Kansas State Tax Return Form

Kansas State Tax Return Form - Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Prepare online on efile.com until oct. Find forms for your industry in minutes. Web individual tax return form 1040 instructions; Web you can file your kansas income tax online or via mail. File your state taxes online; Request for taxpayer identification number (tin) and certification form. File your state taxes online; Who can use webfile for a homestead refund claim? Web instructions kansas state income tax forms for current and previous tax years.

File your state taxes online; Request for taxpayer identification number (tin) and certification form. Web kansas state income tax return forms for tax year 2022 (jan. Web kansas has a state income tax that ranges between 3.1% and 5.7%. Web individual tax return form 1040 instructions; Streamlined document workflows for any industry. 1) you are required to file a federal income tax return; To file your return electronically, you can use webfile, a free online application portal offered by the state. What should i do if my address changed since i. Who can use webfile for a homestead refund claim?

Find forms for your industry in minutes. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account Web kansas income tax forms kansas printable income tax forms 74 pdfs kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the. Web kansas has a state income tax that ranges between 3.1% and 5.7%. Complete, edit or print tax forms instantly. 1) you are required to file a federal income tax return; File your state taxes online; File your state taxes online; Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year.

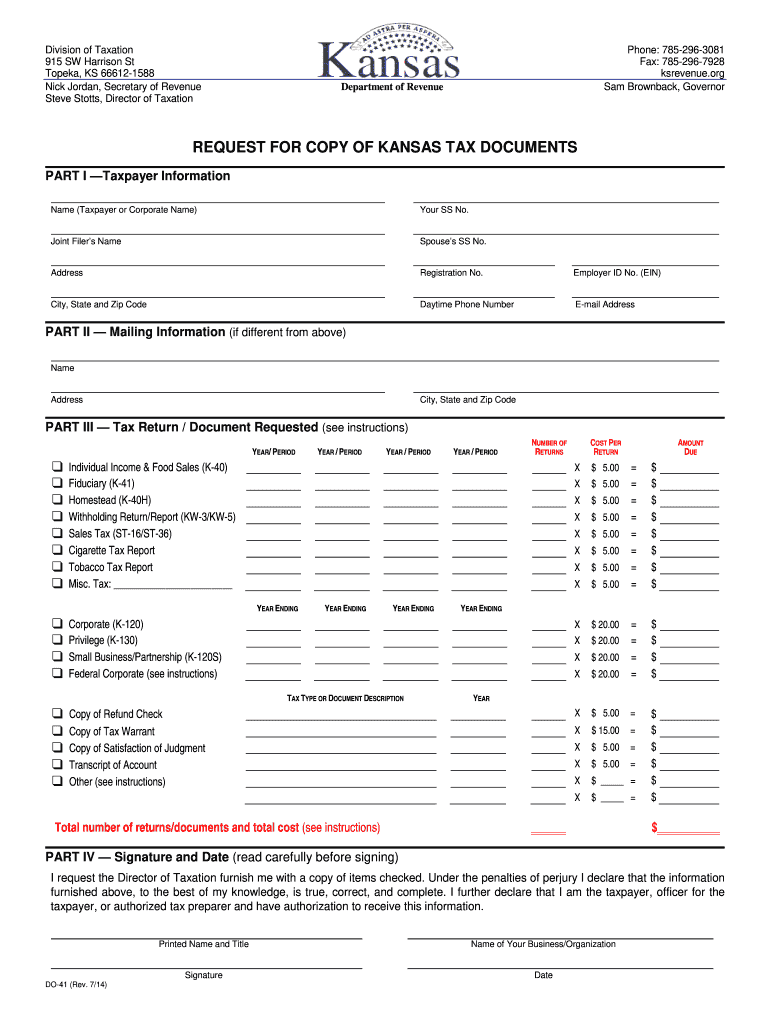

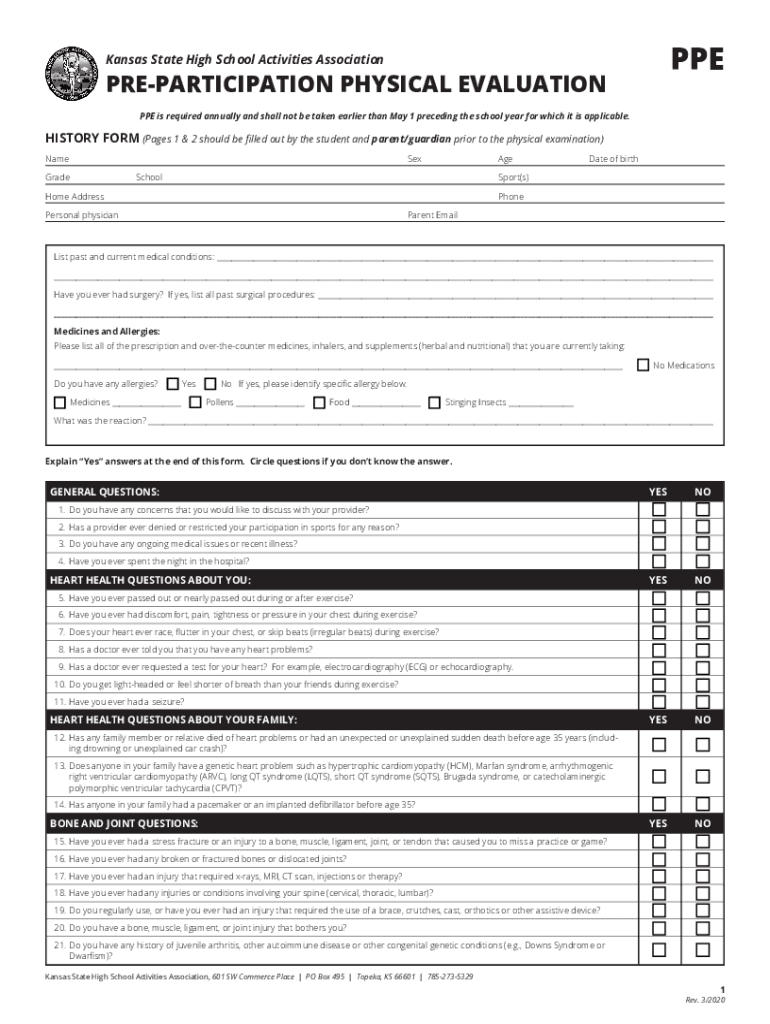

DO 41 Request for Copy of Kansas Tax Documents or Access Rev 7 14 Copy

Web kansas has a state income tax that ranges between 3.1% and 5.7%. Web individual income tax return. Web instructions kansas state income tax forms for current and previous tax years. Web who can use webfile for an income tax return? Request for taxpayer identification number (tin) and certification form.

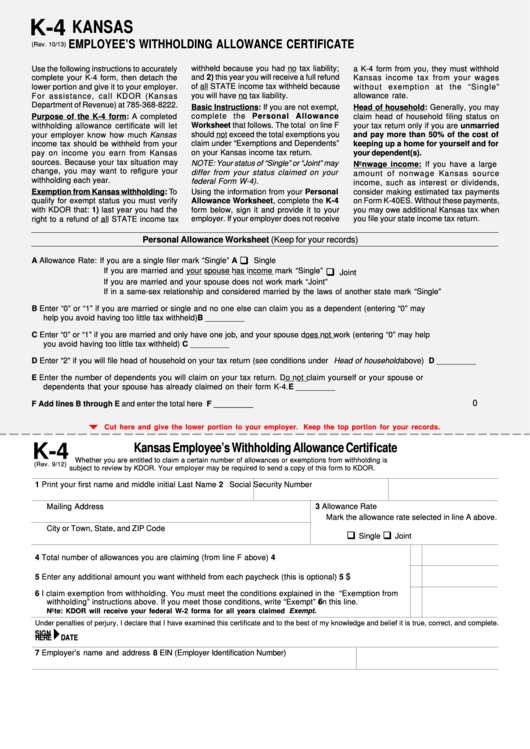

Kansas Withholding Form K 4 2022 W4 Form

Web webfile is an online application for filing kansas individual income tax return that is fast and paperless way to file, and refunds can be deposited directly into your bank account To file your return electronically, you can use webfile, a free online application portal offered by the state. What do i need to file? File your state taxes online;.

