Nj Llc Dissolution Form

Nj Llc Dissolution Form - Web to begin the dissolution filing process, corporations should submit a completed dissolution package containing all of the following to the new jersey division of revenue, po box 308, trenton, n.j. Go to njportal.com/dor/annualreports and select “close a business.” businesses that choose to complete a paper application must submit all of the following: The filing fee is $128. The details are mentioned on the second page of the article dissolution filing form. You will not be able to close your business if your annual reports are not current. who needs to do it: Select an option from the table below to view the method of dissolution, cancellation or withdrawal that applies to your business. Web effective july 1, 2003, new procedures for profit corporations were implemented. List the name as it appears on the records of the state treasurer. Your business formation will determine the income tax forms needed to. No fee the mandatory fields are:

Your business formation will determine the income tax forms needed to. No fee the mandatory fields are: File the closure of your business. $125 the mandatory fields are: Web effective july 1, 2003, new procedures for profit corporations were implemented. List the name as it appears on the records of the state treasurer. Review the information on tax clearance requirements and eligibility. You will not be able to close your business if your annual reports are not current. who needs to do it: Web to close your business in new jersey and avoid potential fines and fees there are several steps you need to take: Web to begin the dissolution filing process, corporations should submit a completed dissolution package containing all of the following to the new jersey division of revenue, po box 308, trenton, n.j.

Go to njportal.com/dor/annualreports and select “close a business.” businesses that choose to complete a paper application must submit all of the following: Web to begin the dissolution filing process, corporations should submit a completed dissolution package containing all of the following to the new jersey division of revenue, po box 308, trenton, n.j. Web to close your business in new jersey and avoid potential fines and fees there are several steps you need to take: Web effective july 1, 2003, new procedures for profit corporations were implemented. $125 the mandatory fields are: The details are mentioned on the second page of the article dissolution filing form. Web corporations ending business in new jersey can dissolve, cancel, or withdraw online. Review the information on tax clearance requirements and eligibility. File the closure of your business. No fee the mandatory fields are:

Dissolution Delaware Llc Forms Form Resume Examples n49m57r9Zz

File the closure of your business. Web to dissolve an llc in new jersey, llcs have to file an article of dissolution. Select an option from the table below to view the method of dissolution, cancellation or withdrawal that applies to your business. $125 the mandatory fields are: The details are mentioned on the second page of the article dissolution.

New Jersey Dissolution Package to Dissolve Corporation Dissolution

Web to begin the dissolution filing process, corporations should submit a completed dissolution package containing all of the following to the new jersey division of revenue, po box 308, trenton, n.j. Web to dissolve an llc in new jersey, llcs have to file an article of dissolution. Web effective july 1, 2003, new procedures for profit corporations were implemented. Select.

