Mi Form 1040

Mi Form 1040 - You may file online with efile or by mail. Type or print in blue or black ink. Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. You may file online with efile or by mail. 90 percent of your total 2021 tax (qualified farmers, 110 percent of your total 2020 tax if your 2020 adjusted. Who must file estimated tax payments you must make estimated. Payment for tax due on the 2022. Issued under authority of public act 281 of 1967, as amended. Web individual income tax forms and instructions www.mifastfile.org unclaimed property. Web michigan became the first state to allow individuals to sign up to be an organ donor on their state income tax return, according to the governor's office.

Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. The michigan department of treasury is holding millions of. Where is your michigan tax refund money? Who must file estimated tax payments you must make estimated. Only married filers may file joint returns. You may file online with efile or by mail. This form is for income earned in tax year 2022, with tax returns due in april. 2020 michigan individual income tax return mi. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. If you enter the word “income” in the form.

Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. Issued under authority of public act 281 of 1967, as amended. You may file online with efile or by mail. Michigan state income tax forms for current and previous tax years. Type or print in blue or black ink. Where is your michigan tax refund money? Payment for tax due on the 2022. Who must file estimated tax payments you must make estimated. You may file online with efile or by mail. Web michigan department of treasury (rev.

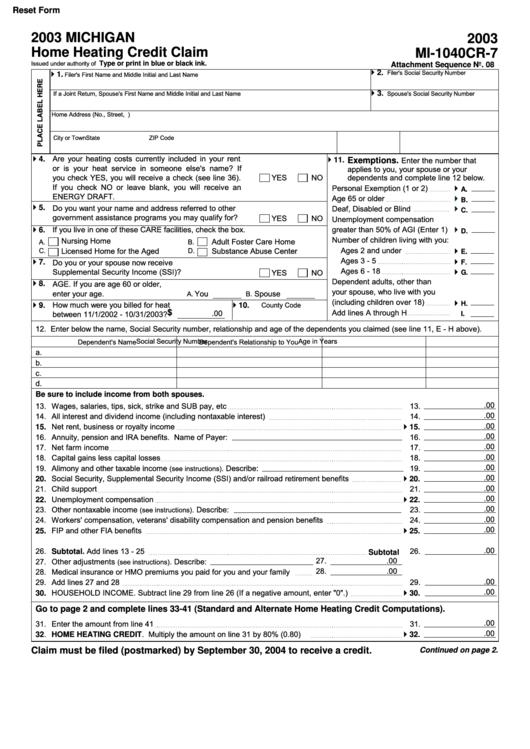

MI MI1040CR7 2018 Fill and Sign Printable Template Online US

Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. Type or print in blue or black ink. Who must file estimated tax payments you must make estimated. You may file online with efile or by mail. Web michigan became the first state to allow individuals.

