Michigan Property Tax Exemption Form

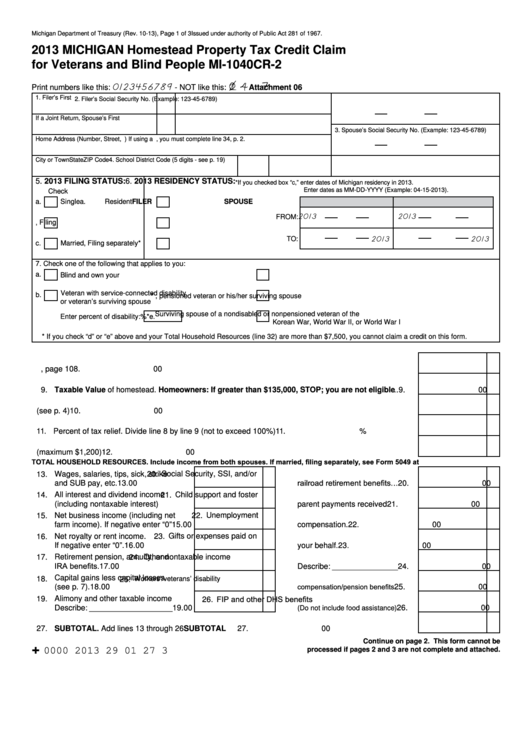

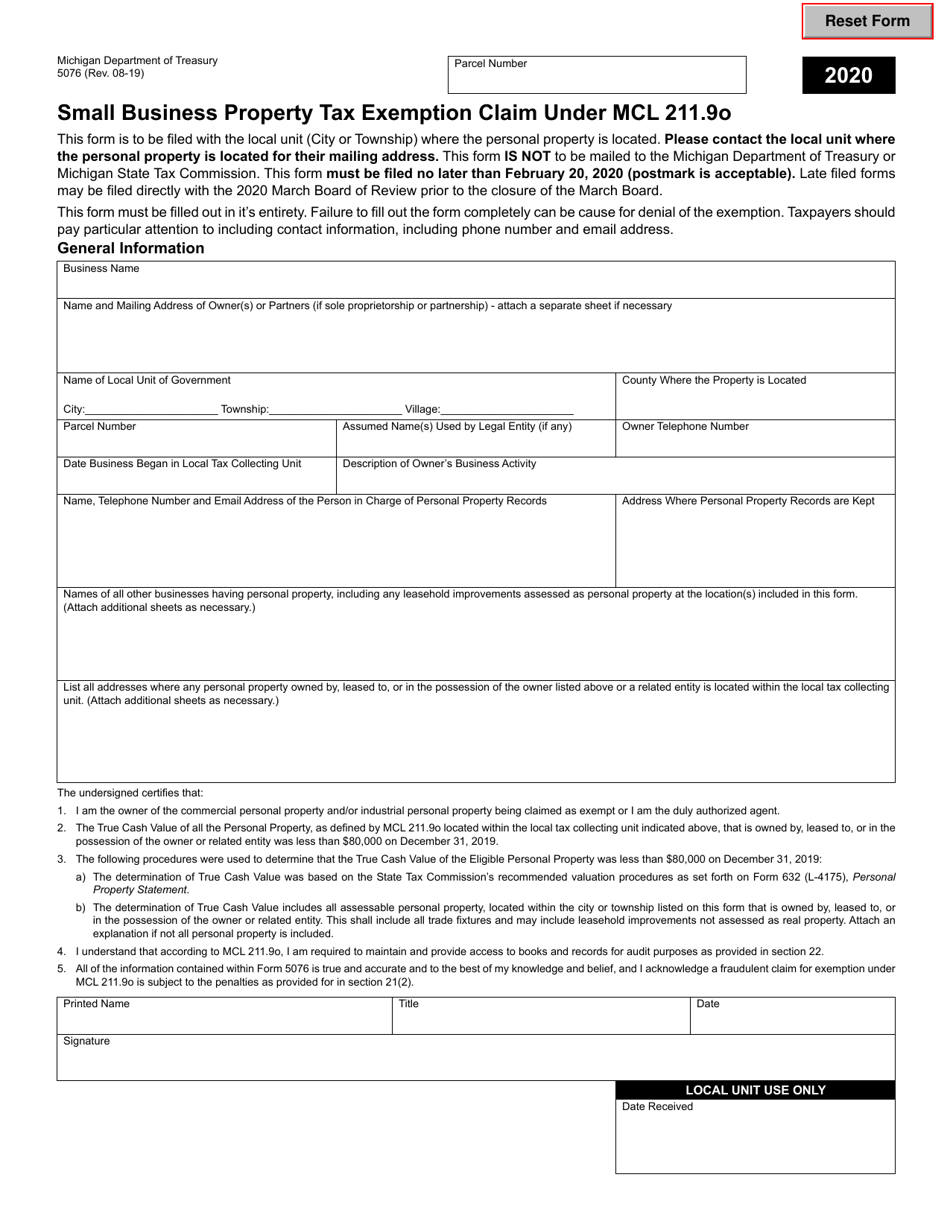

Michigan Property Tax Exemption Form - You can fill out the form on. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Other property tax exemptions in michigan Web there are multiple types of organizations that may qualify for a property tax exemption under michigan law. Form 632 (personal property tax statement) form 5076 (small business property tax exemption claim under mcl 211.9o) form 5278 (affidavit and. Property tax exemptions are specific programs created by state and local authorities to help people reduce their tax bills. Web the principal residence exemption (pre) affidavit, form 2368, and other principal residence exemption forms should be available from your local assessor or at. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran who was. A completed and signed application for mcl 211.7u poverty. Web application for exemption from property taxes instructions:

Web to apply, you need to fill out the michigan property tax poverty exemption form. Web application for exemption from property taxes instructions: Batch cover sheet for principal. Other property tax exemptions in michigan Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Web to be considered for an exemption on your property taxes, the applicant is required to submit the following to the board of review: Ad download or email form 2022 & more fillable forms, register and subscribe now! Notice of denial of principal residence exemption (local (city/township)) 2753. File this application with copies of documents listed on page two (2) of this form. A completed and signed application for mcl 211.7u poverty.

Form 632 (personal property tax statement) form 5076 (small business property tax exemption claim under mcl 211.9o) form 5278 (affidavit and. File this application with copies of documents listed on page two (2) of this form. Web by paul arnold may 31, 2022. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently. Notice of denial of principal residence exemption (local (city/township)) 2753. Web to be considered for an exemption, the applicant is required to submit the following to the board of review: Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. A completed and signed application for mcl 211.7u poverty. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran who was. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was.

Property Tax Exemption For Seniors In Michigan PRORFETY

Notice of denial of principal residence exemption (local (city/township)) 2753. Please see the city’s exemption application for a list of the most. Web property tax exemptions poverty exemption mcl 211.7u provides for a property tax exemption, in whole or part, for the principal residence of persons who, by reason of. Web there are multiple types of organizations that may qualify.

michigan sales tax exemption number Jodie Mccord

Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran who was. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Web.

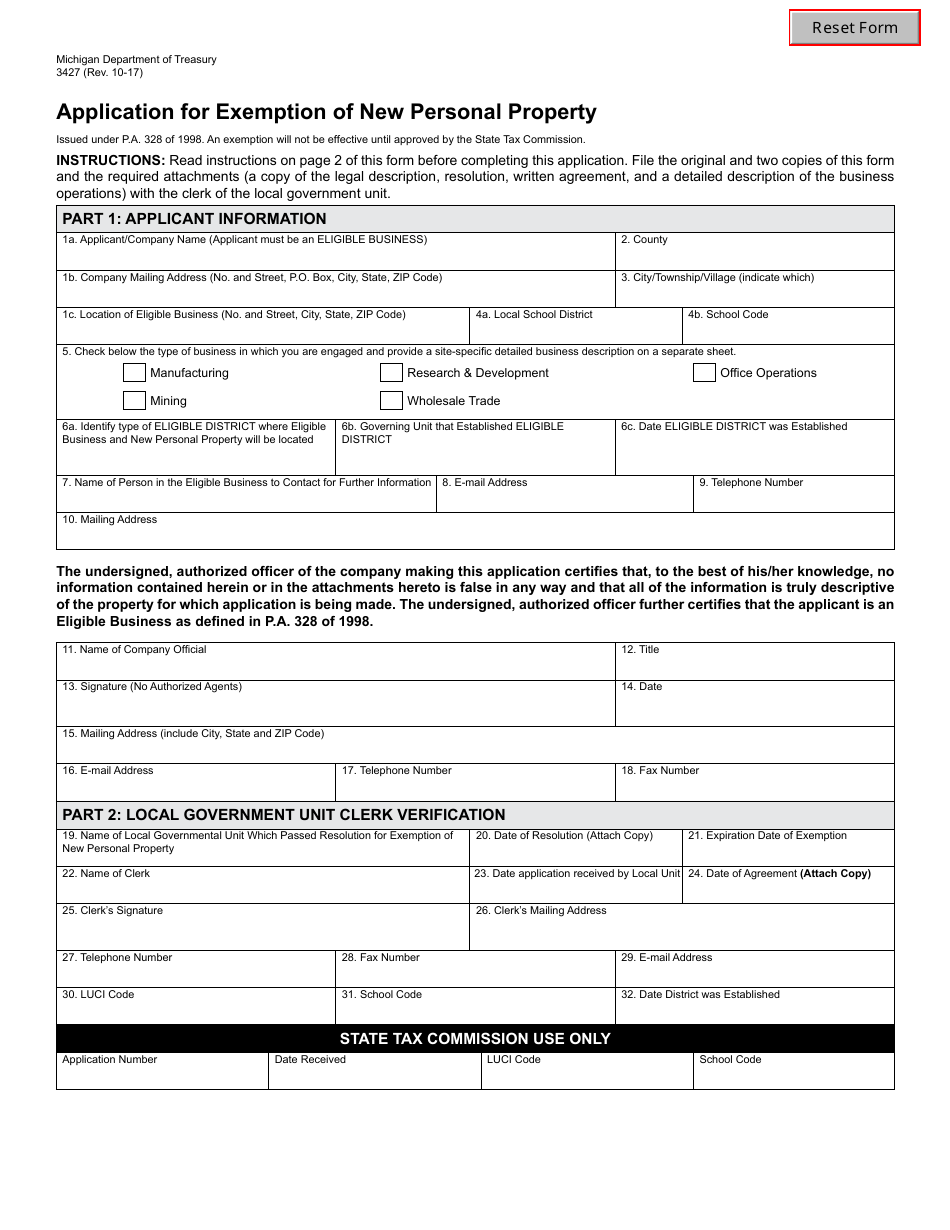

Form 3427 Download Fillable PDF or Fill Online Application for

Please see the city’s exemption application for a list of the most. Web to apply, you need to fill out the michigan property tax poverty exemption form. Web application for exemption from property taxes instructions: Ad download or email form 2022 & more fillable forms, register and subscribe now! Web the charitable nonprofit housing property exemption, public act 612 of.

