Nebraska Property Tax Credit Form

Nebraska Property Tax Credit Form - The nebraska property tax incentive act provides that, for taxable years beginning on or after jan. 1, 2020, taxpayers that pay. Previously, because the income from the. Web step 1 go to: To claim the credits a. Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. Web which nebraska property tax credit, form ptc should i file? Web 2021 form ptc, nebraska property tax incentive act credit. Taxpayers claiming the credit should complete part b.

Web step 1 go to: Nebraska property tax incentive act credit (line 3 multiplied by.06) enter. 1, 2020, taxpayers that pay. For tax year 2021, the credit equals 25.3 percent of property taxes paid to schools and applies to taxes paid. Web lb 1107 created the nebraska property tax incentive act that provides for a refundable income tax credit beginning in tax year 2020. 2022 nebraska property tax credit state sen. Web form ptc, property tax incentive act credit, is available on turbotax. Web nebraska property tax credit form ptc for 2022 i am trying to efile my nebraska state income tax return and am taking a property tax credit on the ptc. This credit is available to. Web income tax credit on the amount of property taxes paid to schools.

Web form ptc, property tax incentive act credit, is available on turbotax. For tax year 2021, the credit equals 25.3 percent of property taxes paid to schools and applies to taxes paid. This credit is available to. For taxable years beginning on or after january 1, 2020, a property tax incentive act credit. Web lb 1107 created the nebraska property tax incentive act that provides for a refundable income tax credit beginning in tax year 2020. 2022 social security number or nebraska id number. 1, 2020, taxpayers that pay. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. Web the nebraska property tax incentive act provides refundable credits to any taxpayer who paid school district and community college property taxes. To claim the credits a.

