Irs Reconsideration Form

Irs Reconsideration Form - The irs will review the taxpayer’s claim. Web request an audit reconsideration: Web the audit reconsideration request is a filing a taxpayer can make to ask the irs to reconsider its prior changes to a tax return. Audit reconsideration is the process the irs uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid, or a tax credit. Web these letters provide taxpayers with information about their right to challenge proposed irs adjustments in the united states tax court by filing a petition within 90. Web reconsideration requests on cases previously closed in appeals that meet the guidelines for reconsideration should be routed to the appropriate appeals office. (1)you previously agreed to pay the amount of tax you owe by signing an agreement such as: Web appeal rights on reconsiderations. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax liability. The taxpayer will qualify for an appeal when the return is accepted for reconsideration and the result of the reconsideration disallowed the.

Audit reconsideration is the process the irs uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid, or a tax credit. Web audit reconsideration is a highly effective tool available to practitioners when a client is not satisfied with the results of a prior audit, as well as when clients have not. Review, reexamination, retrospect, reappraisal, retrospection, recapitulation, recap, rehash; Web reconsideration requests on cases previously closed in appeals that meet the guidelines for reconsideration should be routed to the appropriate appeals office. Web audit reconsideration is a process that allows taxpayers to challenge the results of an irs audit, or reject a return that was created on their behalf as a result of. Web the audit reconsideration request is a filing a taxpayer can make to ask the irs to reconsider its prior changes to a tax return. (1)you previously agreed to pay the amount of tax you owe by signing an agreement such as: Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax liability. Web an audit reconsideration can be requested at any time after the irs has assessed a deficiency or audit assessment for a particular tax year and before your tax bill has been. Web irs won’t accept an audit reconsideration request if:

Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. Web reconsideration requests on cases previously closed in appeals that meet the guidelines for reconsideration should be routed to the appropriate appeals office. Web the audit reconsideration request is a filing a taxpayer can make to ask the irs to reconsider its prior changes to a tax return. It is a request for the irs to reduce your tax. Web irs won’t accept an audit reconsideration request if: In any of the four situations below, you can request an audit reconsideration. (2) this section contains general information on. Audit reconsideration is the process the irs uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid, or a tax credit. You will also need to submit: Web find 99 ways to say reconsideration, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus.

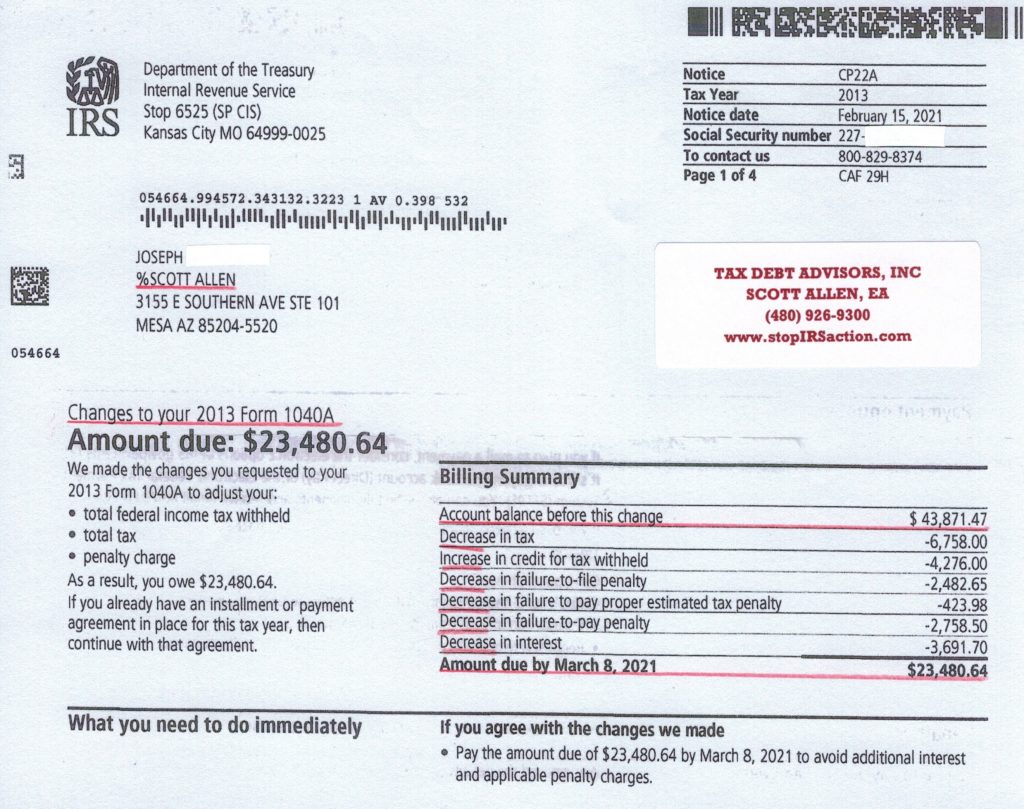

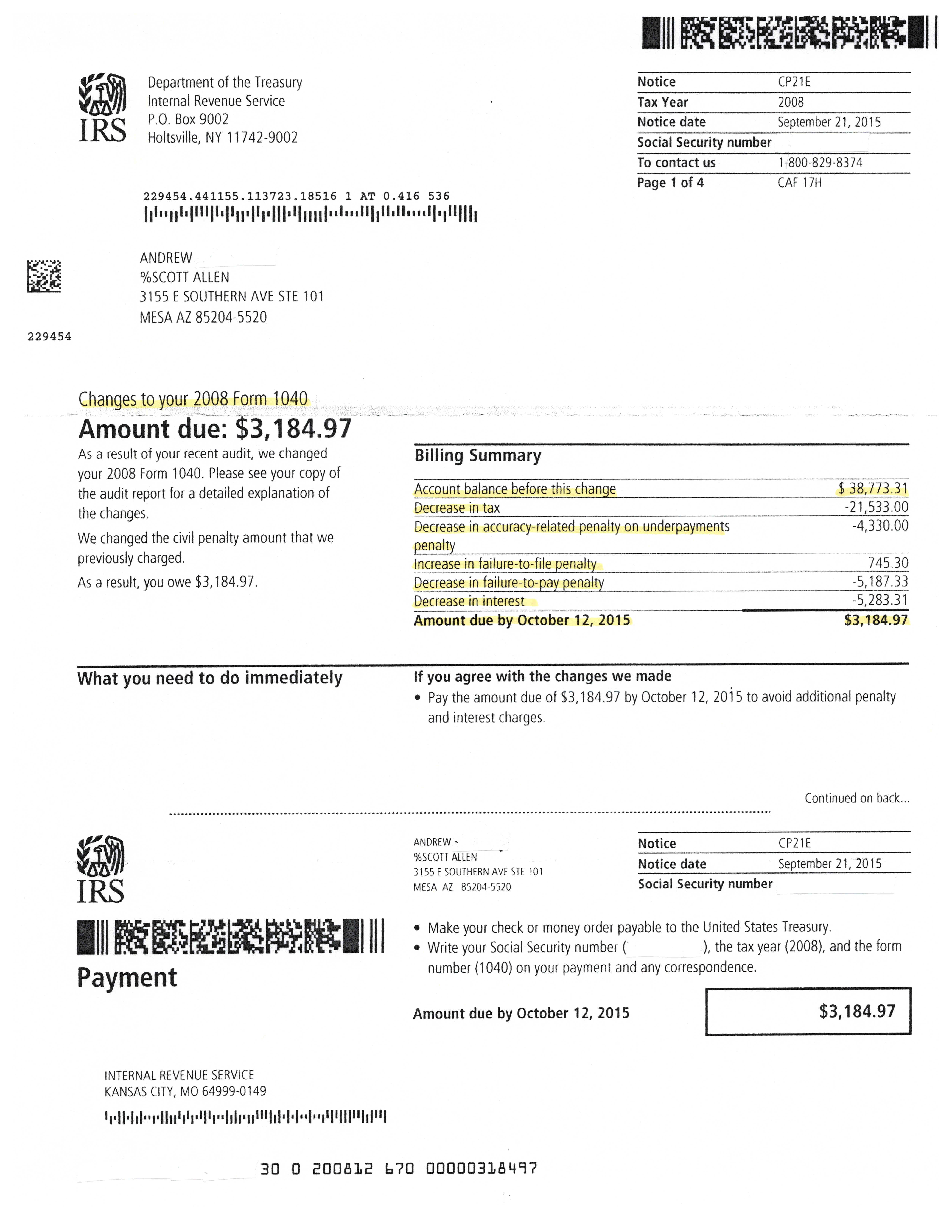

IRS audit reconsideration in Arizona IRS help from Tax Debt Advisors

Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web find 99 ways to say reconsideration, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. How long do i have to file for audit reconsideration? In any.

What is IRS Audit Reconsideration? YouTube

You will also need to submit: Web appeal rights on reconsiderations. Review, reexamination, retrospect, reappraisal, retrospection, recapitulation, recap, rehash; It is a request for the irs to reduce your tax. Web reconsideration requests on cases previously closed in appeals that meet the guidelines for reconsideration should be routed to the appropriate appeals office.

