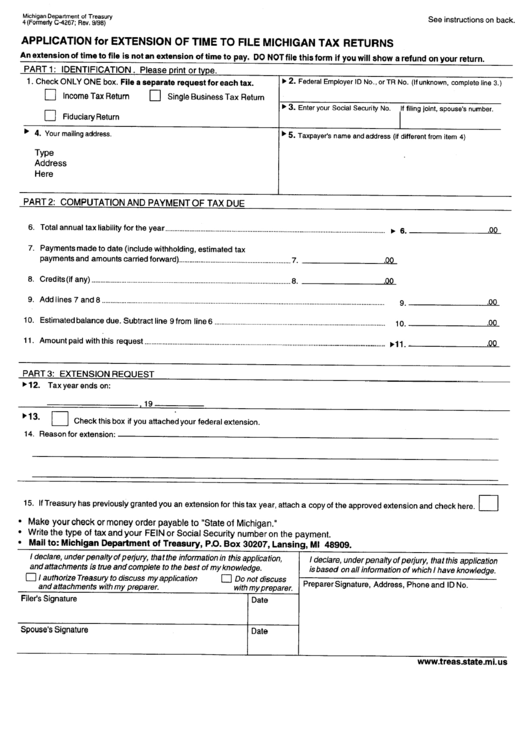

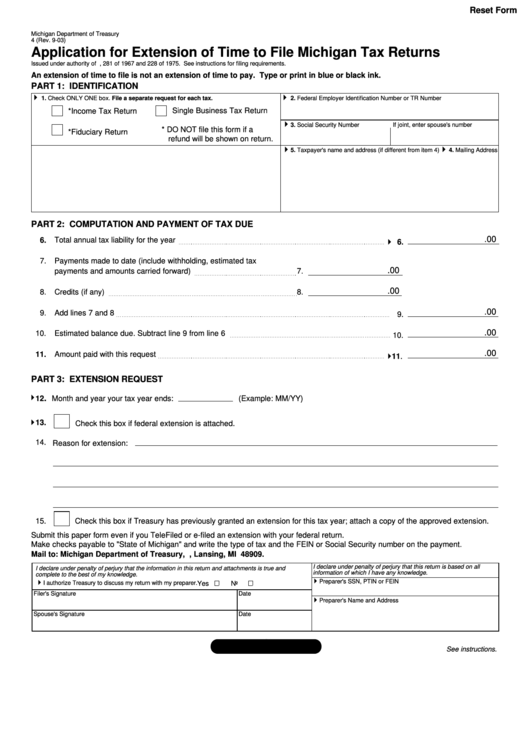

Michigan Extension Form 4

Michigan Extension Form 4 - Web the taxpayer will need to file form 4, instructions for application for extension of time to file michigan tax returns, include a copy of the federal extension request and pay tax. Web michigan individual income tax extension (form 4) the dropdown menu will identify the specific tax year and payment type currently available. If you have not been granted a federal. Extension, the michigan department of treasury (treasury) will grant a 6 month. Web to request an extension of time to file the state of michigan tax form, please follow the instructions for form 4, instructions for application for extension of. Public act 38 of 2011 established the michigan file form 4 or a copy of your federal extension. Treasury will not notify you of. Web if a federal extension is not filed, taxpayers must send payment with form 4, application for extension of time to file michigan tax returns. Looking for forms from 2015 and earlier? Web if you do not have a federal extension, file an application for extension of time to file michigan tax returns ( form 4) with your payment.

What will i need to make a. Web federal extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month. Public act 38 of 2011 established the michigan file form 4 or a copy of your federal extension. More about the michigan form 4 extension we last. Looking for forms from 2015 and earlier? Web 2018 fiduciary tax forms. Web if a federal extension is not filed, taxpayers must send payment with form 4, application for extension of time to file michigan tax returns. Web individual and fiduciary filers submit form 4 or a copy of your federal extension. Extension, the michigan department of treasury (treasury) will grant a 6 month. Look for forms using our forms search or view a list of income tax forms by.

