Maryland Form 511 Instructions

Maryland Form 511 Instructions - Web ptes making the pte election to pay maryland tax on behalf of all members must now file the new form 511. Ptes that have already made the election on a filed. There has been an update to our previous news brief regarding the maryland form 511. Web select the applicable return type below for instructions on generating the form 510 or form 511 in proseries 2021 and newer: Web this affirms the instructions for 2023 maryland form 510/511d: Web the newly released maryland administrative release no. To claim the credit on an individual. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. State and local taxes based on income (trade/business, rental.

State and local taxes based on income (trade/business, rental. There has been an update to our previous news brief regarding the maryland form 511. To claim the credit on an individual. What is maryland form 511? Web others (see instructions) e. State and local taxes based on income. The form 511 won't generate unless you check both the print updated. Ptes that have already made the election on a filed. 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web select the applicable return type below for instructions on generating the form 510 or form 511 in proseries 2021 and newer:

State and local taxes based on income (trade/business, rental. Ptes that have already made the election on a filed. Web ptes making the pte election to pay maryland tax on behalf of all members must now file the new form 511. State and local taxes based on income. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. News | july 1, 2021. Web select the applicable return type below for instructions on generating the form 510 or form 511 in proseries 2021 and newer: 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. There has been an update to our previous news brief regarding the maryland form 511. Web others (see instructions) e.

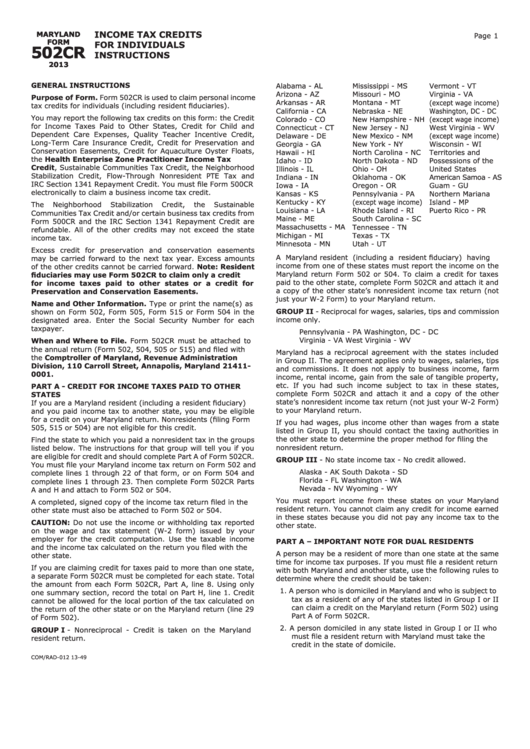

Instructions For Maryland Form 502cr Tax Credits For

Web refer to the above instructions for generating form 511 when filing an amended return. Web others (see instructions) e. Web select the applicable return type below for instructions on generating the form 510 or form 511 in proseries 2021 and newer: Web this affirms the instructions for 2023 maryland form 510/511d: There has been an update to our previous.

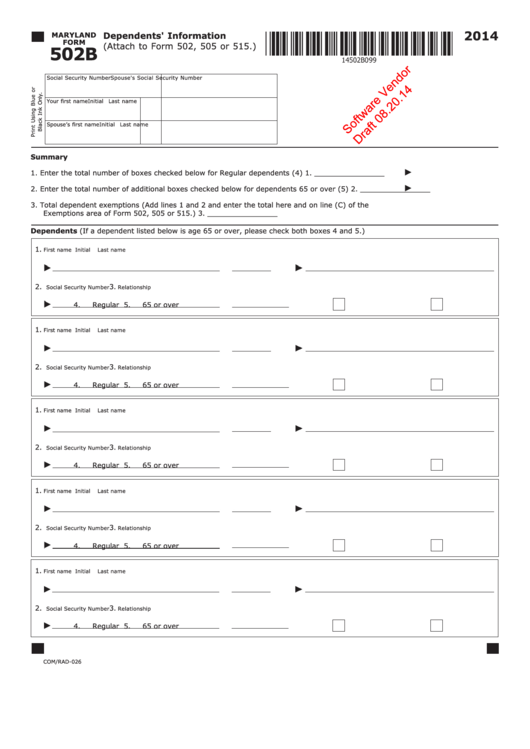

Maryland Form 502b Draft Dependents' Information 2014 printable pdf

The form 511 won't generate unless you check both the print updated. News | july 1, 2021. What is maryland form 511? 6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web others (see instructions) e.

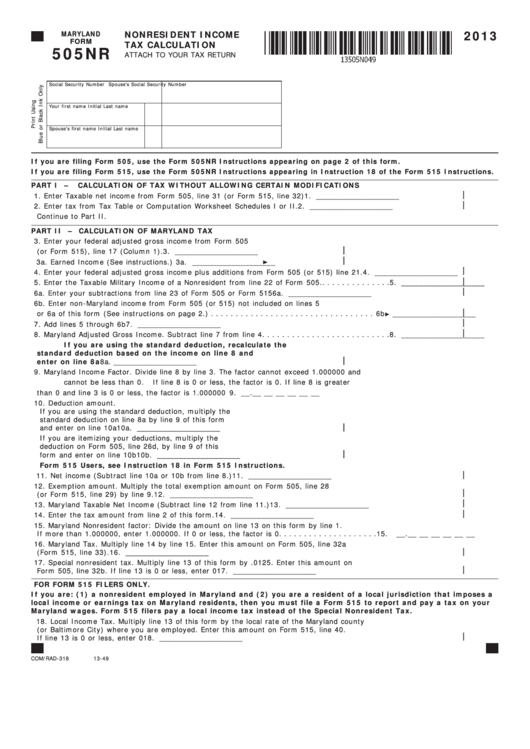

Fillable Maryland Form 505nr Nonresident Tax Calculation

6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web others (see instructions) e. There has been an update to our previous news brief regarding the maryland form 511. What is maryland form 511? State and local taxes based on income.

Maryland Printable Tax Forms Printable Form 2022

6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. There has been an update to our previous news brief regarding the maryland form 511. The form 511 won't generate unless you check both the print updated. Ptes that have already made the election on a filed. Web others (see instructions) e.

New Form 511 May Extend Maryland PassThrough Entities’ Deadline I95

Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. State and local taxes based on income. State and local taxes based on income (trade/business, rental. Ptes that have already made the election on a filed. Web this affirms the instructions for 2023 maryland form 510/511d:

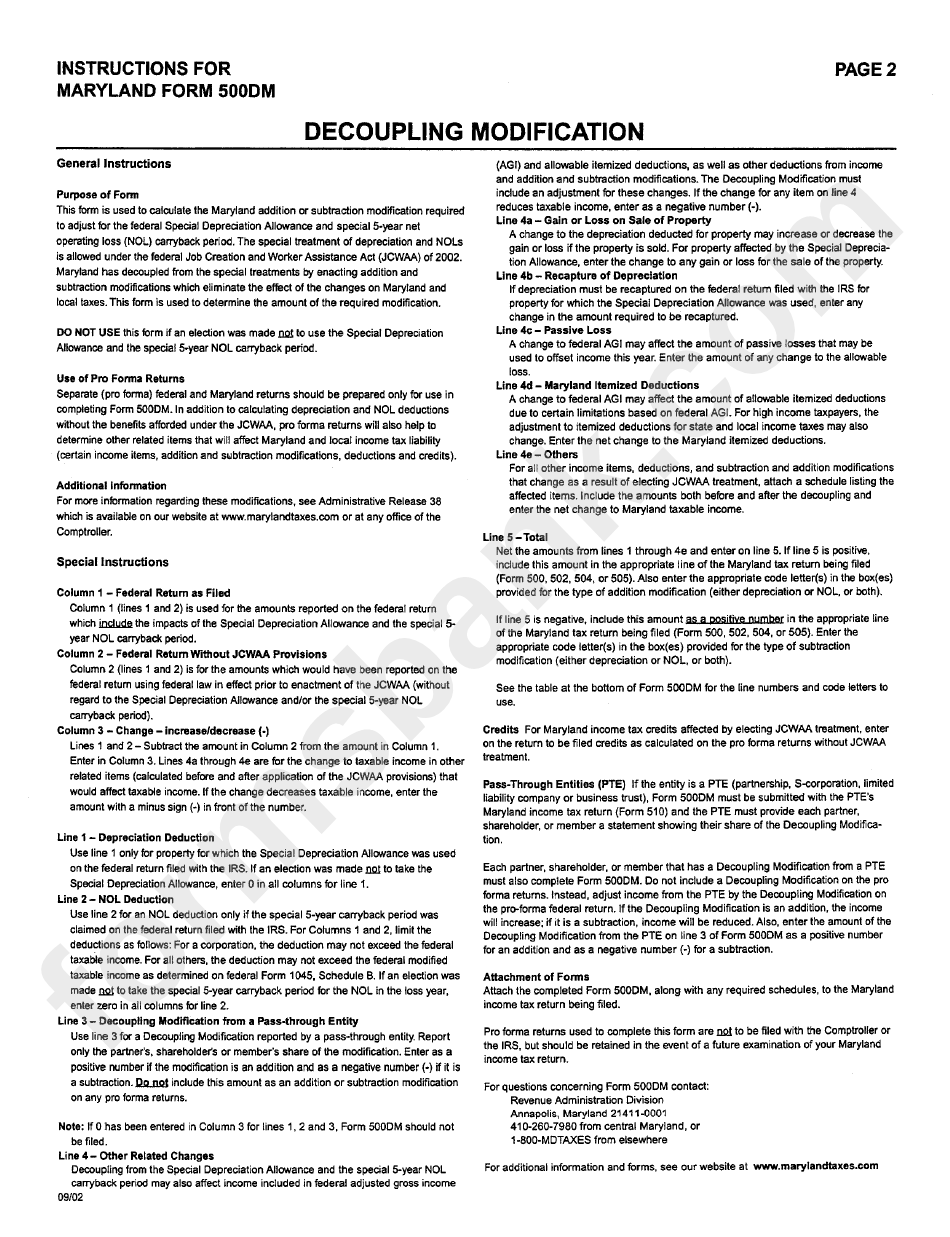

Instructions For Maryland Form 500dm printable pdf download

Web others (see instructions) e. There has been an update to our previous news brief regarding the maryland form 511. State and local taxes based on income. Web this affirms the instructions for 2023 maryland form 510/511d: Web refer to the above instructions for generating form 511 when filing an amended return.