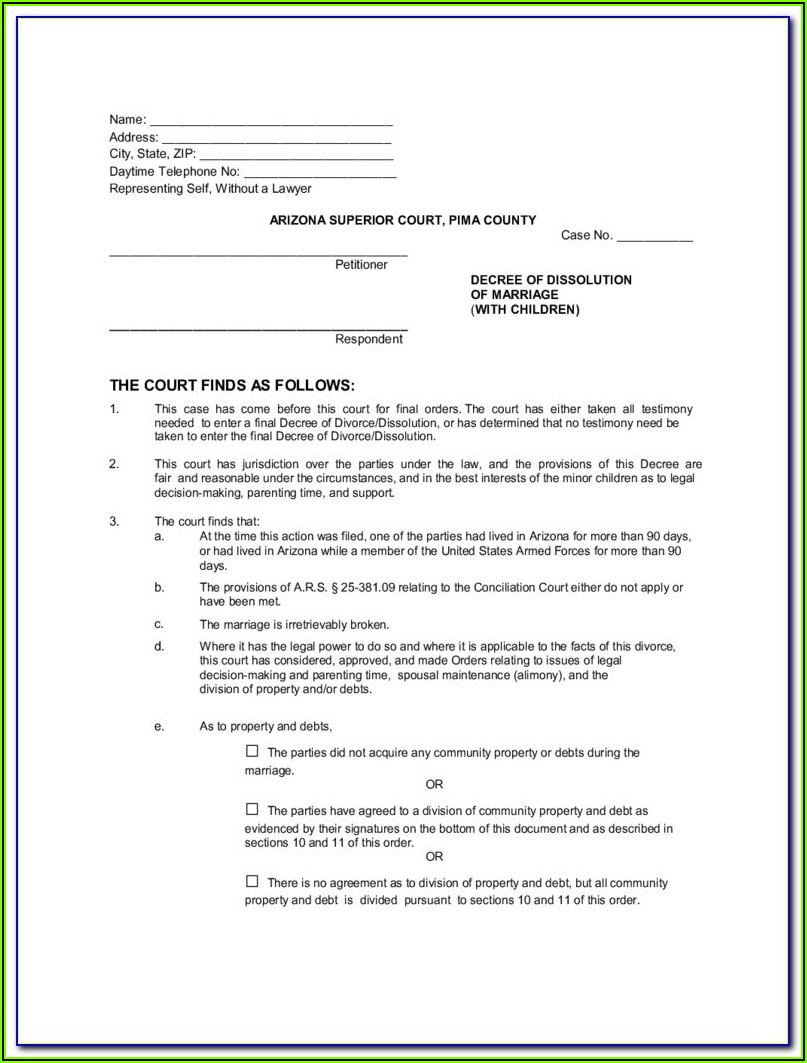

Ohio Dissolution Of Marriage Forms Form Resume Examples L71xWyx8MX

List the name as it appears on the records of the state treasurer. Web corporations ending business in new jersey can dissolve, cancel, or withdraw online. No fee the mandatory fields are: Go to njportal.com/dor/annualreports and select “close a business.” businesses that choose to complete a paper application must submit all of the following: Review the information on tax clearance.

New Jersey Dissolution Package to Dissolve Limited Liability Company

Web corporations ending business in new jersey can dissolve, cancel, or withdraw online. Web to dissolve an llc in new jersey, llcs have to file an article of dissolution. No fee the mandatory fields are: You will not be able to close your business if your annual reports are not current. who needs to do it: Your business formation will.