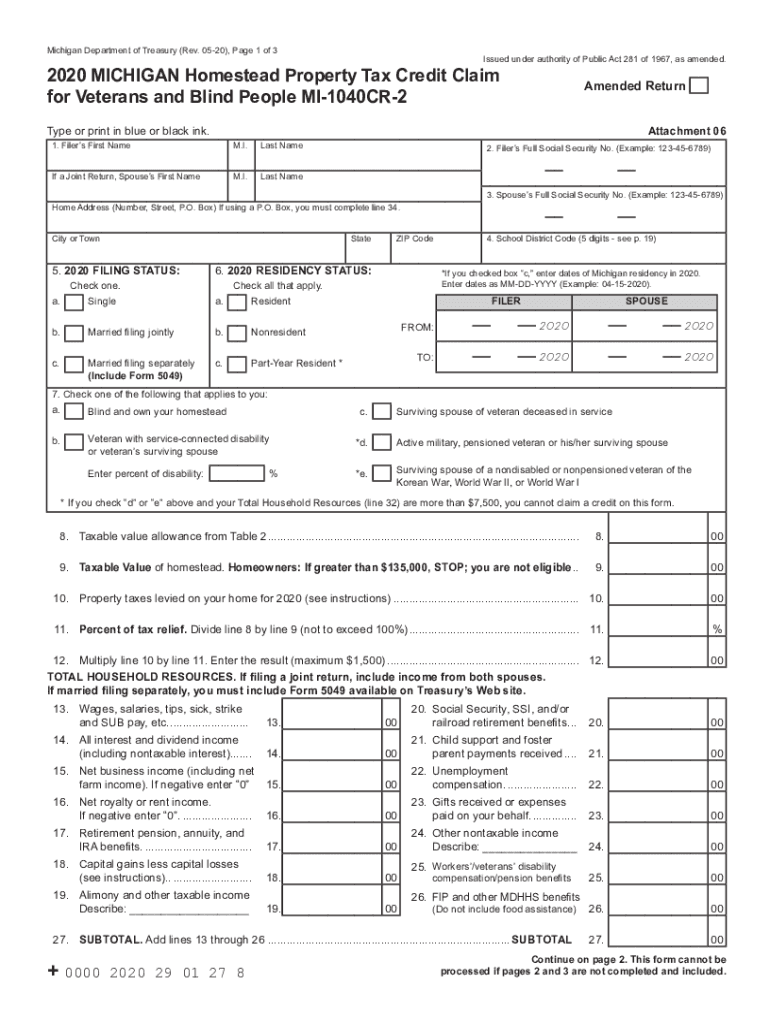

MI DoT MI1040CR2 20202021 Fill out Tax Template Online US Legal

Web property tax exemptions poverty exemption mcl 211.7u provides for a property tax exemption, in whole or part, for the principal residence of persons who, by reason of. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran who.

Printable Tax Exempt Form Fill Online, Printable, Fillable, Blank

Web the principal residence exemption (pre) affidavit, form 2368, and other principal residence exemption forms should be available from your local assessor or at. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Web michigan department of treasury 5076 (rev. A completed michigan.

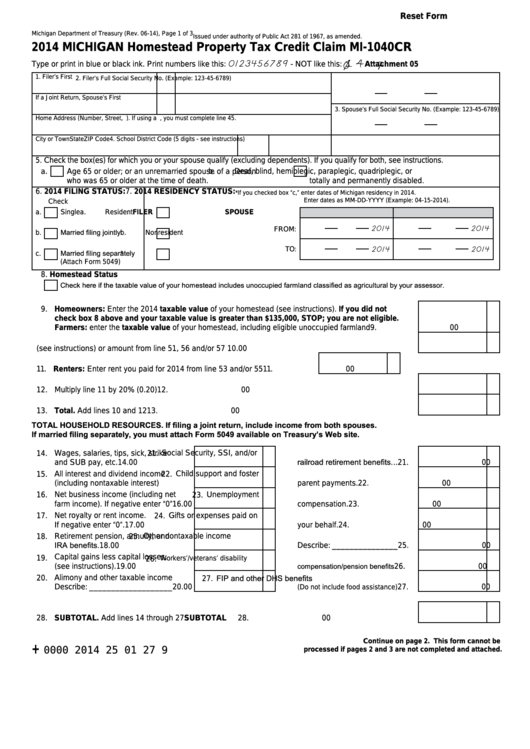

Fillable Form Mi1040cr Michigan Homestead Property Tax Credit Claim

Web request to rescind principal residence exemption. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was. Web what are property tax exemptions? You can fill out the form on. Web to be considered for an exemption on your property taxes, the applicant is.

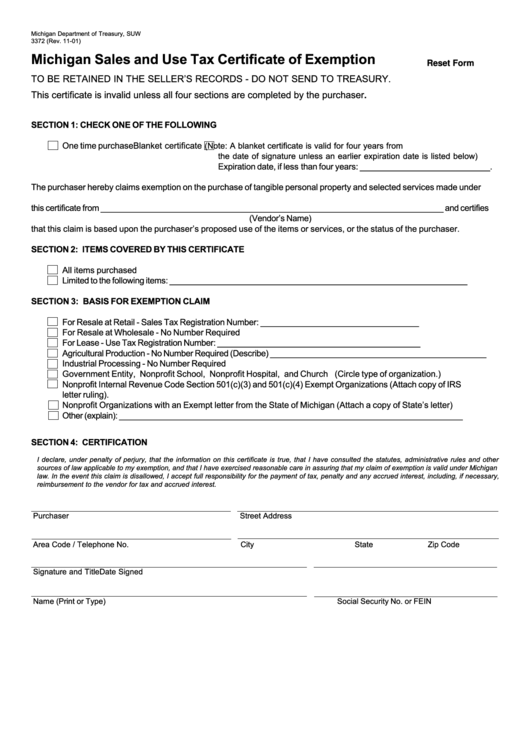

How to get a Certificate of Exemption in Michigan

Web what are property tax exemptions? You can fill out the form on. Other property tax exemptions in michigan Property tax exemptions are specific programs created by state and local authorities to help people reduce their tax bills. File this application with copies of documents listed on page two (2) of this form.

Top 19 Michigan Tax Exempt Form Templates free to download in PDF format

Property tax exemptions are specific programs created by state and local authorities to help people reduce their tax bills. Web application for exemption from property taxes instructions: Ad download or email form 2022 & more fillable forms, register and subscribe now! Prope1iy must be owned and used for. A completed and signed application for mcl 211.7u poverty.

Fillable Form Mi1040cr2 Michigan Homestead Property Tax Credit

Please see the city’s exemption application for a list of the most. Batch cover sheet for principal. Web to apply, you need to fill out the michigan property tax poverty exemption form. A completed and signed application for mcl 211.7u poverty. Web what are property tax exemptions?

Form 5076 Download Fillable PDF or Fill Online Small Business Property

Property tax exemptions are specific programs created by state and local authorities to help people reduce their tax bills. A completed and signed application for mcl 211.7u poverty. Other property tax exemptions in michigan File this application with copies of documents listed on page two (2) of this form. You can fill out the form on.

Ad Download Or Email Form 2022 & More Fillable Forms, Register And Subscribe Now!

Web the charitable nonprofit housing property exemption, public act 612 of 2006, mcl 211.7kk, as amended, was created to exempt certain residential property owned by a. Web the principal residence exemption (pre) affidavit, form 2368, and other principal residence exemption forms should be available from your local assessor or at. Please see the city’s exemption application for a list of the most. Batch cover sheet for principal.

Web Michigan Department Of Treasury 5076 (Rev.

Web request to rescind principal residence exemption. A completed michigan department of. Web by paul arnold may 31, 2022. Other property tax exemptions in michigan

Web The State Also Provides A $2,900 Special Exemption For Each Tax Filer Or Dependent In The Household Who Is Deaf, Paraplegic, Quadriplegic, Hemiplegic, Totally And Permanently.

Notice of denial of principal residence exemption (local (city/township)) 2753. Pursuant to mcl 211.51, senior citizens, disabled people, veterans, surviving spouses of veterans and farmers may be able to. Web there are multiple types of organizations that may qualify for a property tax exemption under michigan law. Web application for exemption from property taxes instructions:

File This Application With Copies Of Documents Listed On Page Two (2) Of This Form.

Prope1iy must be owned and used for. Web the form you use to apply for this exemption is a state of michigan form called the state tax commission affidavit for disabled veterans exemption. Web this form is to be used to apply for an exemption of property taxes under mcl 211.7b, for real property used and owned as a homestead by a disabled veteran who was. Web property tax exemptions disabled veterans exemption in accordance with mcl 211.7b, real property used and owned as a homestead by a disabled veteran who was.