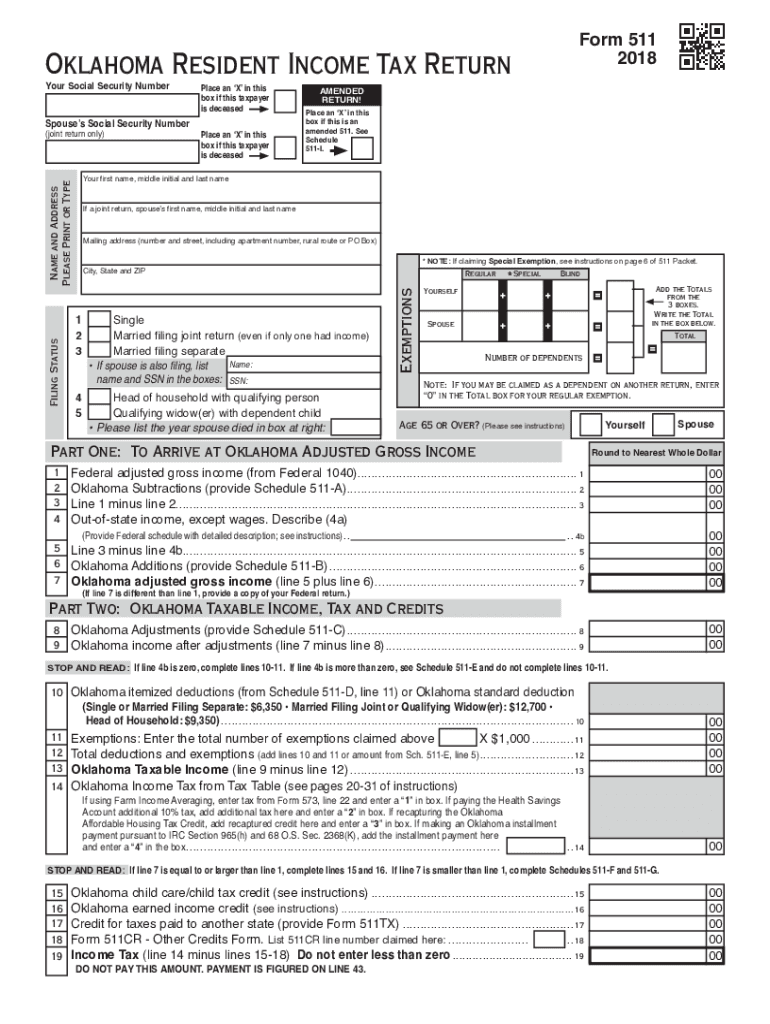

2018 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

The form 511 won't generate unless you check both the print updated. There has been an update to our previous news brief regarding the maryland form 511. Web others (see instructions) e. Web the newly released maryland administrative release no. Web select the applicable return type below for instructions on generating the form 510 or form 511 in proseries 2021.

Maryland Form 511 for PassThrough Entities Hoffman Group

There has been an update to our previous news brief regarding the maryland form 511. News | july 1, 2021. Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. Ptes that have already made the election on a filed. The form 511 won't generate unless you.

Release of Maryland Form 511 and What it Means for Your Tax Return

News | july 1, 2021. Web this affirms the instructions for 2023 maryland form 510/511d: Ptes that have already made the election on a filed. State and local taxes based on income (trade/business, rental. Web refer to the above instructions for generating form 511 when filing an amended return.

2013 Form MD MW506FR Fill Online, Printable, Fillable, Blank pdfFiller

Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. State and local taxes based on income. What is maryland form 511? Web this affirms the instructions for 2023 maryland form 510/511d: Web select the applicable return type below for instructions on generating the form 510 or.

State And Local Taxes Based On Income (Trade/Business, Rental.

6 (july 2021) and the instructions to form 511 contain important information to ensure the members of. Web ptes making the pte election to pay maryland tax on behalf of all members must now file the new form 511. What is maryland form 511? State and local taxes based on income.

Web Refer To The Above Instructions For Generating Form 511 When Filing An Amended Return.

Ptes that have already made the election on a filed. To claim the credit on an individual. Web the newly released maryland administrative release no. News | july 1, 2021.

The Form 511 Won't Generate Unless You Check Both The Print Updated.

Web if your clients as pte owners receive adjustment notices, indicating unprocessed or incorrectly processed credits related to form 511, contact the tax. Web this affirms the instructions for 2023 maryland form 510/511d: There has been an update to our previous news brief regarding the maryland form 511. Web select the applicable return type below for instructions on generating the form 510 or form 511 in proseries 2021 and newer: