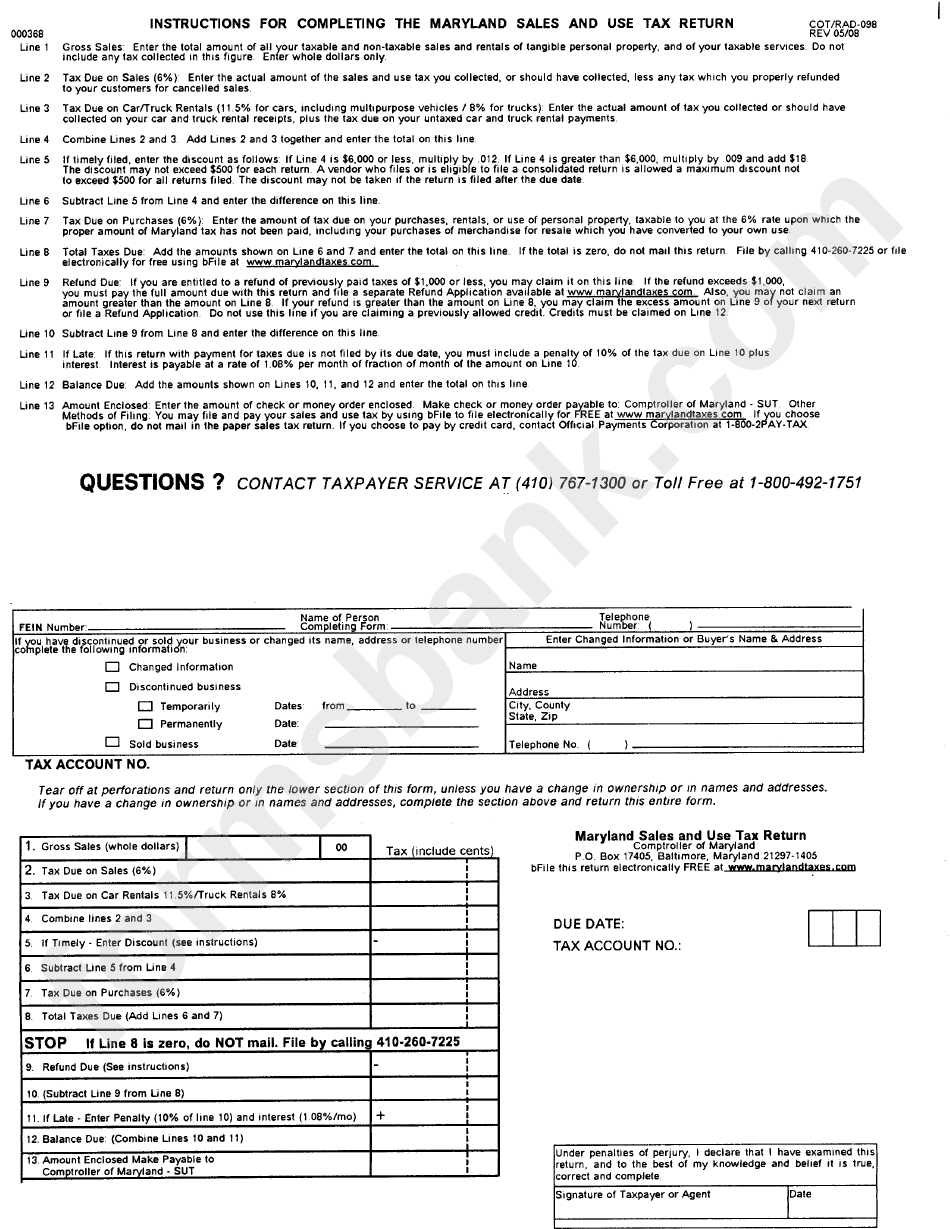

Maryland Form 202 Sales And Use Tax

Maryland Form 202 Sales And Use Tax - Complete, edit or print tax forms instantly. Web maryland form 202 sales and use tax return check here if: Sales of digital products and digital code subject to 6% rate. Tax due on sales of alcoholic beverages. Web sales and use tax is a tax on the purchase of goods and services. Web new sales and use tax return ( table of contents ) using this option is equivalent to filing a maryland sales and use tax return for the period you select. In box 5a enter the. Sales of digital products and digital code subject to 6% rate. The form can be filled out. Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f.

You can download or print. Sales of digital products and digital code subject to 6% rate. Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically! Send this form accompanied with the final sales and use tax return if you have. The form is due on. Do not use this option if. The maryland sales use tax form 202 is used to report and pay the sales and use tax. Web maryland form 202 sales and use tax return check here if: Form used by consumers to report and pay the use tax. In box 5a enter the.

Web you may use this application to file withholding and sales and use tax returns for periods beginning after december 31, 2020. Form used by consumers to report and pay the use tax. Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. Complete, edit or print tax forms instantly. Web sales and use tax is a tax on the purchase of goods and services. Name or address has changed (attach completed change of name or address form) july. Web new sales and use tax return ( table of contents ) using this option is equivalent to filing a maryland sales and use tax return for the period you select. In box 5a enter the. Web we last updated the sales and use tax final return form in january 2023, so this is the latest version of sut202fr, fully updated for tax year 2022. Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically!

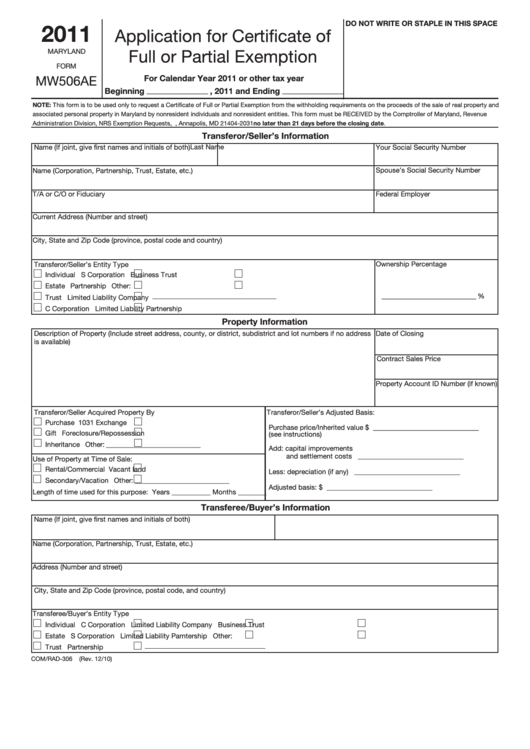

Fillable Maryland Form Mw506ae Application For Certificate Of Full Or

Web handy tips for filling out maryland form 202 sales and use tax online. Web we last updated the sales and use tax final return form in january 2023, so this is the latest version of sut202fr, fully updated for tax year 2022. Sales of digital products and digital code subject to 6% rate. Web do not include sales and.

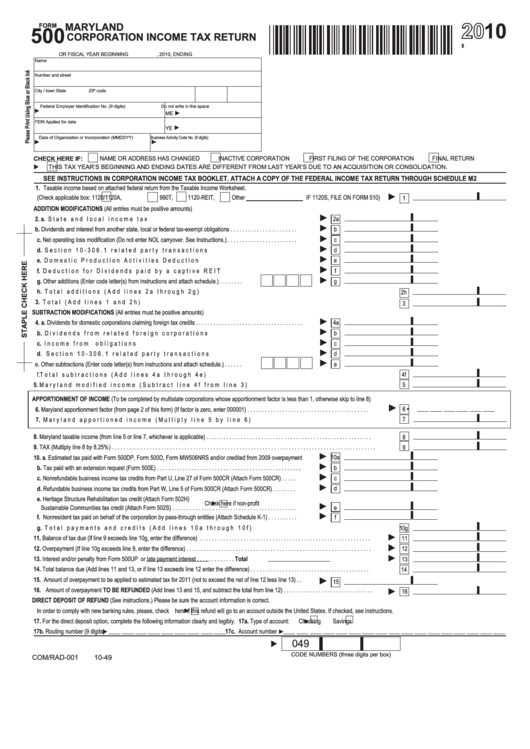

Fillable Form 500 Maryland Corporation Tax Return 2010

Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. Web you may use this application to file withholding and sales and use tax returns for periods beginning after december 31, 2020. In box 5a enter the. Go digital and save time with. Web 2021 sales and use tax forms.

How to File and Pay Sales Tax in Maryland TaxValet

Form used by consumers to report and pay the use tax. 2019 sales and use tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web 2021 sales and use tax forms. Line 1 gross sales enter the.

Form Cot/rad098 The Maryland Sales And Use Tax Return 2008 printable

If you need to correct a previously submitted. Web new sales and use tax return ( table of contents ) using this option is equivalent to filing a maryland sales and use tax return for the period you select. Sales of digital products and digital code subject to 6% rate. Line 1 gross sales enter the. The maryland sales use.

Form 202 Maryland Fill Online, Printable, Fillable, Blank pdfFiller

Web you may use this application to file withholding and sales and use tax returns for periods beginning after december 31, 2020. 2018 sales and use tax. Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically! Web sales and use tax.

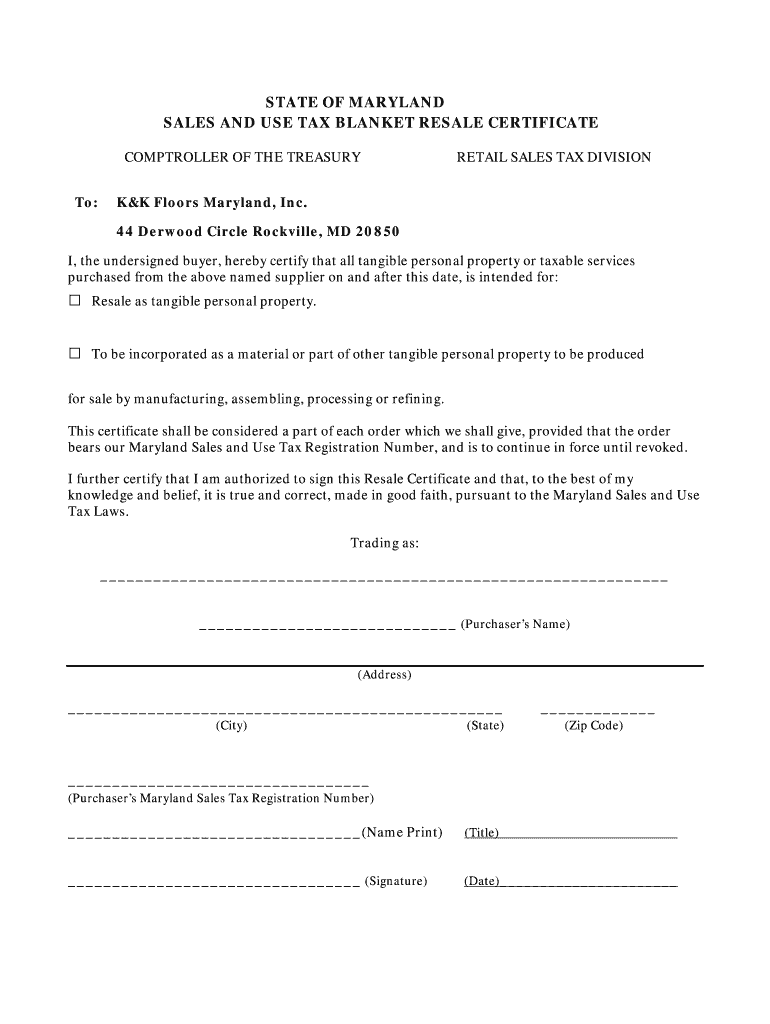

Maryland Resale Certificate Form Fill Out and Sign Printable PDF

You can download or print. Web we last updated the sales and use tax final return form in january 2023, so this is the latest version of sut202fr, fully updated for tax year 2022. Do not use this option if. Printing and scanning is no longer the best way to manage documents. Web handy tips for filling out maryland form.

Maryland Sales and Use Tax form 202 Beautiful Blog

The maryland sales use tax form 202 is used to report and pay the sales and use tax. Name or address has changed (attach completed change of name or address form) july. Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. Web sales and use tax is a tax on the.

