Michigan State Tax Withholding Form 2022

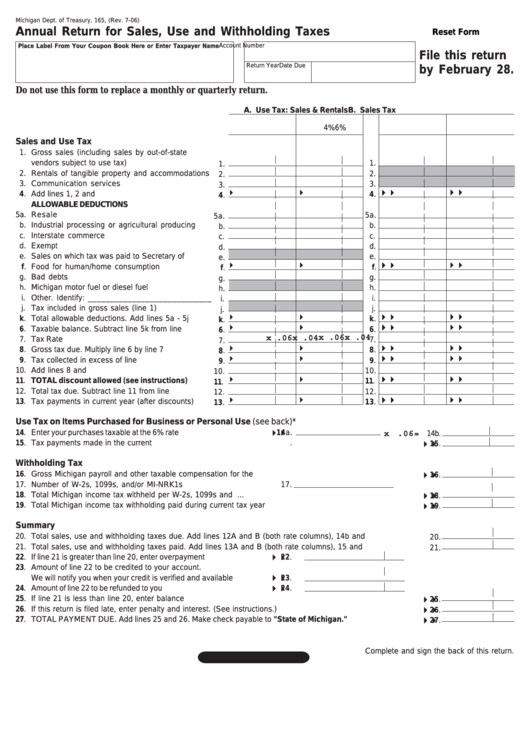

Michigan State Tax Withholding Form 2022 - Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits,. Statement to determine state of domicile: Once the form is completed, push finished. Complete, edit or print tax forms instantly. Web find out which michigan income tax forms you should be aware of when filing your taxes this year, with help from h&r block. 2022 sales, use and withholding taxes. Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web the michigan department of treasury march 1 published 2022 withholding tax forms for corporate income, individual income, and sales and use tax purposes. Web 2022 sales, use and withholding taxes annual return:

Be sure to verify that the form you are. If you make $70,000 a year living in arkansas you will be taxed $11,683. Web instructions included on form: Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web 2022 sales, use and withholding taxes annual return: Complete, edit or print tax forms instantly. Web 2022 tax year dear taxpayer: Michigan state income tax forms for current and previous tax years. Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument.