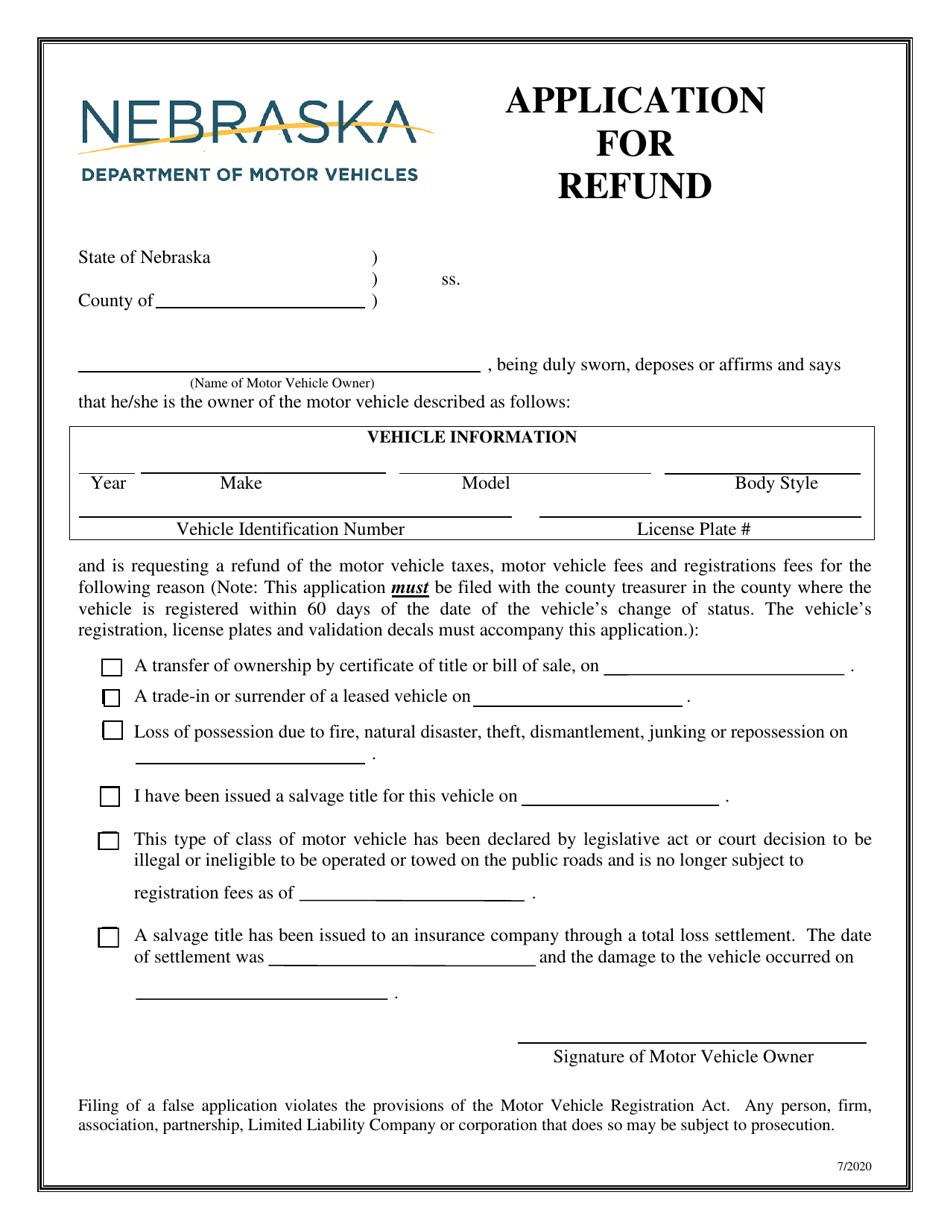

Nebraska Application for Refund Download Fillable PDF Templateroller

Web the nebraska property tax incentive act provides refundable credits to any taxpayer who paid school district and community college property taxes. Work with federal tax credits and incentives specialists who have decades of experience. 1, 2020, taxpayers that pay. You must file the form ptc for the same tax year as the income tax return on which the credit.

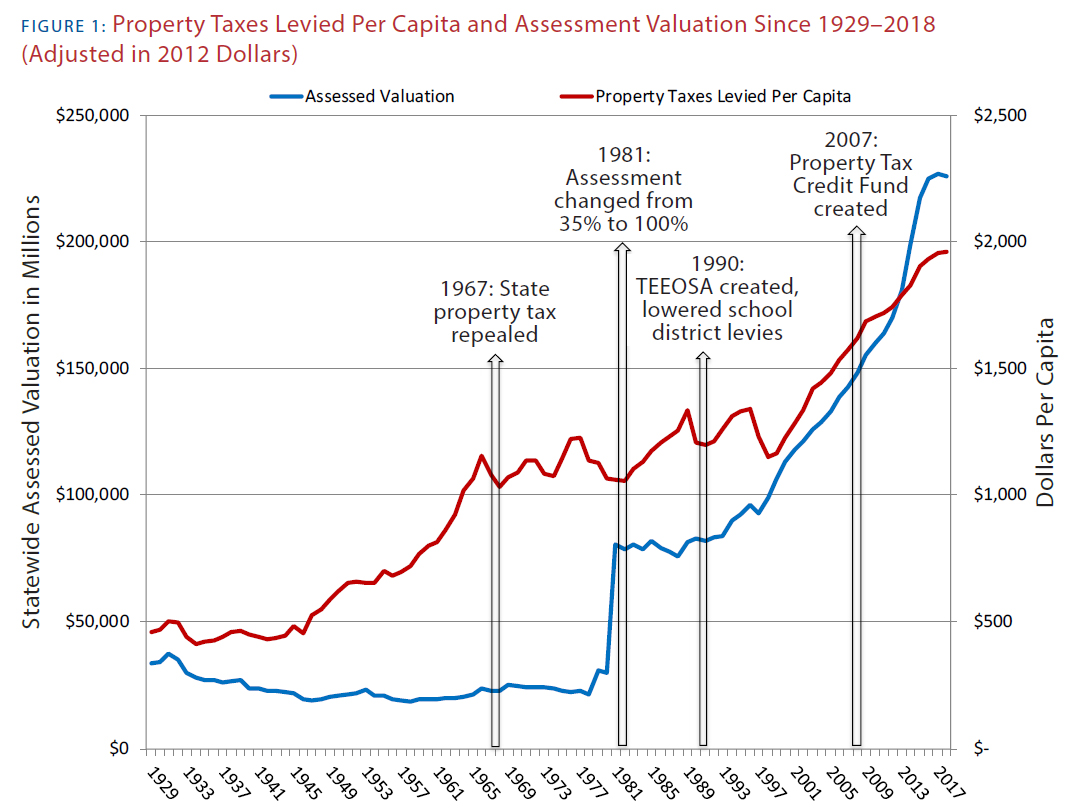

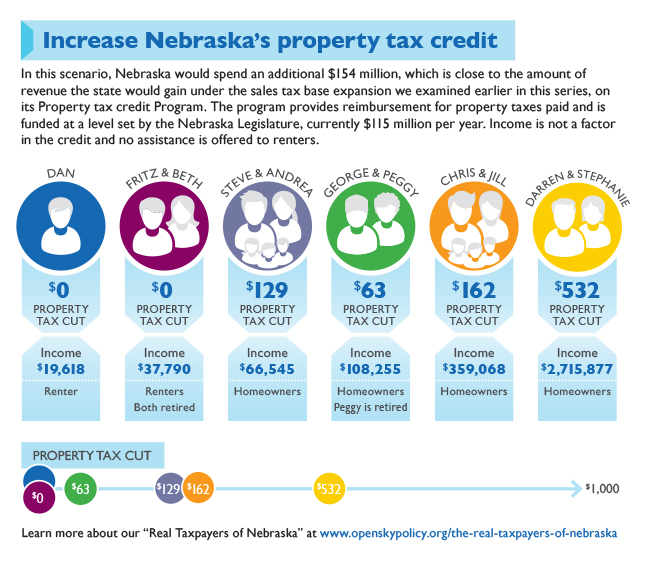

Get Real About Property Taxes, 2nd Edition

Web form ptc, property tax incentive act credit, is available on turbotax. Web to claim the credit, nebraskans need to include form ptc 2022 when they file their income taxes, which can be found on the nebraska department of revenue website. Web the nebraska dept. Nebraska property tax incentive act credit (line 3 multiplied by.06) enter. How to complete the.

