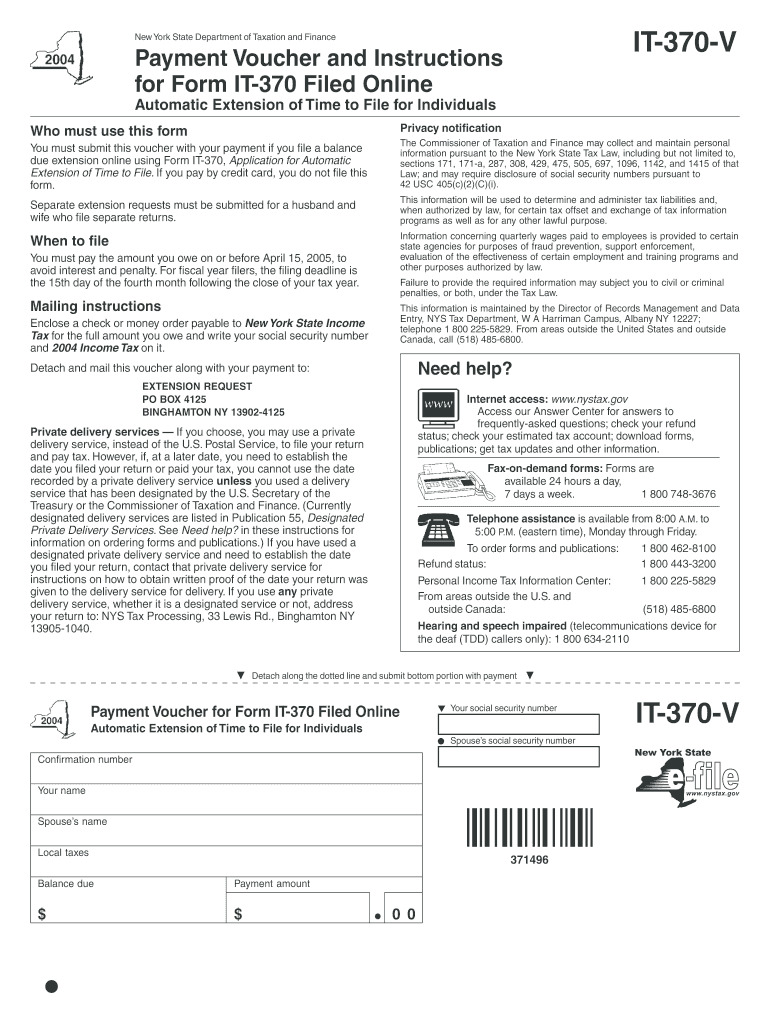

New York Form It-370

New York Form It-370 - Web ★ ★ ★ 4.8 satisfied 50 votes how to fill out and sign nys form it 370 online? Today, most americans prefer to do. Filers that do not pay taxes by may 17 may owe interest on both state and federal taxes. Web 19 rows partnership and llc/llp tax forms (current year) partnerships with partners. Get your online template and fill it in using progressive features. Follow the simple instructions below: Pdf free fillable forms for new york state Even if you filed an extension, you will still need to file your ny tax return either via efile or by. Complete, edit or print tax forms instantly. Detach and mail this voucher along with your payment to:

Follow the simple instructions below: Web ★ ★ ★ 4.8 satisfied 50 votes how to fill out and sign nys form it 370 online? Filers that do not pay taxes by may 17 may owe interest on both state and federal taxes. Web 19 rows partnership and llc/llp tax forms (current year) partnerships with partners. Even if you filed an extension, you will still need to file your ny tax return either via efile or by. Complete, edit or print tax forms instantly. Web application for automatic extension of time to file for partnerships and fiduciaries; Detach and mail this voucher along with your payment to: You must apply for an extension of time to file your return when you mail in your payment voucher;. Enjoy smart fillable fields and interactivity.

Web new york income tax forms new york printable income tax forms 272 pdfs tax day has passed, and refunds are being processed! Web pay all of your ny income taxes online at new york tax online service. Follow the simple instructions below: You must apply for an extension of time to file your return when you mail in your payment voucher;. Today, most americans prefer to do. Enjoy smart fillable fields and interactivity. Even if you filed an extension, you will still need to file your ny tax return either via efile or by. Get your online template and fill it in using progressive features. Detach and mail this voucher along with your payment to: We no longer accept a.