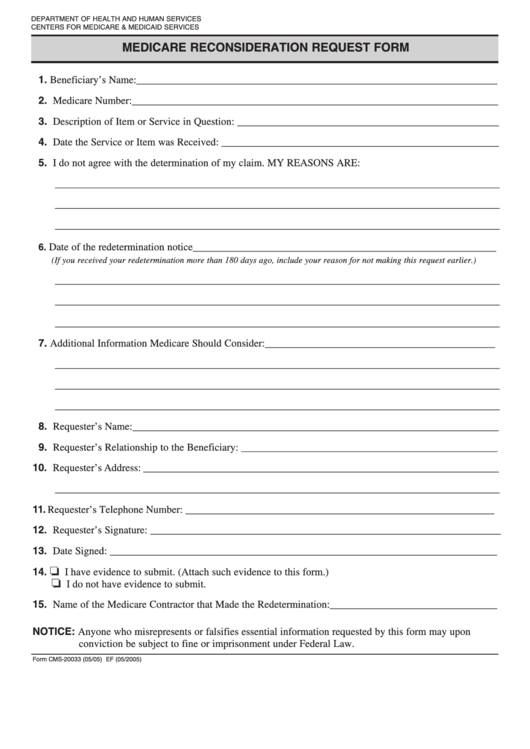

Fillable Medicare Reconsideration Request Form printable pdf download

Web december 16, 2015 purpose (1) this transmits revised 4.13.1 audit reconsideration, introduction. The irs will review the taxpayer’s claim. Web find 99 ways to say reconsideration, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. Web reconsideration requests on cases previously closed in appeals that meet the guidelines for reconsideration should be.

Irs Audit Forms Free Printable Documents

How long do i have to file for audit reconsideration? Web appeal rights on reconsiderations. Web an audit reconsideration can be requested at any time after the irs has assessed a deficiency or audit assessment for a particular tax year and before your tax bill has been. The taxpayer will qualify for an appeal when the return is accepted for.

Fill Free fillable Form 14708 2016 Streamlined Domestic Penalty

(2) this section contains general information on. Web audit reconsideration is a highly effective tool available to practitioners when a client is not satisfied with the results of a prior audit, as well as when clients have not. Web these letters provide taxpayers with information about their right to challenge proposed irs adjustments in the united states tax court by.

Successful IRS Audit Reconsideration in Phoenix Arizona Tax Debt Advisors

The taxpayer will qualify for an appeal when the return is accepted for reconsideration and the result of the reconsideration disallowed the. You will also need to submit: Web reconsideration requests on cases previously closed in appeals that meet the guidelines for reconsideration should be routed to the appropriate appeals office. Web audit reconsideration is a highly effective tool available.

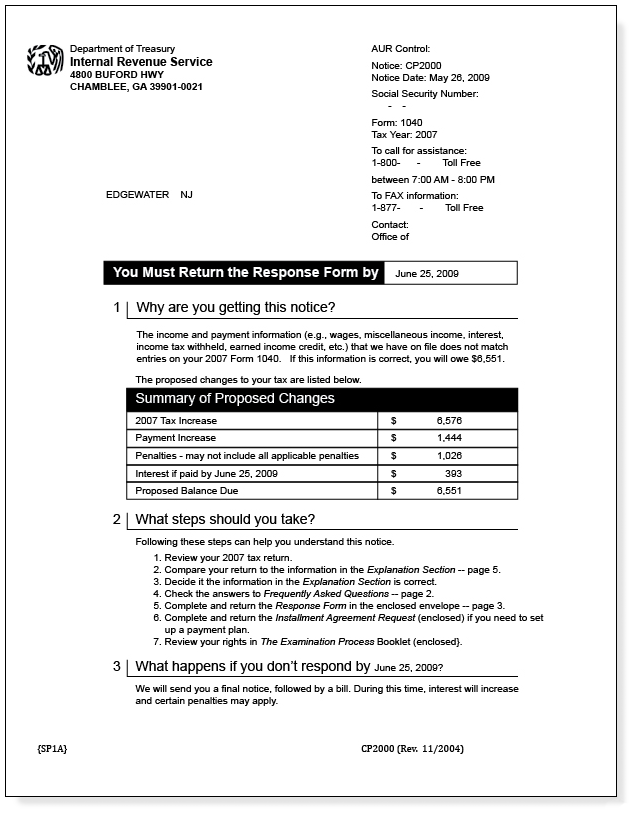

How To File An IRS Audit Reconsideration Request

Web irs won’t accept an audit reconsideration request if: It is a request for the irs to reduce your tax. How long do i have to file for audit reconsideration? Web an audit reconsideration can be requested at any time after the irs has assessed a deficiency or audit assessment for a particular tax year and before your tax bill.

irs audit reconsideration form 12661 Fill Online, Printable, Fillable

The irs will review the taxpayer’s claim. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. A process that reopens your irs audit. Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. Web the irs audit reconsideration is an option.

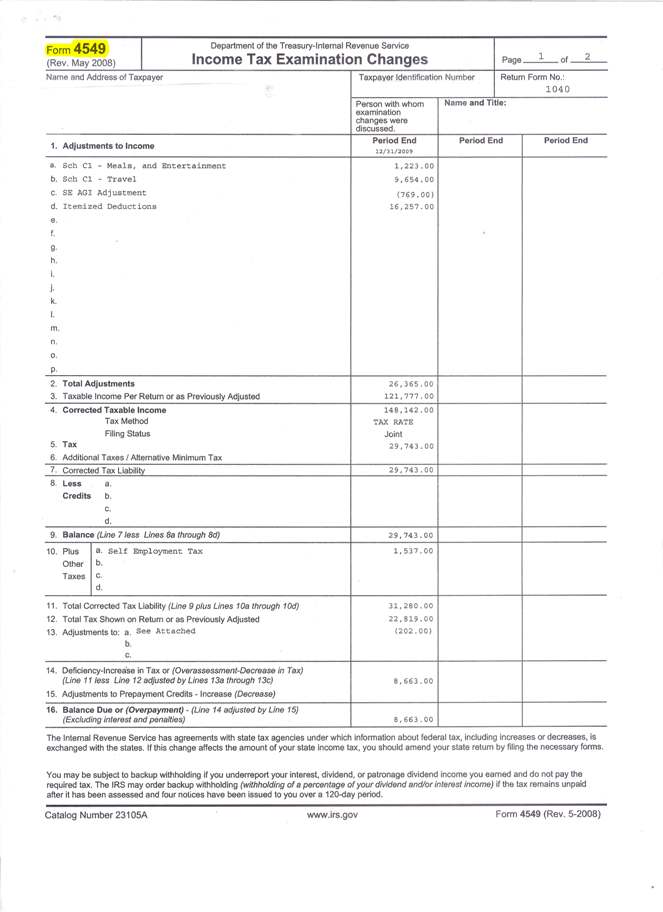

Audit Form 4549 Tax Lawyer Response to IRS Determination

How long do i have to file for audit reconsideration? Web these letters provide taxpayers with information about their right to challenge proposed irs adjustments in the united states tax court by filing a petition within 90. Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. Audit reconsideration is the process the irs uses to reevaluate.

IRS Audit Penalties Everything to Know About IRS Audit Tax Penalties

Web purpose (1) this transmits revised irm 4.13.3, audit reconsideration, central reconsideration unit. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax liability. Web december 16, 2015 purpose (1) this transmits revised 4.13.1 audit reconsideration, introduction. Web form 12661 is a form.

Web These Letters Provide Taxpayers With Information About Their Right To Challenge Proposed Irs Adjustments In The United States Tax Court By Filing A Petition Within 90.

A process that reopens your irs audit. The irs will review the taxpayer’s claim. Web an audit reconsideration can be requested at any time after the irs has assessed a deficiency or audit assessment for a particular tax year and before your tax bill has been. It is a request for the irs to reduce your tax.

Web Appeal Rights On Reconsiderations.

Web the audit reconsideration request is a filing a taxpayer can make to ask the irs to reconsider its prior changes to a tax return. (2) this section contains general information on. Web an audit reconsideration is a process used by the internal revenue service to help you when you disagree with the results of an irs audit of your tax return, or a return created. Audit reconsideration is the process the irs uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid, or a tax credit.

You Will Also Need To Submit:

Web find 99 ways to say reconsideration, along with antonyms, related words, and example sentences at thesaurus.com, the world's most trusted free thesaurus. Web audit reconsideration is a process that allows taxpayers to challenge the results of an irs audit, or reject a return that was created on their behalf as a result of. Web irs won’t accept an audit reconsideration request if: Review, reexamination, retrospect, reappraisal, retrospection, recapitulation, recap, rehash;

The Taxpayer Will Qualify For An Appeal When The Return Is Accepted For Reconsideration And The Result Of The Reconsideration Disallowed The.

Web request an audit reconsideration: In any of the four situations below, you can request an audit reconsideration. Web the irs audit reconsideration is an option you must explore if the irs has made an assessment based on your return and imposed an additional tax liability. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited.