Mn Form M1M

Mn Form M1M - Web 2020 form m1, individual income tax your first name and initial *201111* your last name your social security number (ssn) if a joint return, spouse’s first name and initial. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. Web get the minnesota form m1m (income additions and subtractions. Web use form m1 , individual income tax , to estimate your minnesota tax. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Download your adjusted document, export it to the cloud, print it from the. Web we last updated minnesota form m1m in december 2022 from the minnesota department of revenue. See the minnesota instructions for full requirements. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s.

Download your adjusted document, export it to the cloud, print it from the. Web minnesota itemized deductions > schedule m1ma marriage credit > schedule m1wfc minnesota working family credit > schedule m1ref refundable credits > schedule. • recalculate lines 4, 5, 8, 9, 11, and 12 of your minnesota m1m 4562. Minnesota individual income tax applies to residents and nonresidents who meet the state's minimum filing requirements. Web we last updated minnesota form m1m in december 2022 from the minnesota department of revenue. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Your first name and initial last nameyour social. Web the result on line 12 of minnesota form 4562 cannot be more than. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. Wednesday night i filed 2 returns that bounced on minnesota with the following message:

Wednesday night i filed 2 returns that bounced on minnesota with the following message: Web plete schedule m1mt to determine if you are required to pay minnesota amt. • recalculate lines 4, 5, 8, 9, 11, and 12 of your minnesota m1m 4562. Download your adjusted document, export it to the cloud, print it from the. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. This form is for income earned in tax year 2022, with tax returns due in april. Bond obligations if you deducted expenses on your federal return connected with. Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. See the minnesota instructions for full requirements. If the result is less than $12,525 and you had amounts withheld or.

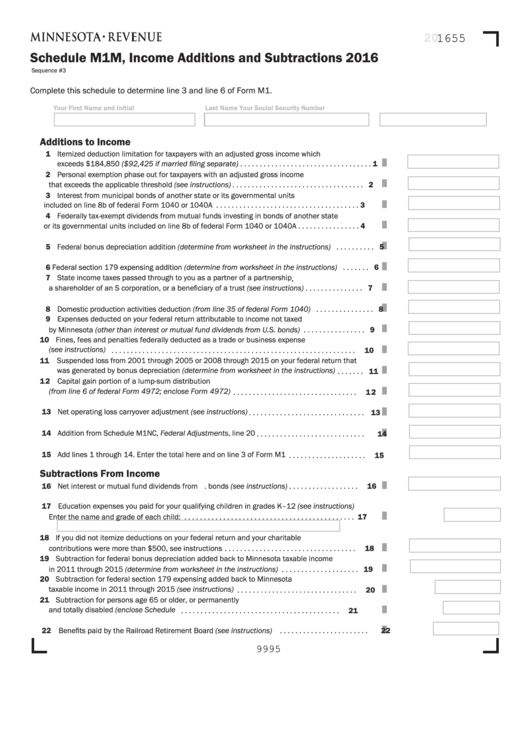

Schedule M1m Additions And Substractions 2016 printable pdf

Web we last updated the income additions and subtractions (onscreen version) in december 2022, so this is the latest version of form m1m, fully updated for tax year 2022. Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. Wednesday night i filed 2 returns that bounced on minnesota with the following.

