Louisiana State Income Tax Form

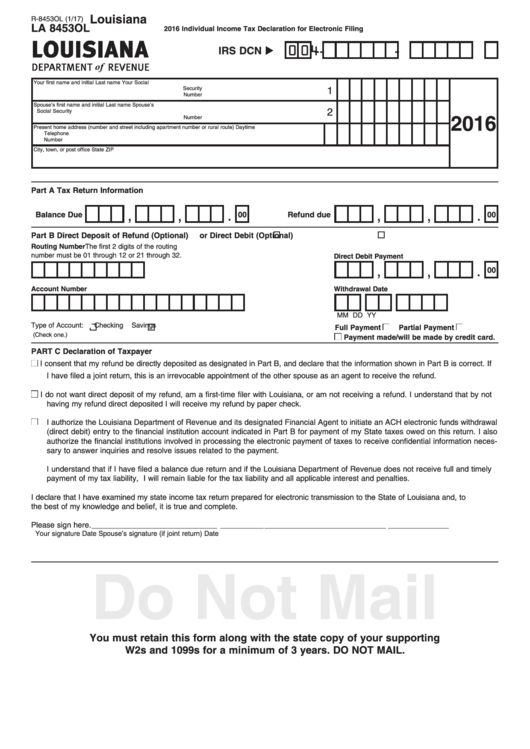

Louisiana State Income Tax Form - Web what’s new for louisiana 2022 individual income tax. • www.revenue.louisiana.gov/individuals for tax information. Web if you have more than 6 dependents, attach a statement to your return with the required information. Web request an individual income tax return booklet to be mailed to your home address. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web form la 8453, individual income tax declaration for electronic filing. You will need to mail your. Большой выбор товаров для рукоделия и творчества по низким ценам. If you are married and both you and your.

Web printable income tax forms. Web what’s new for louisiana 2022 individual income tax. Mailed booklets are identical to the pdf version (option 2). Web 2022 income & franchise tax changes; Большой выбор товаров для рукоделия и творчества по низким ценам. Get ready for tax season deadlines by completing any required tax forms today. New users for online filing in order to use the online tax filing application, you must have already filed a return with the state. Complete, edit or print tax forms instantly. If you are married and both you and your. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone.

Get ready for tax season deadlines by completing any required tax forms today. Web what’s new for louisiana 2022 individual income tax. Web the louisiana tax forms are listed by tax year below and all la back taxes for previous years would have to be mailed in. Complete, edit or print tax forms instantly. Mailed booklets are identical to the pdf version (option 2). Check on the status of your individual income refund. Get ready for tax season deadlines by completing any required tax forms today. New users for online filing in order to use the online tax filing application, you must have already filed a return with the state. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. Web printable income tax forms.

The New Tax Deadline for Louisiana State and Federal tax is July

Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. Web form la 8453, individual income tax declaration for electronic filing. Web 2022 income & franchise tax changes; New users for online filing in order to use the online tax filing application, you must have already filed a return with the state..

Louisiana state tax filing begins January 28

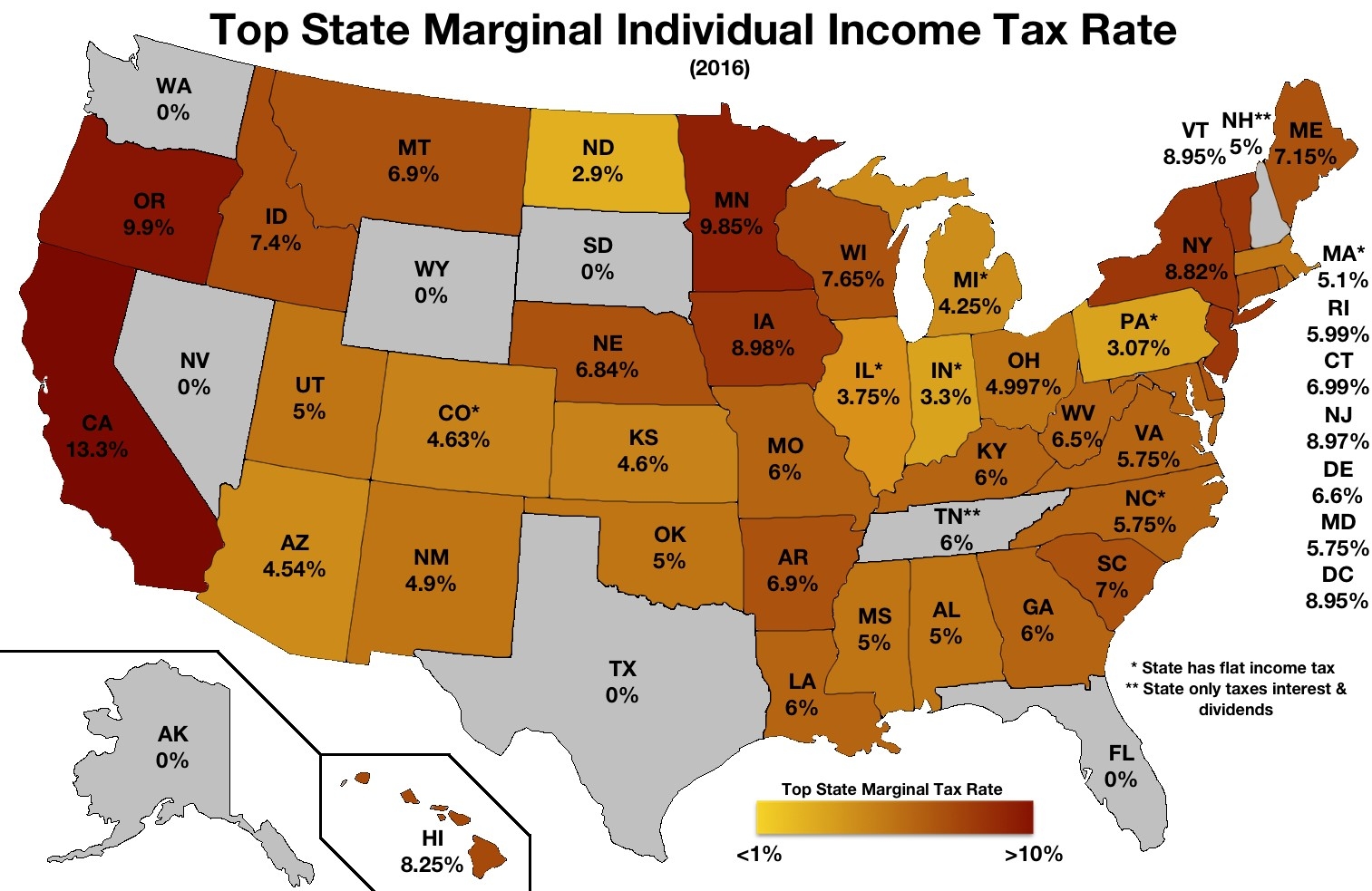

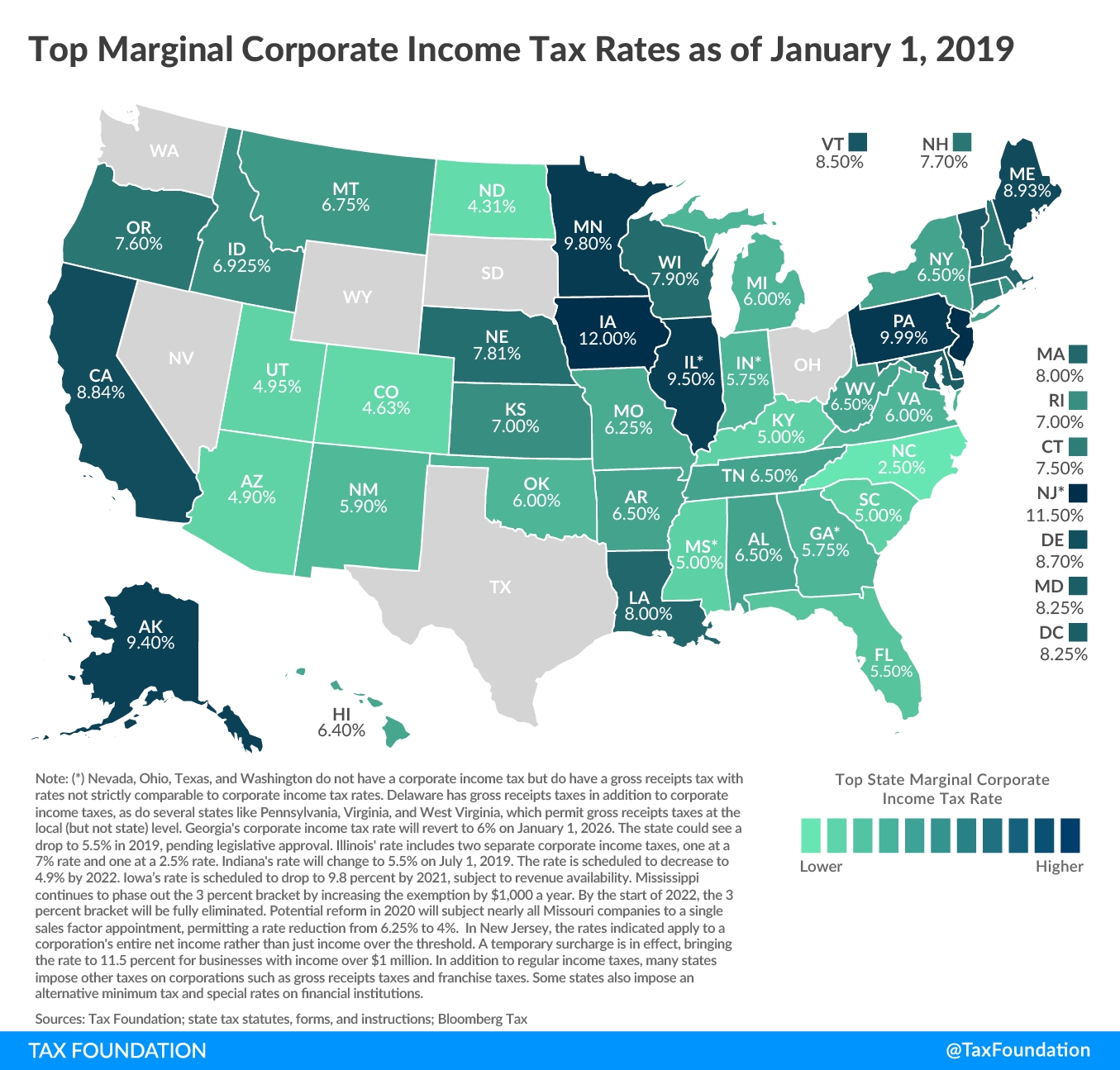

You can complete the forms with the help of efile.com. Web 2022 income & franchise tax changes; If you are married and both you and your. Louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue. Complete, edit or print tax forms instantly.

Tax Return Louisiana State Tax Return

Louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue. Web request an individual income tax return booklet to be mailed to your home address. Complete, edit or print tax forms instantly. You can complete the forms with the help of efile.com. Web form la 8453, individual income.

Louisiana Tax Free 2020 Template Calendar Design

Louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue. Check on the status of your individual income refund. Web request an individual income tax return booklet to be mailed to your home address. With our fillable form 1040 individual income tax return form, you can. Web we.

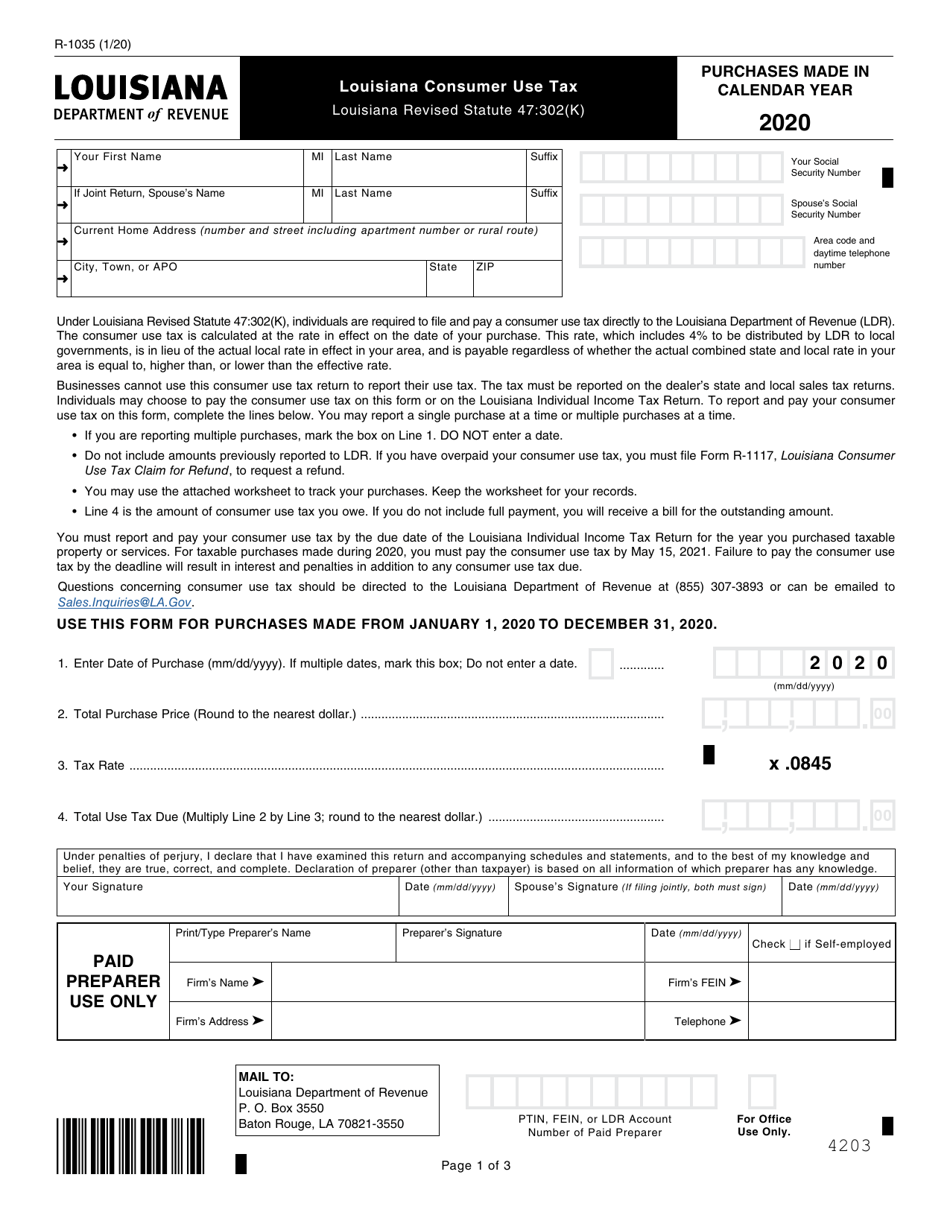

Form R1035 Download Fillable PDF or Fill Online Louisiana Consumer Use

Web we last updated the resident income tax return instructions in january 2023, so this is the latest version of form it540i, fully updated for tax year 2022. Web printable income tax forms. Web if you have more than 6 dependents, attach a statement to your return with the required information. Get ready for tax season deadlines by completing any.

Louisiana Tax Free 2020 Template Calendar Design

You will need to mail your. Complete, edit or print tax forms instantly. You can download or print. This form is this form is required for all electronic returns as a source of information (unless using irs pin). With our fillable form 1040 individual income tax return form, you can.

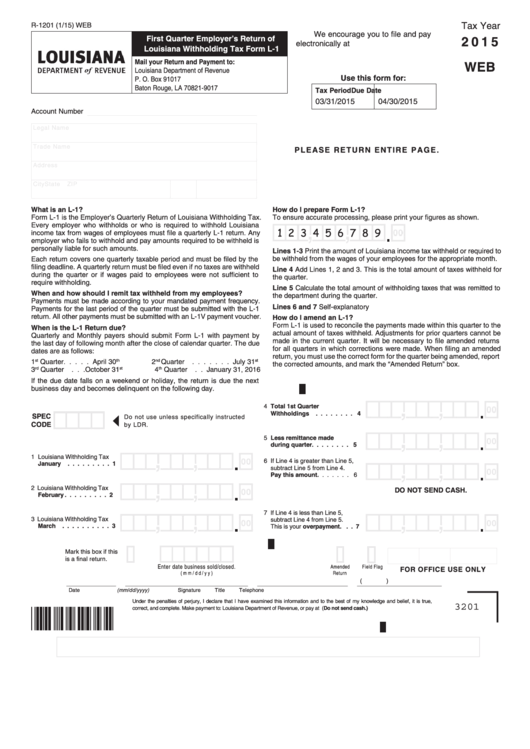

Fillable R1201, 2015 , Louisiana Withholding Tax Form L1 printable

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Mailed booklets are identical to the pdf version (option 2). Web we last updated the resident income tax return instructions in january 2023, so this is the latest version of form it540i, fully updated for tax year 2022. Web •.

8453 Ol Form Louisiana Department Of Revenue Individual Tax

Get ready for tax season deadlines by completing any required tax forms today. Mailed booklets are identical to the pdf version (option 2). If you are married and both you and your. Complete, edit or print tax forms instantly. Web printable income tax forms.

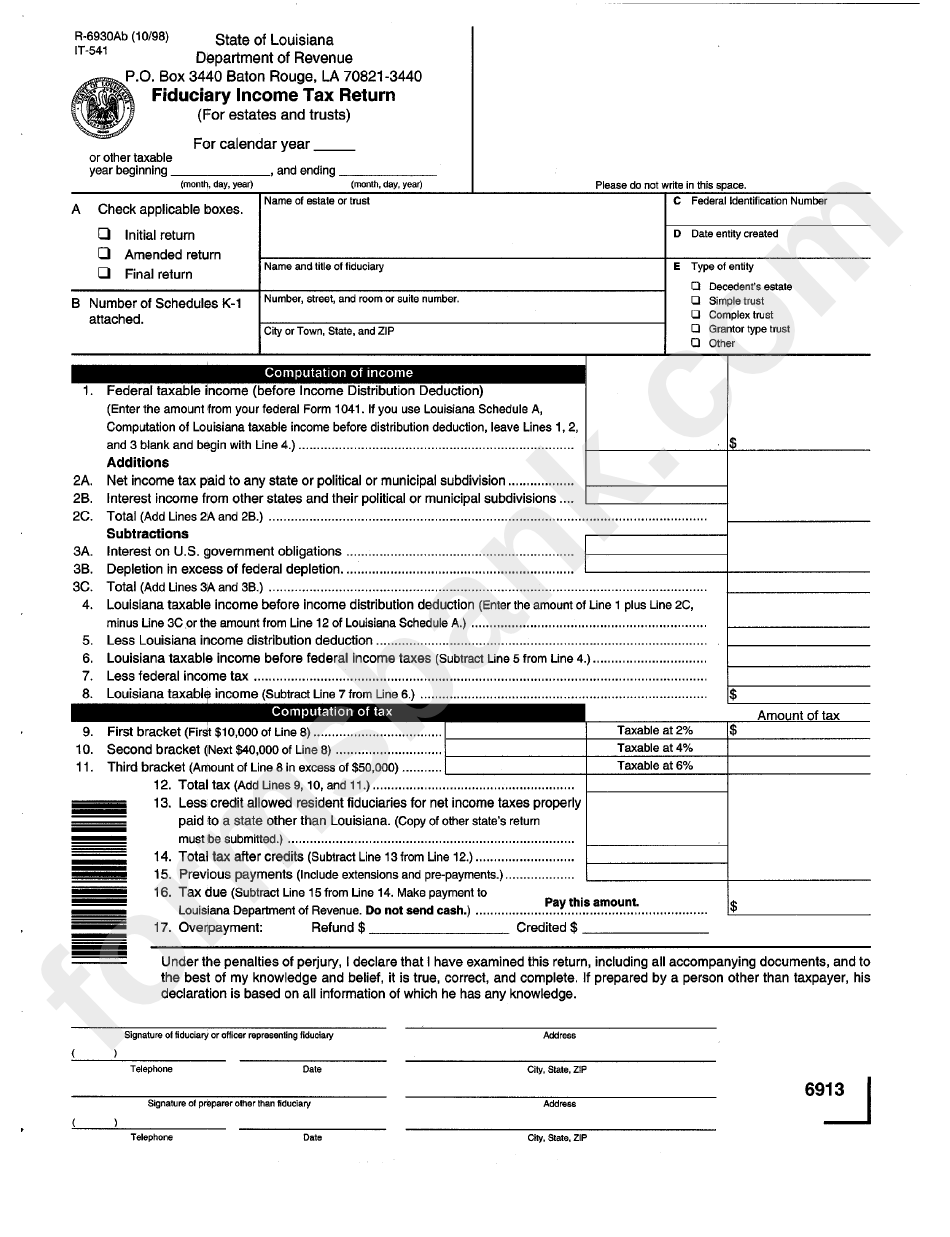

Fillable Form It541 Louisiana Fiduciary Tax Return printable

You will need to mail your. Web we last updated the resident income tax return instructions in january 2023, so this is the latest version of form it540i, fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. Web form 1040 is an irs tax form used by united states residents.

