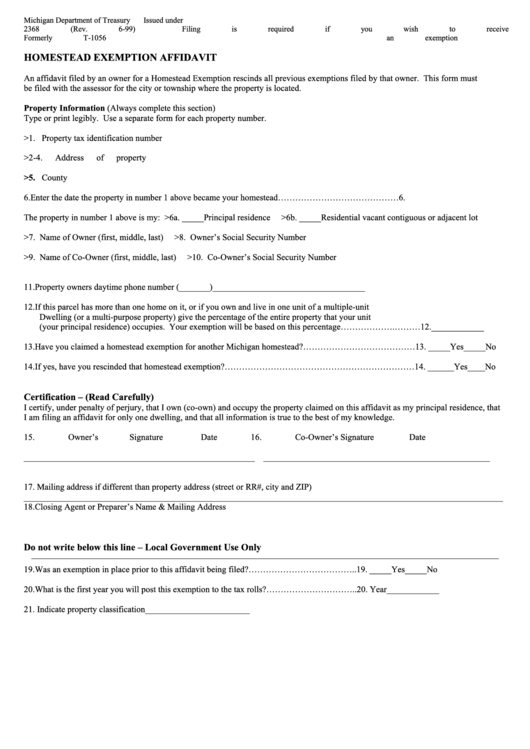

Michigan Homestead Exemption Form

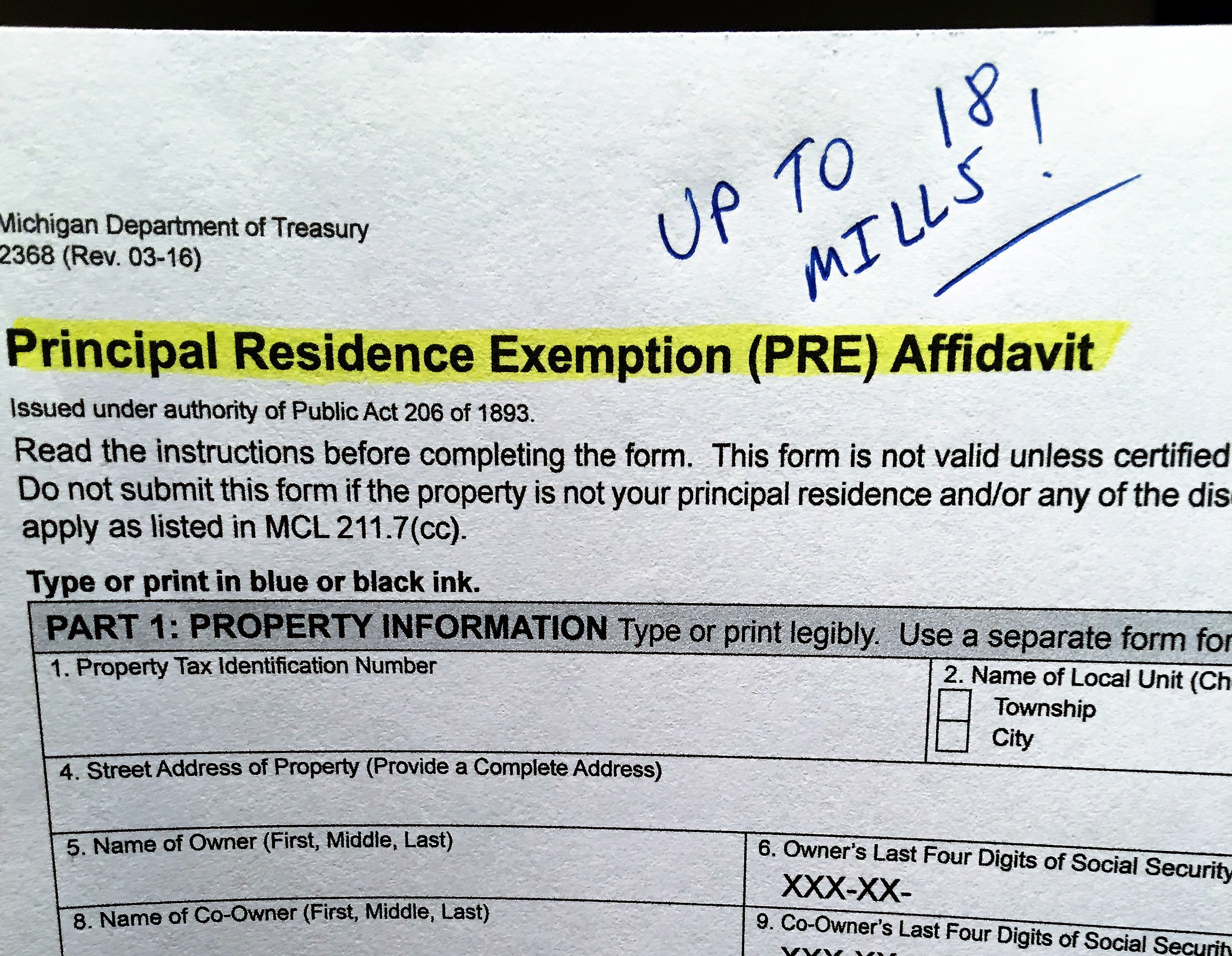

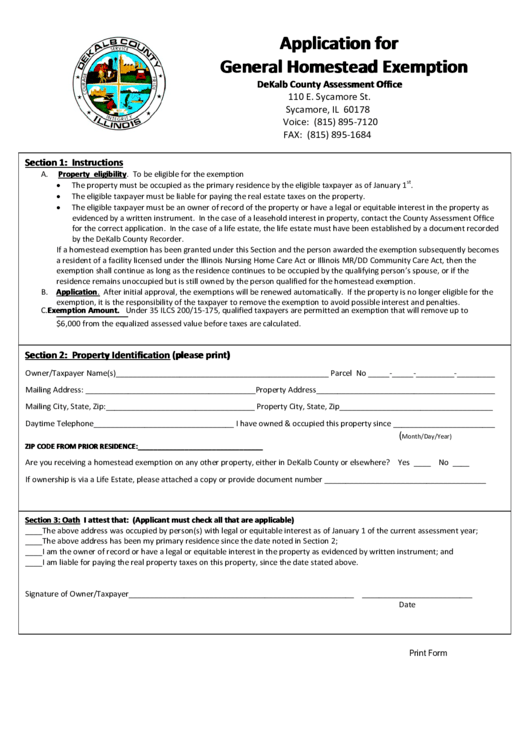

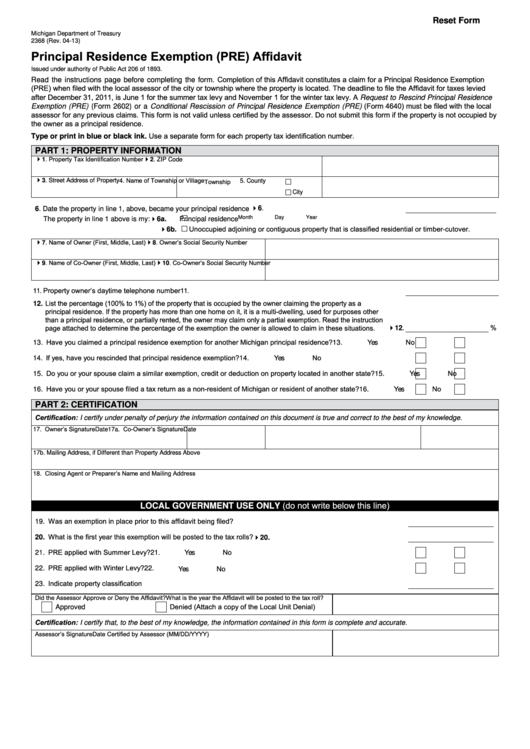

Michigan Homestead Exemption Form - Is there a filing deadline to request a principal residence exemption? Foreclosure entity payment form (pre) 5101. Web the form a michigan taxpayer must file to claim a homestead property tax credit depends on the filer's circumstances. There are two deadlines by which a principal residence exemption may be filed. The property must be owned by a person for the exemption to be effective. Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor. Web a michigan homeowner is only entitled to one personal residence exemption. Web if you own and occupy the property as your home, you should file a principal residence exemption affidavit (form 2368) with your county, city, township or village and submit your summer and winter property tax statements to michigan department of treasury for review. To claim the exemption, you must be a michigan resident who has not made this kind of claim for exemption in another state. Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser.

An additional $400 exemption is. Principal residence exemption affidavit for similar exemptions in. Web a michigan homeowner is only entitled to one personal residence exemption. Is there a filing deadline to request a principal residence exemption? Web foreclosure entity conditional rescission of a principal residence exemption (pre) 5005. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. The property must be owned by a person for the exemption to be effective. There are two deadlines by which a principal residence exemption may be filed. Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser.

Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. Principal residence exemption affidavit for similar exemptions in. Web the form a michigan taxpayer must file to claim a homestead property tax credit depends on the filer's circumstances. There are two deadlines by which a principal residence exemption may be filed. Download this form print this form The latter is called the michigan homestead property tax credit claim for veterans and blind people. An additional $400 exemption is. To claim the exemption, you must be a michigan resident who has not made this kind of claim for exemption in another state. Foreclosure entity payment form (pre) 5101.

Homestead Exemption in Michigan YouTube

Web the form a michigan taxpayer must file to claim a homestead property tax credit depends on the filer's circumstances. There are two deadlines by which a principal residence exemption may be filed. The property must be owned by a person for the exemption to be effective. Foreclosure entity payment form (pre) 5101. To claim the exemption, you must be.

Michigan Homestead Property Tax Credit Tax credits, Homestead

Principal residence exemption affidavit for similar exemptions in. Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor. To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file it with your township or city assessor. To claim the exemption, you must be a michigan.

Understanding Michigan’s Homestead Exemption Resnick Law, P.C.

To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file it with your township or city assessor. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. There are two deadlines by which a principal.

An Introduction to the Homestead Exemption Envoy Mortgage

Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1..

Form 2368 (Formerly T1056) Homestead Exemption Affidavit 1999

Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor. An additional $400 exemption is. Web a michigan homeowner is only entitled to one personal residence exemption. Web foreclosure entity conditional rescission of a principal residence exemption (pre) 5005. Principal residence exemption affidavit for similar exemptions in.

Your Homestead Exemption (AKA Principal Residence) Know the Limits!

The property must be owned by a person for the exemption to be effective. Download this form print this form There are two deadlines by which a principal residence exemption may be filed. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or.

Ingham County Property Homestead Exemption Form

An additional $400 exemption is. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. The latter is called the michigan homestead property tax credit claim for veterans and blind people. Web the state also provides a $2,900 special exemption.