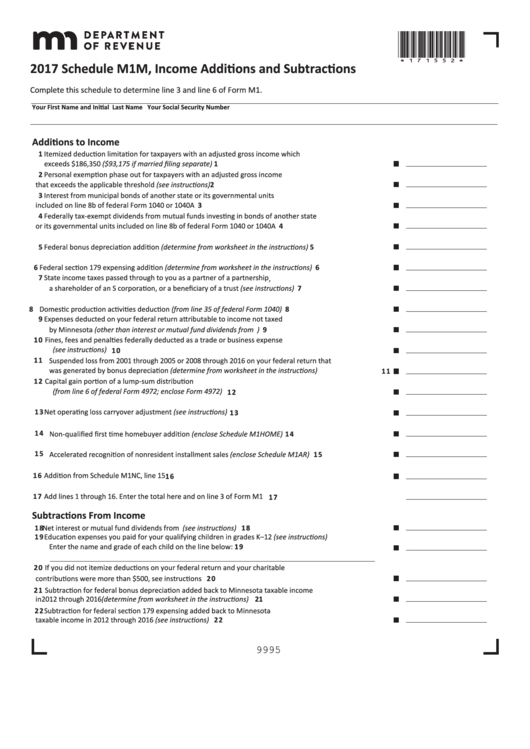

Schedule M1m Additions And Subtractions 2017 printable pdf

Web we last updated the minnesota individual income tax instructions (form m1) in february 2023, so this is the latest version of form m1 instructions, fully updated for tax year. Income you calculated in step 1 on form m1 , line 1. Web minnesota allows the following subtractions from income on forms m1m and m1mb: • recalculate lines 4, 5,.

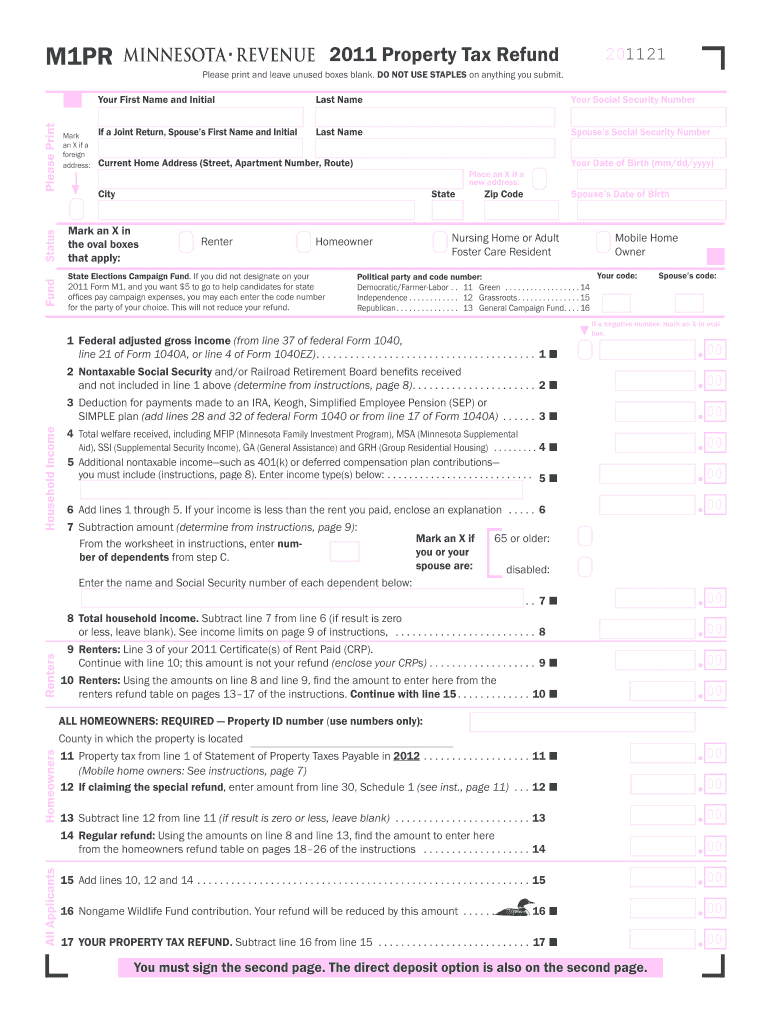

Minnesota Form Fill Out and Sign Printable PDF Template signNow

Complete form m1 using the minnesota. Web the result on line 12 of minnesota form 4562 cannot be more than. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. Web 25 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax.