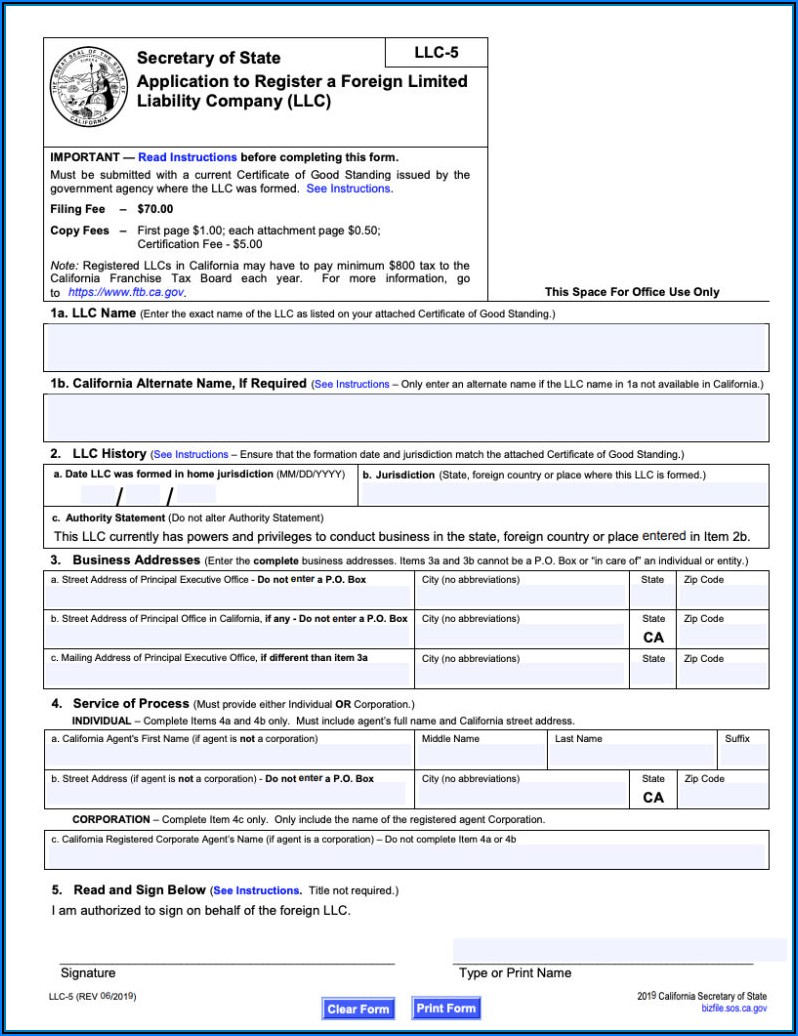

Llc dissolution form Fill out & sign online DocHub

Web corporations ending business in new jersey can dissolve, cancel, or withdraw online. Web to dissolve an llc in new jersey, llcs have to file an article of dissolution. The details are mentioned on the second page of the article dissolution filing form. File the closure of your business. You will not be able to close your business if your.

