Mississippi Form 83-105 Instructions 2021

Mississippi Form 83-105 Instructions 2021 - Use get form or simply click on the template preview to open it in the editor. Name of date of address or date name of other. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. Web net taxable income schedule 2021 fein apportionment / allocation 20 mississippi apportioned income(loss)(if 100% mississippi, enter line 16, otherwise,. Web individual income tax return. A copy of all legislative bills is available at. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. The new due date for filing income tax returns is july 15, 2020. Legislative changes the following is a brief description of selected legislative changes. You can download or print.

Use get form or simply click on the template preview to open it in the editor. Web send form 83 105 2016 via email, link, or fax. A copy of all legislative bills is available at. Web net taxable income schedule 2021 fein apportionment / allocation 20 mississippi apportioned income(loss)(if 100% mississippi, enter line 16, otherwise,. You must file, online or through the mail, yearly by april 17. The new due date for filing income tax returns is july 15, 2020. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. Name of date of address or date name of other. Legislative changes the following is a brief description of selected legislative changes. Web filing if they have mississippi unrelated business taxable income.

Legislative changes the following is a brief description of selected legislative changes. Emergency services health & social services new residents guide e11 directory. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. Web individual income tax return. You must file, online or through the mail, yearly by april 17. Web filing if they have mississippi unrelated business taxable income. Web send form 83 105 2016 via email, link, or fax. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. Web net taxable income schedule 2021 fein apportionment / allocation 20 mississippi apportioned income(loss)(if 100% mississippi, enter line 16, otherwise,. List all adopted children of the decedent.

20202022 Form MS DoR 89350 Fill Online, Printable, Fillable, Blank

Emergency services health & social services new residents guide e11 directory. You must file, online or through the mail, yearly by april 17. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. A copy of all legislative.

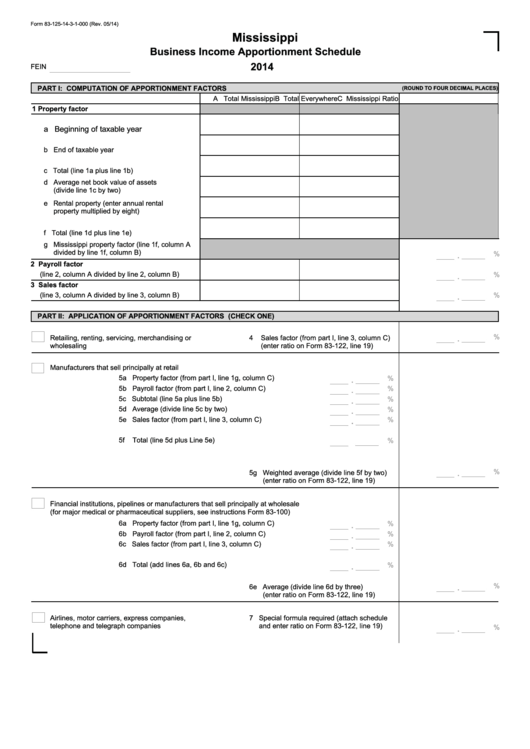

Fillable Form 831251431000 Mississippi Business

Web net taxable income schedule 2021 fein apportionment / allocation 20 mississippi apportioned income(loss)(if 100% mississippi, enter line 16, otherwise,. Web filing if they have mississippi unrelated business taxable income. Emergency services health & social services new residents guide e11 directory. Use get form or simply click on the template preview to open it in the editor. Legislative changes the.

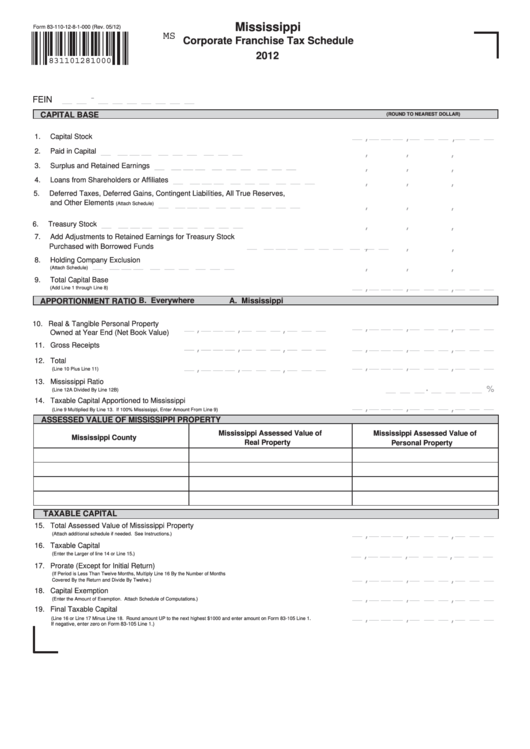

Fillable Form 831101281000 Mississippi Corporate Franchise Tax

Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. Emergency services health & social services new residents guide e11 directory. Web filing if they have mississippi unrelated business taxable income. Use get form or simply click on the template preview to open it in the editor. A copy of all legislative bills is.

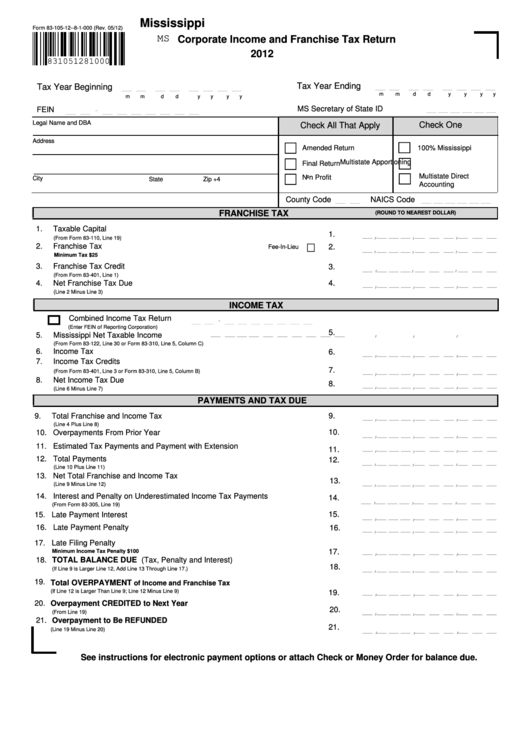

Form 831051281000 Corporate And Franchise Tax Return

A copy of all legislative bills is available at. Web filing if they have mississippi unrelated business taxable income. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. Web send form 83 105 2016 via email, link, or fax. Name of date of address or date name of other.

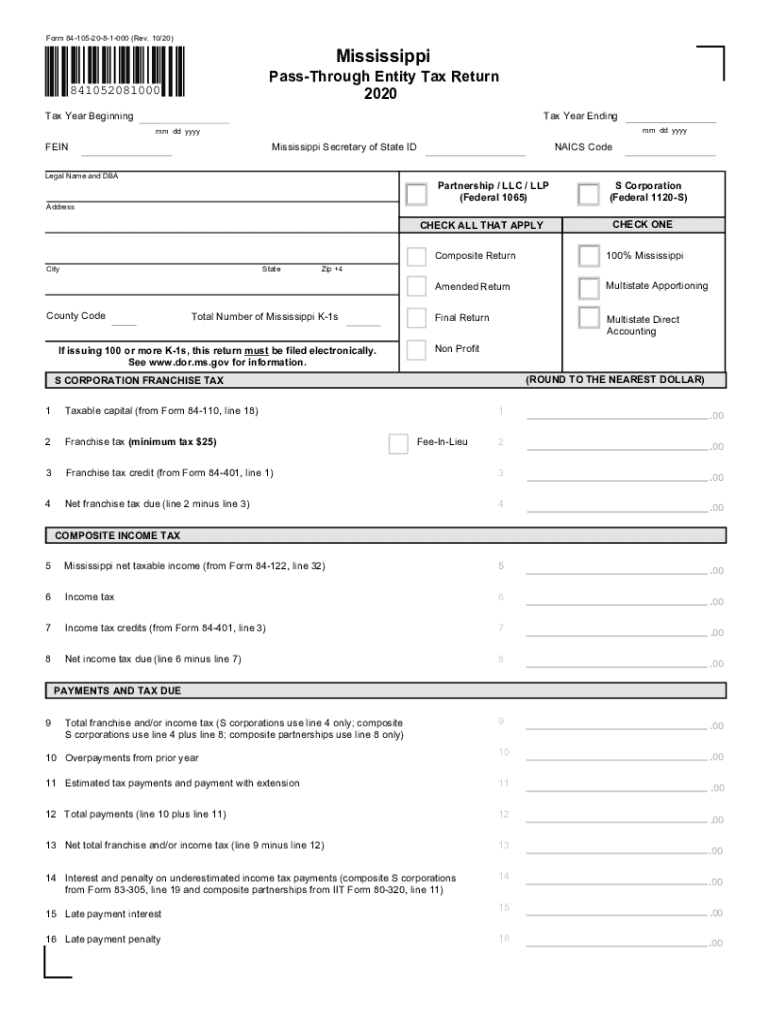

Ms Form 84 105 Instructions 2020 Fill Out and Sign Printable PDF

Use get form or simply click on the template preview to open it in the editor. You must file, online or through the mail, yearly by april 17. A copy of all legislative bills is available at. Web individual income tax return. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more.