Mn Form Instructions Fill Out and Sign Printable PDF Template signNow

Income you calculated in step 1 on form m1 , line 1. If the result is less than $12,525 and you had amounts withheld or. • recalculate lines 4, 5, 8, 9, 11, and 12 of your minnesota m1m 4562. Determine line 4 of schedule m1m by c omple ng the following s teps: See the minnesota instructions for full.

M1M taxes.state.mn.us

Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Determine line 4 of schedule m1m by c omple ng the following s teps: Web 2020 form m1, individual income tax your first.

Fill Free fillable 2020 Schedule M1M, Addions and Subtracons

Web if the total is $12,525 or more, you must file a minnesota income tax return and schedule m1nr. Web minnesota itemized deductions > schedule m1ma marriage credit > schedule m1wfc minnesota working family credit > schedule m1ref refundable credits > schedule. Line 1 of that form. See the minnesota instructions for full requirements. Web we last updated the minnesota.

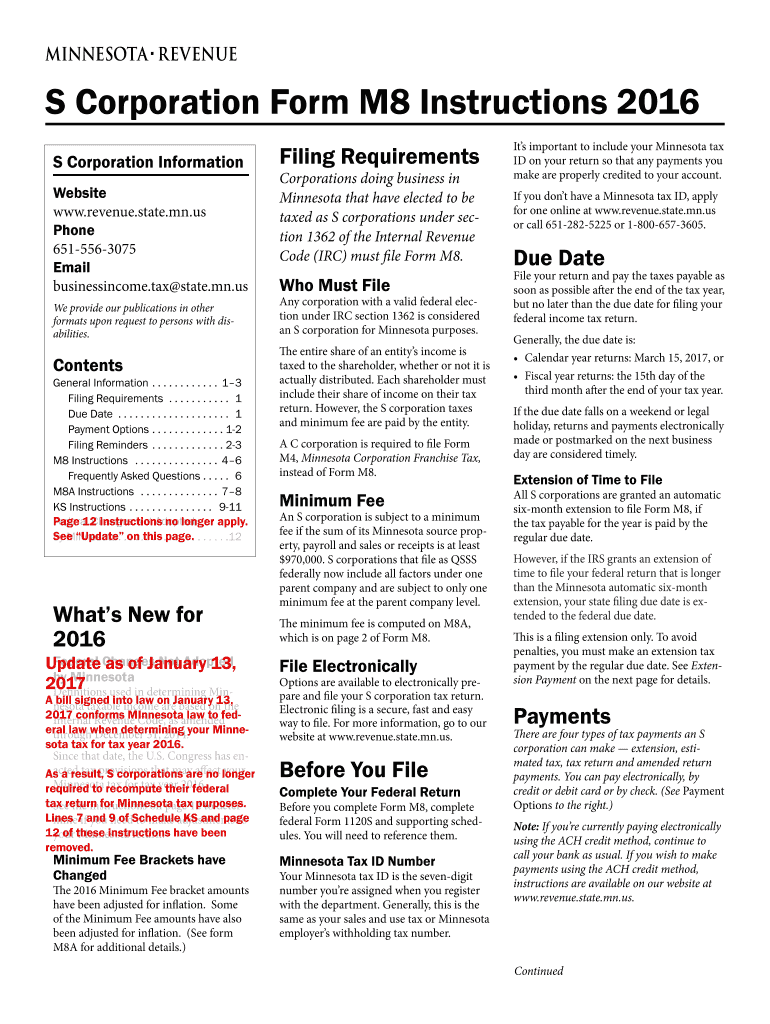

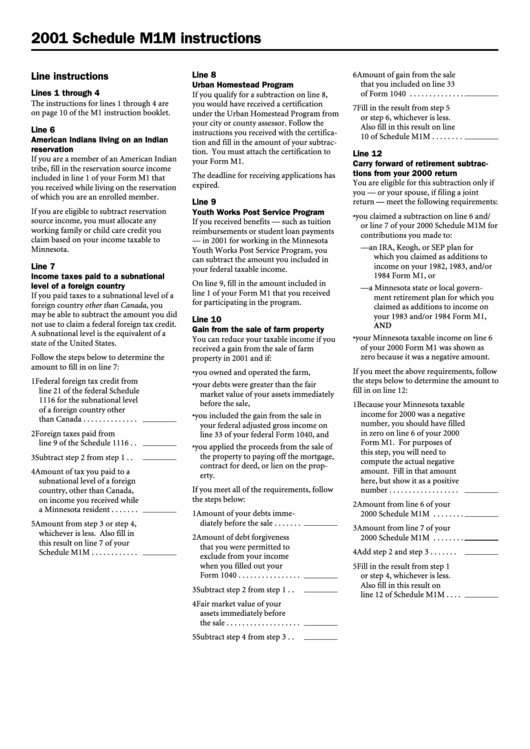

Schedule M1m Instructions 2001 printable pdf download

Wednesday night i filed 2 returns that bounced on minnesota with the following message: If the result is less than $12,525 and you had amounts withheld or. Web minnesota allows the following subtractions from income on forms m1m and m1mb: Web 18 if you are a resident of michigan or north dakota filing form m1 only to receive a refund.

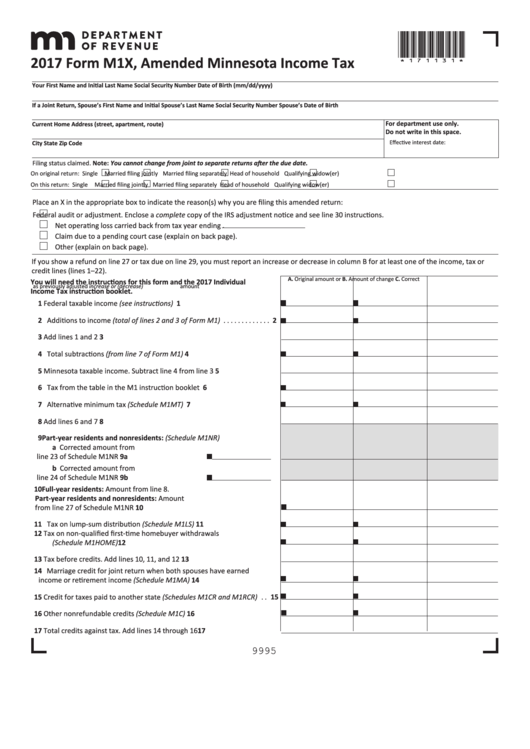

Fillable Form M1x Amended Minnesota Tax 2017 printable pdf

Complete form m1 using the minnesota. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. Web use form m1 , individual income tax , to estimate your minnesota tax. Web we last updated minnesota form.

MN DoR M1 2018 Fill out Tax Template Online US Legal Forms

This form is for income earned in tax year 2022, with tax returns due in april. You may be required to pay minnesota alternative minimum tax even if you did not have to pay. If the result is less than $12,525 and you had amounts withheld or. Determine line 4 of schedule m1m by c omple ng the following s.