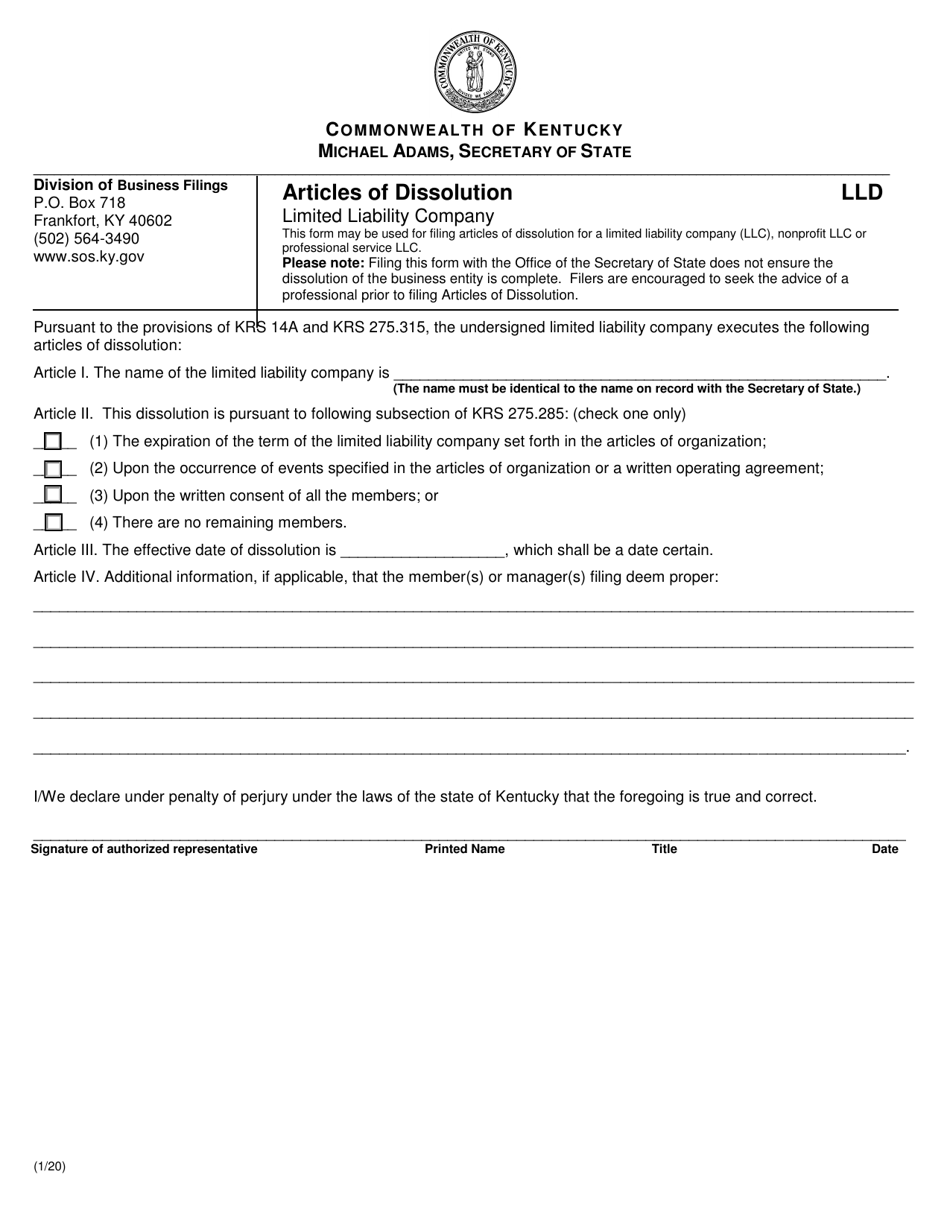

Kentucky Articles of Dissolution Limited Liability Company Download

File the closure of your business. Web to begin the dissolution filing process, corporations should submit a completed dissolution package containing all of the following to the new jersey division of revenue, po box 308, trenton, n.j. The filing fee is $128. The details are mentioned on the second page of the article dissolution filing form. You will not be.

Statement Of Dissolution Fill Out and Sign Printable PDF Template

$125 the mandatory fields are: The filing fee is $128. Go to njportal.com/dor/annualreports and select “close a business.” businesses that choose to complete a paper application must submit all of the following: Web effective july 1, 2003, new procedures for profit corporations were implemented. List the name as it appears on the records of the state treasurer.