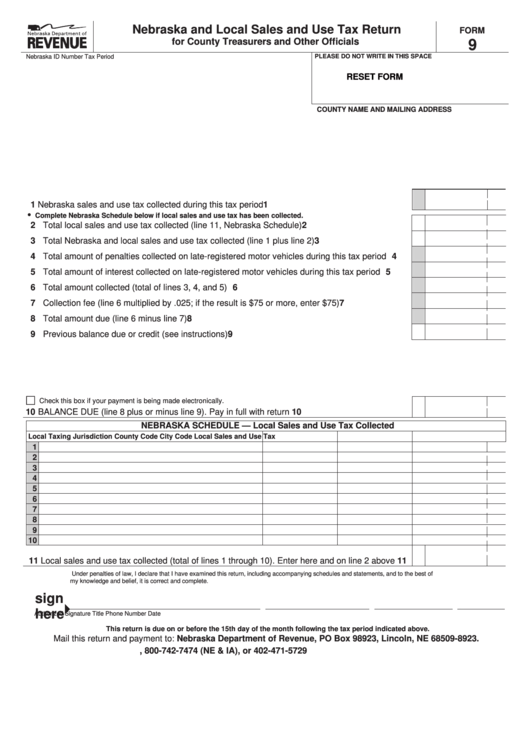

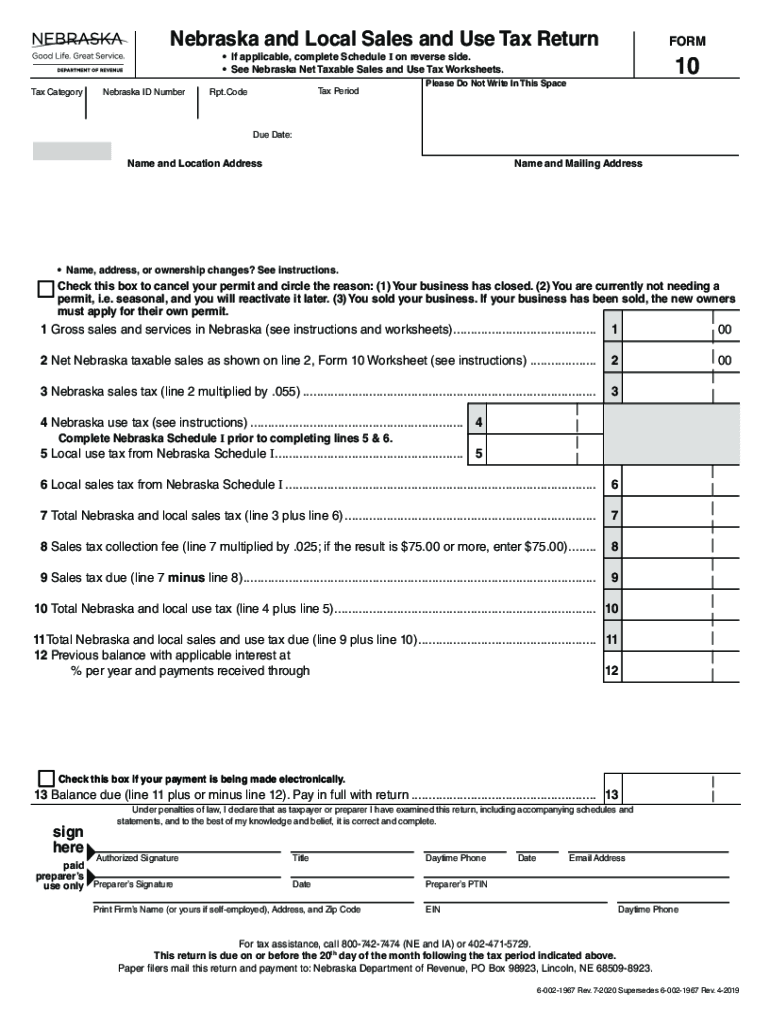

Fillable Form 9 Nebraska And Local Sales And Use Tax Return For

Web income tax credit on the amount of property taxes paid to schools. Of revenue has a property tax credit lookup tool on its website as well as a number of tips and an instructional video as well. Web 2021 form ptc, nebraska property tax incentive act credit. 1, 2020, taxpayers that pay. Web nebraska property tax incentive act credit.

Nebraska’s Sales Tax

Previously, because the income from the. Web use this form with the forms noted below to claim the property tax credit. For tax year 2021, the credit equals 25.3 percent of property taxes paid to schools and applies to taxes paid. Web the nebraska dept. 2022 social security number or nebraska id number.

KRVN 880 KRVN 93.1 KAMI Nebraska Personal Property Return and

Web income tax credit on the amount of property taxes paid to schools. Web form ptc nebraska property tax credit use this form with the forms noted below to claim the property tax credits. Web step 1 go to: Taxpayers claiming the credit should complete part b. The nebraska property tax incentive act provides that, for taxable years beginning on.

