Iso Exercise Tax Form

Iso Exercise Tax Form - If you exercise a statutory stock option, don't include any amount in income when you exercise the option. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. Your employer grants you an option to purchase stock in. Web on march 13, 2021, your filing status is single, you paid $20,000 to exercise an iso (which was granted to you on january 3, 2020) to buy 200 shares of stock worth $200,000. Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have to use form 6251 to determine if you owe any. Exercise your option to purchase the shares and hold them. Web when reporting this information, corporations use the applicable form for both the information statement and the information return. Web online california tax forms and publications. Web exercise incentive stock options without paying the alternative minimum tax. There is no tax — in fact, nothing to report on your tax return.

Exercise your option to purchase the shares, then sell them any time within the. Web unlike with nsos, you only sometimes have to pay taxes when you exercise isos. Exercise your option to purchase the shares and hold them. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2018, corporations must file completed forms 3921 and forms 3922 with. Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have to use form 6251 to determine if you owe any. Alternative minimum tax (amt) depending on when you. If you exercise a statutory stock option, don't include any amount in income when you exercise the option. As described above, copy a of. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. Your employer grants you an option to purchase stock in.

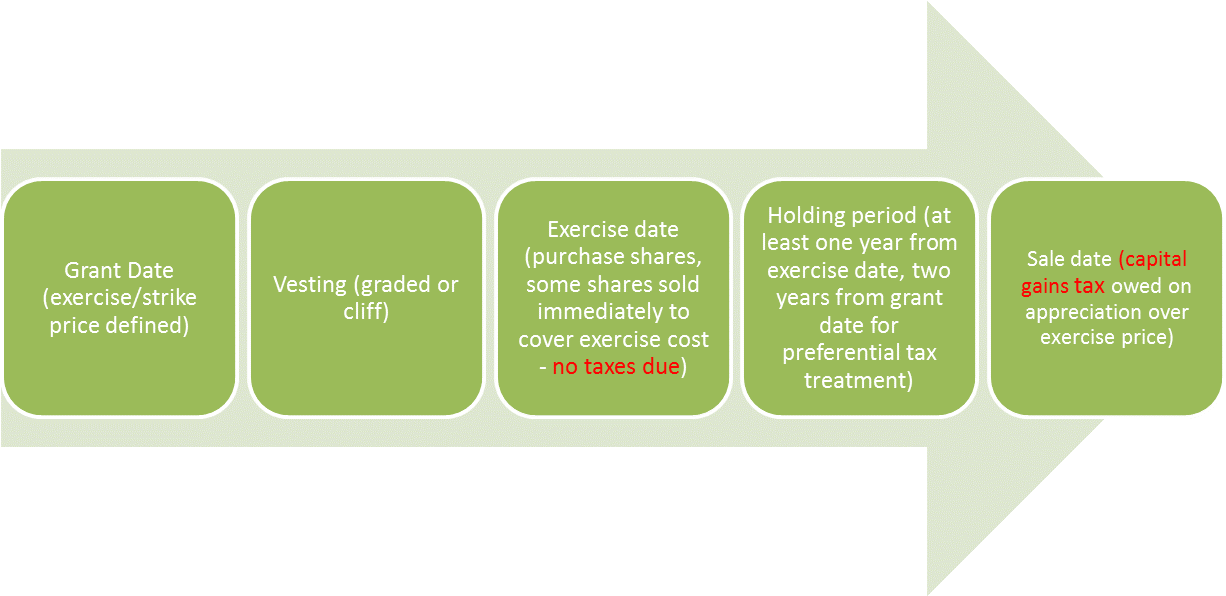

Exercise your option to purchase the shares and hold them. Your employer grants you an option to purchase stock in. Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have to use form 6251 to determine if you owe any. Web with an iso, you can: Web exercise incentive stock options without paying the alternative minimum tax. To locate current and prior year tax forms and publications, go to ftb.ca.gov and search for forms and publications. Web when reporting this information, corporations use the applicable form for both the information statement and the information return. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. Web if your employer grants you a statutory stock option, you generally don't include any amount in your gross income when you receive or exercise the option. Web unlike with nsos, you only sometimes have to pay taxes when you exercise isos.

Get the Most Out of Employee Stock Options

Web unlike with nsos, you only sometimes have to pay taxes when you exercise isos. There is no tax — in fact, nothing to report on your tax return. Web on march 13, 2021, your filing status is single, you paid $20,000 to exercise an iso (which was granted to you on january 3, 2020) to buy 200 shares of.