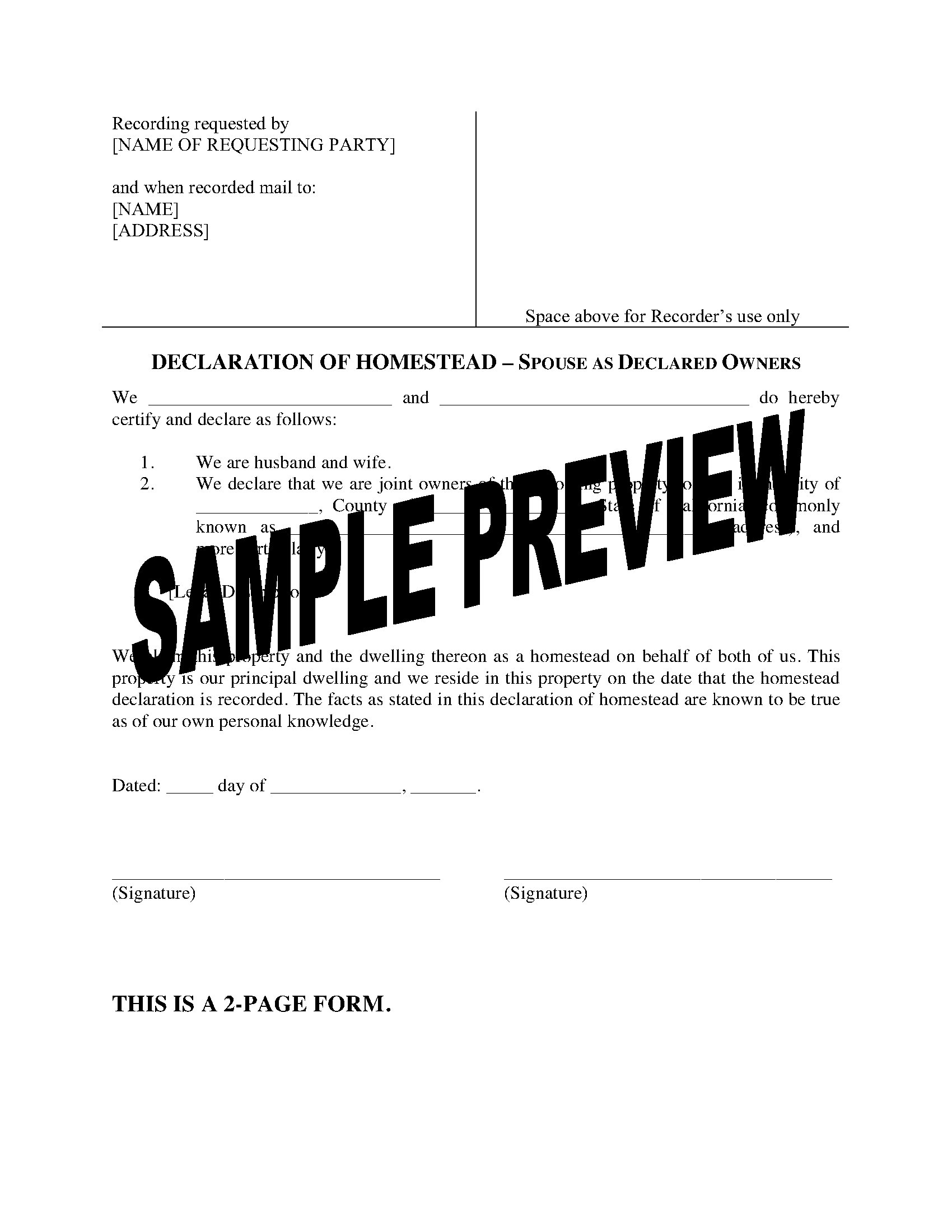

California Homestead Declaration Form for spouses Legal Forms and

Foreclosure entity payment form (pre) 5101. Web foreclosure entity conditional rescission of a principal residence exemption (pre) 5005. Web a michigan homeowner is only entitled to one personal residence exemption. The latter is called the michigan homestead property tax credit claim for veterans and blind people. Web if you own and occupy the property as your home, you should file.

Top Michigan Homestead Exemption Form Templates free to download in PDF

An additional $400 exemption is. Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor. Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser. Web if you own and occupy the property as.

Homestead Exemption Joel Richardson

Web a michigan homeowner is only entitled to one personal residence exemption. There are two deadlines by which a principal residence exemption may be filed. An additional $400 exemption is. To claim an exemption, complete the homeowner's principal residence exemption affidavit (form 2368) and file it with your township or city assessor. Web the state also provides a $2,900 special.

Failure To Do So May Subject You To Additional Tax Plus Penalties And Interest As Determined Under The General Property Tax Act.

Web the form a michigan taxpayer must file to claim a homestead property tax credit depends on the filer's circumstances. To claim the exemption, you must be a michigan resident who has not made this kind of claim for exemption in another state. The deadlines for a property owner to file a “principal residence exemption (pre) affidavit” (form 2368) for taxes are on or before june 1 or on or before november 1. Is there a filing deadline to request a principal residence exemption?

The Latter Is Called The Michigan Homestead Property Tax Credit Claim For Veterans And Blind People.

Web if you own and occupy the property as your home, you should file a principal residence exemption affidavit (form 2368) with your county, city, township or village and submit your summer and winter property tax statements to michigan department of treasury for review. The property must be owned by a person for the exemption to be effective. Download this form print this form Web michigan — homestead property tax credit claim download this form print this form it appears you don't have a pdf plugin for this browser.

Web Foreclosure Entity Conditional Rescission Of A Principal Residence Exemption (Pre) 5005.

Web a michigan homeowner is only entitled to one personal residence exemption. Foreclosure entity payment form (pre) 5101. There are two deadlines by which a principal residence exemption may be filed. Web the state also provides a $2,900 special exemption for each tax filer or dependent in the household who is deaf, paraplegic, quadriplegic, hemiplegic, totally and permanently disabled or blind.

To Claim An Exemption, Complete The Homeowner's Principal Residence Exemption Affidavit (Form 2368) And File It With Your Township Or City Assessor.

Principal residence exemption affidavit for similar exemptions in. An additional $400 exemption is. Web rescind principal residence exemption (pre) (form 2602) or file a conditional rescission (form 4640) with your township or city assessor.