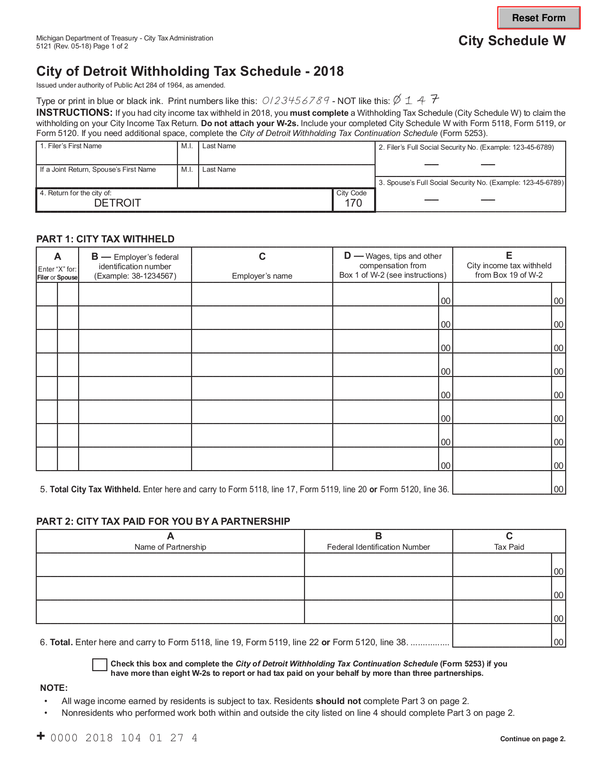

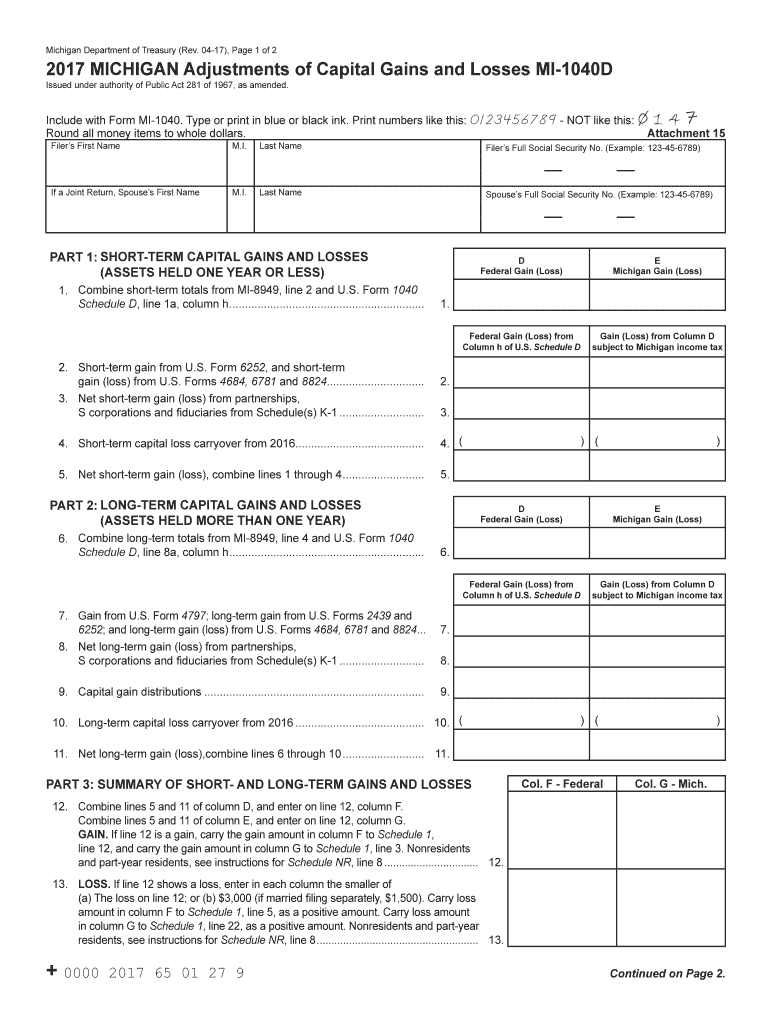

Complete, edit or print tax forms instantly. Web find out which michigan income tax forms you should be aware of when filing your taxes this year, with help from h&r block. Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. Web the michigan department of treasury march 1 published 2022 withholding tax forms for corporate income, individual income, and sales and use tax purposes. Web withholding formula >(michigan effective 2022) <. Complete, edit or print tax forms instantly. Web instructions included on form: Be sure to verify that the form you are. Complete if your company is making required withholding payments on. If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual.

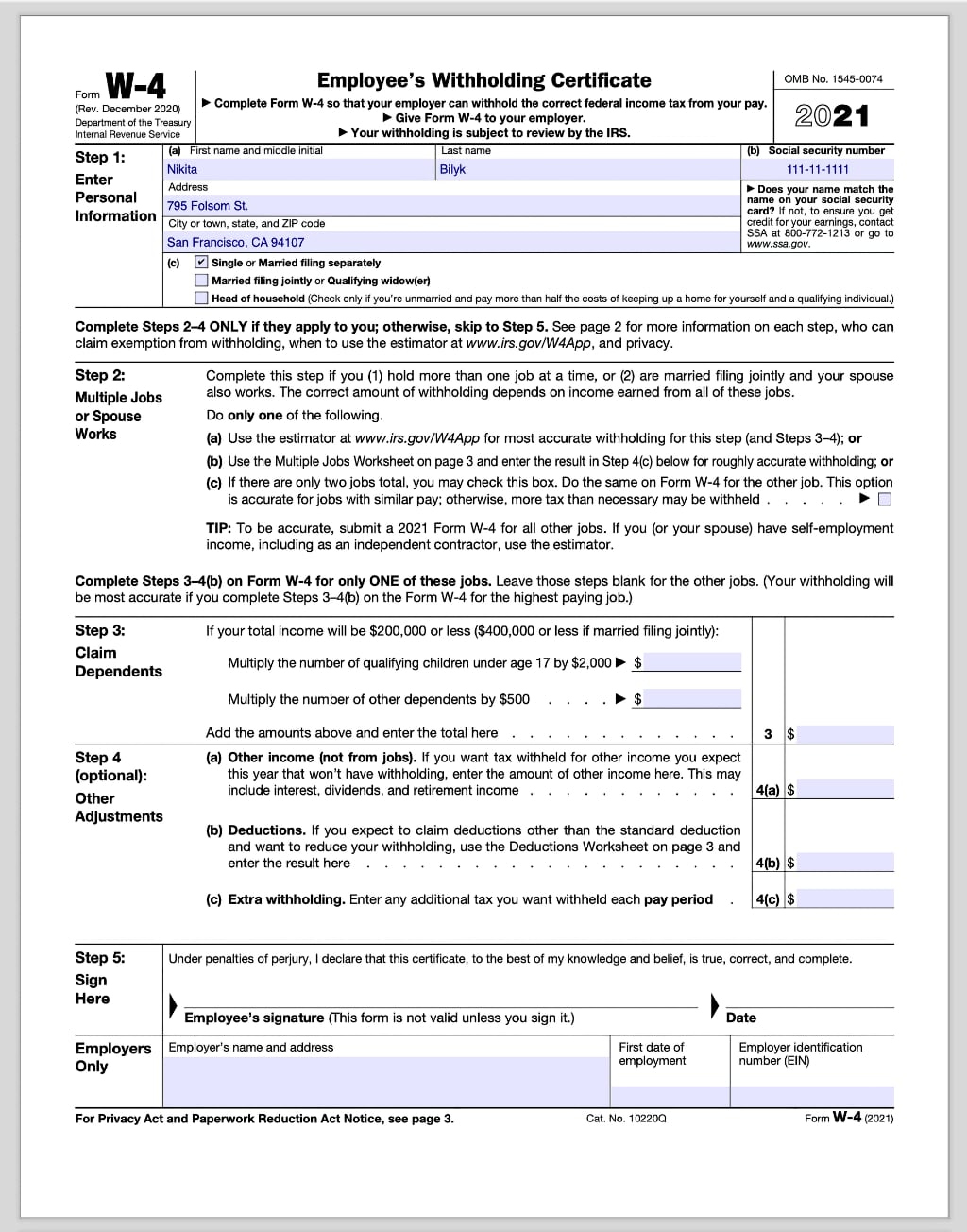

2020 Form MO W4 Fill Online, Printable, Fillable, Blank pdfFiller

Complete if your company is making required withholding payments on. If you make $70,000 a year living in arkansas you will be taxed $11,683. 2022 sales, use and withholding taxes. If you enter the word “income” in the form. Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results.

Michigan W 4 2021 2022 W4 Form

Be sure to verify that the form you are. Web 2022 tax year dear taxpayer: This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of. Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. If.

Form Mi 1041 Fill Out and Sign Printable PDF Template signNow

Once the form is completed, push finished. If you make $70,000 a year living in arkansas you will be taxed $11,683. Web 2022 sales, use and withholding taxes annual return: Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. If you enter the word “income” in the form.