Iso Exercise 4 YouTube

Exercise your option to purchase the shares and hold them. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2018, corporations must file completed forms 3921 and forms 3922 with. Your employer grants you an option to purchase stock in. Web exercise incentive stock options without paying the alternative minimum tax. As described above, copy.

Split ISO Exercises between December and January

As described above, copy a of. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2018, corporations must file completed forms 3921 and forms 3922 with. If you exercise a statutory stock option, don't include any amount in income when you exercise the option. Web information returns for iso exercises must be made on form.

Excise Tax Definition, Types and Examples TheStreet

Web when reporting this information, corporations use the applicable form for both the information statement and the information return. As described above, copy a of. Exercise your option to purchase the shares and hold them. Web exercise incentive stock options without paying the alternative minimum tax. Your employer grants you an option to purchase stock in.

How to Calculate ISO Alternative Minimum Tax (AMT) 2021

Web online california tax forms and publications. Exercise your option to purchase the shares and hold them. Web with an iso, you can: Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have to use form 6251 to determine if you owe any. As described above, copy a of.

Employee Stock Options Simplified

Web online california tax forms and publications. There is no tax — in fact, nothing to report on your tax return. Web when reporting this information, corporations use the applicable form for both the information statement and the information return. Web if your employer grants you a statutory stock option, you generally don't include any amount in your gross income.

Are Incentive Stock Options Worth the Trouble? Pearl Meyer

Web when reporting this information, corporations use the applicable form for both the information statement and the information return. Alternative minimum tax (amt) depending on when you. If you exercise a statutory stock option, don't include any amount in income when you exercise the option. Web with an iso, you can: Web online california tax forms and publications.

Stock Options and Restricted Stock What You Need to Know About Taxes

Web when reporting this information, corporations use the applicable form for both the information statement and the information return. To locate current and prior year tax forms and publications, go to ftb.ca.gov and search for forms and publications. Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2018, corporations must file completed forms 3921 and.

An Ounce of History The Sixth Circuit Addresses Refund Claims for

Web exercise incentive stock options without paying the alternative minimum tax. Web information returns for iso exercises must be made on form 3921, and information returns for espp stock transfers must be made on form 3922. Web with an iso, you can: As described above, copy a of. To locate current and prior year tax forms and publications, go to.

How to Calculate ISO Alternative Minimum Tax (AMT) 2021

Web when reporting this information, corporations use the applicable form for both the information statement and the information return. As described above, copy a of. If you exercise a statutory stock option, don't include any amount in income when you exercise the option. Web on march 13, 2021, your filing status is single, you paid $20,000 to exercise an iso.

Web Information Returns For Iso Exercises Must Be Made On Form 3921, And Information Returns For Espp Stock Transfers Must Be Made On Form 3922.

If you exercise a statutory stock option, don't include any amount in income when you exercise the option. Your employer grants you an option to purchase stock in. There is no tax — in fact, nothing to report on your tax return. Alternative minimum tax (amt) depending on when you.

Exercise Your Option To Purchase The Shares, Then Sell Them Any Time Within The.

Web on march 13, 2021, your filing status is single, you paid $20,000 to exercise an iso (which was granted to you on january 3, 2020) to buy 200 shares of stock worth $200,000. Exercise your option to purchase the shares and hold them. Web unlike with nsos, you only sometimes have to pay taxes when you exercise isos. As described above, copy a of.

Web Incentive Stock Options (Isos) Are A Type Of Employee Compensation In The Form Of Stock Rather Than Cash.

Web for iso exercises and applicable espp stock transfers which occurred in calendar year 2018, corporations must file completed forms 3921 and forms 3922 with. To locate current and prior year tax forms and publications, go to ftb.ca.gov and search for forms and publications. Web with an iso, you can: Web online california tax forms and publications.

Web When Reporting This Information, Corporations Use The Applicable Form For Both The Information Statement And The Information Return.

Web exercise incentive stock options without paying the alternative minimum tax. Web you have received form 3291 because your employer (or transfer agent) transferred your employer's stock to you pursuant to your exercise of an incentive stock option (iso). Web if your employer grants you a statutory stock option, you generally don't include any amount in your gross income when you receive or exercise the option. Web when you exercise an incentive stock option (iso), there are generally no tax consequences, although you will have to use form 6251 to determine if you owe any.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

.png)