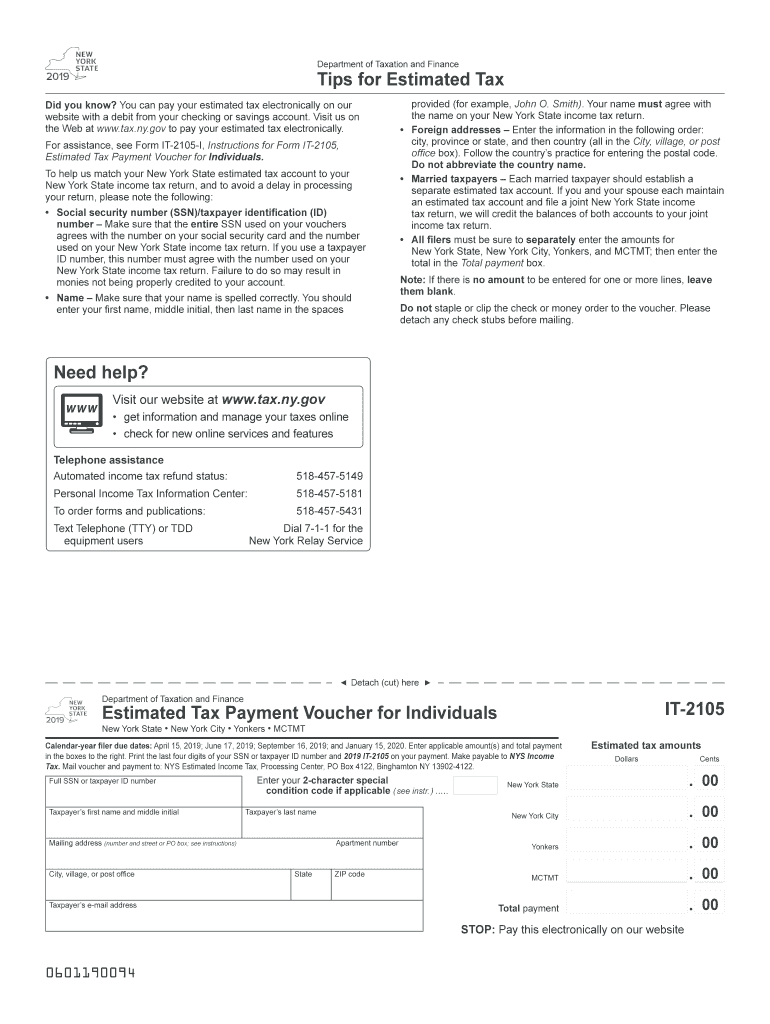

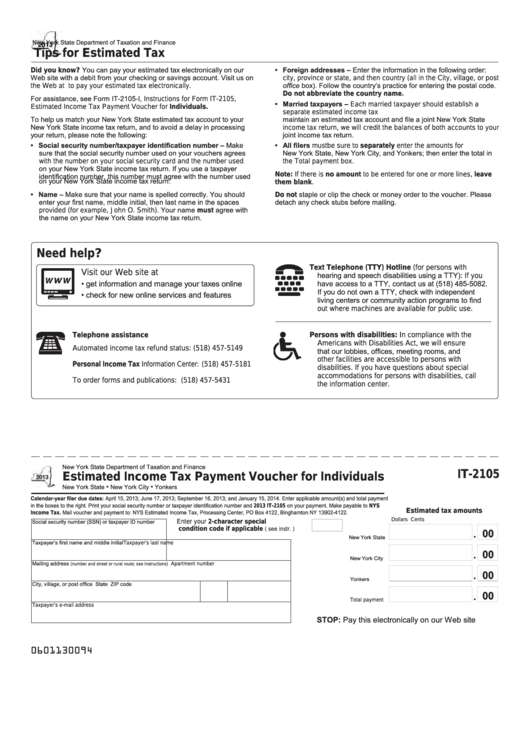

New York State Estimated Tax Form

New York State Estimated Tax Form - Web if the requirements for filing estimated payments file the form on or before the: Web estimated income tax payment voucher for fiduciaries; Web estimated income tax is the amount of new york state, new york city, and yonkers tax you expect to owe for the year after subtracting: The balance of estimated tax is due as follows: Are first met during the taxable year: Web report of estimated tax for corporate partners; You may be required to make estimated. Web if you would like to make an estimated income tax payment, you can make your payment directly on our website or use approved tax preparation software. Four of these options are based on a percentage of tax from both the prior year and the current year. Claim for new york city enhanced real property tax credit for.

If you would like to make an estimated income tax payment, you can make your payment. See important information for nyc residents. Customize using your filing status, deductions, exemptions and more. Payments due april 18, june 15, september 15, 2023, and january 16, 2024. These options are to pay:. Are first met during the taxable year: You may be required to make estimated. • the amount of tax you expect to have. Web estimated income tax payment voucher for fiduciaries; Four of these options are based on a percentage of tax from both the prior year and the current year.

• the amount of tax you expect to have. Payments due april 18, june 15, september 15, 2022, and january 17, 2023. Are first met during the taxable year: Web estimated tax penalties for partnerships and new york s corporations: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web new york state gives you five options. Web if you would like to make an estimated income tax payment, you can make your payment directly on our website or use approved tax preparation software. Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Web find out how much you'll pay in new york state income taxes given your annual income. Web if the requirements for filing estimated payments file the form on or before the:

Tax Withholding Estimator New Job QATAX

Be sure to verify that the form you are downloading is for the correct year. Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Web find out how much you'll pay in new york state income taxes given your annual.

Nys Estimated Tax Forms Fill Out and Sign Printable PDF Template

See important information for nyc residents. Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Web find out how much you'll pay in new york state income taxes given your annual income. Web estimated income tax is the amount of.

Printable Ny State Tax Form It 201 Form Resume Examples VEk19Rmk8p

Web report of estimated tax for corporate partners; Here are new york income tax forms, specific to individual filers: Web estimated tax penalties for partnerships and new york s corporations: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web estimated income tax is the amount of new york state, new.

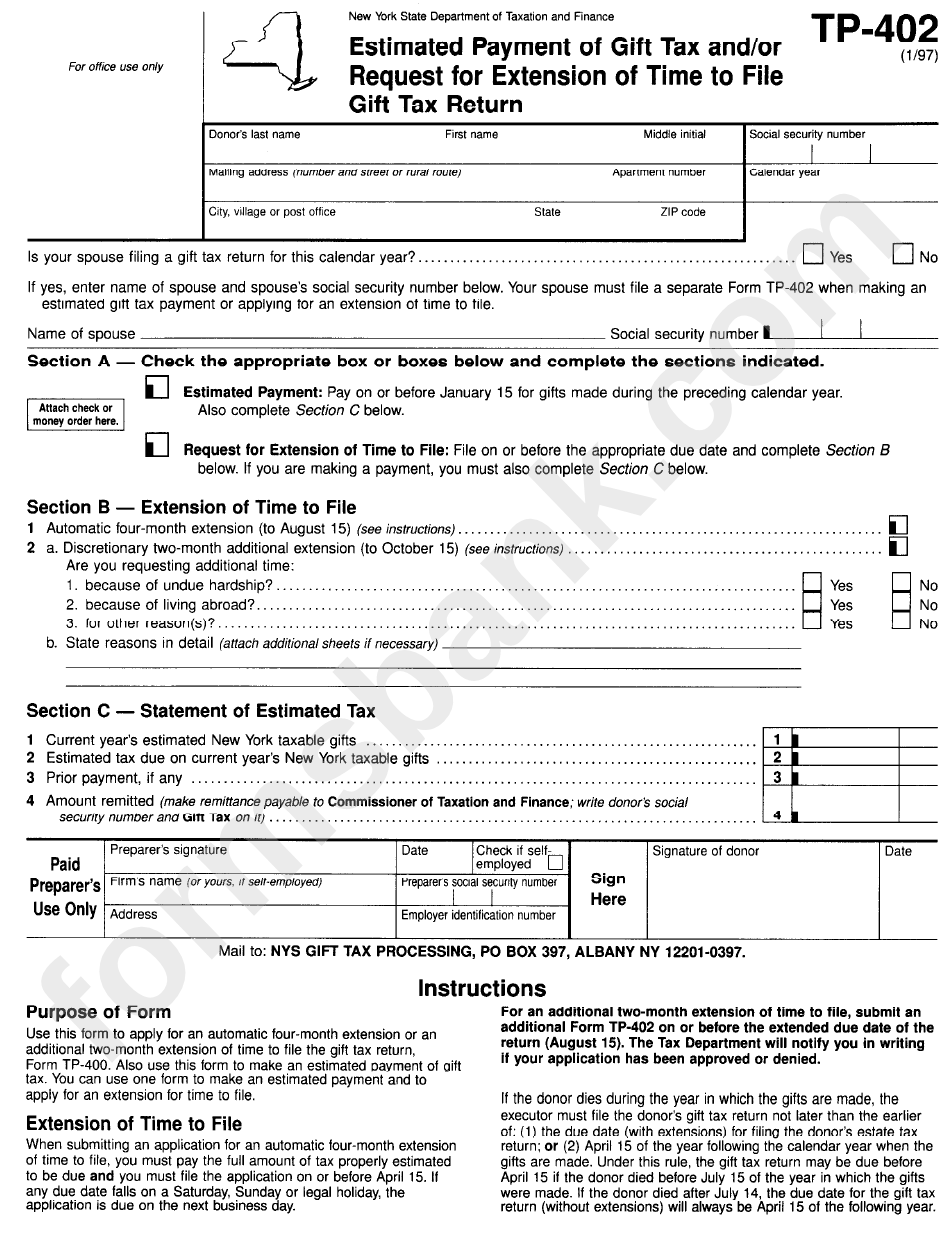

Form Tp402 Estimated Payment Of Gift Tax And/or Request For

Commonly used income tax forms and instructions;. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web if the requirements for filing estimated payments file the form on or before the: New york income tax forms. Estimated tax is the method used to pay tax on income when no tax—or not.

Fillable Form It2105 Estimated Tax Payment Voucher For

Be sure to verify that the form you are downloading is for the correct year. Are first met during the taxable year: Web report of estimated tax for corporate partners; The balance of estimated tax is due as follows: Web if you would like to make an estimated income tax payment, you can make your payment directly on our website.

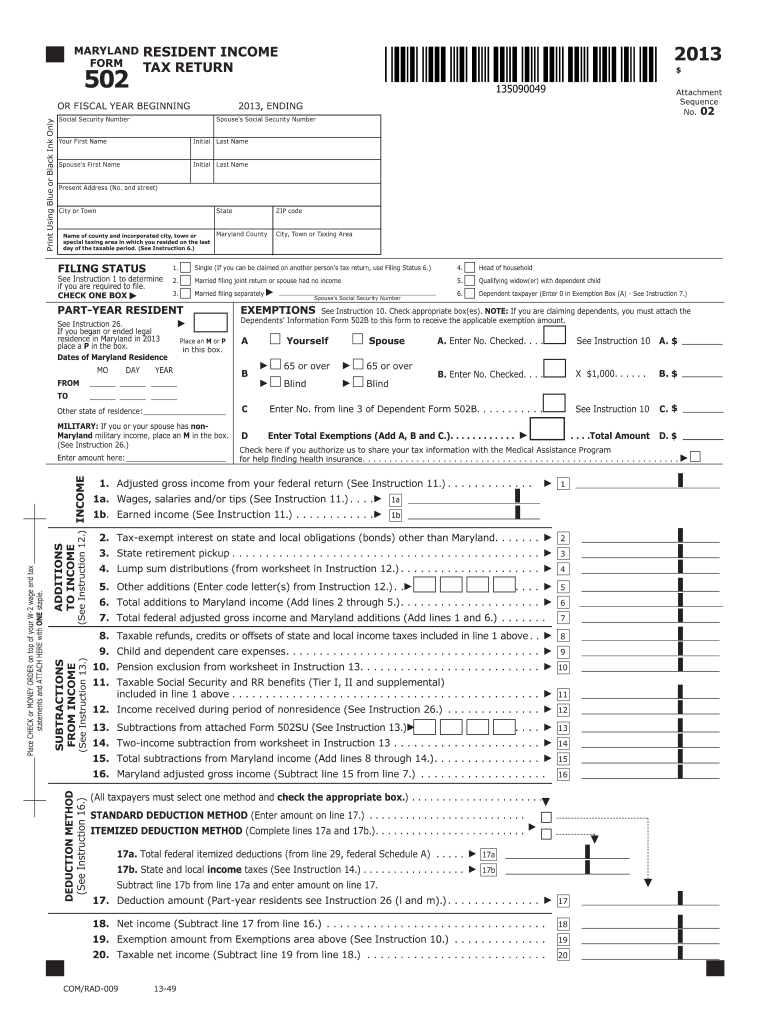

Fillable Md 502 Form Fill Out and Sign Printable PDF Template signNow

These options are to pay:. What is this form for? Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Are first met during the taxable year: Four of these options are based on a percentage of tax from both the.

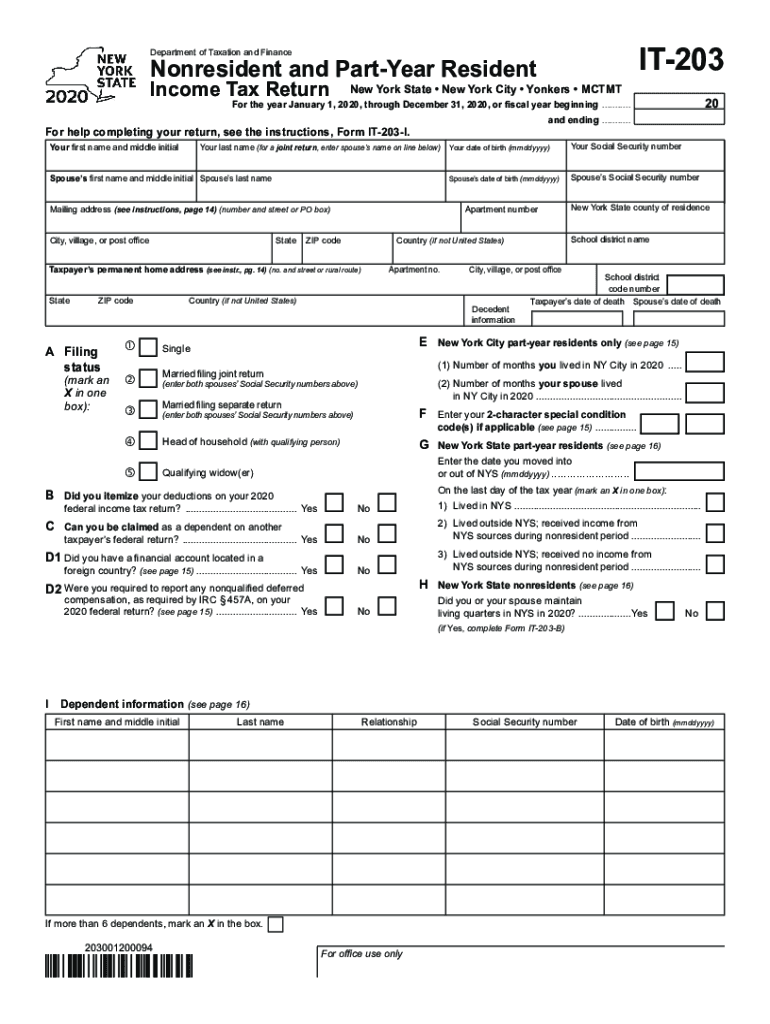

2020 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

Web if the requirements for filing estimated payments file the form on or before the: The balance of estimated tax is due as follows: Web new york has a state income tax that ranges between 4% and 8.82%, which is administered by the new york department of taxation and finance. Payments due april 18, june 15, september 15, 2022, and.

2020 Form IRS 1040ES Fill Online, Printable, Fillable, Blank pdfFiller

The due date for the. See important information for nyc residents. Claim for new york city enhanced real property tax credit for. Web new york state gives you five options. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook.

IRS 2220 2020 Fill out Tax Template Online US Legal Forms

Web porated business or profession in new york city if its estimated tax (line 6 of tax computation schedule) can reasonably be expected to exceed $3,400 for the calendar. Estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. Four of these options are based on a percentage of tax from both.

Web New York State Gives You Five Options.

Web estimated income tax is the amount of new york state, new york city, and yonkers tax you expect to owe for the year after subtracting: Commonly used income tax forms and instructions;. If you would like to make an estimated income tax payment, you can make your payment. The balance of estimated tax is due as follows:

New York Income Tax Forms.

Claim for new york city enhanced real property tax credit for. Payments due april 18, june 15, september 15, 2022, and january 17, 2023. Web new york has a state income tax that ranges between 4% and 8.82%, which is administered by the new york department of taxation and finance. You may be required to make estimated.

Be Sure To Verify That The Form You Are Downloading Is For The Correct Year.

Customize using your filing status, deductions, exemptions and more. These options are to pay:. Payments due april 18, june 15, september 15, 2023, and january 16, 2024. Web if the requirements for filing estimated payments file the form on or before the:

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web report of estimated tax for corporate partners; Estimated tax is the method used to pay tax on income when no tax—or not enough tax—is withheld. Payments due april 18, june 15, september 15, 2023, and january 16,. Web estimated tax penalties for partnerships and new york s corporations: