Montana Withholding Form

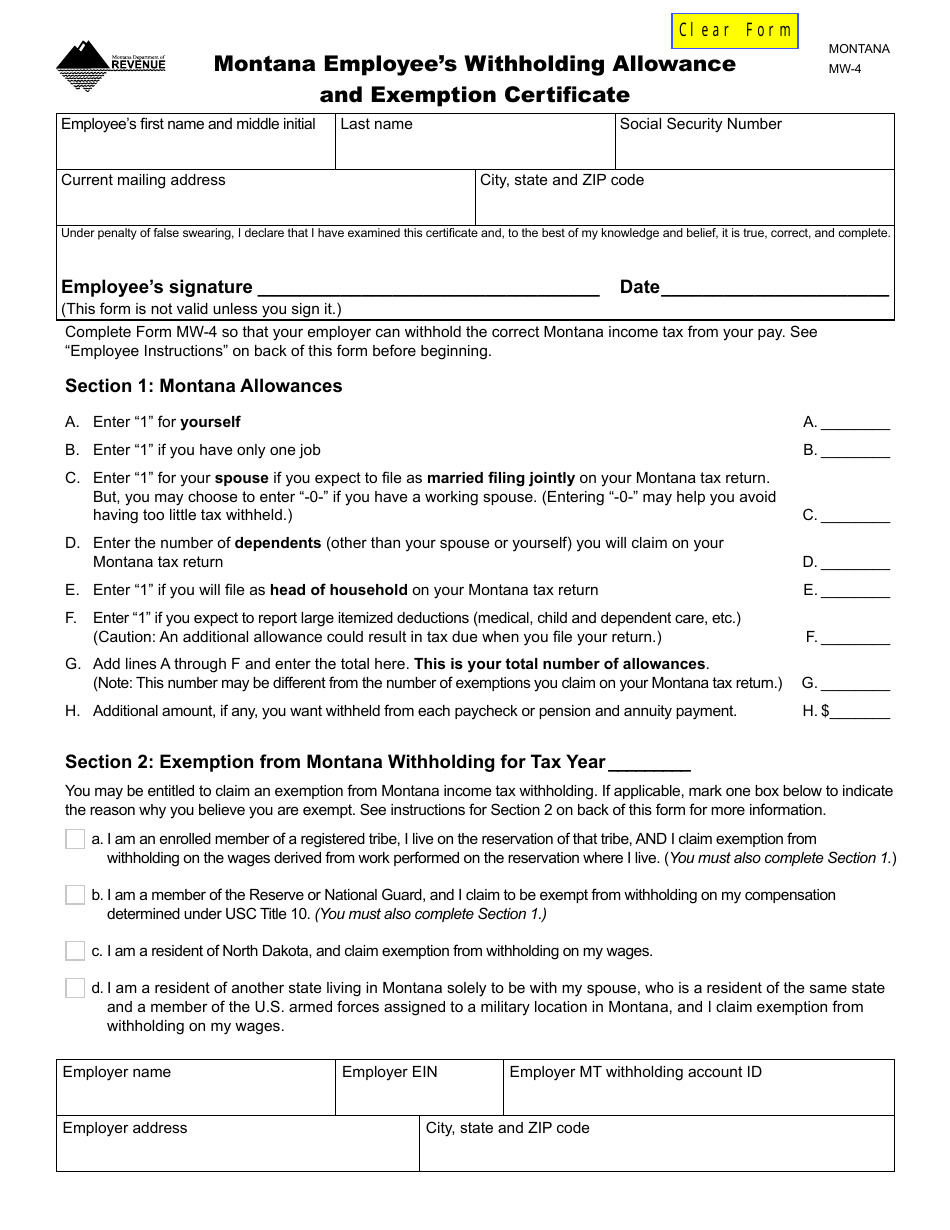

Montana Withholding Form - (1) for purposes of determining the employee's withholding allowances and withholding. Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income. Web irs withholding certificate for periodic pension or annuity payments: Web the transaction portal (tap) is a free service for individuals, businesses, and tax professionals to access and manage accounts with the montana department of. For information about montana state tax withholding, contact the montana. Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. See employee instructions on back of this form before beginning. The treasure state has a progressive income tax system. You can pay your withholding tax liability with your paper voucher or by using. Forms 1099 with no withholding;

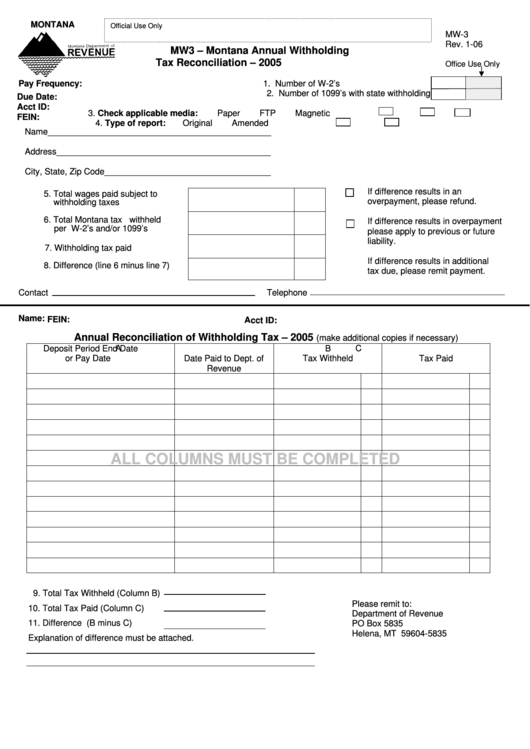

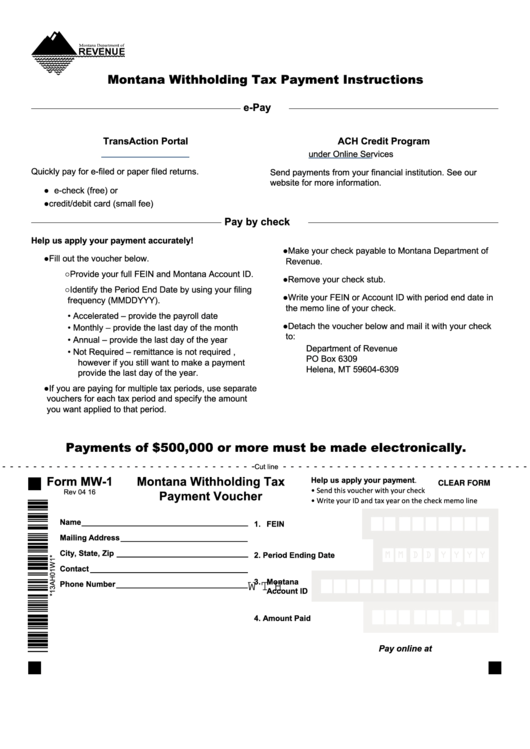

Web irs withholding certificate for periodic pension or annuity payments: Use the montana paycheck calculators to see the taxes. Web (a) other income (not from jobs). You can pay your withholding tax liability with your paper voucher or by using. Web you may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole proprietorship asset. Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. Web mineral royalty withholding tax; You may use this form to make montana withholding tax payments. Web december 30, 2021. See “employee instructions” on back of this form before beginning.

Web the transaction portal (tap) is a free service for individuals, businesses, and tax professionals to access and manage accounts with the montana department of. Transaction portal (tap) services and aidsthe transaction portal (tap) is a free service for individuals, businesses, and. You can pay your withholding tax liability with your paper voucher or by using. Web (a) other income (not from jobs). Web mineral royalty withholding tax; Use the montana paycheck calculators to see the taxes. Web latest version of the adopted rule presented in administrative rules of montana (arm): You may use this form to make montana withholding tax payments. See employee instructions on back of this form before beginning. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here.

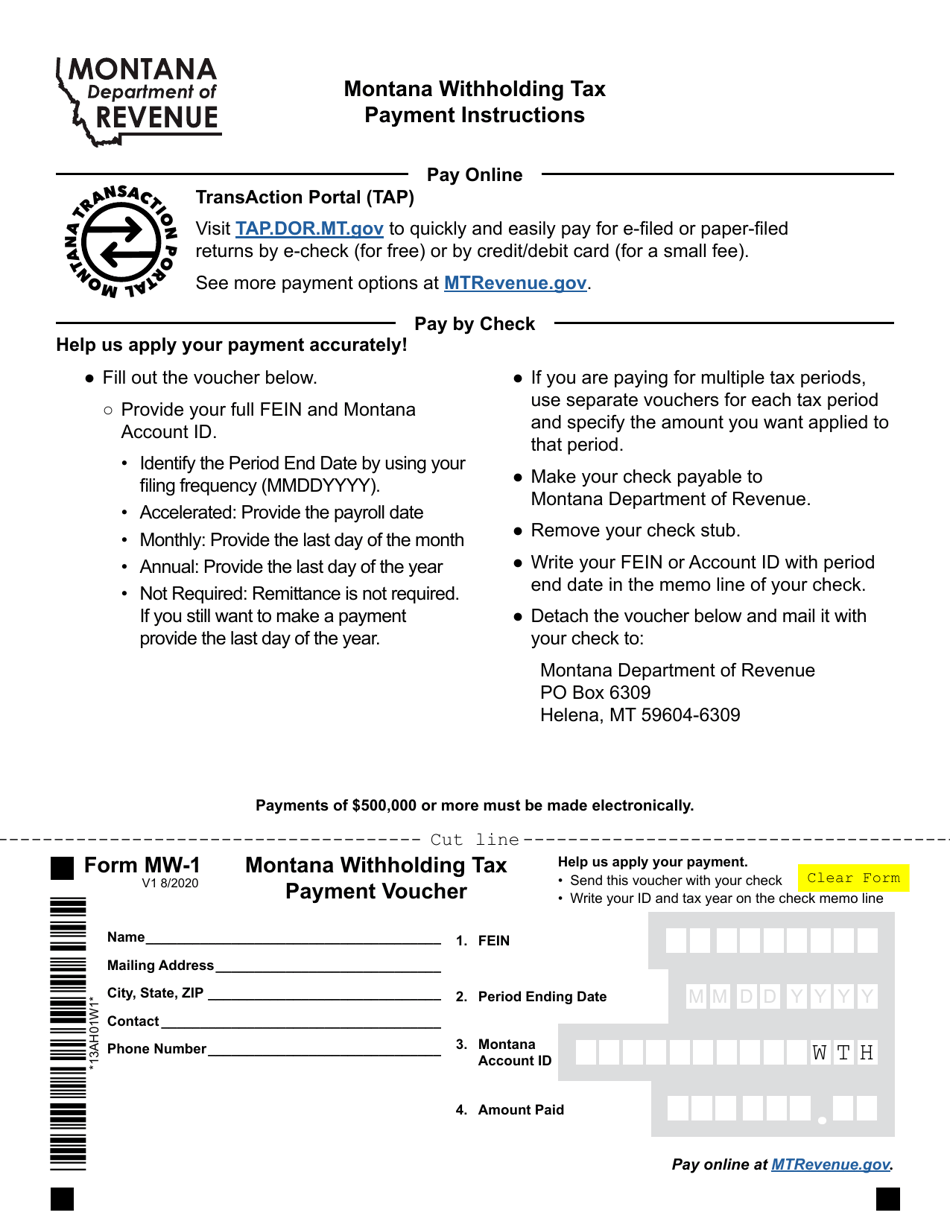

Form MW1 Download Fillable PDF or Fill Online Montana Withholding Tax

Web you may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole proprietorship asset. Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. Forms 1099 with no withholding; See “employee instructions” on back.

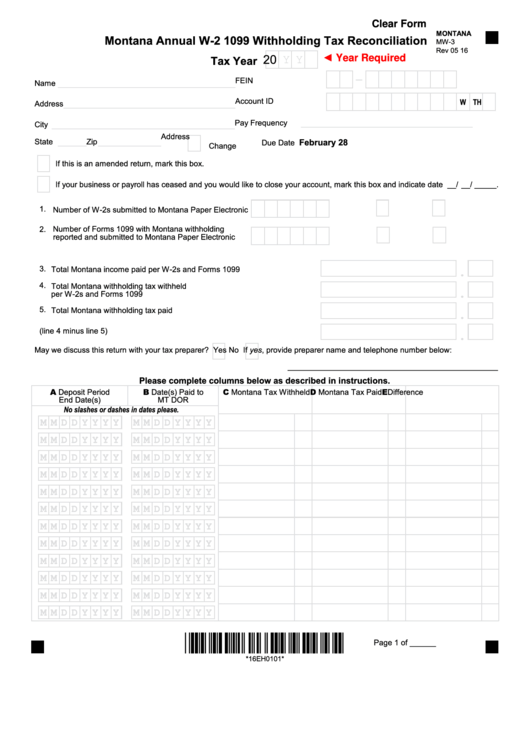

Fillable Form Mw3 Montana Annual W2 1099 Withholding Tax

You can pay your withholding tax liability with your paper voucher or by using. Web mineral royalty withholding tax; Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. See employee instructions on back of this form before beginning. See “employee instructions” on back of this form before beginning.