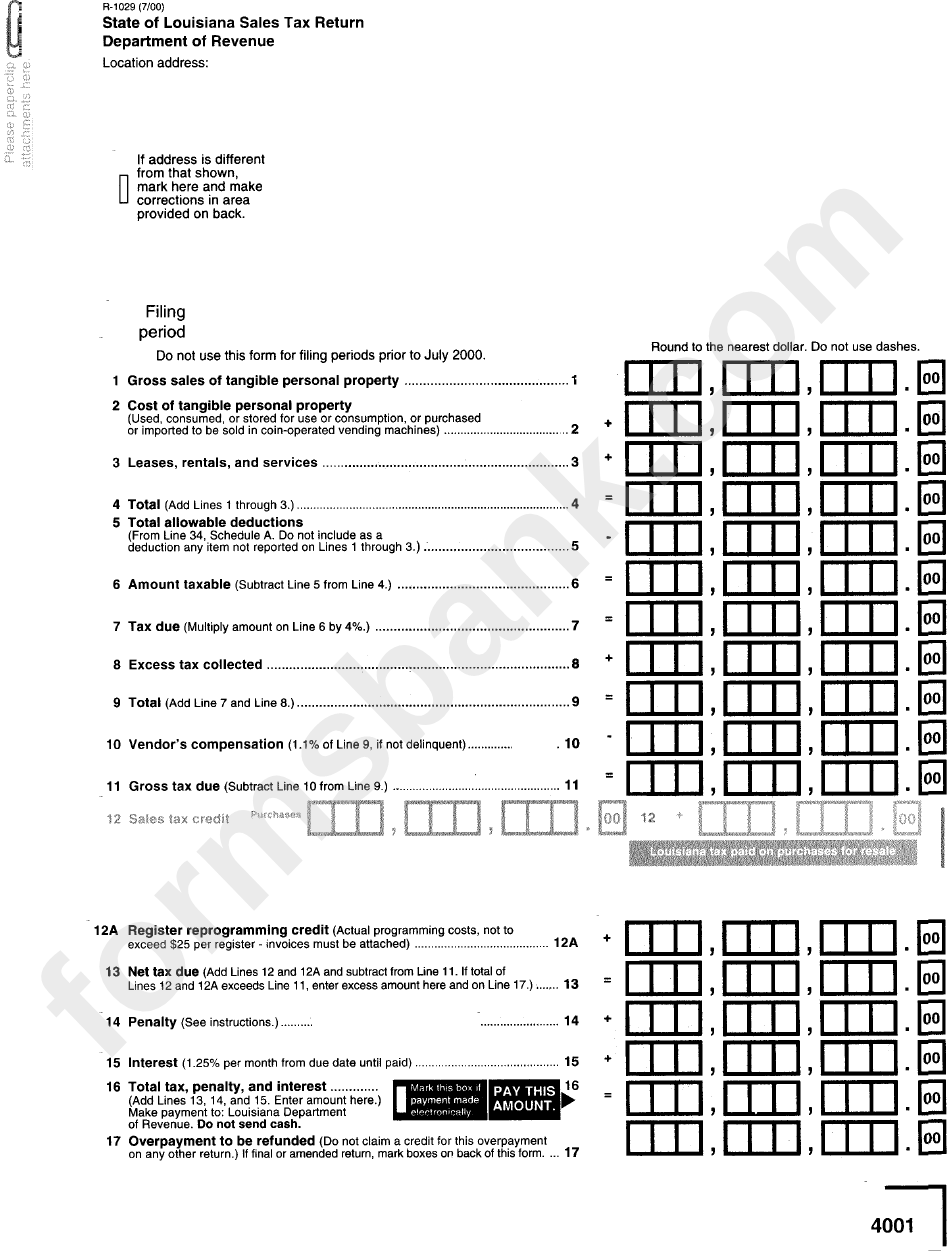

Form R1029 State Of Louisiana Sales Tax Return printable pdf download

With our fillable form 1040 individual income tax return form, you can. Web where's my refund. Web if you have more than 6 dependents, attach a statement to your return with the required information. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. Louisiana has a state income tax that ranges.

You Can Download Or Print.

Web if you have more than 6 dependents, attach a statement to your return with the required information. Web 2022 income & franchise tax changes; Get ready for tax season deadlines by completing any required tax forms today. With our fillable form 1040 individual income tax return form, you can.

Web The Louisiana Tax Forms Are Listed By Tax Year Below And All La Back Taxes For Previous Years Would Have To Be Mailed In.

Check on the status of your individual income refund. You can complete the forms with the help of efile.com. Web printable income tax forms. Web where's my refund.

Complete, Edit Or Print Tax Forms Instantly.

Get ready for tax season deadlines by completing any required tax forms today. Web you can pay your louisiana personal income tax by credit card over the internet or by telephone. If you are married and both you and your. Mailed booklets are identical to the pdf version (option 2).

Complete, Edit Or Print Tax Forms Instantly.

Web we last updated the resident income tax return instructions in january 2023, so this is the latest version of form it540i, fully updated for tax year 2022. Web form 1040 is an irs tax form used by united states residents to file their personal federal income taxes. Web form la 8453, individual income tax declaration for electronic filing. Louisiana has a state income tax that ranges between 2% and 6% , which is administered by the louisiana department of revenue.