Web the taxpayer will need to file form 4, instructions for application for extension of time to file michigan tax returns, include a copy of the federal extension request and pay tax. If you have not been granted a federal. Web to request an extension of time to file the state of michigan tax form, please follow the instructions for form 4, instructions for application for extension of. Explore more file form 4868 and extend your 1040 deadline. Look for forms using our forms search or view a list of income tax forms by. Extension, the michigan department of treasury (treasury) will grant a 6 month. An extension of time to file the federal return automatically extends the time to file the. What will i need to make a. Treasury will not notify you of. Web a fiscal year taxpayer may request an additional extension on form 4, application for extension of time to file michigan tax returns, if the extension to april 30, 2013,.

Learn about Michigan’s lakes online from MSU Extension

Extension, the michigan department of treasury (treasury) will grant a 6 month. Web to apply for a michigan extension, file form 4 (application for extension of time to file michigan tax returns) by the original due date of your return (april 30). Web individual and fiduciary filers submit form 4 or a copy of your federal extension. Web if a.

Fillable Form 4 Application For Extension Of Time To File Michigan

An extension of time to file the federal return automatically extends the time to file the. Looking for forms from 2015 and earlier? Web federal extension, the michigan department of treasury (treasury) will grant a 6 month extension for individual income tax (iit) and composite returns, or a 5.5 month. Web if you do not have a federal extension, file.

Fillable Form 4 Application For Extension Of Time To File Michigan

More about the michigan form 4 extension we last. Web a fiscal year taxpayer may request an additional extension on form 4, application for extension of time to file michigan tax returns, if the extension to april 30, 2013,. Extension, the michigan department of treasury (treasury) will grant a 6 month. Web individual and fiduciary filers submit form 4 or.

HathiTrust Members Opening State and Local Agriculture Document

Web if you do not have a federal extension, file an application for extension of time to file michigan tax returns ( form 4) with your payment. Web if a federal extension is not filed, taxpayers must send payment with form 4, application for extension of time to file michigan tax returns. Web a fiscal year taxpayer may request an.

Extensole Corp. French Provincial Style Cherrywood Extending Games

Web a fiscal year taxpayer may request an additional extension on form 4, application for extension of time to file michigan tax returns, if the extension to april 30, 2013,. More about the michigan form 4 extension we last. Web an extension of time to file is not an extension of time to pay. Solved•by intuit•updated july 14, 2022. Web.

Btec extension form (4) (1)

Web income tax forms 2022 individual income tax forms and instructions need a different form? Web an extension of time to file is not an extension of time to pay. Looking for forms from 2015 and earlier? Web common questions about michigan extensions. If you have not been granted a federal.

