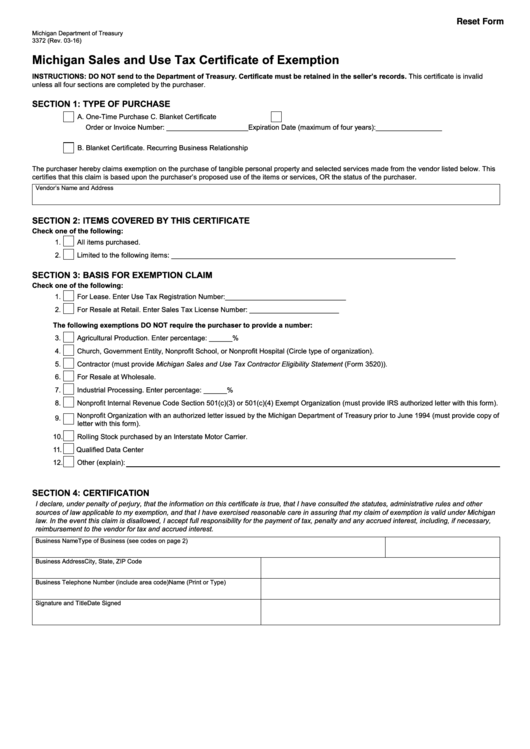

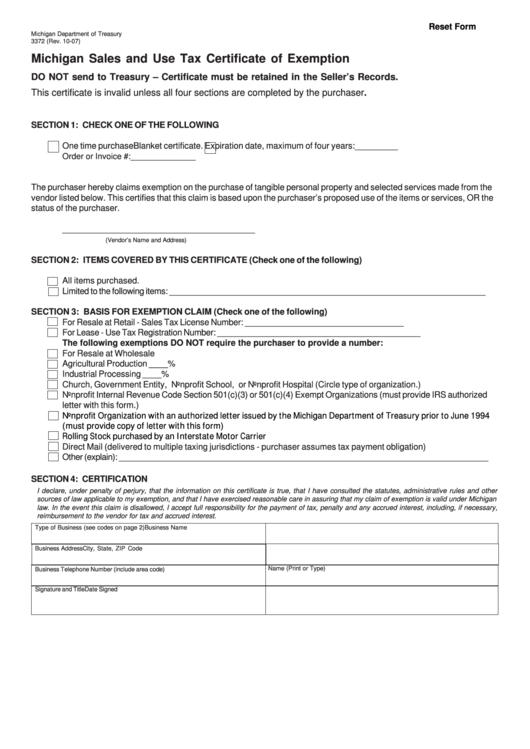

Michigan Form 3372

Michigan Form 3372 - Sales, use and withholding tax due dates for holidays and weekends: This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections. This certificate is invalid unless all four sections are completed by the purchaser. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury. Health insurance claims assessment (hica) ifta / motor carrier; This certificate is invalid unless all four sections are completed by the purchaser. Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Web michigan department of treasuryform 3372 (rev.

Therefore, you can complete the 3372 tax exemption certificate form by providing your michigan sales tax number. Web instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: This certificate is invalid unless all four sections are completed by the purchaser. Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Web michigan department of treasuryform 3372 (rev. Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Sales, use and withholding tax due dates for holidays and weekends: Certificate must be retained in the seller’s records. Web michigan department of treasuryform 3372 (rev. Certificate must be retained in the seller’s records.

This certificate is invalid unless all four sections are completed by the purchaser. Certificate must be retained in the seller’s records. Web michigan department of treasury 3372 (rev. Do not send a copy to treasury unless one is requested. Certificate must be retained in the seller’s records. Web once you have that, you are eligible to issue a resale certificate. Sales, use and withholding tax due dates for holidays and weekends: Web michigan department of treasury 3372 (rev. Certificate must be retained in the seller’s records. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following:

MI 5081 Instruction 2020 Fill out Tax Template Online US Legal Forms

Web once you have that, you are eligible to issue a resale certificate. Do not send a copy to treasury unless one is requested. Web michigan department of treasuryform 3372 (rev. Sales, use and withholding tax due dates for holidays and weekends: Sales and use tax forms index by year

Sales Order Form Template Business

Certificate must be retained in the seller’s records. Web michigan department of treasuryform 3372 (rev. Fill out the michigan 3372 tax exemption certificate form Corporate income tax (cit) city income tax forms; A seller must meet a.