Download Mississippi Form 89350 for Free FormTemplate

Legislative changes the following is a brief description of selected legislative changes. You must file, online or through the mail, yearly by april 17. Web send form 83 105 2016 via email, link, or fax. You can download or print. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more.

Mississippi Sublease Agreement Form Free Download

Emergency services health & social services new residents guide e11 directory. A copy of all legislative bills is available at. The new due date for filing income tax returns is july 15, 2020. You can download or print. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more.

MS DoR 80105 20202022 Fill out Tax Template Online US Legal Forms

Legislative changes the following is a brief description of selected legislative changes. The new due date for filing income tax returns is july 15, 2020. Web filing if they have mississippi unrelated business taxable income. You can download or print. Emergency services health & social services new residents guide e11 directory.

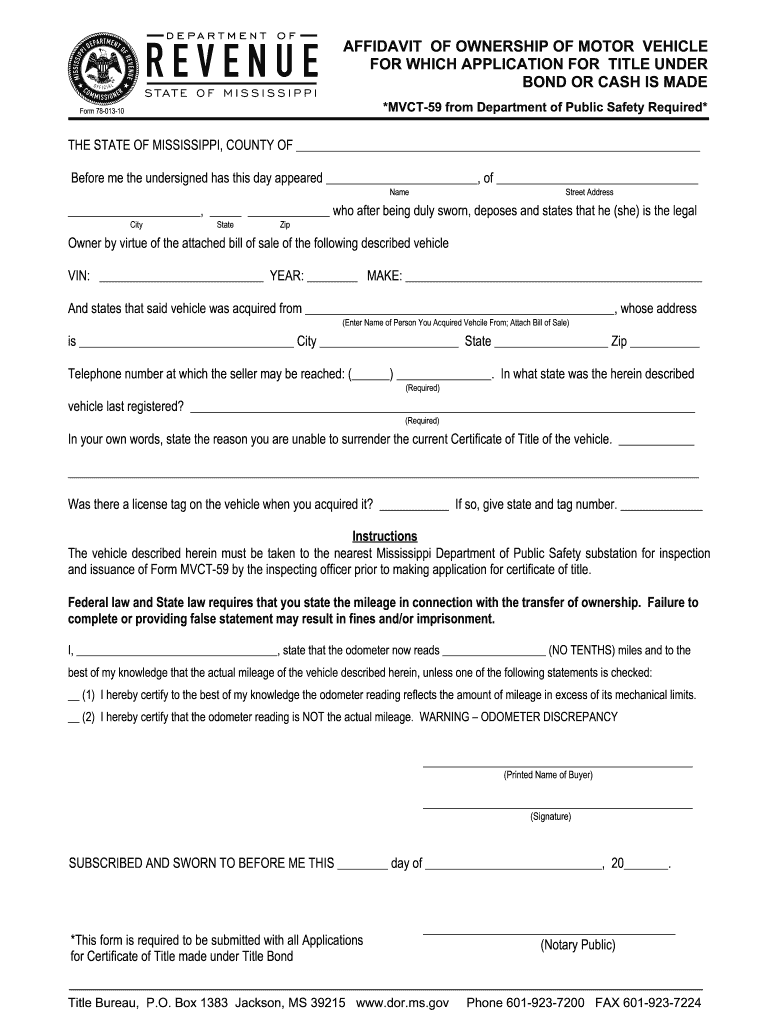

Mississippi Title Application Form Fill Out and Sign Printable PDF

Web send form 83 105 2016 via email, link, or fax. List all adopted children of the decedent. Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. You can download or print. The new due date for filing income tax returns is july 15, 2020.

