Nebraska Tax Form

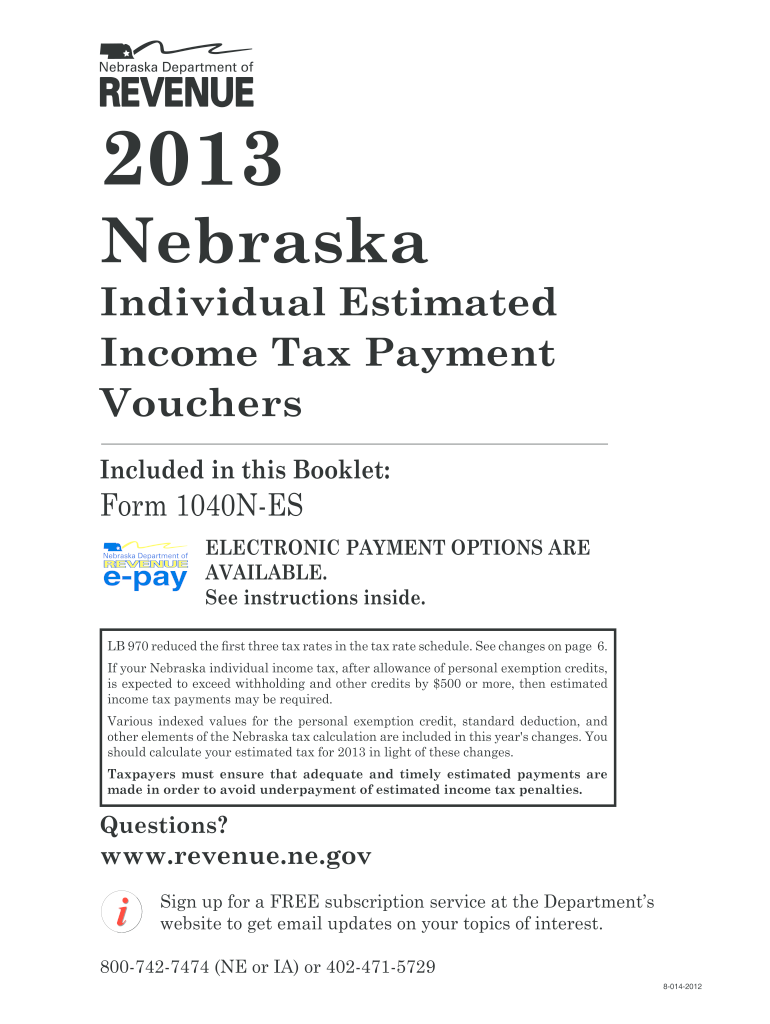

Nebraska Tax Form - Web nebraska usually releases forms for the current tax year between january and april. 2022 nebraska tax table, including local sales an use tax codes and rates (12/2022) tax tables. Property assessment forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. 2022 form 1040n, schedules i, ii, and iii. 2020 please do not write in this space. File online by purchasing software from a retailer, or with an authorized tax return preparer. 2022 nebraska public high school district codes. These are the official pdf files published by the nebraska department of revenue, we do not alter them in any way. 2022 form 1040n, nebraska individual income tax return. All other premiums tax (multiply line 11 by line 12) gross direct premiums received on nebraska business net premium tax (line 7 plus line 13 and line 19) tax (multiply line 17 by line 18) tax rate applicable net taxable premiums (line 14.

This form is read only, meaning you cannot print or file it. 2022 form 1040n, schedules i, ii, and iii. 2022 nebraska public high school district codes. Web printable nebraska tax forms for 2022 are available for download below on this page. 2022 public high school district codes (12/2022) school. Nebraska sales and use tax statement for motorboat sales note: 2022 individual income tax booklet, with forms, tables, instructions, and additional information. 2020 please do not write in this space. The pdf file format allows you to safely print, fill in, and mail in your 2022 nebraska tax forms. Show sources > about the sales tax

2022 nebraska public high school district codes. 2022 form 1040n, nebraska individual income tax return. This form is read only, meaning you cannot print or file it. Filing deadline for the 2022 nebraska income tax return and the 2023 nebraska first quarter estimated payment is april 18, 2023 for most taxpayers. Under nebraska law, the nebraska income tax return (and estimated payment date) is due the same day as the federal income tax return. 2022 form 1040n, schedules i, ii, and iii. These are the official pdf files published by the nebraska department of revenue, we do not alter them in any way. Amended nebraska sales and use tax statement for. Web nebraska usually releases forms for the current tax year between january and april. 2020 please do not write in this space.

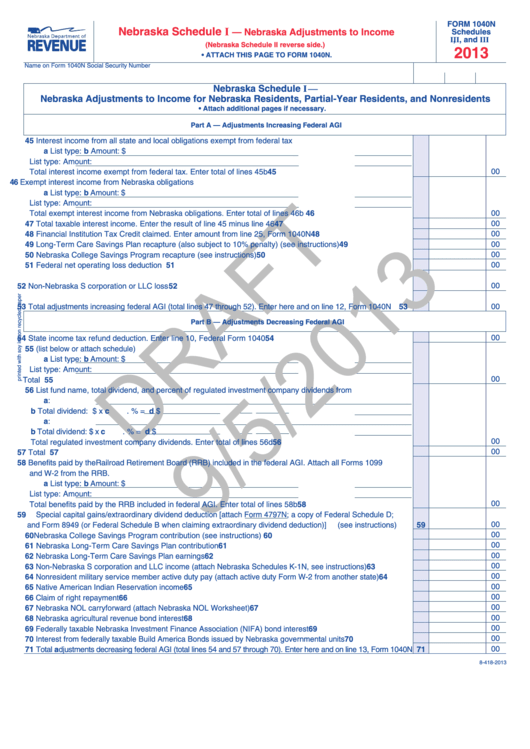

Form 1040n Draft Nebraska Schedule I Nebraska Adjustments To

Show sources > about the sales tax 2022 nebraska public high school district codes. File online by purchasing software from a retailer, or with an authorized tax return preparer. 2022 form 1040n, nebraska individual income tax return. Web it is the fast, secure, and easy way to file!

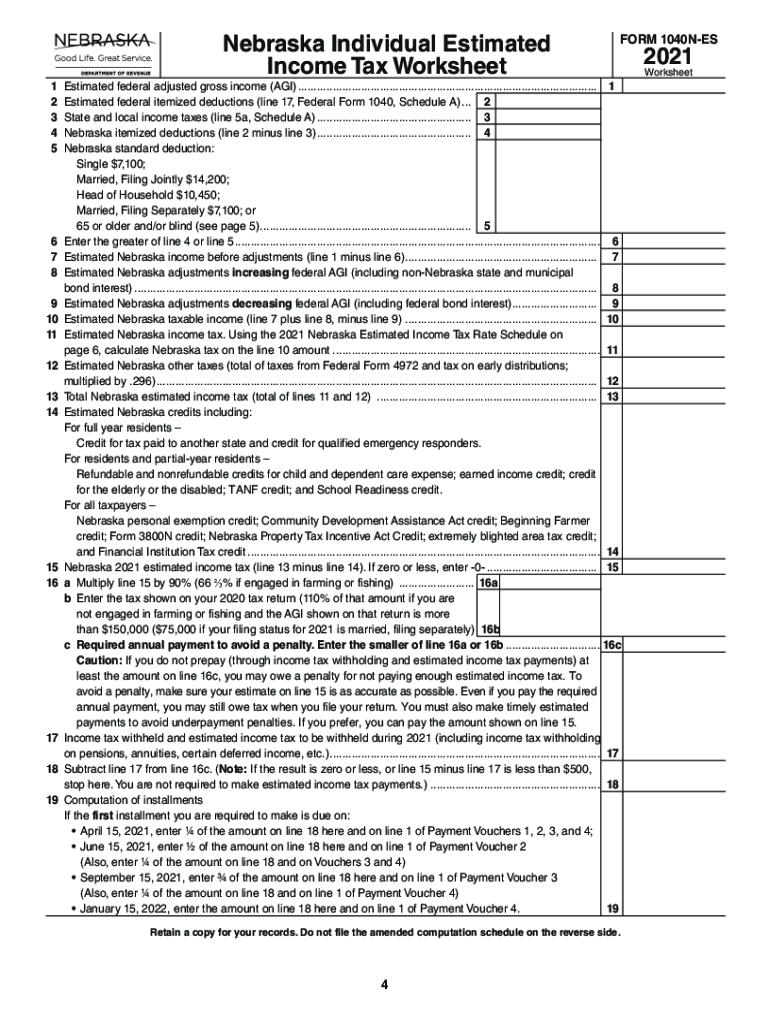

2021 Nebraska Tax Fill Out and Sign Printable PDF Template signNow

Amended nebraska sales and use tax statement for. 2022 individual income tax booklet, with forms, tables, instructions, and additional information. We last updated nebraska form 13 from the department of revenue in january 2023. This form is read only, meaning you cannot print or file it. Web it is the fast, secure, and easy way to file!