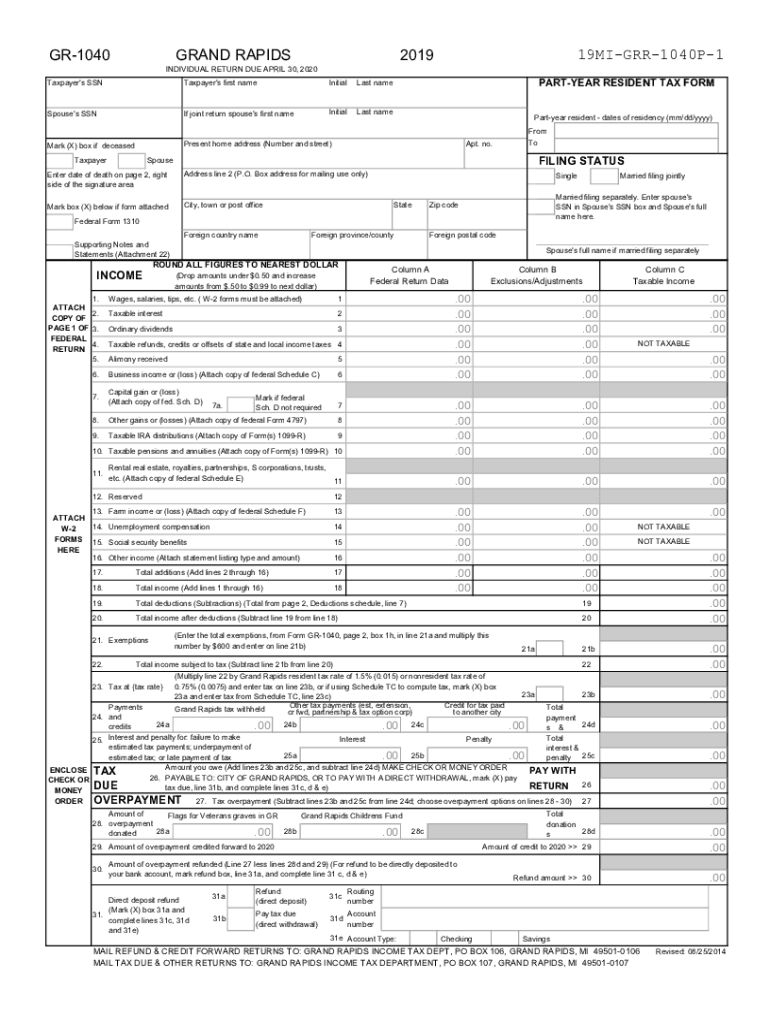

MI GR1040 2019 Fill out Tax Template Online US Legal Forms

The michigan department of treasury is holding millions of. Web michigan department of treasury (rev. This form is for income earned in tax year 2022, with tax returns due in april. Who must file estimated tax payments you must make estimated. If you enter the word “income” in the form.

Fillable Form Mi1040cr7 Home Heating Credit Claim 2003 printable

Where is your michigan tax refund money? Web michigan income tax forms. Web michigan became the first state to allow individuals to sign up to be an organ donor on their state income tax return, according to the governor's office. 90 percent of your total 2021 tax (qualified farmers, 110 percent of your total 2020 tax if your 2020 adjusted..

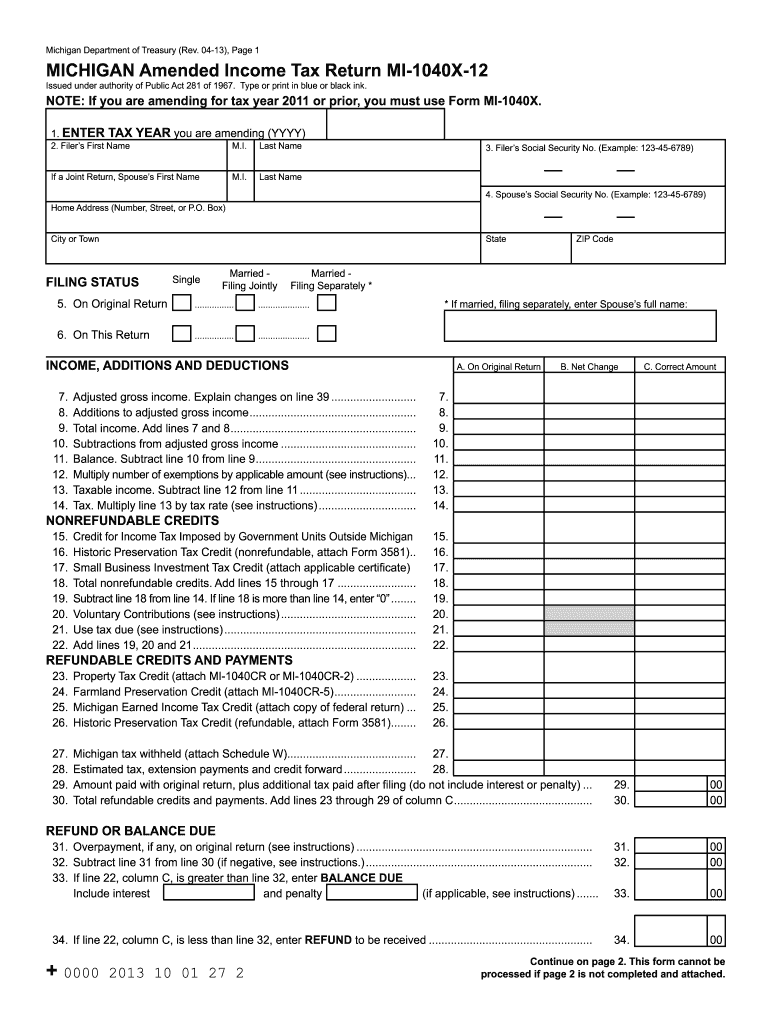

Fill Free fillable Form MI1040X12 Amended Tax Return 2017

Web michigan income tax forms. 90 percent of your total 2021 tax (qualified farmers, 110 percent of your total 2020 tax if your 2020 adjusted. If you enter the word “income” in the form. Web individual income tax forms and instructions www.mifastfile.org unclaimed property. Payment for tax due on the 2022.

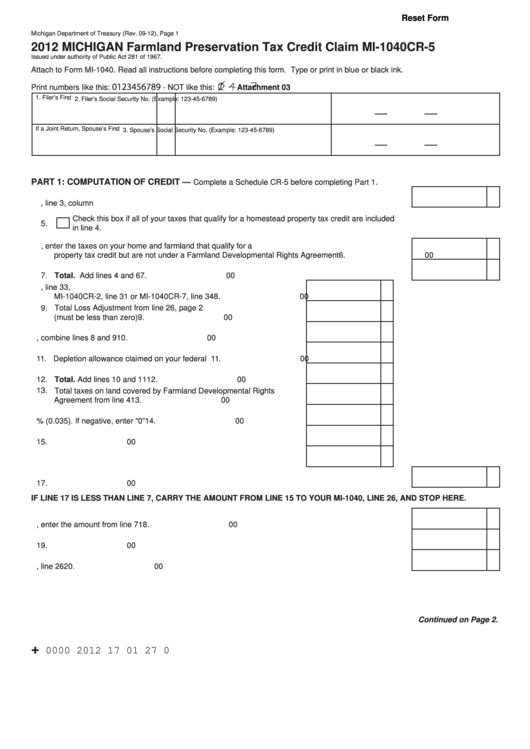

Fillable Form Mi1040cr5 Michigan Farmland Preservation Tax Credit

Type or print in blue or black ink. Michigan state income tax forms for current and previous tax years. 2020 michigan individual income tax return mi. Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. Issued under authority of public act 281 of 1967, as.

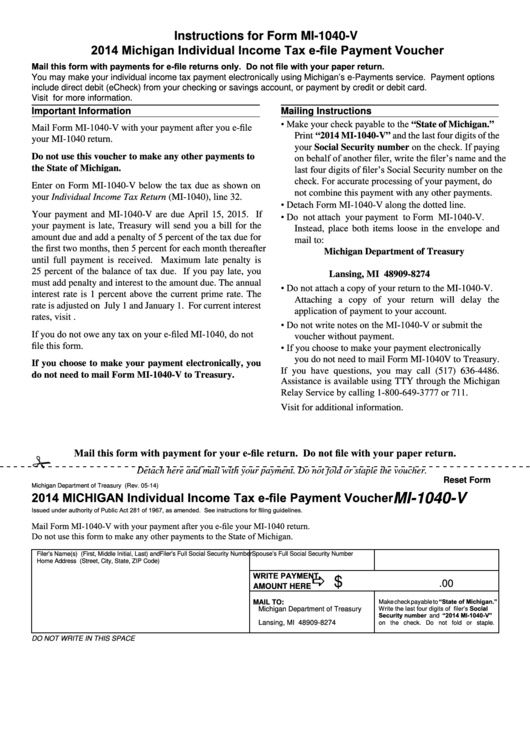

Fillable Form Mi1040V Individual Tax EFile Payment Voucher

Where is your michigan tax refund money? Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. If you enter the word “income” in the form. The michigan department of treasury is holding millions of. Issued under authority of public act 281 of 1967, as amended.

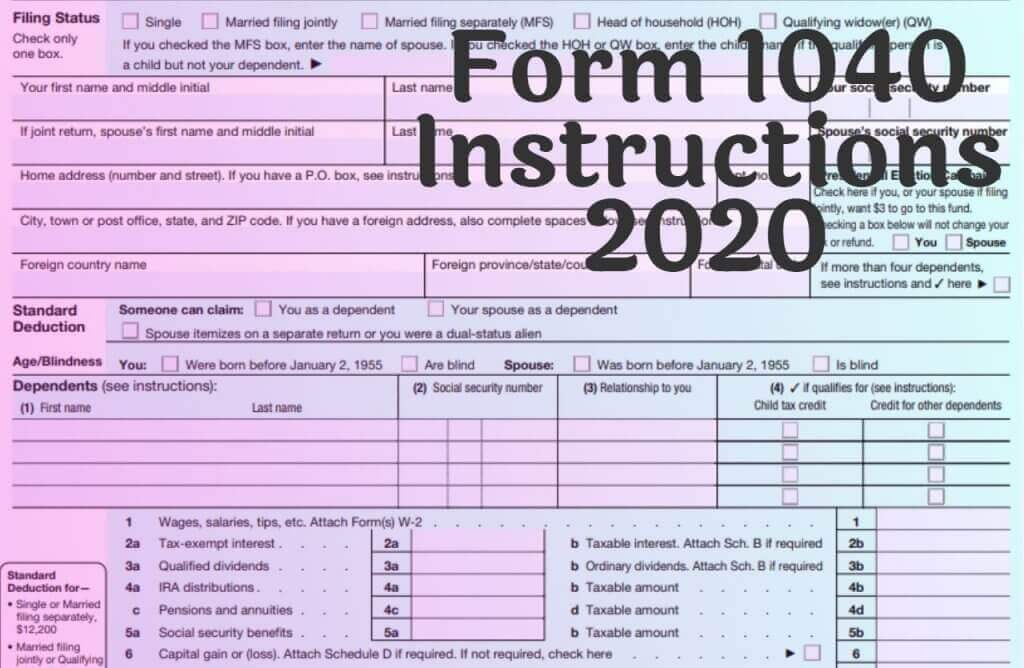

Form 1040 Instructions 2020

Type or print in blue or black ink. Only married filers may file joint returns. Where is your michigan tax refund money? Web michigan income tax forms. You may file online with efile or by mail.

Form 1040 U.S. Individual Tax Return Definition

Payment for tax due on the 2022. This form is for income earned in tax year 2022, with tax returns due in april. Web michigan income tax forms. If you enter the word “income” in the form. Web michigan department of treasury (rev.

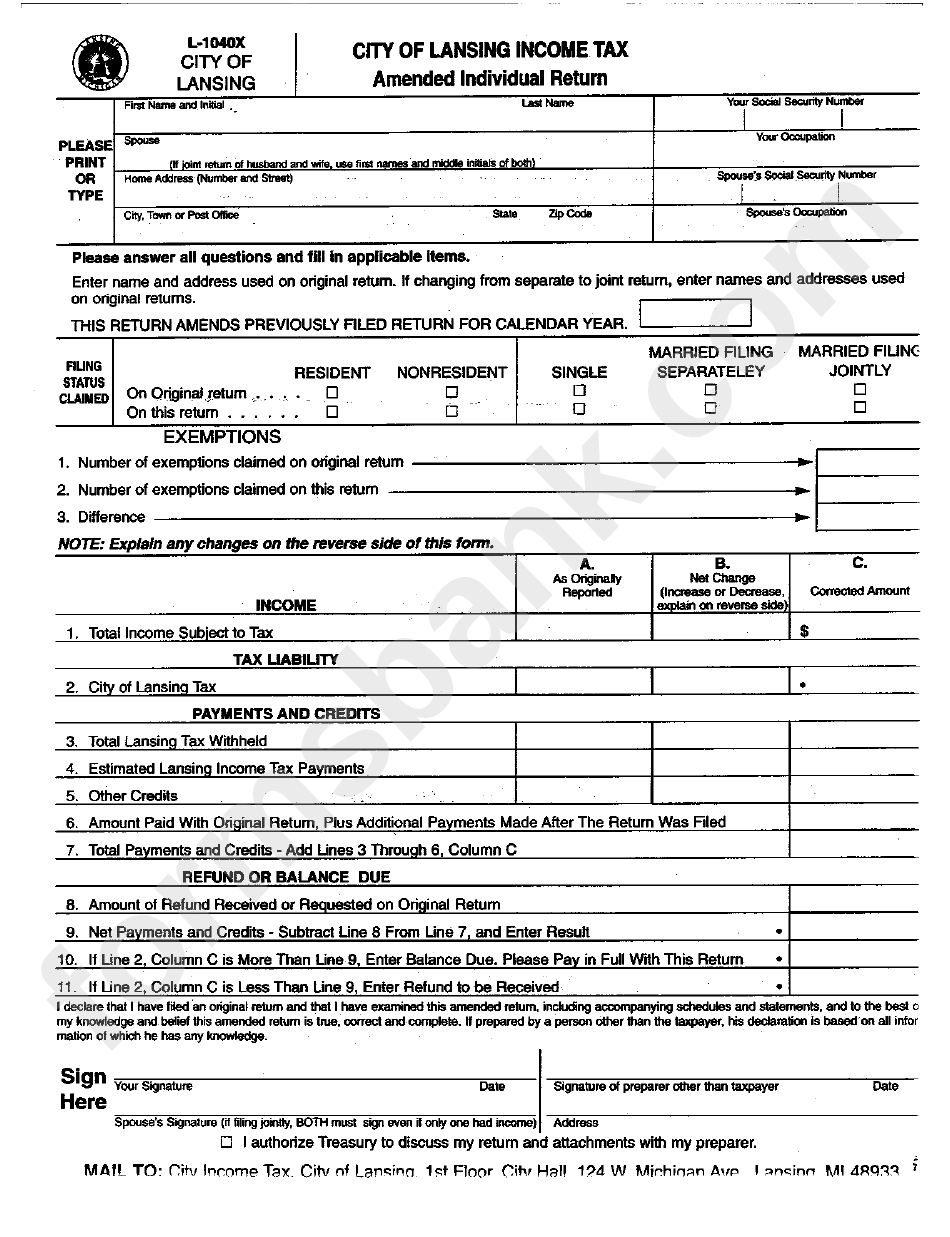

Form L1040x Amended Individual Return City Of Lansing printable

Web michigan income tax forms. If you enter the word “income” in the form. Web michigan became the first state to allow individuals to sign up to be an organ donor on their state income tax return, according to the governor's office. Web for example, if you search using tax year 2022 and individual income tax as the tax area,.

Mi 1040X Fill Out and Sign Printable PDF Template signNow

You may file online with efile or by mail. Who must file estimated tax payments you must make estimated. Web michigan department of treasury (rev. Michigan state income tax forms for current and previous tax years. Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed.

Type Or Print In Blue Or Black Ink.

Web michigan income tax forms. Web individual income tax forms and instructions www.mifastfile.org unclaimed property. Only married filers may file joint returns. Issued under authority of public act 281 of 1967, as amended.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

90 percent of your total 2021 tax (qualified farmers, 110 percent of your total 2020 tax if your 2020 adjusted. The michigan department of treasury is holding millions of. Web michigan department of treasury (rev. Web michigan became the first state to allow individuals to sign up to be an organ donor on their state income tax return, according to the governor's office.

Michigan State Income Tax Forms For Current And Previous Tax Years.

Where is your michigan tax refund money? 2020 michigan individual income tax return mi. You may file online with efile or by mail. Payment for tax due on the 2022.

Who Must File Estimated Tax Payments You Must Make Estimated.

Web for example, if you search using tax year 2022 and individual income tax as the tax area, 40+ form results will be displayed. Web 2017 individual income tax 2016 individual income tax previous years fiduciary tax forms 2021 fiduciary tax forms 2020 fiduciary tax forms 2019 fiduciary tax forms. You may file online with efile or by mail. You may file online with efile or by mail.

:max_bytes(150000):strip_icc()/ScreenShot2020-01-29at2.02.36PM-684e12df977744fa8f7e2c37999d5118.png)