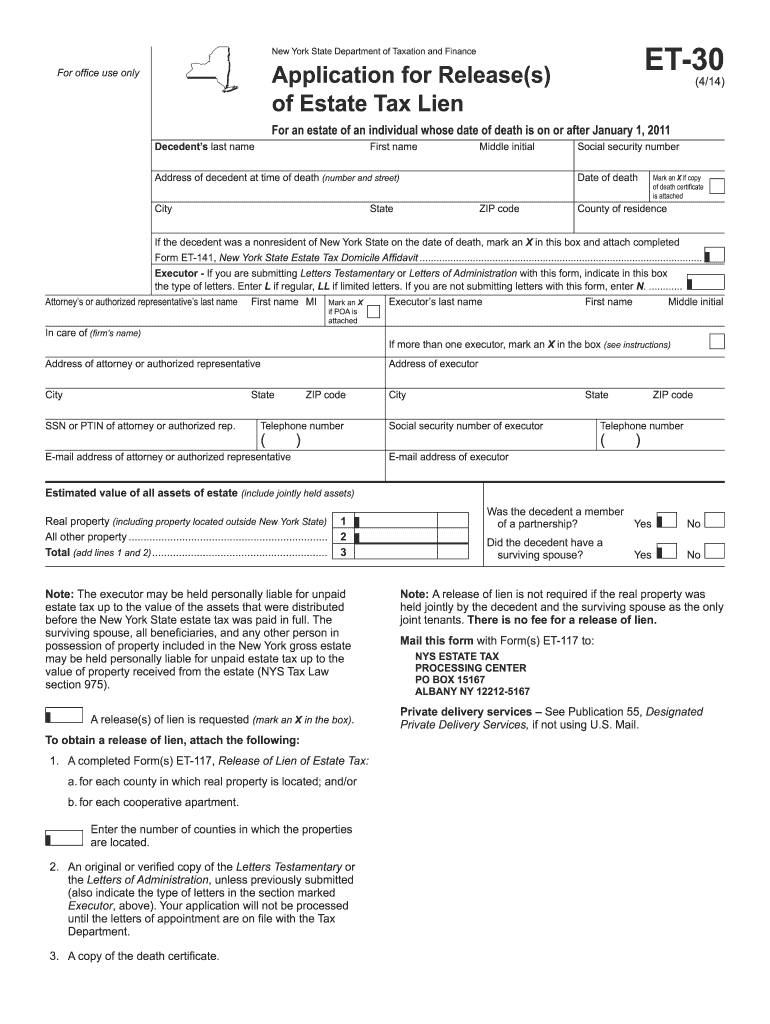

nys tax form et 30 Fill out & sign online DocHub

Web pay all of your ny income taxes online at new york tax online service. Pdf free fillable forms for new york state Detach and mail this voucher along with your payment to: Enjoy smart fillable fields and interactivity. Even if you filed an extension, you will still need to file your ny tax return either via efile or by.

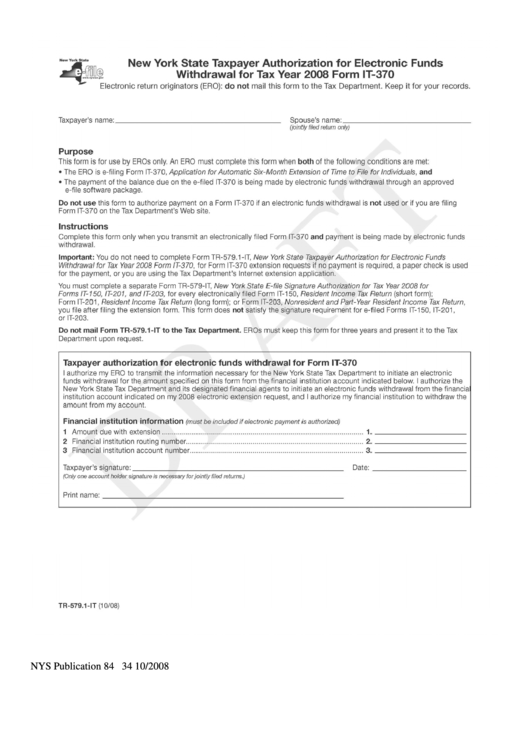

Form Tr579.1It New York State Taxpayer Authorization For Electronic

Get your online template and fill it in using progressive features. Complete, edit or print tax forms instantly. We no longer accept a. Web pay all of your ny income taxes online at new york tax online service. Enjoy smart fillable fields and interactivity.

