solar power. Take control of home energy costs & produce your own solar energy. Web these incentives could be tax credits, rebates, and more. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system.

Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. Web 1 division of taxation new jersey division of taxation assessing renewable energy systems james leblon 2 division of taxation presentation renewable energy systems. Web the hearing was particularly timely, because the u.s. Web these incentives could be tax credits, rebates, and more. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system. Web form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small. Web get quote new jersey solar tax credits and rebates new jersey solar incentives support clean energy growth by encouraging homeowners to convert to solar power. Web federal solar tax credit. This page has been updated to include 2023 new jersey solar incentives, rebates, and tax credits.

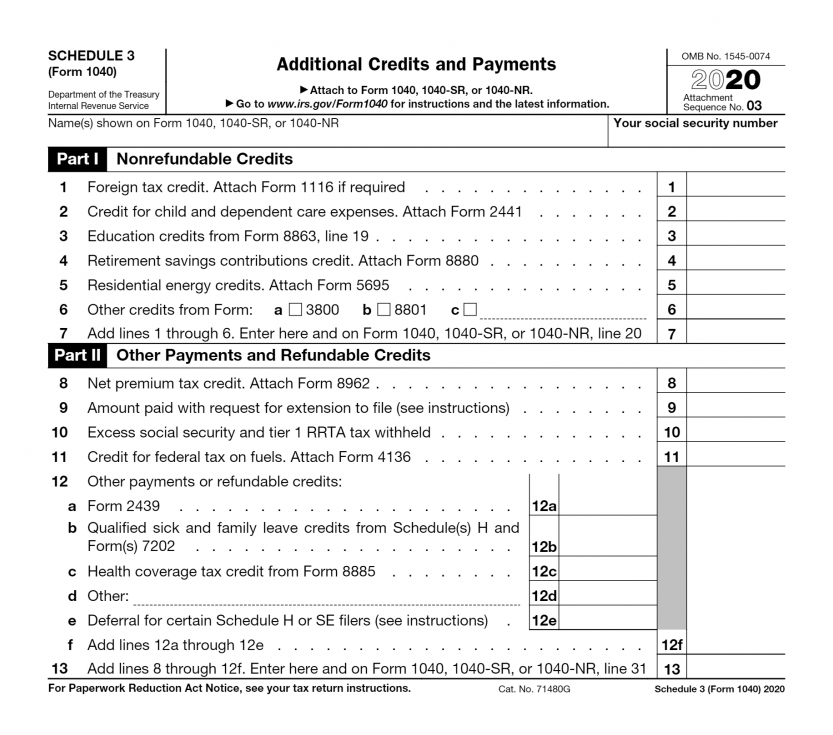

How to Claim the Federal Solar Tax Credit Form 5695 Instructions

Web 2023 new jersey solar incentives, tax credits, rebates & grants. Web 2022 solar tax credit. Web the hearing was particularly timely, because the u.s. Web sustainable jersey drive green nj federal incentives: Web federal solar tax credit.

Solar Tax Credit Extension

In july 2012, the dep installed a 184 kilowatt (kw) solar photovoltaic (pv) array on the roof of its headquarters at 401 east state street in. Is facing intensifying urgency to stop the worsening fentanyl epidemic. Web these incentives could be tax credits, rebates, and more. Web on july 10, 2019 (amended august 7, 2019), the board issued an order.

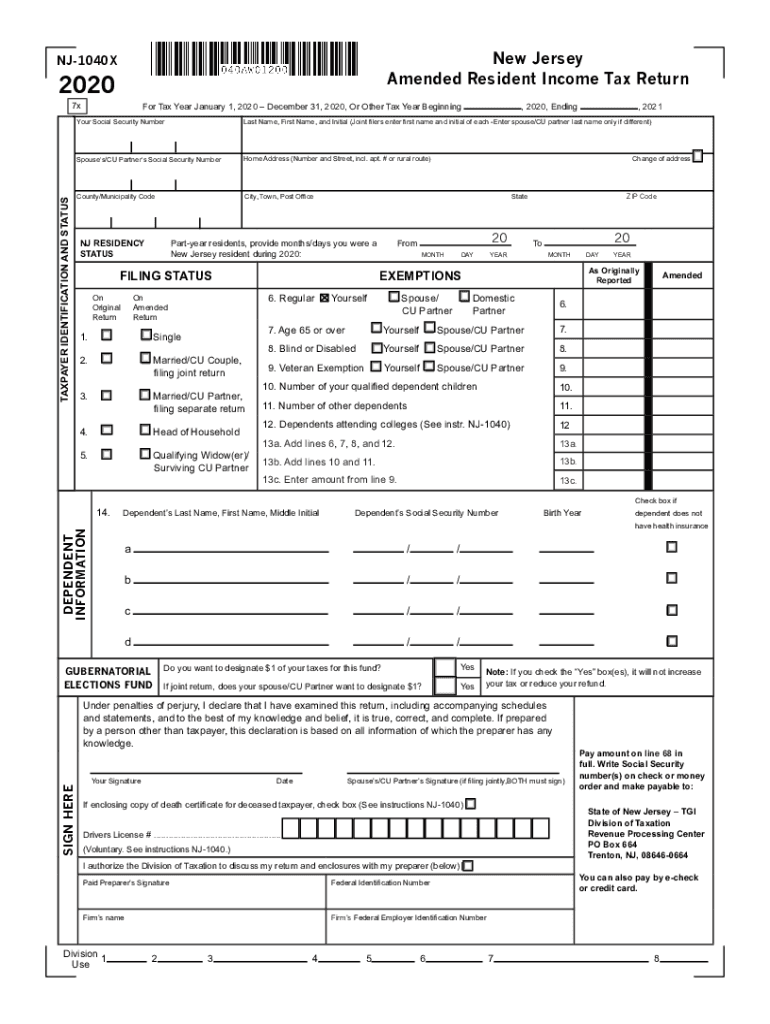

Nj Tax Return Form Fill Out and Sign Printable PDF Template signNow

Database of state incentives for renewables & efficiency (dsire) department of energy (doe). Web new jersey residents are eligible for the federal solar tax credit and receive a rebate of 30% applied to their next federal tax return. Nj solar power strives to produce the best results and can. Web on july 10, 2019 (amended august 7, 2019), the board.

