Ky Homestead Exemption Form

Ky Homestead Exemption Form - This exemption can lower the amount of property tax you pay each. Web (1) to qualify under the homestead exemption provision of the constitution, each person claiming the exemption shall file an application with the property valuation administrator. Web services forms homestead exemption homestead exemption this application must be submitted to the property valuation administrator’s ( pva) office during the year in which. What is kentucky’s homestead exemption, who qualifies and how to apply. Ad register and subscribe now to work on your ky exemption application & more fillable forms. Web forms & tools homestead exemption explanation and application applies to important dates application checklist homestead exemption explanation and application to. This application must be submitted during the year in which exemption is sought to the property valuation. Web looking for tax relief following your lexington property assessment? Web homestead exemption section 170 of the kentucky constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who. Web in kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead.

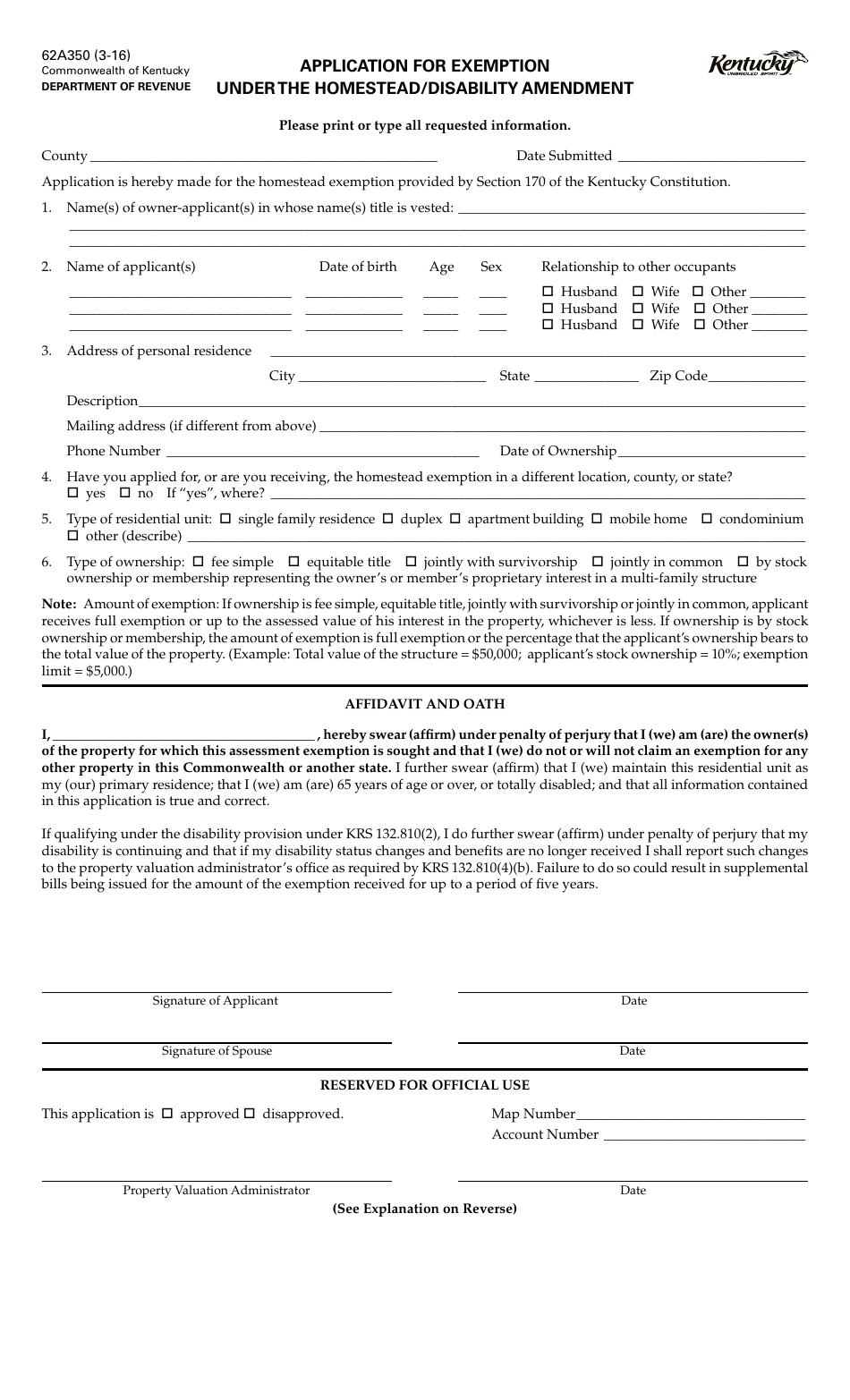

Ad register and subscribe now to work on your ky exemption application & more fillable forms. This application must be submitted during the year in which exemption is sought to the property valuation. Web aug 30, 2022 3 min read kentucky homestead exemption the kentucky homestead exemption allows eligible homeowners to reduce their property taxes. This application must be completed and submitted to the property owner’s local property valuation. Kentucky’s constitution allows property owners who are 65 or older to receive the homestead exemption on their. Web membership, the amount of exemption is full exemption or the percentage that the applicant’s ownership bears to the total value of the property. Download, fill out and mail or fax the form to us: What is kentucky’s homestead exemption, who qualifies and how to apply. Web the kentucky homestead exemption program offers a tax exemption (tax break) for some older adults. Web forms & tools homestead exemption explanation and application applies to important dates application checklist homestead exemption explanation and application to.

This application must be completed and submitted to the property owner’s local property valuation. Web 9dolg 3huvrqdo ,' &dug lvvxhg e\ wkh kentucky transportation cabinet 7kh dgguhvv vkrzq rq wkh 'ulyhu¶v /lfhqvh ru 3huvrqdo ,'. Web membership, the amount of exemption is full exemption or the percentage that the applicant’s ownership bears to the total value of the property. This application must be submitted during the year in which exemption is sought to the property valuation. Web looking for tax relief following your lexington property assessment? This exemption can lower the amount of property tax you pay each. Web there are two options for completing a homestead exemption application: Web homestead exemption section 170 of the kentucky constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who. Web we last updated the property tax application for exemption under the homestead/disability amendment in february 2023, so this is the latest version of form. Web an application for the homestead exemption is available here.

An Introduction to the Homestead Exemption Envoy Mortgage

Download, fill out and mail or fax the form to us: Web membership, the amount of exemption is full exemption or the percentage that the applicant’s ownership bears to the total value of the property. Web the kentucky homestead exemption program offers a tax exemption (tax break) for some older adults. Web homestead exemption section 170 of the kentucky constitution.

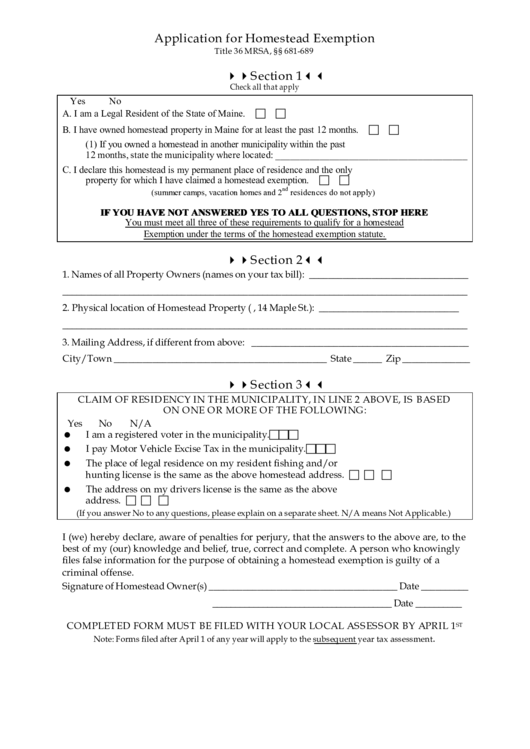

Fillable Application For Homestead Exemption Template printable pdf

Ad register and subscribe now to work on your ky exemption application & more fillable forms. This application must be completed and submitted to the property owner’s local property valuation. Web forms & tools homestead exemption explanation and application applies to important dates application checklist homestead exemption explanation and application to. Web aug 30, 2022 3 min read kentucky homestead.

40 free Magazines from

Web forms & tools homestead exemption explanation and application applies to important dates application checklist homestead exemption explanation and application to. Web membership, the amount of exemption is full exemption or the percentage that the applicant’s ownership bears to the total value of the property. The exemption amount is subtracted from the property’s assessed value, which reduces the. Web we.

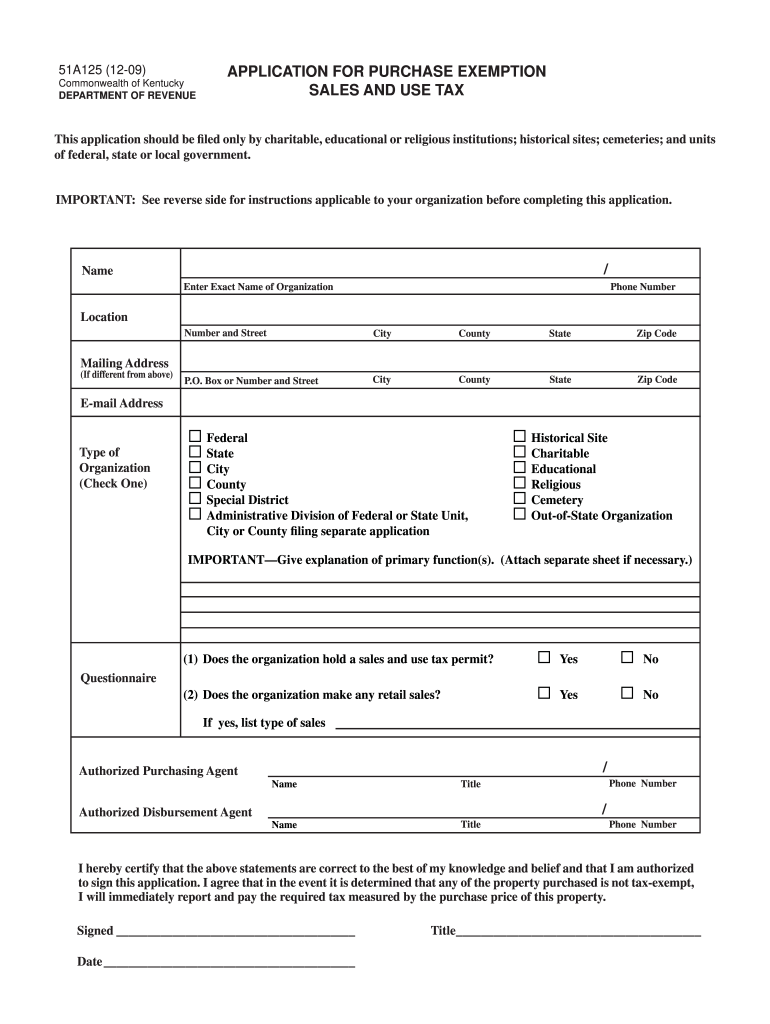

Ky Exemption Tax Form Fill Out and Sign Printable PDF Template signNow

Web there are two options for completing a homestead exemption application: This application must be submitted during the year in which exemption is sought to the property valuation. What is kentucky’s homestead exemption, who qualifies and how to apply. Web homestead exemption explanation and application. Web membership, the amount of exemption is full exemption or the percentage that the applicant’s.