20162021 Form NY DTF IT203F Fill Online, Printable, Fillable, Blank

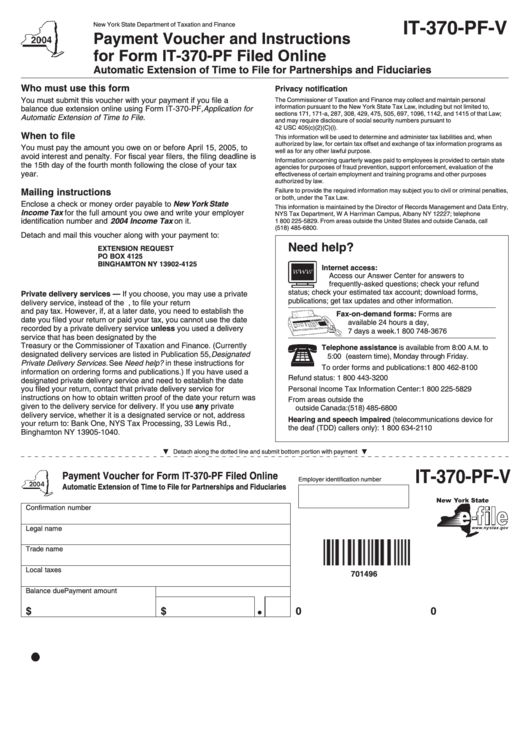

Enjoy smart fillable fields and interactivity. Web new york income tax forms new york printable income tax forms 272 pdfs tax day has passed, and refunds are being processed! Web mailing instructions enclose a check or money order payable to new york state income tax for the full amount you owe and write your social security number and 2004 income.

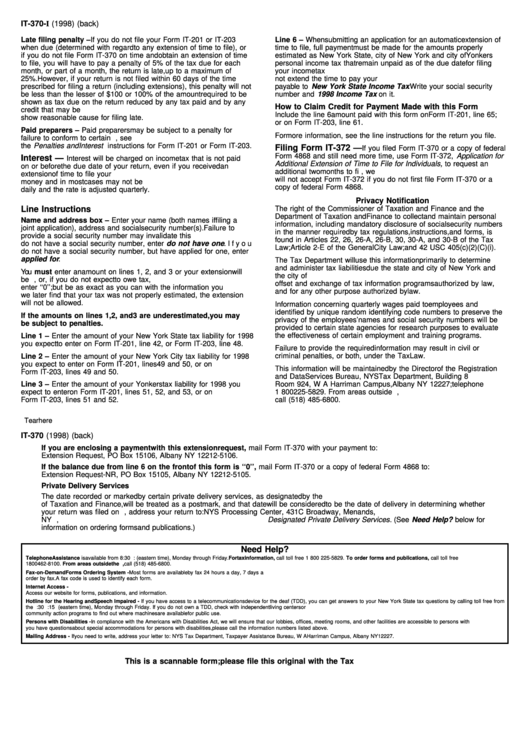

Instructions For Form It370 Application For Automatic SixMonth

We no longer accept a. Follow the simple instructions below: Detach and mail this voucher along with your payment to: Page last reviewed or updated: You must apply for an extension of time to file your return when you mail in your payment voucher;.