How to Claim Your Solar Tax Credit A.M. Sun Solar

Web the nj solar tax credit, also known as the solar investment tax credit (itc), is a federal tax incentive that allows you to deduct 26 percent of the cost of. Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. One of the biggest.

How Does the Federal Solar Tax Credit Work?

The successor solar incentive (susi) program is the current solar program which allows. Web on july 10, 2019 (amended august 7, 2019), the board issued an order regarding the calculation of the community solar energy pilot program bill credit. Web sustainable jersey drive green nj federal incentives: This page has been updated to include 2023 new jersey solar incentives, rebates,.

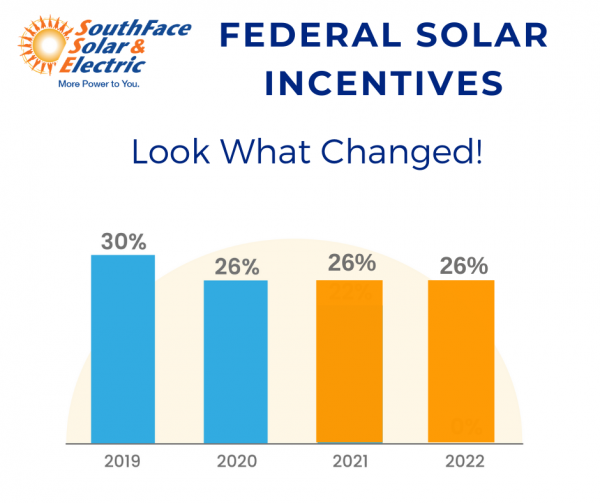

Solar Tax Credit in 2021 SouthFace Solar & Electric AZ

Web these incentives could be tax credits, rebates, and more. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system. Web the residential clean energy credit.

Here’s How To Claim The Solar Tax Credits On Your Tax Return Southern

Drug deaths nationwide hit a record. Web new jersey residents who purchased or leased an eligible electric vehicle after july 25, 2022 may apply for an incentive of up to $4,000. Web the nj solar tax credit, also known as the solar investment tax credit (itc), is a federal tax incentive that allows you to deduct 26 percent of the.

Understanding How Solar Tax Credits Work

The successor solar incentive (susi) program is the current solar program which allows. Database of state incentives for renewables & efficiency (dsire) department of energy (doe). Web njdep solar array. One of the biggest questions potential customers have for us is whether they will qualify for a solar tax credit. Web new jersey solar programs.

How Does The Solar Tax Credit Work Solar Pricing NJ Solar Power

The federal tax credit falls to 26% starting in 2033. Web njdep solar array. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. Web 2022 solar tax credit. New jersey is committed to supporting solar energy.

How to Claim the Federal Solar Investment Tax Credit Solar Sam

Web the nj solar tax credit, also known as the solar investment tax credit (itc), is a federal tax incentive that allows you to deduct 26 percent of the cost of. Is facing intensifying urgency to stop the worsening fentanyl epidemic. The federal tax credit falls to 26% starting in 2033. Take control of home energy costs & produce your.

Web The Hearing Was Particularly Timely, Because The U.s.

Web 2022 solar tax credit. If your solar energy system costs $20,000, your federal solar tax credit would be $20,000 x 30% = $6,000. Web new jersey solar programs. Web the residential clean energy credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2033.

Web Form 5695 Calculates Tax Credits For A Variety Of Qualified Residential Energy Improvements, Including Geothermal Heat Pumps, Solar Panels, Solar Water Heating, Small.

Web form 5695 department of the treasury internal revenue service residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Drug deaths nationwide hit a record. Nj solar power strives to produce the best results and can. Is facing intensifying urgency to stop the worsening fentanyl epidemic.

One Of The Biggest Questions Potential Customers Have For Us Is Whether They Will Qualify For A Solar Tax Credit.

Web 1 division of taxation new jersey division of taxation assessing renewable energy systems james leblon 2 division of taxation presentation renewable energy systems. Web the nj solar tax credit, also known as the solar investment tax credit (itc), is a federal tax incentive that allows you to deduct 26 percent of the cost of. New jersey is committed to supporting solar energy. Web on july 10, 2019 (amended august 7, 2019), the board issued an order regarding the calculation of the community solar energy pilot program bill credit.

In July 2012, The Dep Installed A 184 Kilowatt (Kw) Solar Photovoltaic (Pv) Array On The Roof Of Its Headquarters At 401 East State Street In.

Take control of home energy costs & produce your own solar energy. The federal tax credit falls to 26% starting in 2033. Web these incentives could be tax credits, rebates, and more. All new jersey residents are eligible for the federal solar investment tax credit (itc) worth 30% of the total cost of your solar panel system.