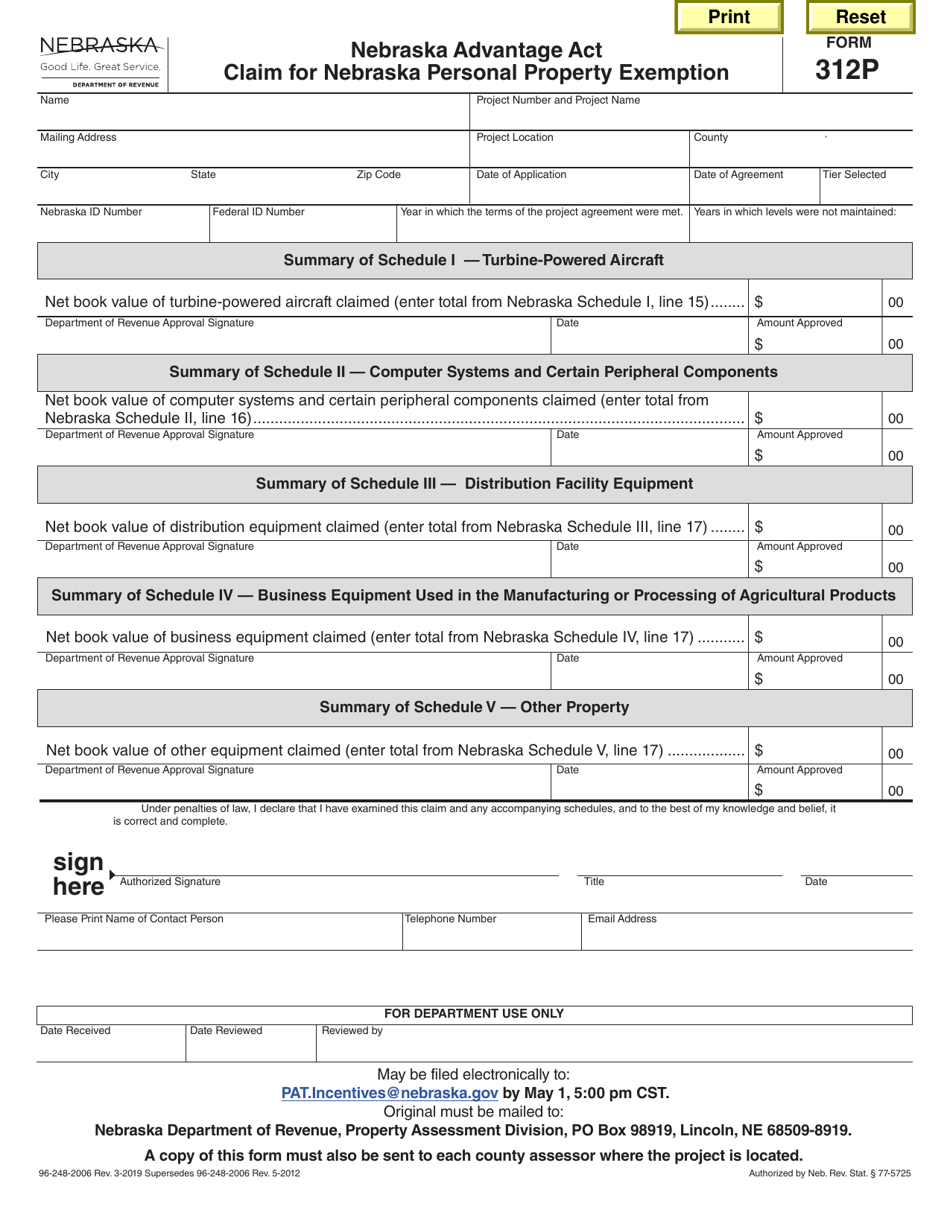

Form 312P Download Fillable PDF or Fill Online Nebraska Advantage Act

The nebraska property tax credit, form ptc, is used to identify parcels and compute a tax credit for nebraska school district and community college property taxes. Web step 1 go to: You must file the form ptc for the same tax year as the income tax return on which the credit is claimed. Web 2021 form ptc, nebraska property tax.

“Real Taxpayers of Nebraska” and increasing the property tax credit

Web the nebraska property tax incentive act provides refundable credits to any taxpayer who paid school district and community college property taxes. Web form ptc, property tax incentive act credit, is available on turbotax. Web lb 1107 created the nebraska property tax incentive act that provides for a refundable income tax credit beginning in tax year 2020. Web nebraska property.