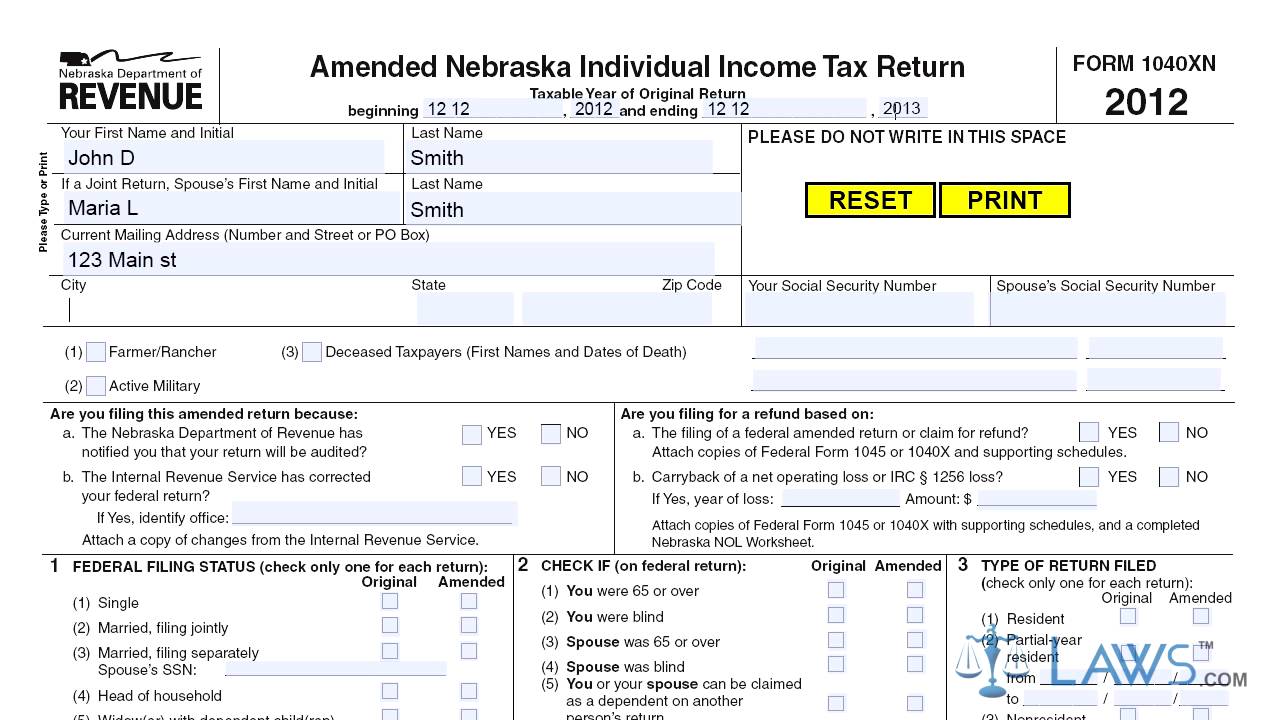

Form 1040XN Amended Nebraska Individual Tax Return YouTube

Web it is the fast, secure, and easy way to file! Amended nebraska sales and use tax statement for. This form is read only, meaning you cannot print or file it. 2022 form 1040n, nebraska individual income tax return. Property assessment forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads.