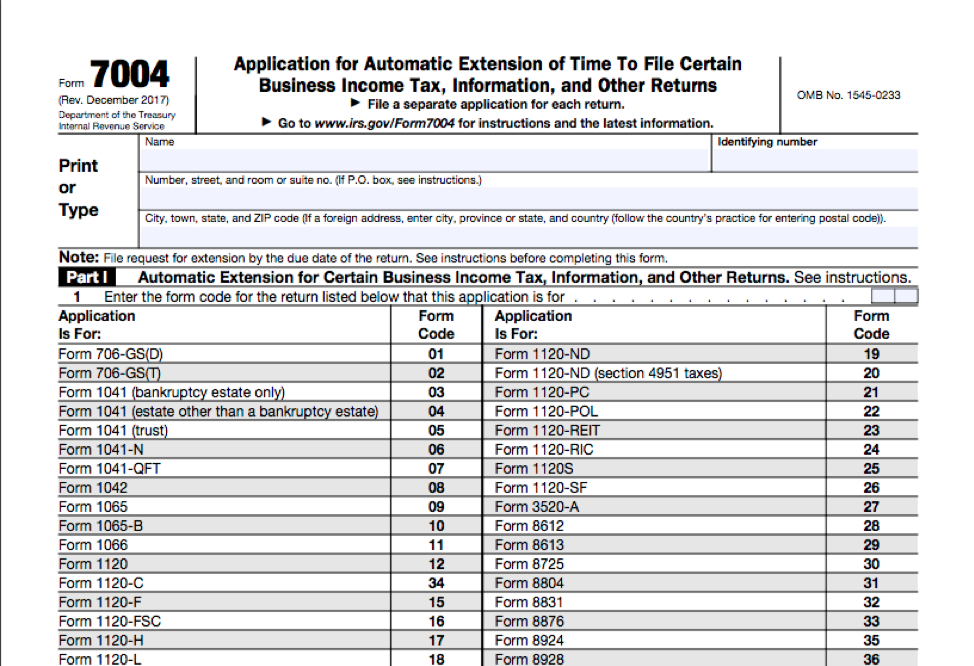

How to File for a Business Tax Extension (Federal) Bench Accounting

Explore more file form 4868 and extend your 1040 deadline. Treasury will not notify you of. Look for forms using our forms search or view a list of income tax forms by. Web if a federal extension is not filed, taxpayers must send payment with form 4, application for extension of time to file michigan tax returns. Web federal extension,.

Sculptural Relief University of Michigan Extension Servic… Flickr

Web a fiscal year taxpayer may request an additional extension on form 4, application for extension of time to file michigan tax returns, if the extension to april 30, 2013,. Web individual and fiduciary filers submit form 4 or a copy of your federal extension. If you have not been granted a federal. Web if a federal extension is not.

Extension of Expiration of Driver’s Licenses, State ID Cards, Vehicle

Web michigan individual income tax extension (form 4) the dropdown menu will identify the specific tax year and payment type currently available. Web individual and fiduciary filers submit form 4 or a copy of your federal extension. Explore more file form 4868 and extend your 1040 deadline. What will i need to make a. Public act 38 of 2011 established.

Pin on Healthy Tips

Extension, the michigan department of treasury (treasury) will grant a 6 month. Solved•by intuit•updated july 14, 2022. Web a fiscal year taxpayer may request an additional extension on form 4, application for extension of time to file michigan tax returns, if the extension to april 30, 2013,. Web if you do not have a federal extension, file an application for.

More About The Michigan Form 4 Extension We Last.

Looking for forms from 2015 and earlier? What will i need to make a. Web the taxpayer will need to file form 4, instructions for application for extension of time to file michigan tax returns, include a copy of the federal extension request and pay tax. If you have not been granted a federal.

Web To Apply For A Michigan Extension, File Form 4 (Application For Extension Of Time To File Michigan Tax Returns) By The Original Due Date Of Your Return (April 30).

An extension of time corporate income tax (cit). Look for forms using our forms search or view a list of income tax forms by. Web michigan individual income tax extension (form 4) the dropdown menu will identify the specific tax year and payment type currently available. Web individual and fiduciary filers submit form 4 or a copy of your federal extension.

Web Federal Extension, The Michigan Department Of Treasury (Treasury) Will Grant A 6 Month Extension For Individual Income Tax (Iit) And Composite Returns, Or A 5.5 Month.

Public act 38 of 2011 established the michigan file form 4 or a copy of your federal extension. Web 2018 fiduciary tax forms. Web if a federal extension is not filed, taxpayers must send payment with form 4, application for extension of time to file michigan tax returns. An extension of time to file the federal return automatically extends the time to file the.

Web If You Do Not Have A Federal Extension, File An Application For Extension Of Time To File Michigan Tax Returns ( Form 4) With Your Payment.

Web a fiscal year taxpayer may request an additional extension on form 4, application for extension of time to file michigan tax returns, if the extension to april 30, 2013,. Web an extension of time to file is not an extension of time to pay. Solved•by intuit•updated july 14, 2022. Web to request an extension of time to file the state of michigan tax form, please follow the instructions for form 4, instructions for application for extension of.