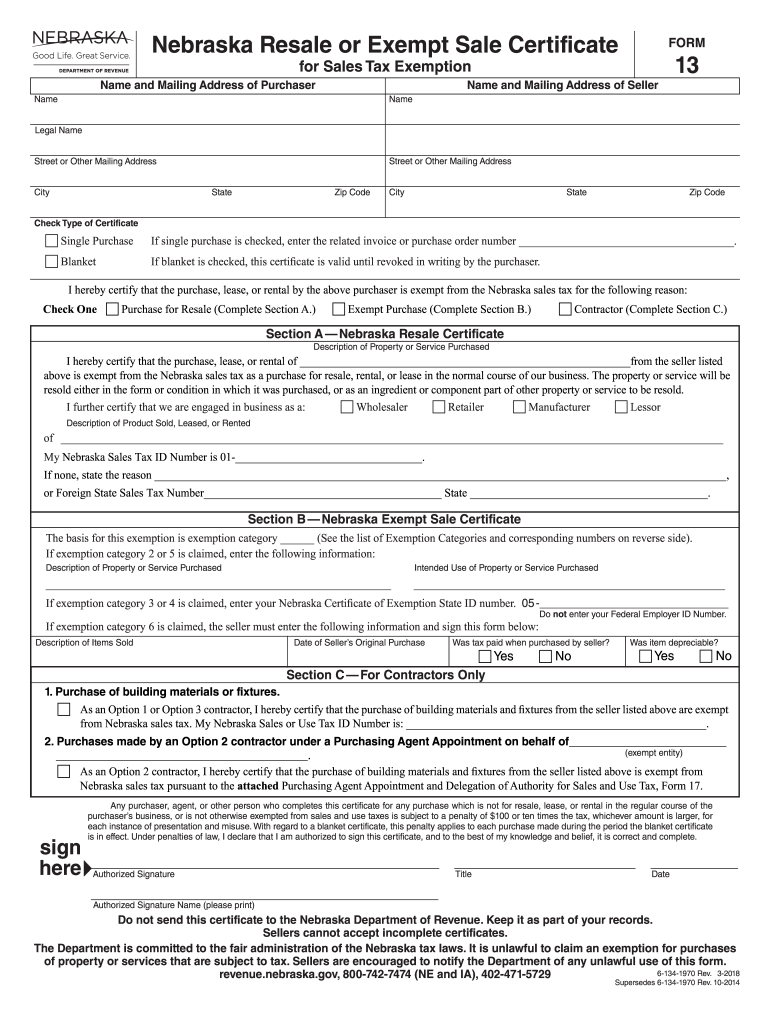

Nebraska Form 13 Fill Out and Sign Printable PDF Template signNow

Web 2021 form ptc, nebraska property tax incentive act credit. Web form ptc nebraska property tax credit use this form with the forms noted below to claim the property tax credits. Nebraska property tax incentive act credit (line 3 multiplied by.06) enter. 2022 social security number or nebraska id number. The nebraska property tax credit, form ptc, is used to.

Nebraska Form 6 20202022 Fill and Sign Printable Template Online

1, 2020, taxpayers that pay. Work with federal tax credits and incentives specialists who have decades of experience. Web property tax credit and reform. Web the nebraska property tax incentive act credit computation, form ptc, must be submitted to indicate the shareholder’s share of distributed nebraska school district. Web lb 1107 created the nebraska property tax incentive act that provides.

Form 10 Nebraska Fill Out and Sign Printable PDF Template signNow

2022 social security number or nebraska id number. Taxpayers claiming the credit should complete part b. 18, 2021 at 3:23 pm pst lincoln, neb. 2022 nebraska property tax credit state sen. Web use this form with the forms noted below to claim the property tax credit.

Web Form Ptc, Property Tax Incentive Act Credit, Is Available On Turbotax.

Of revenue has a property tax credit lookup tool on its website as well as a number of tips and an instructional video as well. Web the nebraska property tax incentive act provides refundable credits to any taxpayer who paid school district and community college property taxes. The nebraska property tax incentive act provides that, for taxable years beginning on or after jan. 2022 social security number or nebraska id number.

The Nebraska Property Tax Credit, Form Ptc, Is Used To Identify Parcels And Compute A Tax Credit For Nebraska School District And Community College Property Taxes.

Web the nebraska dept. 2022 nebraska property tax credit state sen. 1, 2020, taxpayers that pay. Web nebraska property tax credit form ptc for 2022 i am trying to efile my nebraska state income tax return and am taking a property tax credit on the ptc.

Web Nebraska Property Tax Incentive Act Credit (Line 1 Plus Line 2) Enter Here And On Line 36, Form 1040N;

Web the nebraska property tax incentive act credit computation, form ptc, is used to identify parcels and compute a tax credit for school district property tax paid. Web property tax credit and reform. This credit is available to. Nebraska property tax incentive act credit (line 3 multiplied by.06) enter.

You Must File The Form Ptc For The Same Tax Year As The Income Tax Return On Which The Credit Is Claimed.

Web 2021 form ptc, nebraska property tax incentive act credit. Taxpayers claiming the credit should complete part b. To claim the credits a. 18, 2021 at 3:23 pm pst lincoln, neb.