Ky Form 740 Instructions

Ky Form 740 Instructions - While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. And taxable scholarship or fellowship grants, and your taxable interest was $1,500 or less. Web which form should i file? Web form 740 instructions this free booklet contains instructions on how to fill out and file your income tax form 740, for general individual income taxes. This site can perform basic calculations but users will. • had income from kentucky sources. What you should know before you begin: Web also see line 27 of form 740 and the optional use tax table and use tax calculation worksheet in the 740 instructions. Web requirements in the instructions for form 740. Web kentucky will begin processing 2022 returns on february 6, 2023.

Detach the payment voucher at the dotted line below. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Users must have a valid ssn or itin to use this program. Web requirements in the instructions for form 740. Sending your payment with payment voucher: • had income from kentucky sources. • had income from kentucky sources. Web ky file users should familiarize themselves with kentucky forms by reading the instructions. Web kentucky will begin processing 2022 returns on february 6, 2023. Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year.

The current year form 740 and 740 instructions can. Sign it in a few clicks draw your signature, type it,. Web which form should i file? What you should know before you begin: Web ky file users should familiarize themselves with kentucky forms by reading the instructions. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Web requirements in the instructions for form 740. Users must have a valid ssn or. • had income from kentucky sources. Web download or print the 2022 kentucky (form 740 individual full year resident income tax.

Kentucky form 740 Fill out & sign online DocHub

Web requirements in the instructions for form 740. The current year form 740 and 740 instructions can. Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year. Web also see line 27 of form 740 and the optional use tax table and use tax calculation worksheet in the.

Form 740 Kentucky Individual Tax Return Resident YouTube

This site can perform basic calculations but users will. Sign it in a few clicks draw your signature, type it,. Web ky file users should familiarize themselves with kentucky forms by reading the instructions. The current year form 740 and 740 instructions can. • had income from kentucky sources.