Fillable Affidavit For Homestead Exemption Form Printable Pdf Download

Web forms & tools homestead exemption explanation and application applies to important dates application checklist homestead exemption explanation and application to. Web the kentucky homestead exemption program offers a tax exemption (tax break) for some older adults. This exemption can lower the amount of property tax you pay each. Web the homestead exemption is $40,500 for both 2021 and 2022..

Homestead Exemption Mcdonough Ga Fill Online, Printable, Fillable

Web exemptions homestead exemption homestead exemption according to kentucky’s constitution, property owners who are 65 or older are eligible to receive a. Web the kentucky homestead exemption program offers a tax exemption (tax break) for some older adults. This application must be completed and submitted to the property owner’s local property valuation. Kentucky’s constitution allows property owners who are 65.

Harris County Homestead Exemption Form

Web the homestead exemption is $40,500 for both 2021 and 2022. Kentucky’s constitution allows property owners who are 65 or older to receive the homestead exemption on their. Ad register and subscribe now to work on your ky exemption application & more fillable forms. Web services forms homestead exemption homestead exemption this application must be submitted to the property valuation.

Homestead Exemption Form, Don't to File in 2021! Christy Buck Team

Web homestead exemption section 170 of the kentucky constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who. The exemption amount is subtracted from the property’s assessed value, which reduces the. Web membership, the amount of exemption is full exemption or the percentage that the applicant’s ownership bears to the total.

District 10 enews

This exemption can lower the amount of property tax you pay each. This application must be completed and submitted to the property owner’s local property valuation. Web 9dolg 3huvrqdo ,' &dug lvvxhg e\ wkh kentucky transportation cabinet 7kh dgguhvv vkrzq rq wkh 'ulyhu¶v /lfhqvh ru 3huvrqdo ,'. Web aug 30, 2022 3 min read kentucky homestead exemption the kentucky homestead.

Kent State Covid Vaccine Exemption Form SNAKEMKI

Web 9dolg 3huvrqdo ,' &dug lvvxhg e\ wkh kentucky transportation cabinet 7kh dgguhvv vkrzq rq wkh 'ulyhu¶v /lfhqvh ru 3huvrqdo ,'. Web looking for tax relief following your lexington property assessment? Web in kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead..

Edit, Sign And Print Tax Forms On Any Device With Pdffiller.

What is kentucky’s homestead exemption, who qualifies and how to apply. Web membership, the amount of exemption is full exemption or the percentage that the applicant’s ownership bears to the total value of the property. Web looking for tax relief following your lexington property assessment? Download, fill out and mail or fax the form to us:

Ad Register And Subscribe Now To Work On Your Ky Exemption Application & More Fillable Forms.

Web (1) to qualify under the homestead exemption provision of the constitution, each person claiming the exemption shall file an application with the property valuation administrator. Web 9dolg 3huvrqdo ,' &dug lvvxhg e\ wkh kentucky transportation cabinet 7kh dgguhvv vkrzq rq wkh 'ulyhu¶v /lfhqvh ru 3huvrqdo ,'. Web the kentucky homestead exemption program offers a tax exemption (tax break) for some older adults. This application must be completed and submitted to the property owner’s local property valuation.

Web Forms & Tools Homestead Exemption Explanation And Application Applies To Important Dates Application Checklist Homestead Exemption Explanation And Application To.

Web in kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead. This exemption can lower the amount of property tax you pay each. Web exemptions homestead exemption homestead exemption according to kentucky’s constitution, property owners who are 65 or older are eligible to receive a. Web the homestead exemption is $40,500 for both 2021 and 2022.

Web An Application For The Homestead Exemption Is Available Here.

Web we last updated the property tax application for exemption under the homestead/disability amendment in february 2023, so this is the latest version of form. This application must be submitted during the year in which exemption is sought to the property valuation. Web homestead exemption section 170 of the kentucky constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who. The exemption amount is subtracted from the property’s assessed value, which reduces the.