Form A226 Download Fillable PDF or Fill Online Michigan Department of

Sales and use tax forms index by year Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Web michigan department of treasury 3372 (rev. This certificate is invalid unless all four sections are completed by the purchaser. This certificate is invalid unless all four sections are completed by the purchaser.

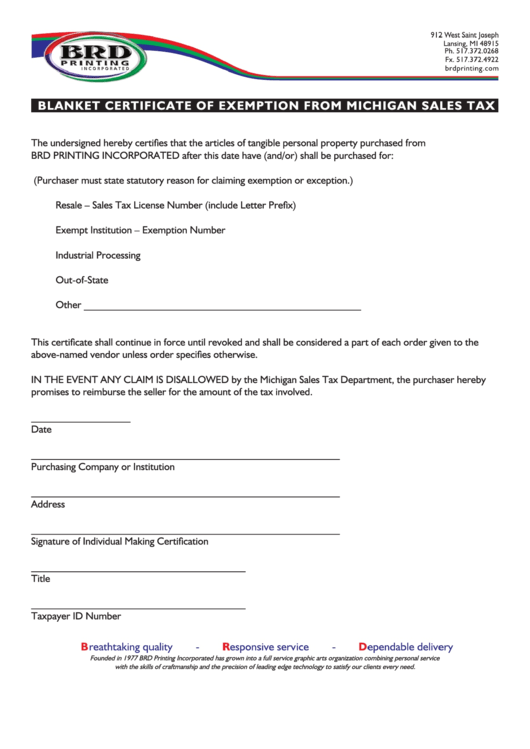

Blank Michigan Sales Tax Exempt Form

Web instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Web once you have that, you are eligible to issue a resale certificate. Certificate must be retained in the seller’s records. Certificate must be.

Michigan form 3372 Fill out & sign online DocHub

Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Sales and use tax forms index by year Corporate income tax (cit) city income tax forms; Web michigan department of treasury 3372 (rev. Web michigan department of treasury 3372.

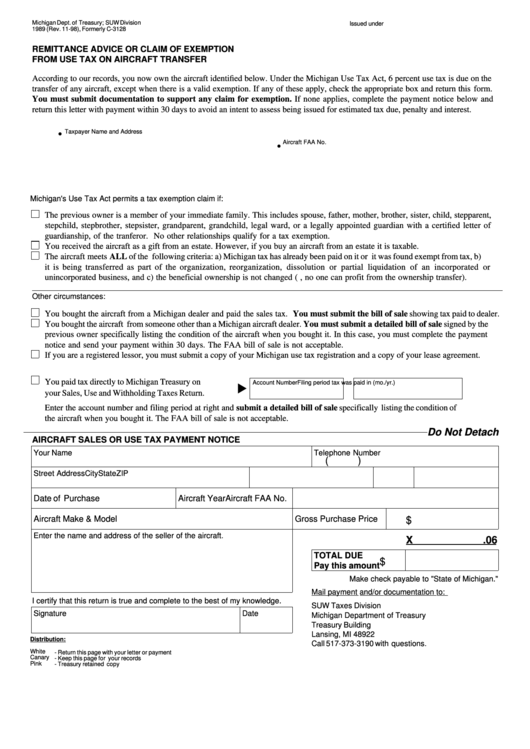

Aircraft Sales Or Use Tax Payment Notice Michigan Deptartment Of

Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Certificate must be retained in the seller’s records. Do not send to the department of treasury. Certificate must be retained in the seller’s records. Web instructions for payments of michigan.

How to get a Certificate of Exemption in Michigan

Web michigan department of treasury 3372 (rev. This certificate is invalid unless all four sections are completed by the purchaser. Do not send a copy to treasury unless one is requested. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. Certificate must be retained in the seller’s records.

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Certificate must be retained in the seller’s records. A seller must meet a. Web michigan department of treasury 3372 (rev. Web michigan department of treasury 3372 (rev. This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections.