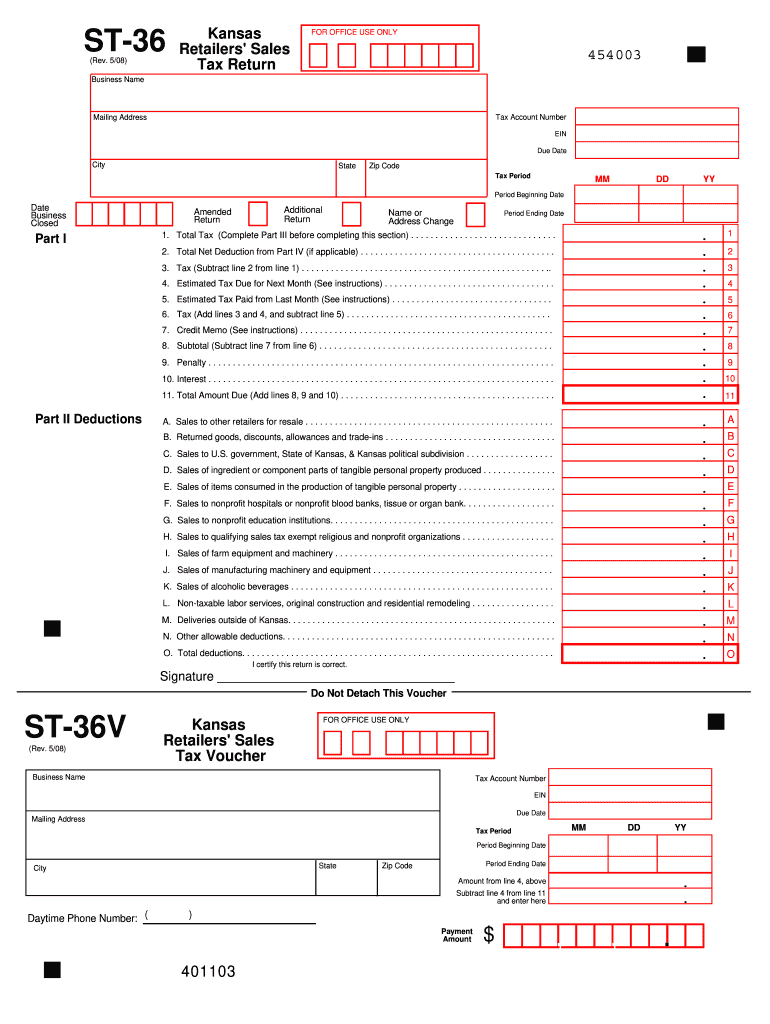

Kansas Retailers Sales Tax Return St 36 Fill and Sign Printable

Web kansas has a state income tax that ranges between 3.1% and 5.7%. Web welcome this application allows you to request copies of the kansas tax documents listed below. Streamlined document workflows for any industry. Web instructions kansas state income tax forms for current and previous tax years. Find forms for your industry in minutes.

Kansas State Tax

Streamlined document workflows for any industry. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Web who can use webfile for an income tax return? Click on any header in the table below to sort the forms by that topic, or use the search box to search by.

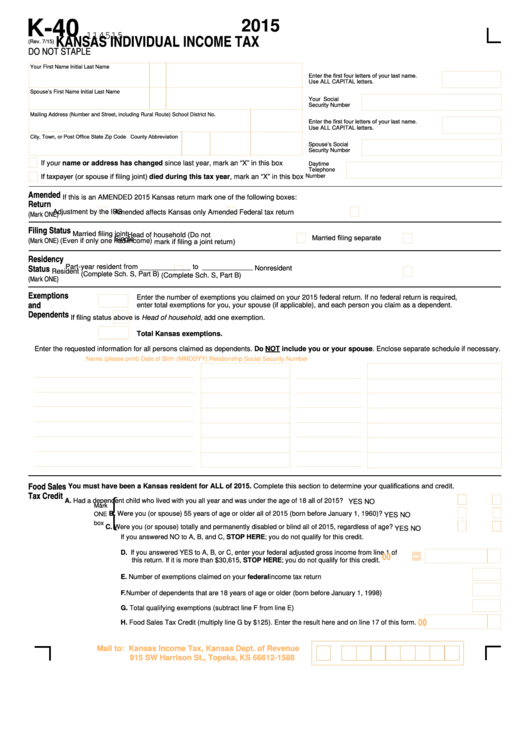

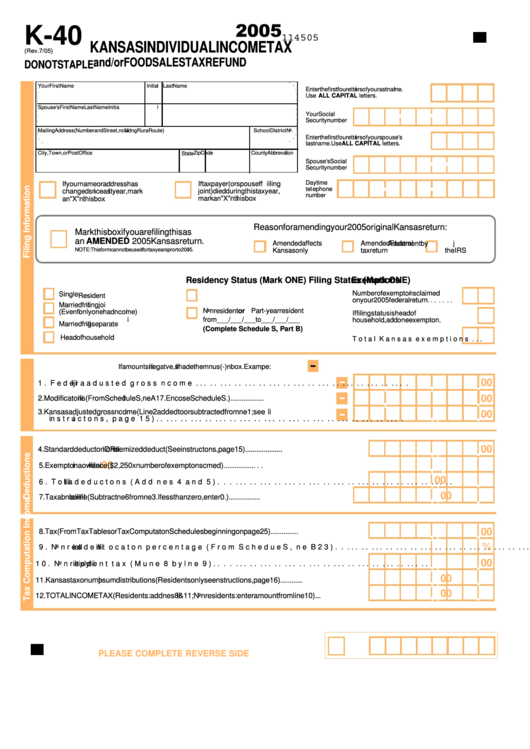

Fillable Form K40 Kansas Individual Tax Return 2015

Web kansas state income tax return forms for tax year 2022 (jan. Find forms for your industry in minutes. Request for taxpayer identification number (tin) and certification form. Web instructions kansas state income tax forms for current and previous tax years. Web welcome this application allows you to request copies of the kansas tax documents listed below.

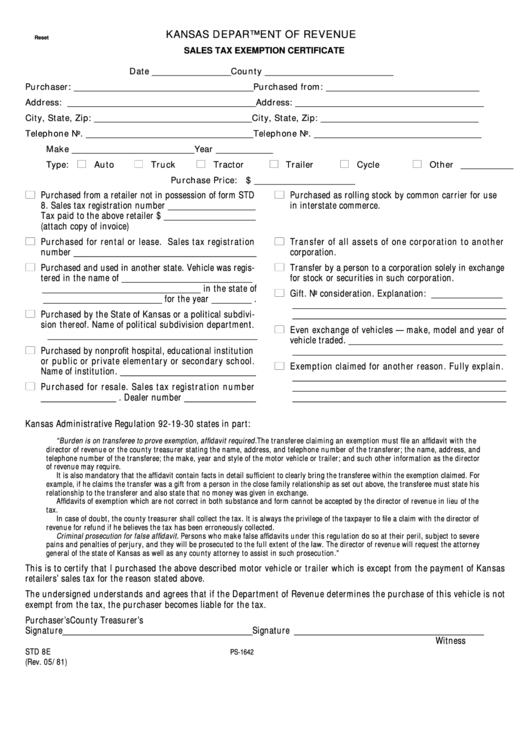

Fillable Form Std 8e Sales Tax Exemption Certificate Kansas

Web kansas state income tax return forms for tax year 2022 (jan. There is a portal processing fee associated with this service, for check payment. Web individual income tax return. Web individual tax return form 1040 instructions; Who can use webfile for a homestead refund claim?

Form K40 Kansas Individual Tax 2005 printable pdf download

To file your return electronically, you can use webfile, a free online application portal offered by the state. Web kansas state income tax return forms for tax year 2022 (jan. Find forms for your industry in minutes. Prepare online on efile.com until oct. Web if you were a kansas resident for the entire year, you must file a kansas individual.

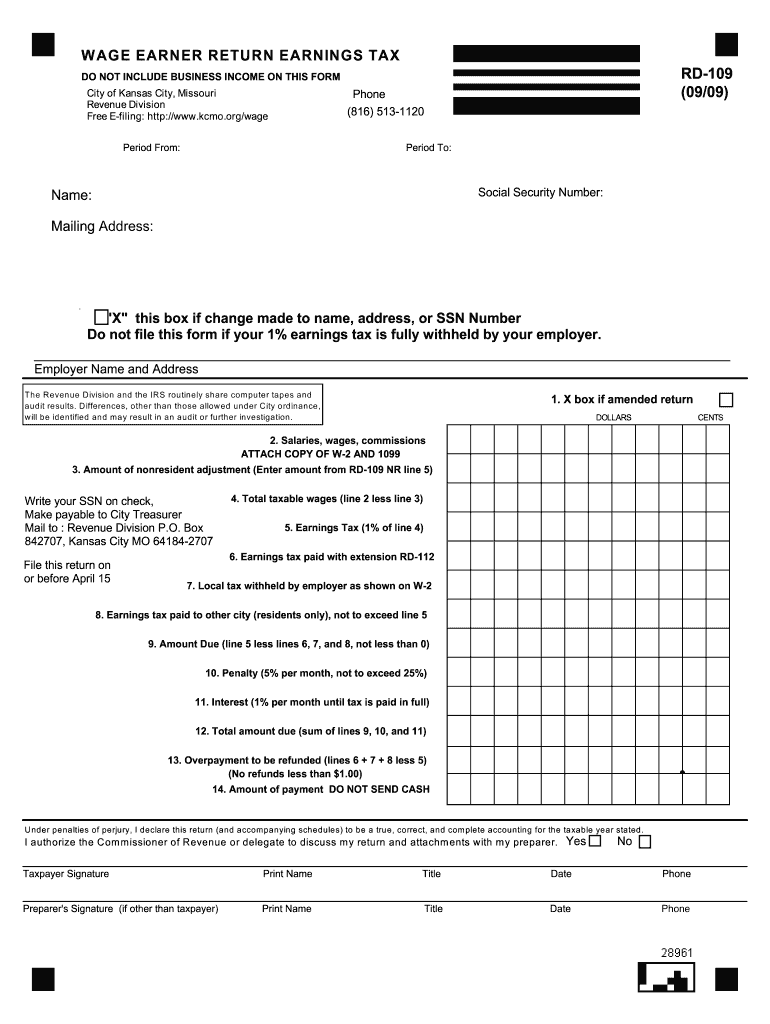

Kansas City Earnings Tax Form Rd 109 Fill Out and Sign Printable PDF

Web kansas has a state income tax that ranges between 3.1% and 5.7%. 1) you are required to file a federal income tax return; Web you can file your kansas income tax online or via mail. To file your return electronically, you can use webfile, a free online application portal offered by the state. Web instructions kansas state income tax.

Kansas State Taxes KS Tax Calculator Community Tax

Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: File your state taxes online; Find forms for your industry in minutes. What should i do if my address changed since i. Web kansas state income tax return forms for tax year 2022 (jan.

Web You Can File Your Kansas Income Tax Online Or Via Mail.

Who can use webfile for a homestead refund claim? Web individual income tax return. Web if you were a kansas resident for the entire year, you must file a kansas individual income tax return if: Streamlined document workflows for any industry.

Prepare Online On Efile.com Until Oct.

File your state taxes online; What should i do if my address changed since i. Click on any header in the table below to sort the forms by that topic, or use the search box to search by form name, number, area or year. Web kansas state income tax return forms for tax year 2022 (jan.

Web Welcome This Application Allows You To Request Copies Of The Kansas Tax Documents Listed Below.

Web kansas income tax forms kansas printable income tax forms 74 pdfs kansas has a state income tax that ranges between 3.1% and 5.7% , which is administered by the. 1) you are required to file a federal income tax return; There is a portal processing fee associated with this service, for check payment. Web who can use webfile for an income tax return?

What Do I Need To File?

Web kansas has a state income tax that ranges between 3.1% and 5.7%. To file your return electronically, you can use webfile, a free online application portal offered by the state. Complete, edit or print tax forms instantly. Request for taxpayer identification number (tin) and certification form.