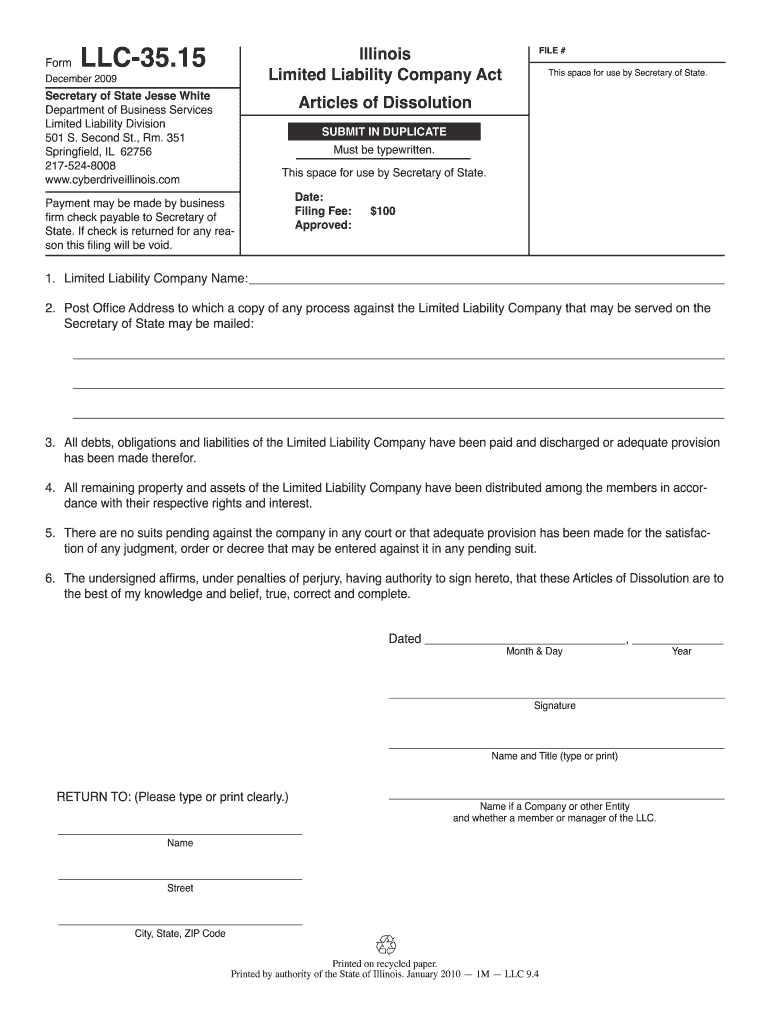

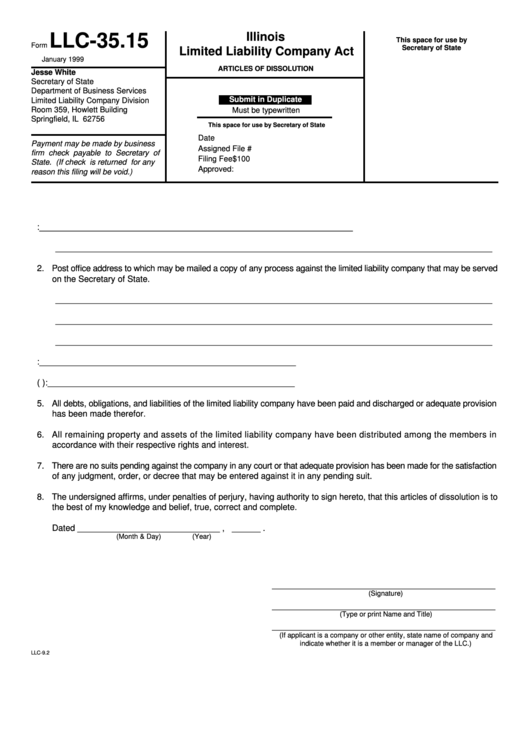

Form Llc35.15 Articles Of Dissolution printable pdf download

Web to dissolve an llc in new jersey, llcs have to file an article of dissolution. Web to close your business in new jersey and avoid potential fines and fees there are several steps you need to take: Review the information on tax clearance requirements and eligibility. Select an option from the table below to view the method of dissolution,.

C 159d Form Fill Online, Printable, Fillable, Blank pdfFiller

The details are mentioned on the second page of the article dissolution filing form. List the name as it appears on the records of the state treasurer. Your business formation will determine the income tax forms needed to. Go to njportal.com/dor/annualreports and select “close a business.” businesses that choose to complete a paper application must submit all of the following:.

Arizona Llc Dissolution Forms Form Resume Examples djVapXwYJk

The details are mentioned on the second page of the article dissolution filing form. File the closure of your business. Select an option from the table below to view the method of dissolution, cancellation or withdrawal that applies to your business. Your business formation will determine the income tax forms needed to. No fee the mandatory fields are:

The Details Are Mentioned On The Second Page Of The Article Dissolution Filing Form.

Web to begin the dissolution filing process, corporations should submit a completed dissolution package containing all of the following to the new jersey division of revenue, po box 308, trenton, n.j. Web effective july 1, 2003, new procedures for profit corporations were implemented. Web to dissolve an llc in new jersey, llcs have to file an article of dissolution. Your business formation will determine the income tax forms needed to.

You Will Not Be Able To Close Your Business If Your Annual Reports Are Not Current. Who Needs To Do It:

The filing fee is $128. Go to njportal.com/dor/annualreports and select “close a business.” businesses that choose to complete a paper application must submit all of the following: List the name as it appears on the records of the state treasurer. Web corporations ending business in new jersey can dissolve, cancel, or withdraw online.

No Fee The Mandatory Fields Are:

Review the information on tax clearance requirements and eligibility. File the closure of your business. $125 the mandatory fields are: Select an option from the table below to view the method of dissolution, cancellation or withdrawal that applies to your business.