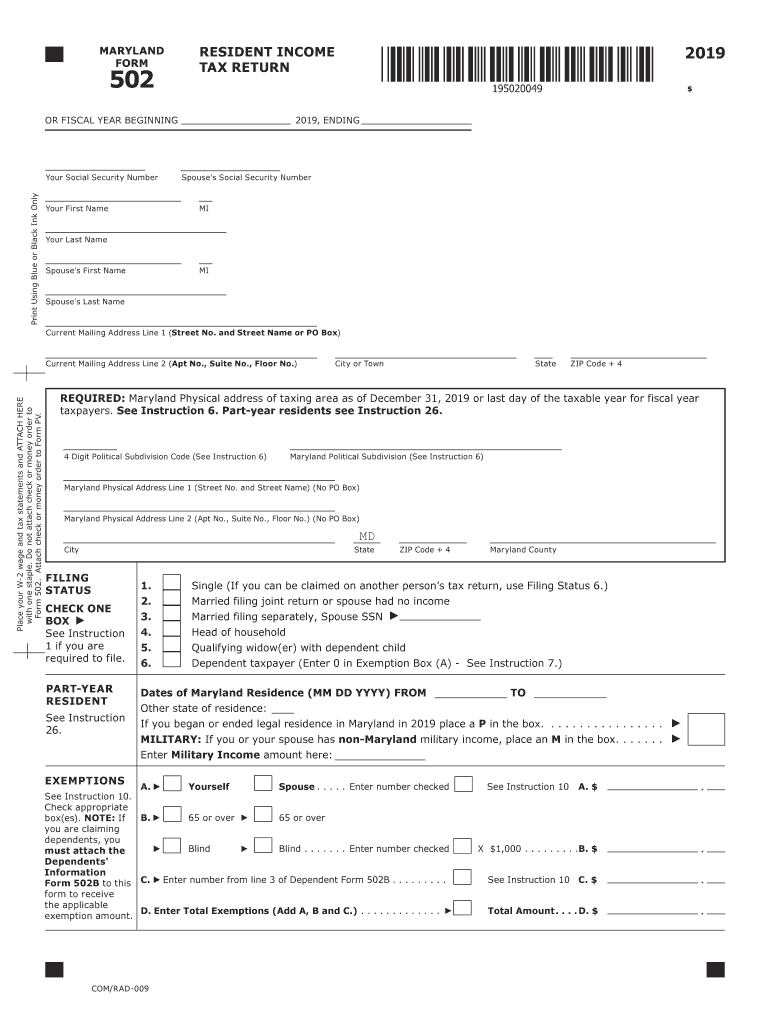

2019 Form MD Comptroller 502 Fill Online, Printable, Fillable, Blank

Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. Web we last updated the sales and use tax final return form in january 2023, so this is the latest version of sut202fr, fully updated for tax year 2022. Web maryland form 202 sales and use tax return check here if: Web.

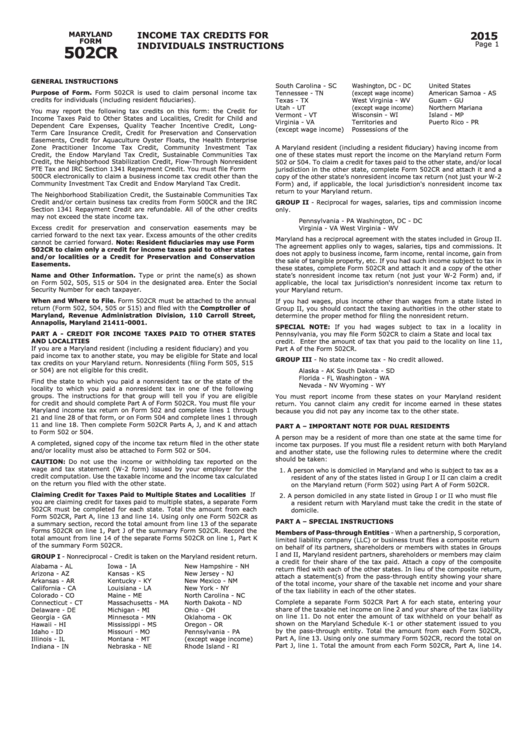

Instructions For Maryland Form 502cr Tax Credits For

2020 sales and use tax forms. Web 2021 sales and use tax forms. You can download or print. Line 1 gross sales enter the. Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f.

Maryland Power Of Attorney Form Free Printable Printable Templates

Web handy tips for filling out maryland form 202 sales and use tax online. Printing and scanning is no longer the best way to manage documents. Form 202f is used by marketplace facilitators to report sales and use tax collected on. In box 5a enter the. Sales of digital products and digital code subject to 6% rate.

Web 2021 Sales And Use Tax Forms.

Form 202f is used by marketplace facilitators to report sales and use tax collected on. Web the maryland sales use tax form 202 is a paper form that's used to report sales and use tax on tangible personal property purchased in the state. Form used by consumers to report and pay the use tax. The maryland sales use tax form 202 is used to report and pay the sales and use tax.

Tax Due On Sales Of Alcoholic Beverages.

The form can be filled out. Go digital and save time with. Complete, edit or print tax forms instantly. Web handy tips for filling out maryland form 202 sales and use tax online.

Sales Of Digital Products And Digital Code Subject To 6% Rate.

2018 sales and use tax. Web do not include sales and use tax collected for facilitated sales, which is reported on form 202f. The form is due on. 2020 sales and use tax forms.

Send This Form Accompanied With The Final Sales And Use Tax Return If You Have.

Web you may use this application to file withholding and sales and use tax returns for periods beginning after december 31, 2020. You can download or print. Get ready for tax season deadlines by completing any required tax forms today. Web as you prepare your return, remember that the fastest, safest, and easiest way to meet your sales and use tax obligation is to file and pay electronically!