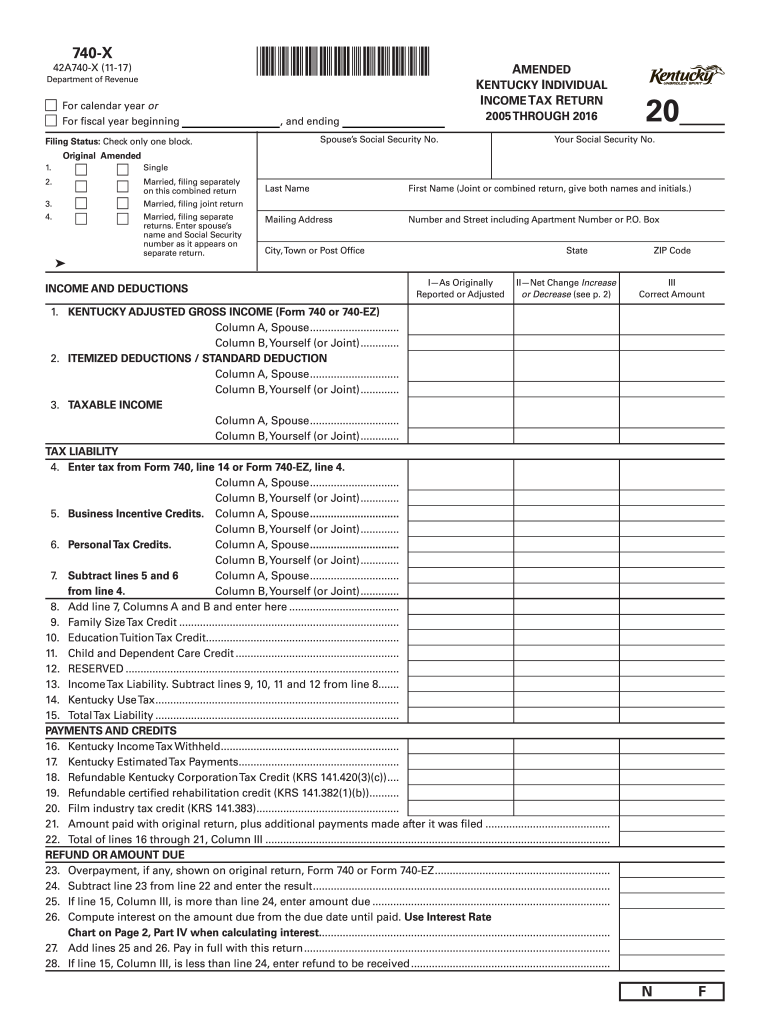

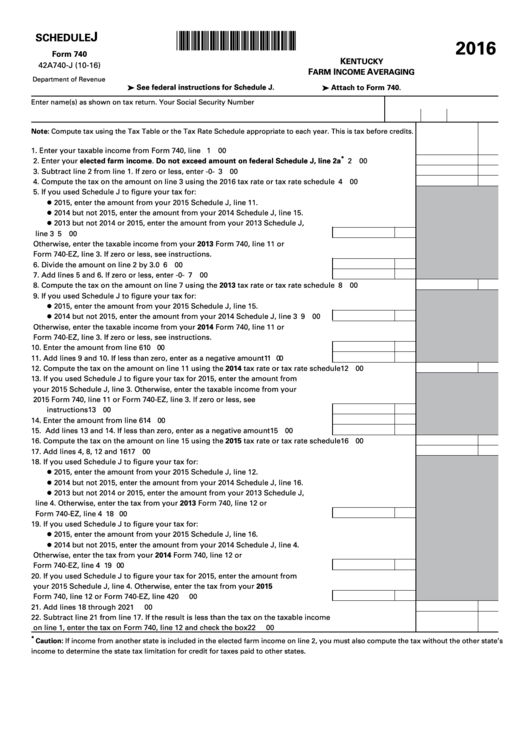

5 Kentucky 740 Forms And Schedules And Templates free to download in PDF

Sign it in a few clicks draw your signature, type it,. What you should know before you begin: Web which form should i file? • had income from kentucky sources. Users must have a valid ssn or.

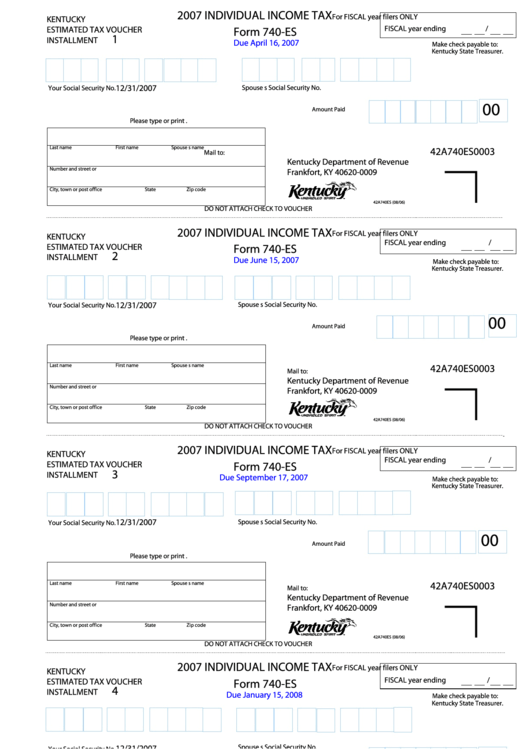

Fillable Form 740Es Individual Tax 2007 printable pdf download

• had income from kentucky sources. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. Web which form should i file? Web ky file users should familiarize themselves with kentucky forms by reading the instructions. This site can perform basic calculations but users will.

Printable Kentucky State Tax Forms Printable World Holiday

The current year form 740 and 740 instructions can. Sign it in a few clicks draw your signature, type it,. Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year. Web blind, or a member of the kentucky national guard at the end of 2010; • had income.

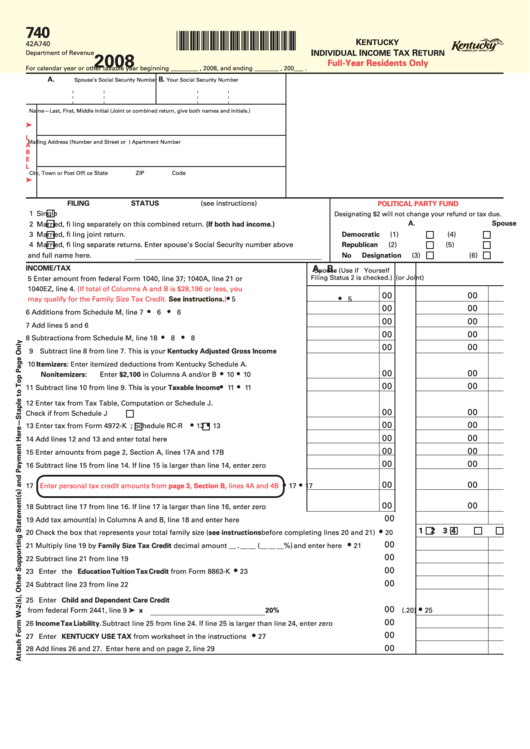

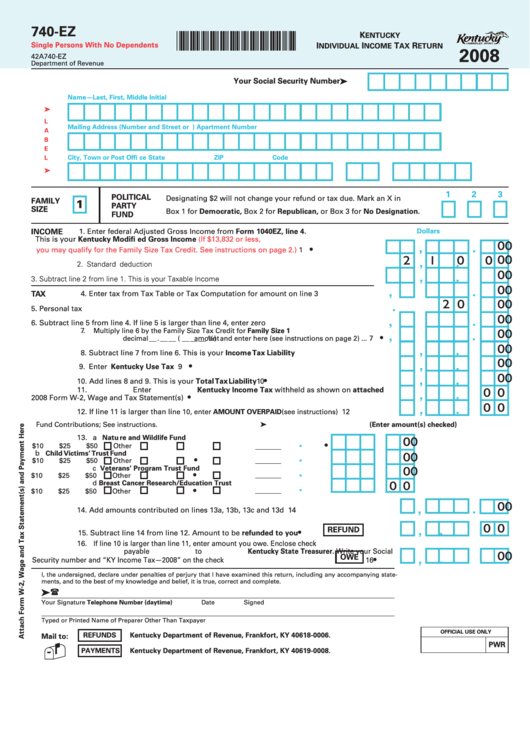

Form 740Ez Kentucky Individual Tax Return 2008 printable

Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year. The current year form 740 and 740 instructions can. Web form 740 instructions this free booklet contains instructions on how to fill out and file your income tax form 740, for general individual income taxes. What you should.

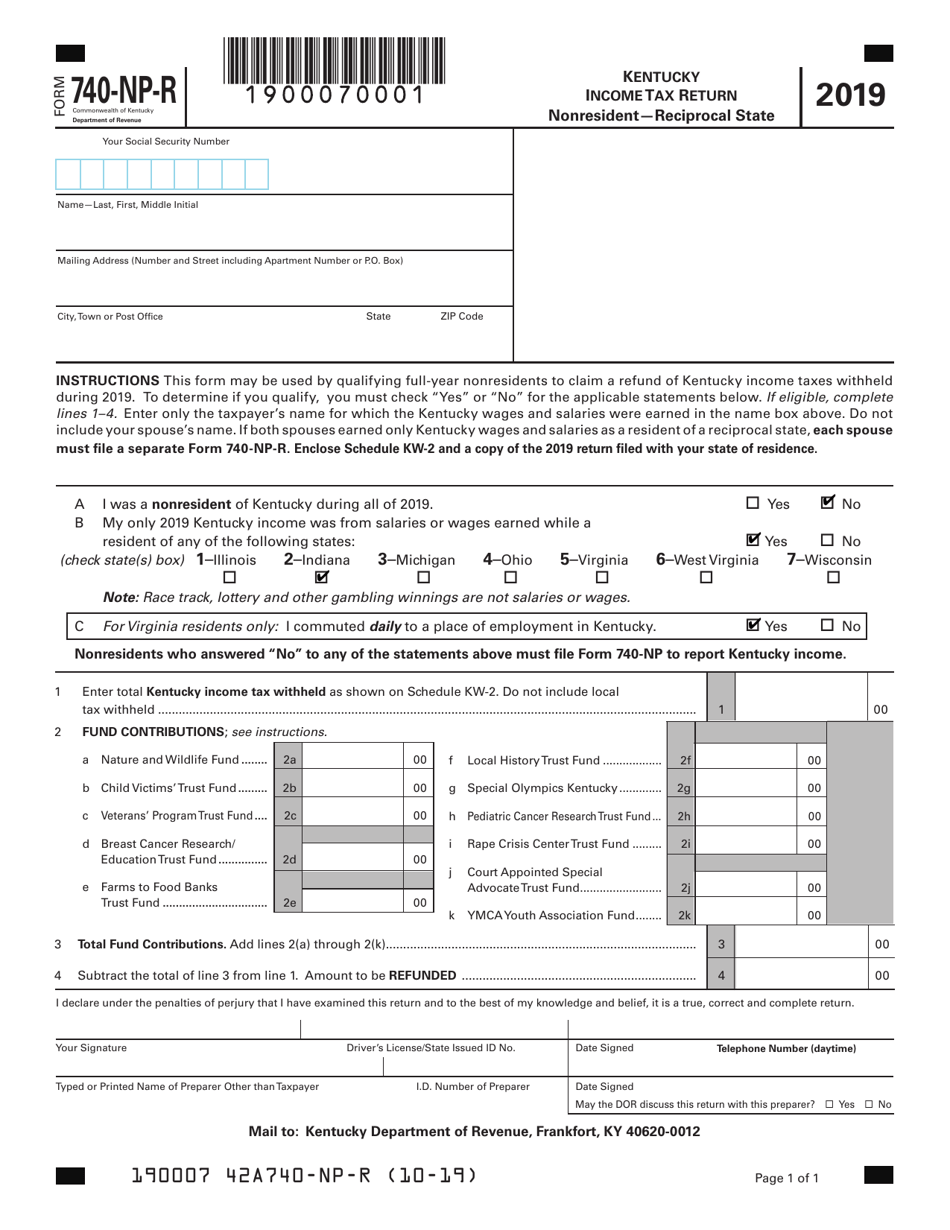

Form 740NPR Download Fillable PDF or Fill Online Kentucky Tax

• had income from kentucky sources. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. • had income from kentucky sources. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. The current year form 740 and 740 instructions can.

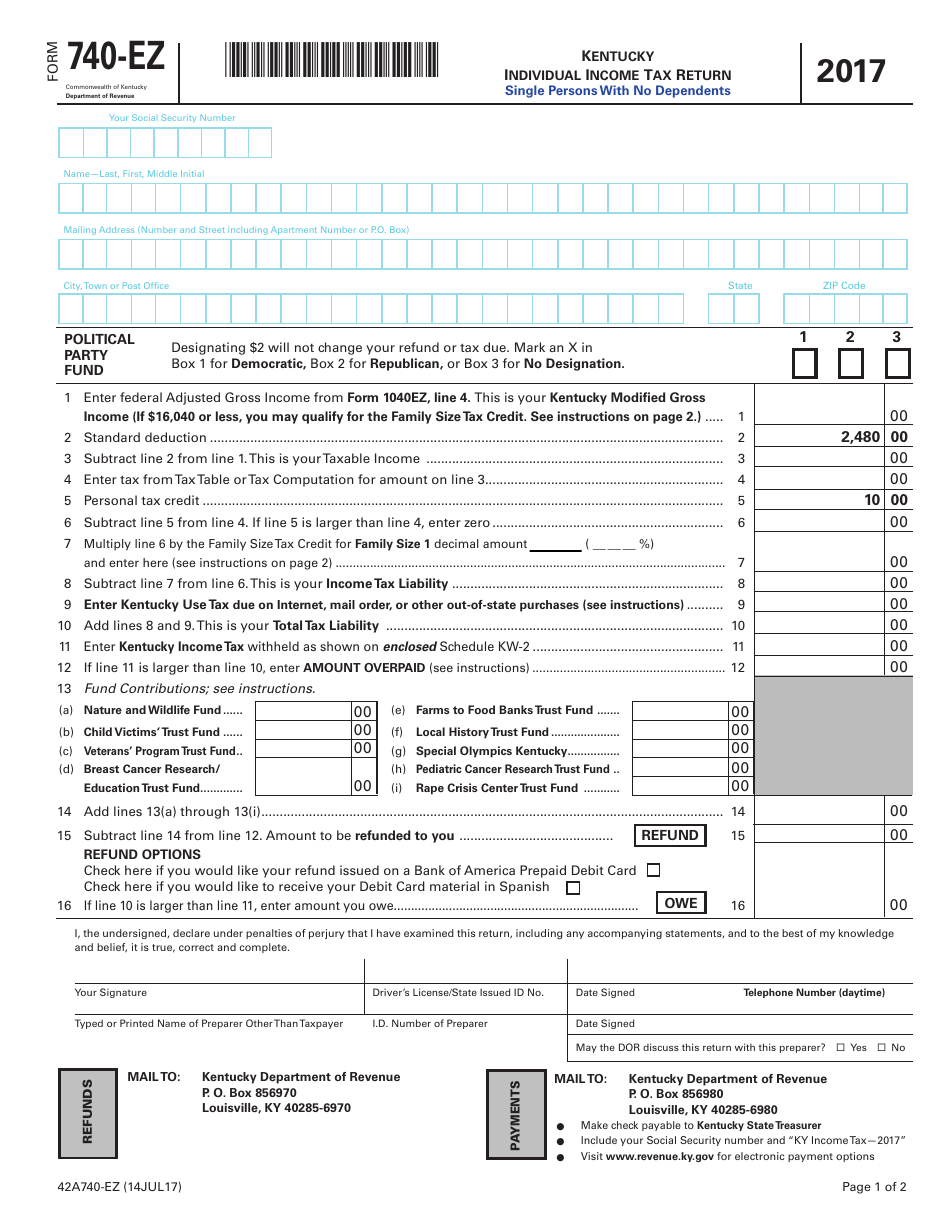

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

The current year form 740 and 740 instructions can. Web requirements in the instructions for form 740. • had income from kentucky sources. This site can perform basic calculations but users will. Users must have a valid ssn or.

2011 Form KY DoR 720S Fill Online, Printable, Fillable, Blank pdfFiller

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers. What you should know before you begin: Web this pdf packet includes form 740, supplemental schedules, and tax instructions combined in one document, updated for the 2011 tax year. • had income from kentucky sources. Web blind, or a member of the kentucky national guard.

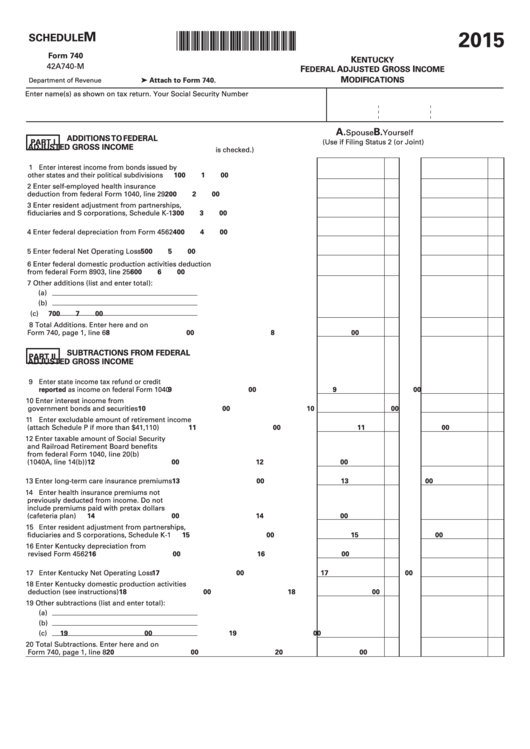

Fillable Schedule M (Form 740) Kentucky Federal Adjusted Gross

Sending your payment with payment voucher: Web blind, or a member of the kentucky national guard at the end of 2010; Sign it in a few clicks draw your signature, type it,. Edit your form 740 online type text, add images, blackout confidential details, add comments, highlights and more. Web requirements in the instructions for form 740.

Web This Pdf Packet Includes Form 740, Supplemental Schedules, And Tax Instructions Combined In One Document, Updated For The 2011 Tax Year.

Sending your payment with payment voucher: Web kentucky will begin processing 2022 returns on february 6, 2023. Web also see line 27 of form 740 and the optional use tax table and use tax calculation worksheet in the 740 instructions. • had income from kentucky sources.

While Most Taxpayers Have Income Taxes Automatically Withheld Every Pay Period By Their Employer, Taxpayers.

Detach the payment voucher at the dotted line below. Web which form should i file? What you should know before you begin: Web download or print the 2022 kentucky (form 740 individual full year resident income tax.

Web Form 740 Instructions This Free Booklet Contains Instructions On How To Fill Out And File Your Income Tax Form 740, For General Individual Income Taxes.

This site can perform basic calculations but users will. The current year form 740 and 740 instructions can. Sign it in a few clicks draw your signature, type it,. Web requirements in the instructions for form 740.

Web Ky File Users Should Familiarize Themselves With Kentucky Forms By Reading The Instructions.

Web blind, or a member of the kentucky national guard at the end of 2010; Users must have a valid ssn or itin to use this program. Web requirements in the instructions for form 740. And taxable scholarship or fellowship grants, and your taxable interest was $1,500 or less.