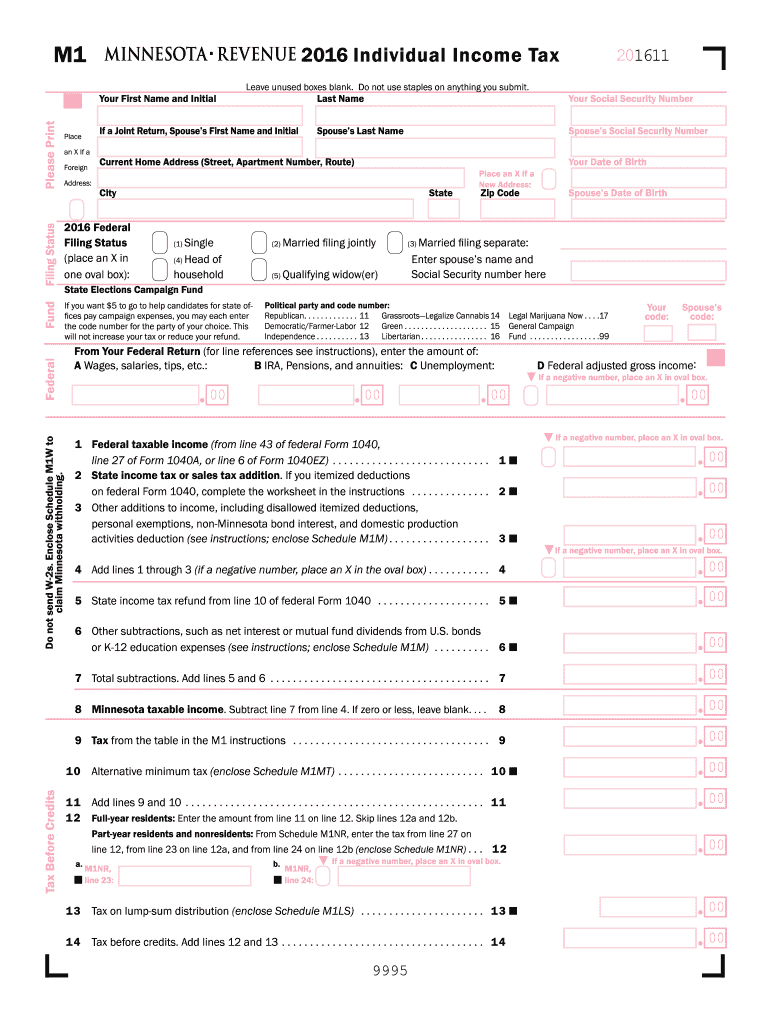

2016 M1 Instructions Fill Out and Sign Printable PDF Template signNow

Web use form m1 , individual income tax , to estimate your minnesota tax. Your first name and initial last nameyour social. Web 18 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Web get the minnesota.

Your First Name And Initial Last Nameyour Social.

This form is for income earned in tax year 2022, with tax returns due in april. Wednesday night i filed 2 returns that bounced on minnesota with the following message: Web minnesota itemized deductions > schedule m1ma marriage credit > schedule m1wfc minnesota working family credit > schedule m1ref refundable credits > schedule. Download your adjusted document, export it to the cloud, print it from the.

Web If The Total Is $12,525 Or More, You Must File A Minnesota Income Tax Return And Schedule M1Nr.

Web the result on line 12 of minnesota form 4562 cannot be more than. Web line 3 — expenses relating to income not taxed by minnesota, other than from u.s. Web plete schedule m1mt to determine if you are required to pay minnesota amt. If the result is less than $12,525 and you had amounts withheld or.

Web 2020 Form M1, Individual Income Tax Your First Name And Initial *201111* Your Last Name Your Social Security Number (Ssn) If A Joint Return, Spouse’s First Name And Initial.

Web use form m1 , individual income tax , to estimate your minnesota tax. Determine line 4 of schedule m1m by c omple ng the following s teps: Web • enter line 10 of your federal form 4562 on line 10 of your minnesota m1m 4562. Line 1 of that form.

Web We Last Updated The Income Additions And Subtractions (Onscreen Version) In December 2022, So This Is The Latest Version Of Form M1M, Fully Updated For Tax Year 2022.

See the minnesota instructions for full requirements. Web 18 if you are a resident of michigan or north dakota filing form m1 only to receive a refund of all minnesota tax withheld, enter the amount from line 1 of form m1. Web we last updated minnesota form m1m in december 2022 from the minnesota department of revenue. • recalculate lines 4, 5, 8, 9, 11, and 12 of your minnesota m1m 4562.