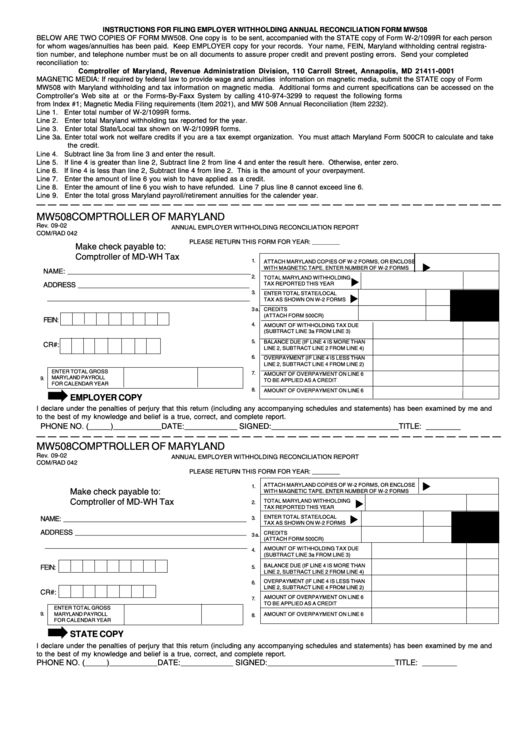

Maryland Withholding Form 2021 2022 W4 Form

Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web find out which michigan income tax forms you should be aware of when filing your taxes this year, with help from h&r block. Web 2022 tax year forms and instructions individual income tax forms.

Michigan 2022 Annual Tax Withholding Form

Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. Web withholding formula >(michigan effective 2022) <. If you make $70,000 a year living in arkansas you will be taxed $11,683. Be sure to verify that the form you are. Web the michigan department of.

2017 Form MS DoR 89350 Fill Online, Printable, Fillable, Blank pdfFiller

Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages. If you enter the word “income” in the form. Be sure to verify that the form you are. This booklet contains information for your 2023 michigan property taxes and 2022 individual income taxes, homestead property tax credits,. Statement to determine state of domicile:

Mi 1040 Fill Out and Sign Printable PDF Template signNow

If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. Web withholding formula >(michigan effective 2022) <. Complete, edit or print tax forms instantly. Web put an digital signature on your mi w4 form 2023 aided by the enable of indicator instrument. Web 2022 tax.

20202023 Form MI MIW4 Fill Online, Printable, Fillable, Blank pdfFiller

If you make $70,000 a year living in arkansas you will be taxed $11,683. If you fail or refuse to submit. Web instructions included on form: If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. Subtract the nontaxable biweekly thrift savings plan contribution from.

Michigan State Tax Form 2020 23 Tips That Will Make You Influential

Once the form is completed, push finished. Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. Web instructions included on form: This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of. Web.

Printable W4 Forms 2022 April Calendar Printable 2022

If you had michigan income tax withheld in 2022, you must complete a withholding tax schedule (schedule w) to claim the withholding on your individual. Web michigan income tax withholding tables weekly payroll period effective january 1, 2022 4.25% of gross pay should be withheld if no exemptions are claimed. If you make $70,000 a year living in arkansas you.

Complete, Edit Or Print Tax Forms Instantly.

Web 2022 employer withholding tax. Statement to determine state of domicile: Web 2022 sales, use and withholding taxes annual return: Subtract the nontaxable biweekly thrift savings plan contribution from the gross biweekly wages.

Michigan State Income Tax Forms For Current And Previous Tax Years.

Web printable michigan state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web withholding formula >(michigan effective 2022) <. If you fail or refuse to submit. Web instructions included on form:

If You Had Michigan Income Tax Withheld In 2022, You Must Complete A Withholding Tax Schedule (Schedule W) To Claim The Withholding On Your Individual.

Web 2022 tax year forms and instructions individual income tax forms and instructions fiduciary tax forms estate tax forms city income tax forms use form search to find. You can download or print. Complete, edit or print tax forms instantly. If you enter the word “income” in the form.

This Booklet Contains Information For Your 2023 Michigan Property Taxes And 2022 Individual Income Taxes, Homestead Property Tax Credits,.

Web the michigan department of treasury march 1 published 2022 withholding tax forms for corporate income, individual income, and sales and use tax purposes. If you make $70,000 a year living in arkansas you will be taxed $11,683. 2022 sales, use and withholding taxes. This revenue administrative bulletin (rab) sets forth the sales tax prepayment rates applicable to the purchase or receipt of.