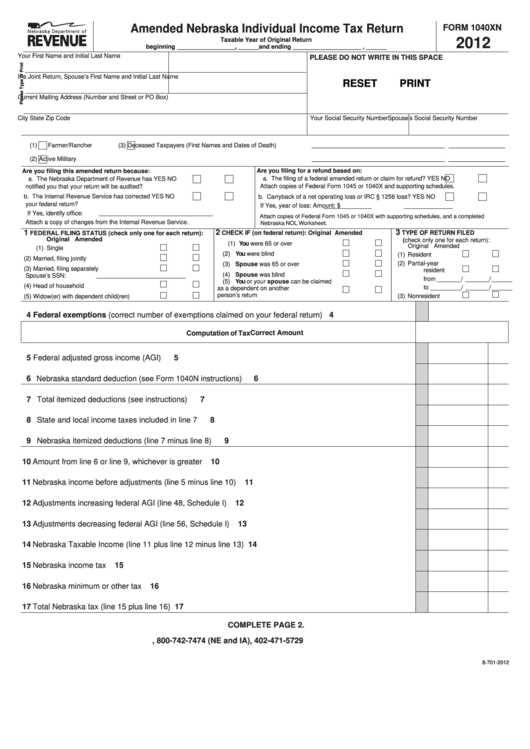

Fillable Form 1040xn Amended Nebraska Individual Tax Return

Web printable nebraska tax forms for 2022 are available for download below on this page. These are the official pdf files published by the nebraska department of revenue, we do not alter them in any way. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2020 through december 31, 2020 or other taxable year: 2022.

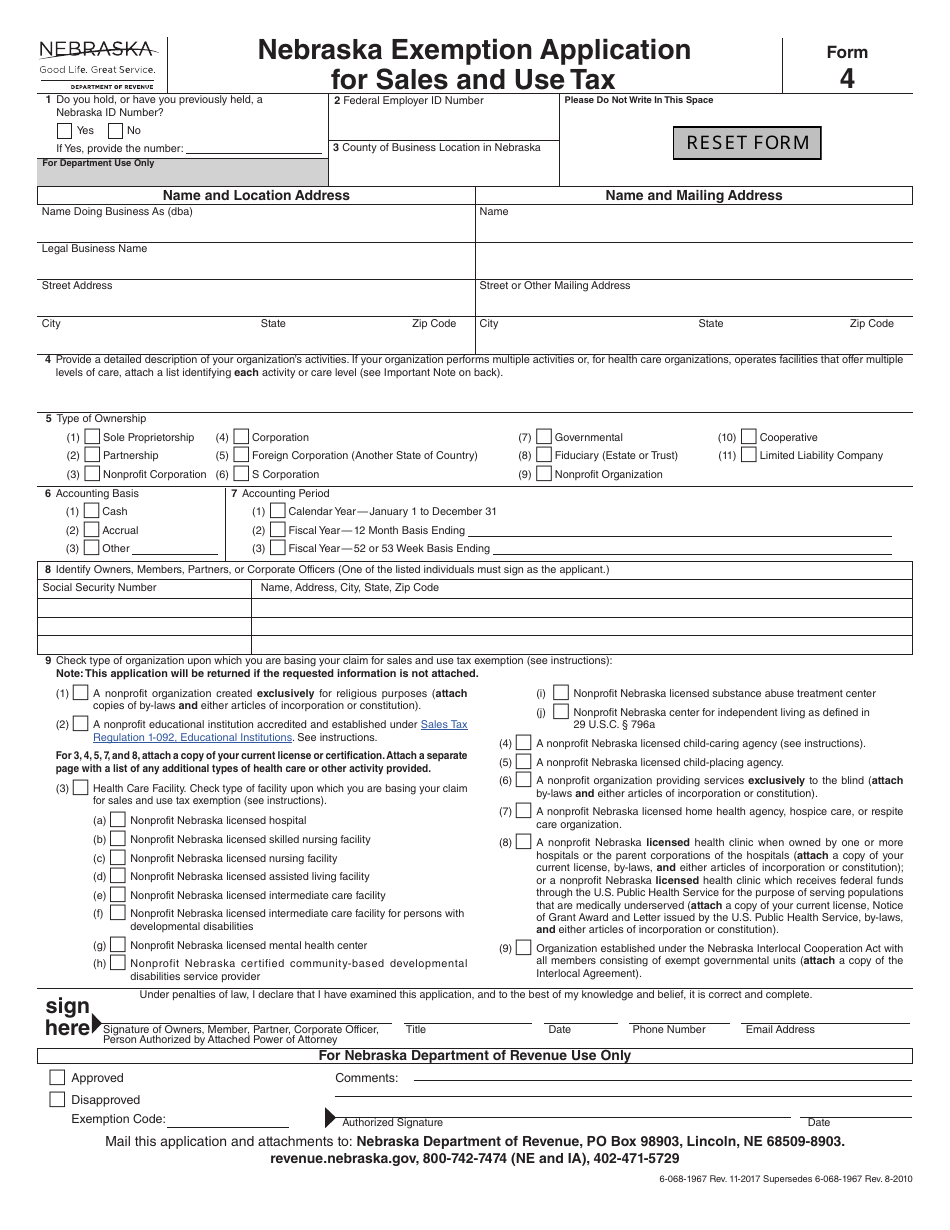

Form 4 Download Fillable PDF or Fill Online Nebraska Exemption

2022 form 1040n, nebraska individual income tax return. Web forms specific to the current tax year. Show sources > about the sales tax Web it is the fast, secure, and easy way to file! These are the official pdf files published by the nebraska department of revenue, we do not alter them in any way.

Form 1040N Nebraska Individual Tax Return YouTube

Our social security numbery spouse’s social security number. 2022 form 1040n, schedules i, ii, and iii. Filing deadline for the 2022 nebraska income tax return and the 2023 nebraska first quarter estimated payment is april 18, 2023 for most taxpayers. 2022 form 1040n, nebraska individual income tax return. Web nebraska usually releases forms for the current tax year between january.

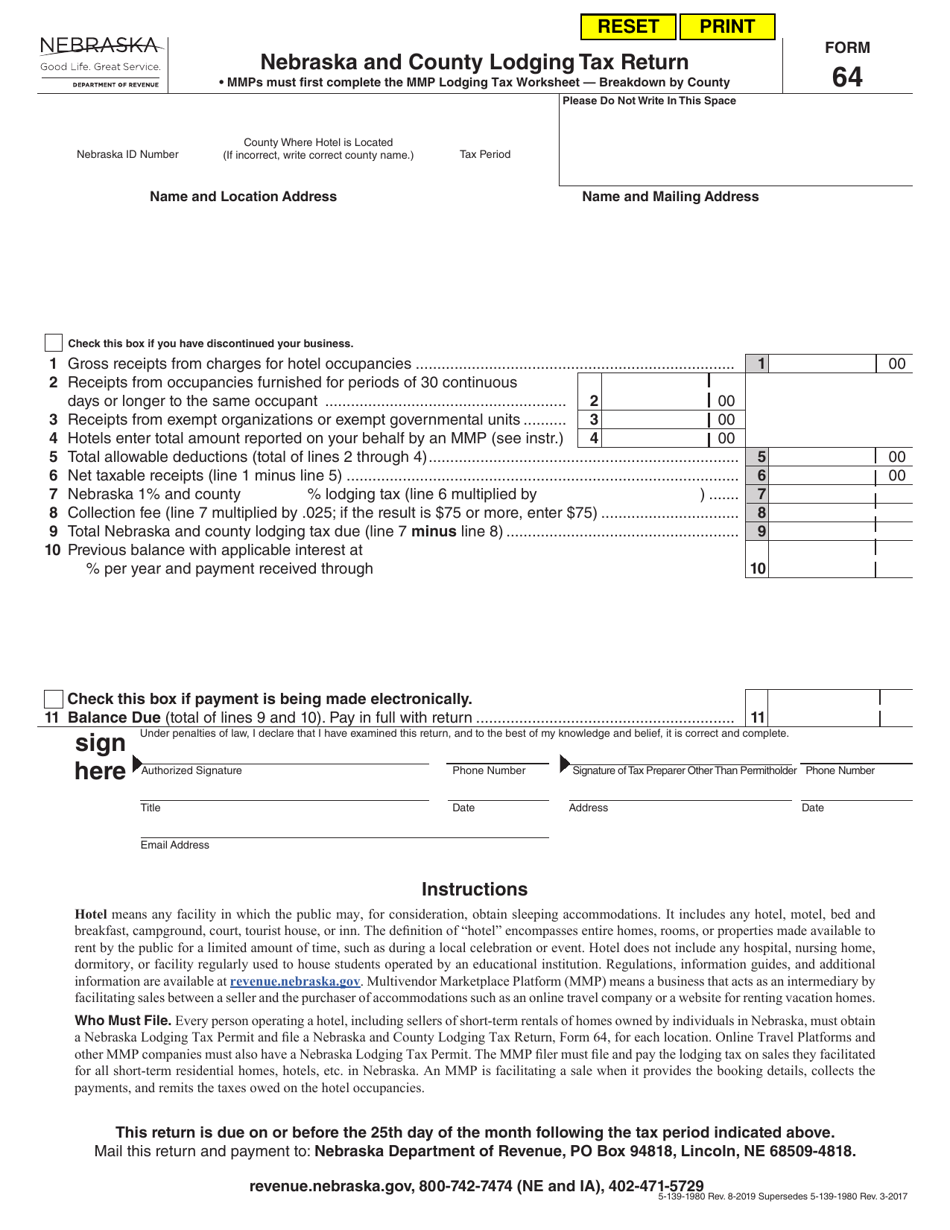

Form 64 Download Fillable PDF or Fill Online Nebraska and County

Filing deadline for the 2022 nebraska income tax return and the 2023 nebraska first quarter estimated payment is april 18, 2023 for most taxpayers. We last updated nebraska form 13 from the department of revenue in january 2023. This form is read only, meaning you cannot print or file it. Property assessment forms for county officials, homestead exemption, car lines,.

Nebraska Tax Form Fillable Fill Out and Sign Printable PDF Template

We last updated nebraska form 13 from the department of revenue in january 2023. Property assessment forms for county officials, homestead exemption, car lines, air carriers, public service entities, and railroads. The pdf file format allows you to safely print, fill in, and mail in your 2022 nebraska tax forms. This form is read only, meaning you cannot print or.

Top 26 Nebraska Sales Tax Form Templates free to download in PDF format

The pdf file format allows you to safely print, fill in, and mail in your 2022 nebraska tax forms. Web it is the fast, secure, and easy way to file! Under nebraska law, the nebraska income tax return (and estimated payment date) is due the same day as the federal income tax return. Web printable nebraska tax forms for 2022.

revenue.ne.gov tax current f_1041n

2022 individual income tax booklet, with forms, tables, instructions, and additional information. 2022 form 1040n, nebraska individual income tax return. Under nebraska law, the nebraska income tax return (and estimated payment date) is due the same day as the federal income tax return. Our social security numbery spouse’s social security number. Web forms specific to the current tax year.

Web Printable Nebraska Tax Forms For 2022 Are Available For Download Below On This Page.

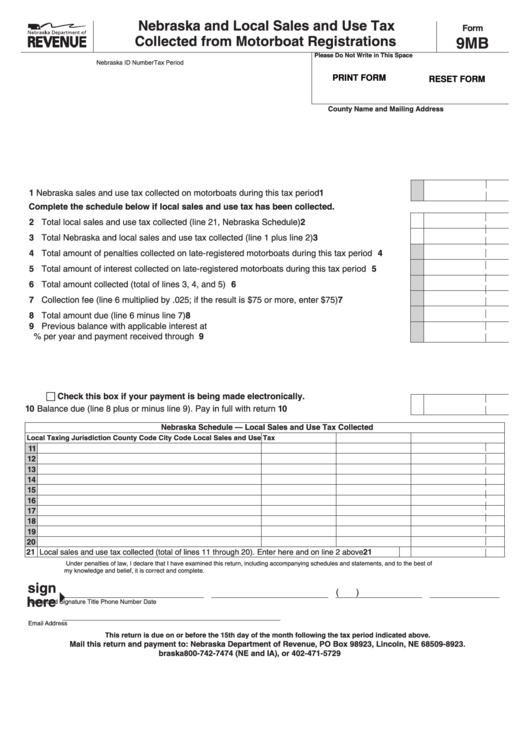

Nebraska sales and use tax statement for motorboat sales note: All other premiums tax (multiply line 11 by line 12) gross direct premiums received on nebraska business net premium tax (line 7 plus line 13 and line 19) tax (multiply line 17 by line 18) tax rate applicable net taxable premiums (line 14. 2022 form 1040n, nebraska individual income tax return. Web nebraska individual income tax return form 1040n for the taxable year january 1, 2020 through december 31, 2020 or other taxable year:

2022 Nebraska Public High School District Codes.

Under nebraska law, the nebraska income tax return (and estimated payment date) is due the same day as the federal income tax return. Web it is the fast, secure, and easy way to file! Web nebraska usually releases forms for the current tax year between january and april. 2022 nebraska tax table, including local sales an use tax codes and rates (12/2022) tax tables.

2022 Public High School District Codes (12/2022) School.

The pdf file format allows you to safely print, fill in, and mail in your 2022 nebraska tax forms. These are the official pdf files published by the nebraska department of revenue, we do not alter them in any way. 2020 please do not write in this space. Show sources > about the sales tax

Property Assessment Forms For County Officials, Homestead Exemption, Car Lines, Air Carriers, Public Service Entities, And Railroads.

File online by purchasing software from a retailer, or with an authorized tax return preparer. Web forms specific to the current tax year. 2022 form 1040n, schedules i, ii, and iii. 2022 individual income tax booklet, with forms, tables, instructions, and additional information.