Fillable Form 3372 Michigan Sales And Use Tax Certificate Of

Certificate must be retained in the seller’s records. Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Michigan sales and use tax certificate of exemption (form 3372) multistate tax commission's uniform sales and. This certificate is invalid unless all four sections are completed by the purchaser. A seller must meet.

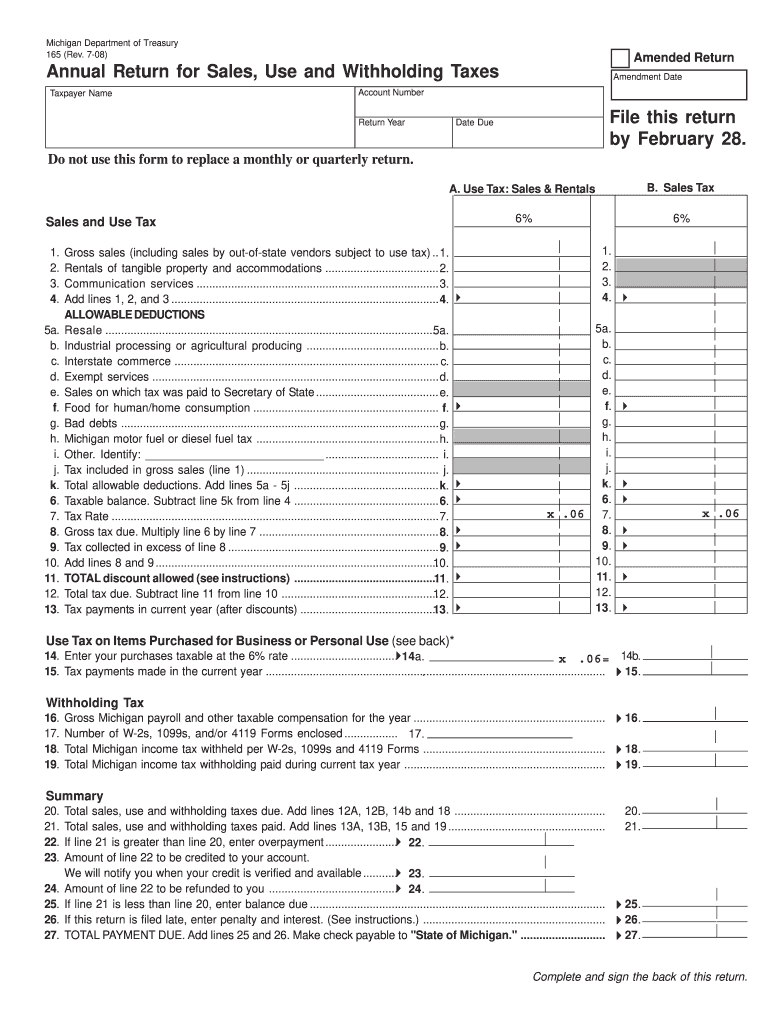

Michigan Form 165 Fill Online, Printable, Fillable, Blank pdfFiller

Web instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Sales, use and withholding tax due dates for holidays and weekends: Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing.

Web Michigan Department Of Treasuryform 3372 (Rev.

Web instructions for completing form 3372, michigan sales and use tax certificate of exemption the purchaser shall complete all four sections of the exemption certificate to establish a valid exemption claim. Do not send to the department of treasury. Web instructions for payments of michigan sales, use, withholding, and other michigan business taxes using electronic funds transfer (eft) credit: Corporate income tax (cit) city income tax forms;

Michigan Sales And Use Tax Certificate Of Exemption (Form 3372) Multistate Tax Commission's Uniform Sales And.

Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will result in an invalid filing and will not be accepted by treasury. Certificate must be retained in the seller’s records. Web michigan department of treasury 3372 (rev. This certificate is invalid unless all four sections are completed by the purchaser.

Sales, Use And Withholding Tax Due Dates For Holidays And Weekends:

Web sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. This exemption claim should be completed by the purchaser, provided to the seller, and is not valid unless the information in all four sections. Do not send a copy to treasury unless one is requested. Certificate must be retained in the seller’s records.

Sales And Use Tax Forms Index By Year

Michigan sales and use tax certificate of exemption: This certificate is invalid unless all four sections are completed by the purchaser. Web in order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Web once you have that, you are eligible to issue a resale certificate.