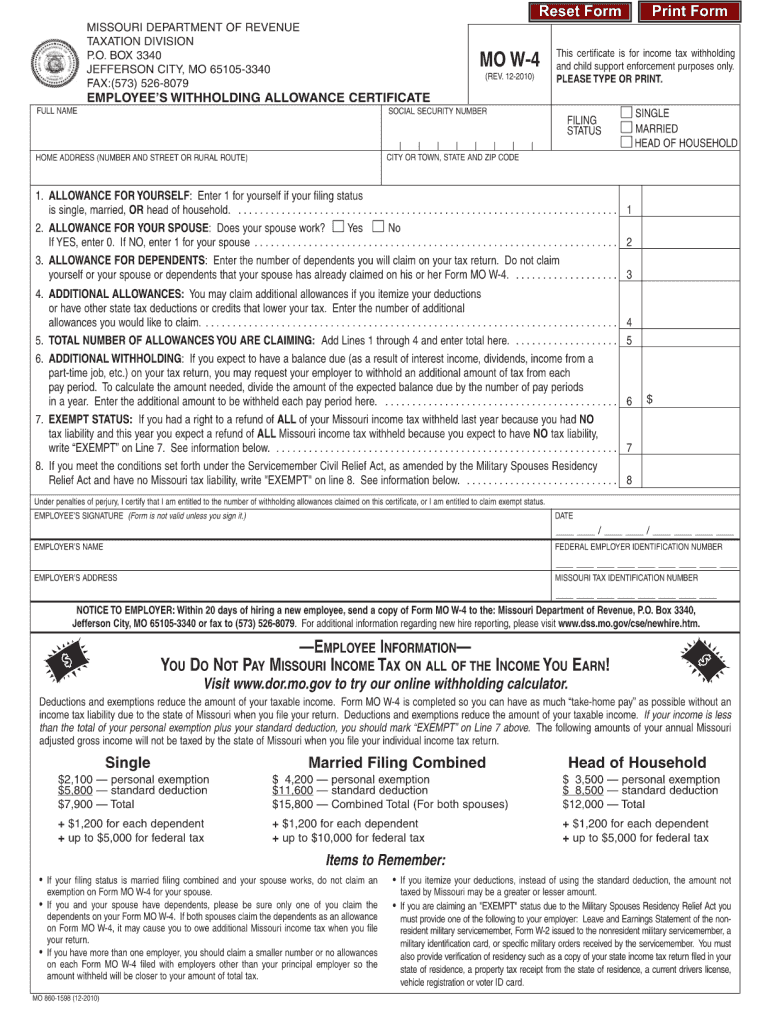

Mo W4 Form 2021 W4 Form 2021

Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. (1) for purposes of determining the employee's withholding allowances and withholding. Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income. Web approved wage withholding and payroll tax software; Web the transaction portal (tap).

Form MW4 Download Fillable PDF or Fill Online Montana Employee's

Forms 1099 with no withholding; Web (a) other income (not from jobs). Web mineral royalty withholding tax; Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. Web approved wage withholding and payroll tax software;

Monthly Withholding Payments Due Montana Department of Revenue

If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here. The treasure state has a progressive income tax system. Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income. Web the transaction portal (tap) is a free service for individuals, businesses, and.

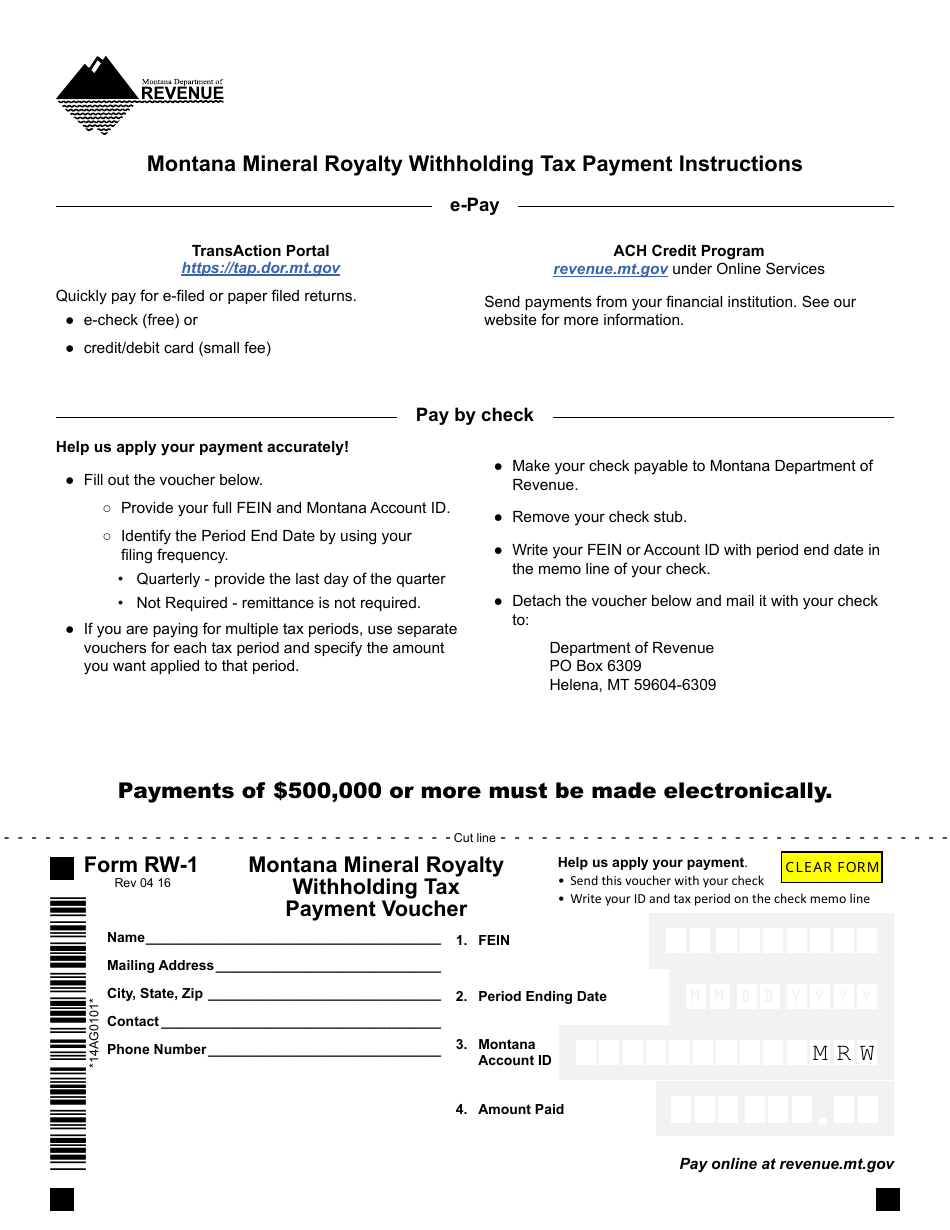

Form RW1 Download Fillable PDF or Fill Online Montana Mineral Royalty

Web (a) other income (not from jobs). Web irs withholding certificate for periodic pension or annuity payments: Use the montana paycheck calculators to see the taxes. Web latest version of the adopted rule presented in administrative rules of montana (arm): You can pay your withholding tax liability with your paper voucher or by using.

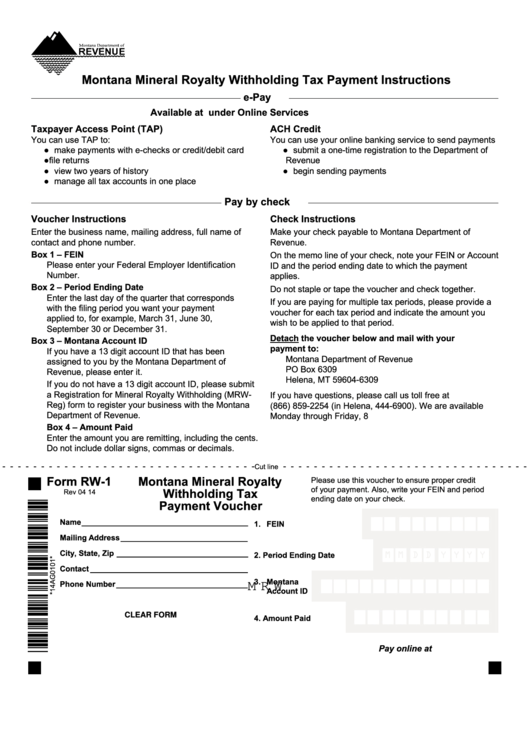

Fillable Form Rw1 Montana Mineral Royalty Withholding Tax Payment

Web approved wage withholding and payroll tax software; Web (a) other income (not from jobs). Web irs withholding certificate for periodic pension or annuity payments: You may use this form to make montana withholding tax payments. If you want tax withheld for other income you expect this year that won’t have withholding, enter the amount of other income here.

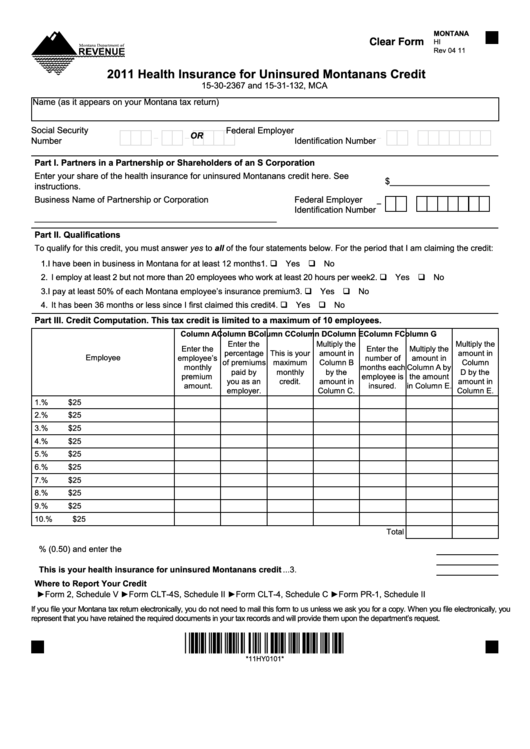

Fillable Montana Form Hi Health Insurance For Uninsured Montanans

Web (a) other income (not from jobs). You can pay your withholding tax liability with your paper voucher or by using. Web irs withholding certificate for periodic pension or annuity payments: You may use this form to make montana withholding tax payments. For information about montana state tax withholding, contact the montana.

Fillable Form Mw3 Montana Annual Withholding Tax Reconciliation

Transaction portal (tap) services and aidsthe transaction portal (tap) is a free service for individuals, businesses, and. Web the transaction portal (tap) is a free service for individuals, businesses, and tax professionals to access and manage accounts with the montana department of. For information about montana state tax withholding, contact the montana. Forms 1099 with no withholding; Web (a) other.

Fillable Form Mw1 Montana Withholding Tax Payment Voucher printable

Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year. See employee instructions on back of this form before beginning. Use the montana paycheck calculators to see the taxes. For information about montana state tax withholding, contact the montana. Forms 1099 with no withholding;

The Treasure State Has A Progressive Income Tax System.

Web the transaction portal (tap) is a free service for individuals, businesses, and tax professionals to access and manage accounts with the montana department of. Transaction portal (tap) services and aidsthe transaction portal (tap) is a free service for individuals, businesses, and. Web december 30, 2021. You can pay your withholding tax liability with your paper voucher or by using.

Forms 1099 With No Withholding;

Web (a) other income (not from jobs). See “employee instructions” on back of this form before beginning. Web you may use this form to register your business and create corporate income tax, small business, partnership, disregarded entity, sole proprietorship asset. Web mineral royalty withholding tax;

(1) For Purposes Of Determining The Employee's Withholding Allowances And Withholding.

Web 505, tax withholding and estimated tax, and irs publication 575, pension and annuity income. Web (1) every employer transacting business in montana is required to withhold montana state income tax from wages paid to an employee for services rendered within montana,. Web irs withholding certificate for periodic pension or annuity payments: Web you may use this form to reconcile all income tax you withheld and paid to montana during the calendar year.

If You Want Tax Withheld For Other Income You Expect This Year That Won’t Have Withholding, Enter The Amount Of Other Income Here.

See employee instructions on back of this form before beginning. You may use this form to make montana withholding tax payments. Web latest version of the adopted rule presented in administrative rules of montana (arm): Web approved wage withholding and payroll tax software;