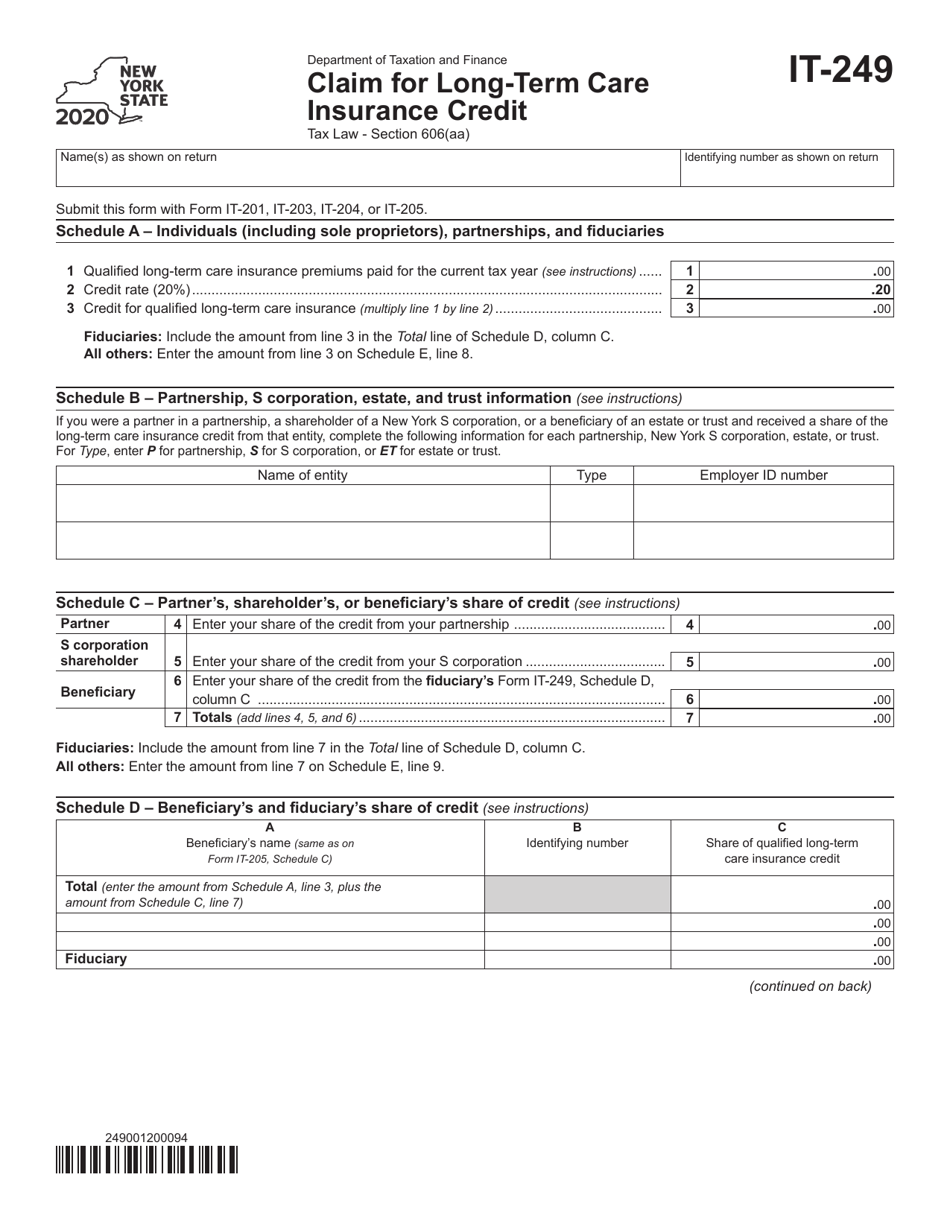

Form IT249 Download Fillable PDF or Fill Online Claim for LongTerm

Web mailing instructions enclose a check or money order payable to new york state income tax for the full amount you owe and write your social security number and 2004 income tax on it. Page last reviewed or updated: Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Even if you filed.

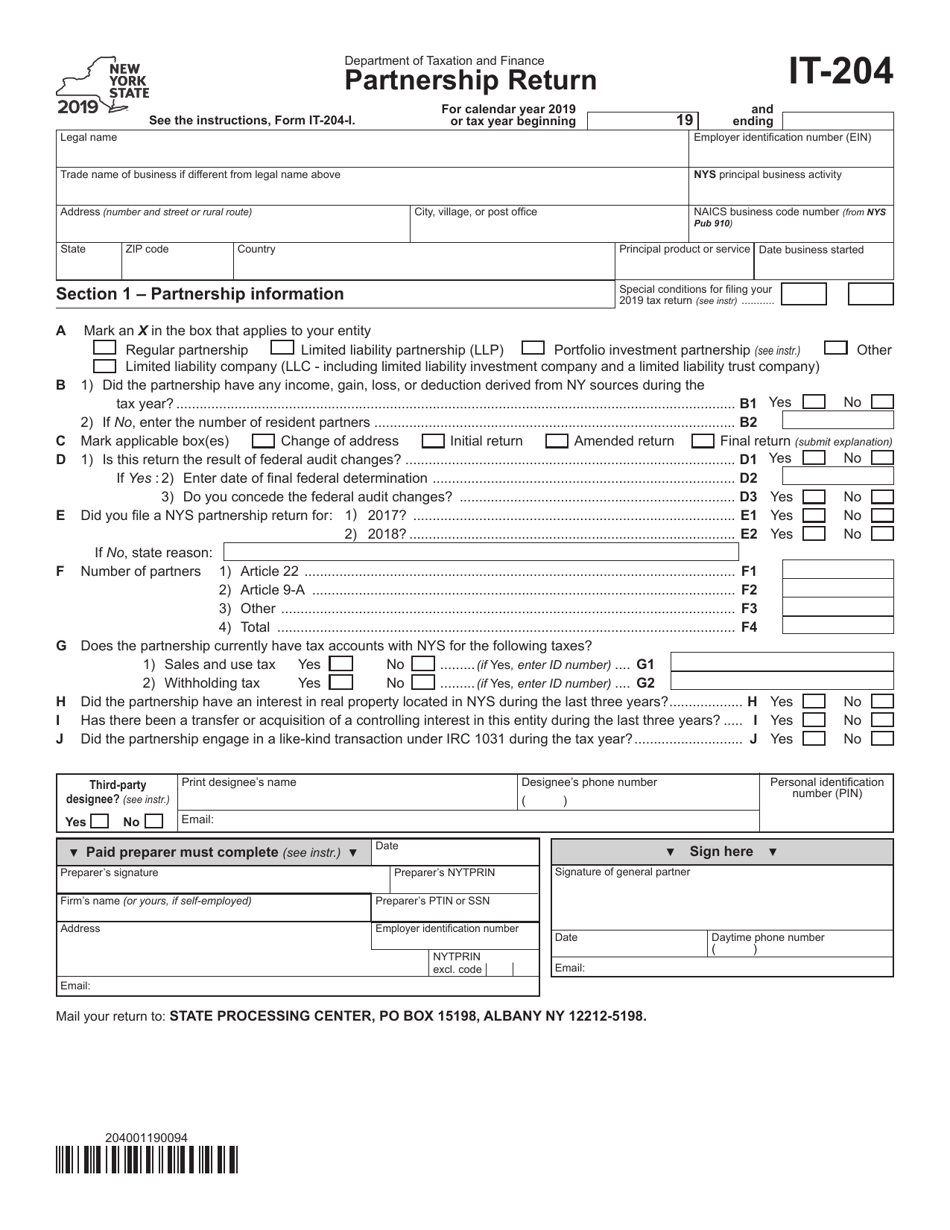

Form IT204 Download Fillable PDF or Fill Online Partnership Return

Complete, edit or print tax forms instantly. Web application for automatic extension of time to file for partnerships and fiduciaries; Web 19 rows partnership and llc/llp tax forms (current year) partnerships with partners. Pdf free fillable forms for new york state You must apply for an extension of time to file your return when you mail in your payment voucher;.