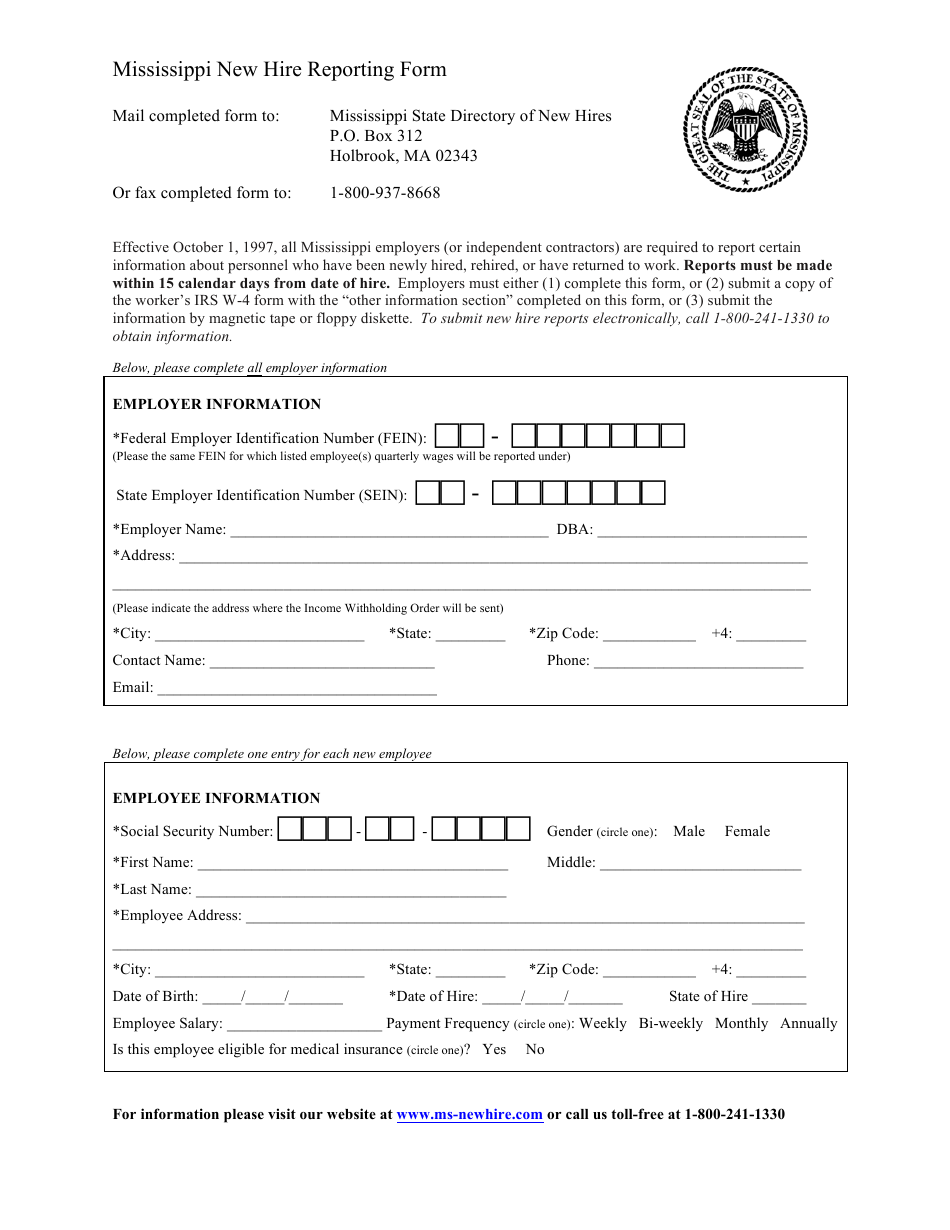

Mississippi Mississippi New Hire Reporting Form Mississippi State

Web filing if they have mississippi unrelated business taxable income. Emergency services health & social services new residents guide e11 directory. Use get form or simply click on the template preview to open it in the editor. You can download or print. A copy of all legislative bills is available at.

Web Individual Income Tax Return.

You can download or print. You can download or print. The new due date for filing income tax returns is july 15, 2020. Web filing if they have mississippi unrelated business taxable income.

Legislative Changes The Following Is A Brief Description Of Selected Legislative Changes.

Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more. A copy of all legislative bills is available at. List all adopted children of the decedent. Web send form 83 105 2016 via email, link, or fax.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Web filing if they have mississippi unrelated business taxable income. Web net taxable income schedule 2021 fein apportionment / allocation 20 mississippi apportioned income(loss)(if 100% mississippi, enter line 16, otherwise,. Name of date of address or date name of other. Emergency services health & social services new residents guide e11 directory.

You Must File, Online Or Through The Mail, Yearly By April 17.

Refer to the “unrelated business taxable income of exempt organizations” section of this booklet for more.