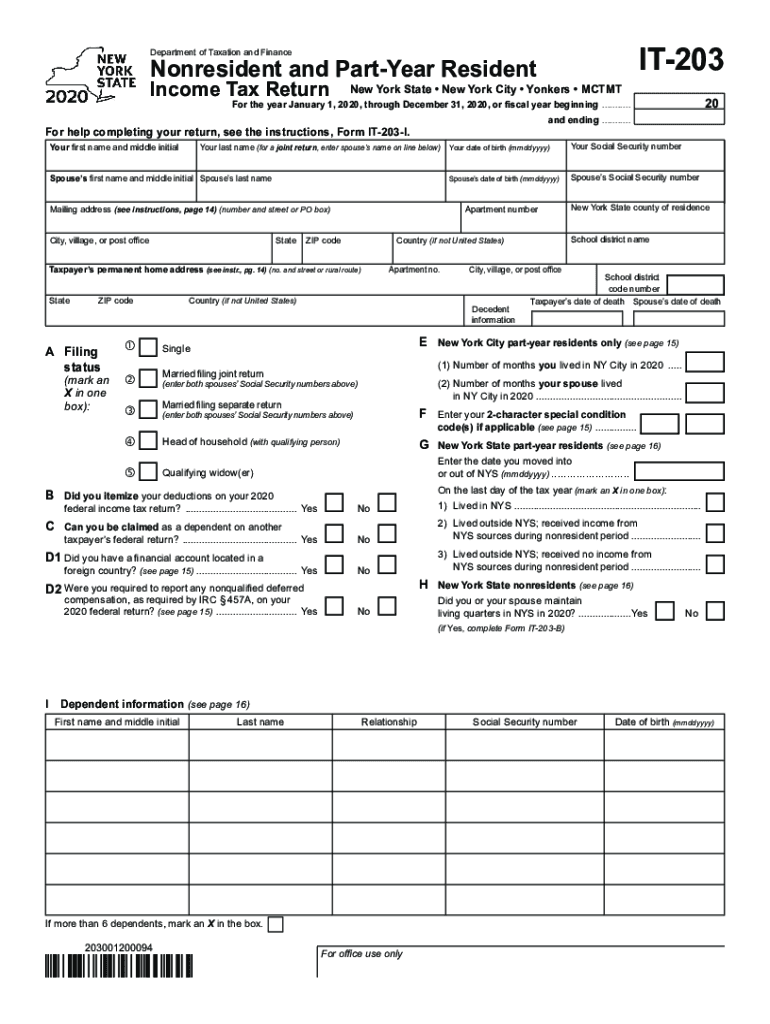

2020 Form NY IT203 Fill Online, Printable, Fillable, Blank pdfFiller

Web new york income tax forms new york printable income tax forms 272 pdfs tax day has passed, and refunds are being processed! Web mailing instructions enclose a check or money order payable to new york state income tax for the full amount you owe and write your social security number and 2004 income tax on it. Web pay all.

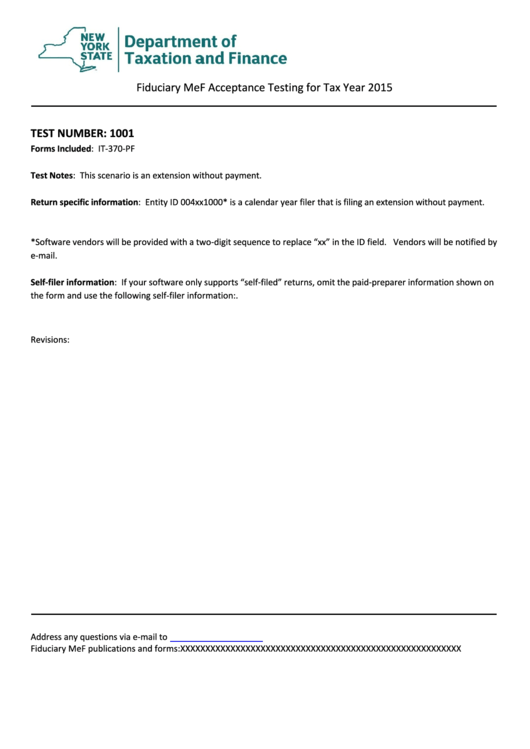

Form It370Pf Department Of Taxation And Finance Application For

Complete, edit or print tax forms instantly. We no longer accept a. Even if you filed an extension, you will still need to file your ny tax return either via efile or by. Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.

It370PfV New York State Department Of Taxation And Finance Payment

Web new york income tax forms new york printable income tax forms 272 pdfs tax day has passed, and refunds are being processed! Detach and mail this voucher along with your payment to: Get your online template and fill it in using progressive features. Today, most americans prefer to do. Web application for automatic extension of time to file for.

It 370 V Fill Online, Printable, Fillable, Blank pdfFiller

Get your online template and fill it in using progressive features. Follow the simple instructions below: Detach and mail this voucher along with your payment to: We no longer accept a. Even if you filed an extension, you will still need to file your ny tax return either via efile or by.

Web Pay All Of Your Ny Income Taxes Online At New York Tax Online Service.

Web new york income tax forms new york printable income tax forms 272 pdfs tax day has passed, and refunds are being processed! Page last reviewed or updated: Detach and mail this voucher along with your payment to: Web application for automatic extension of time to file for partnerships and fiduciaries;

Pdf Free Fillable Forms For New York State

Filers that do not pay taxes by may 17 may owe interest on both state and federal taxes. Web 19 rows partnership and llc/llp tax forms (current year) partnerships with partners. We no longer accept a. Web ★ ★ ★ 4.8 satisfied 50 votes how to fill out and sign nys form it 370 online?

Follow The Simple Instructions Below:

Web mailing instructions enclose a check or money order payable to new york state income tax for the full amount you owe and write your social security number and 2004 income tax on it. Even if you filed an extension, you will still need to file your ny tax return either via efile or by. Complete, edit or print tax forms instantly. Get your online template and fill it in using progressive features.

You Must Apply For An Extension Of Time To File Your Return When You Mail In Your Payment Voucher;.

Today, most americans prefer to do. Enjoy smart fillable fields and interactivity. We no longer accept a.