Irs Form 8846

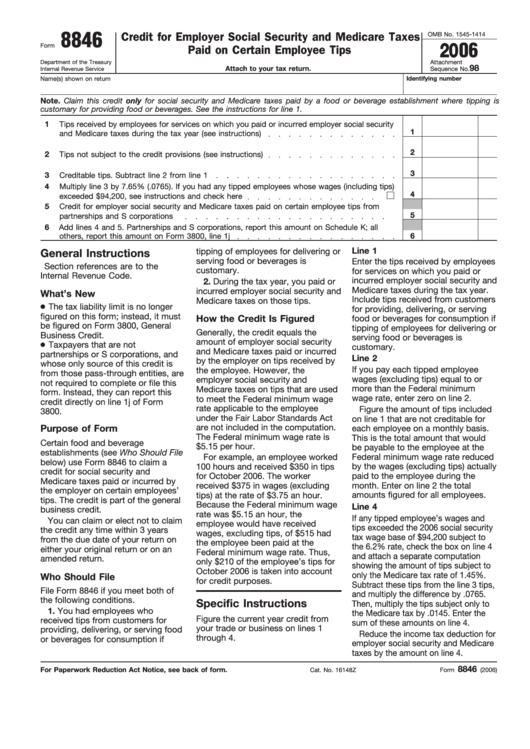

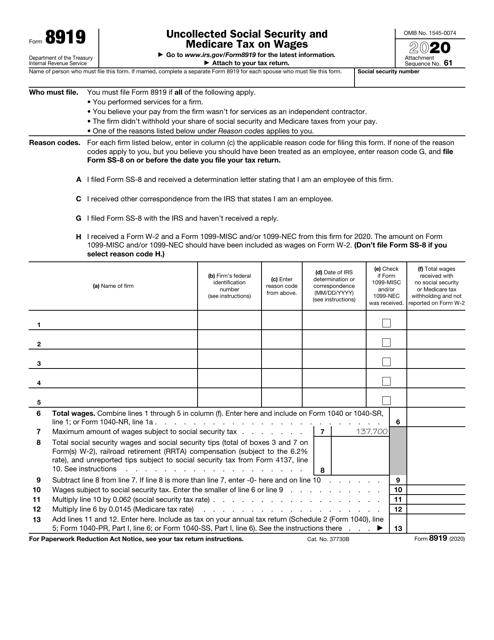

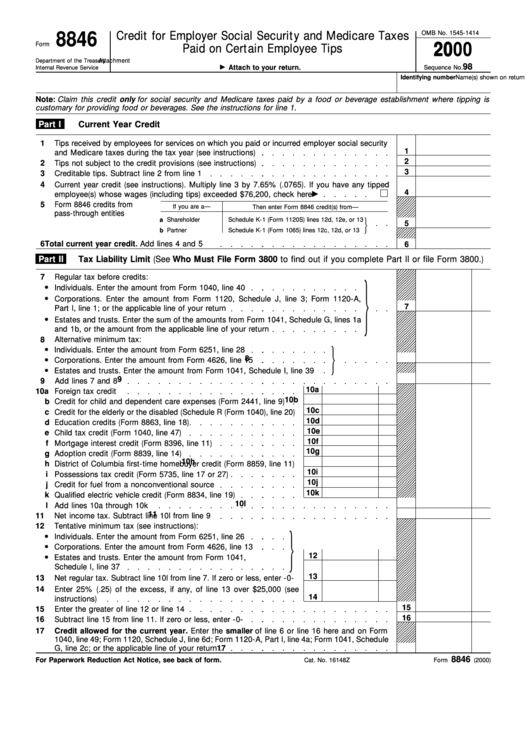

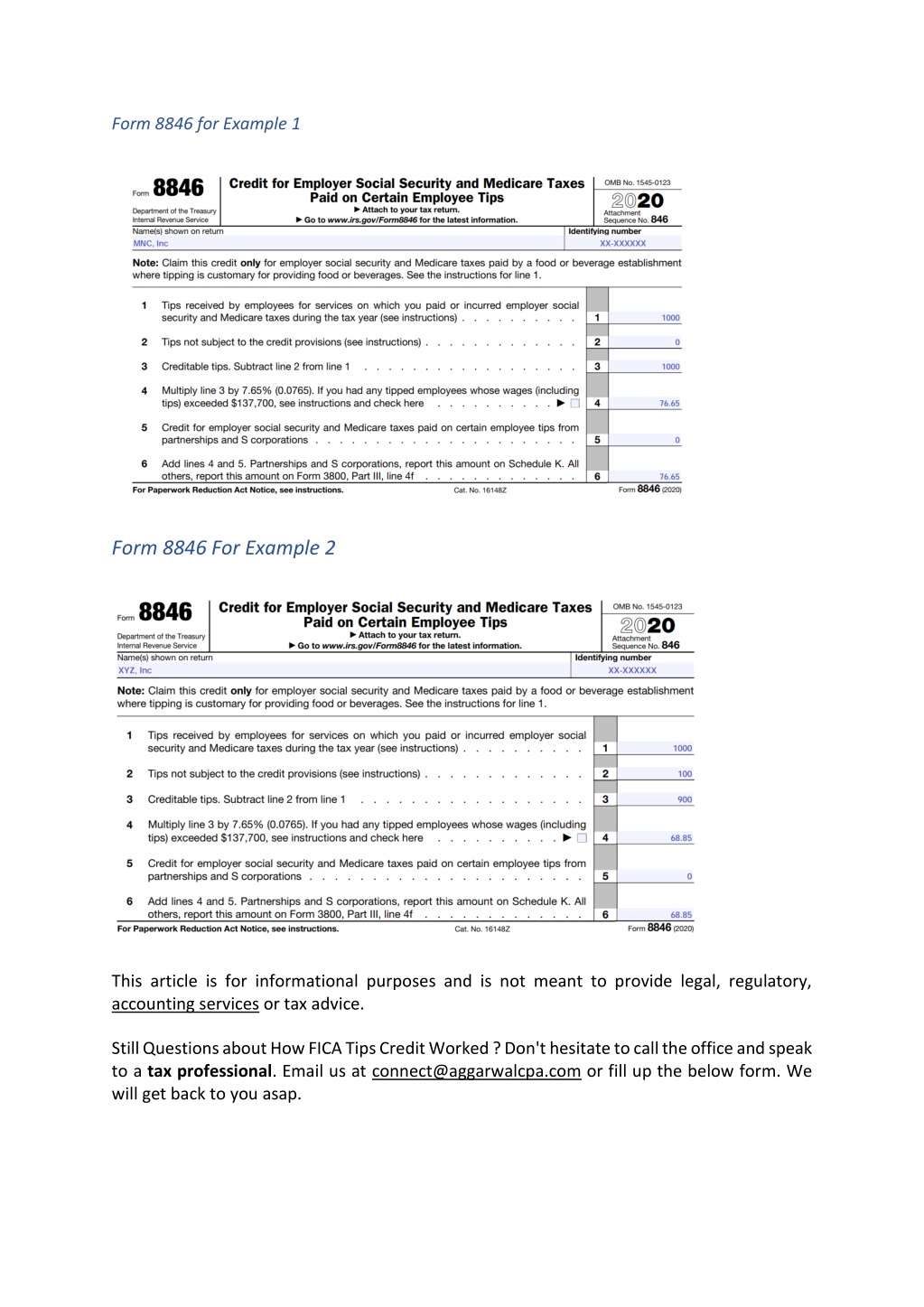

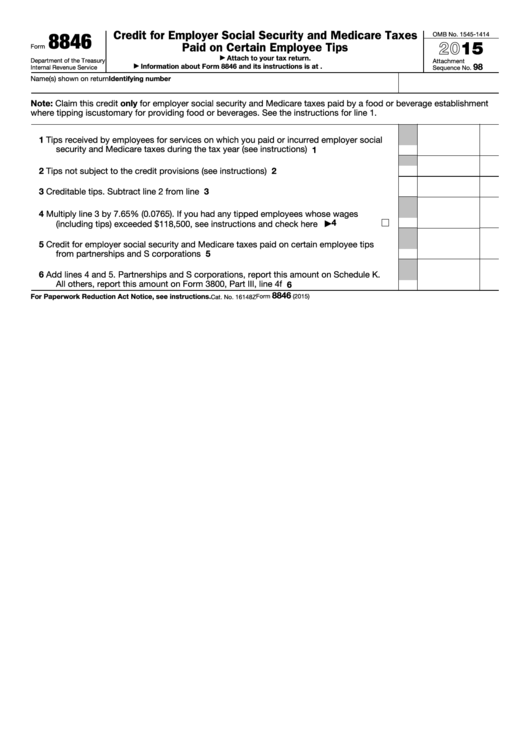

Irs Form 8846 - Filing this form can help your business reduce its tax burden. Web during the tax year, you paid or incurred employer social security and medicare taxes on those tips. Go to www.irs.gov/form8846 for the latest information. Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips. From within your taxact return ( online or desktop), click federal. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social security and medicare taxes paid on employee's tips. This credit is part of the general business credit and is reported on form 3800 general business credit. The tax court held that caselli was not allowed to claim any fica tip credits passing through from agi. The credit is part of the general business credit under section 38 and is figured under the provisions of section 45b. See the instructions for form 8846, on page 2, for more information.

The tax court held that caselli was not allowed to claim any fica tip credits passing through from agi. It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. The credit applies to social security and medicare taxes that the employer pays on some employee tips. Web form 8846 2022 credit for employer social security and medicare taxes paid on certain employee tips department of the treasury internal revenue service attach to your tax return. Go to www.irs.gov/form8846 for the latest information. Web during the tax year, you paid or incurred employer social security and medicare taxes on those tips. Web additionally, the employer must not have already claimed a deduction for the fica tax payment (sec. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. This credit is part of the general business credit and is reported on form 3800 general business credit. Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips.

Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web form 8846 2022 credit for employer social security and medicare taxes paid on certain employee tips department of the treasury internal revenue service attach to your tax return. The credit is part of the general business credit under section 38 and is figured under the provisions of section 45b. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846, fully updated for tax year 2022. The tax court held that caselli was not allowed to claim any fica tip credits passing through from agi. Determining if the fica tax tip applies to your business can be a challenge. Web additionally, the employer must not have already claimed a deduction for the fica tax payment (sec. Go to www.irs.gov/form8846 for the latest information. This credit is part of the general business credit and is reported on form 3800 general business credit. Tip credits are claimed on form 8846.

Fillable Form 8846 Credit For Employer Social Security And Medicare

It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. Filing this form can help your business reduce its tax burden. Web form 8846 gives certain food and beverage establishments a general business tax credit. The credit applies to social security and medicare taxes that the.

IRS FORM 12257 PDF

It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. Web form 8846 gives certain food and beverage establishments a general business tax credit. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on.

Fillable Form 8846 Credit For Employer Social Security And Medicare

See the instructions for form 8846, on page 2, for more information. It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. To enter form 8846 in taxact ®: The credit applies to social security and medicare taxes that the employer pays on some employee tips..

IRS Form 8919 Download Fillable PDF or Fill Online Uncollected Social

The credit applies to social security and medicare taxes that the employer pays on some employee tips. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846, fully updated for tax year 2022. Web how to claim and calculate the.

Credit For Employer Social Security And Medicare Taxes Paid On Certain

The tax court held that caselli was not allowed to claim any fica tip credits passing through from agi. Go to www.irs.gov/form8846 for the latest information. Web additionally, the employer must not have already claimed a deduction for the fica tax payment (sec. The credit applies to social security and medicare taxes that the employer pays on some employee tips..

PPT Understanding How FICA Tips Credit Worked PowerPoint Presentation

The tax court held that caselli was not allowed to claim any fica tip credits passing through from agi. Tip credits are claimed on form 8846. Web form 8846 gives certain food and beverage establishments a general business tax credit. Web during the tax year, you paid or incurred employer social security and medicare taxes on those tips. The credit.

The IRS 8822 Form To File or Not to File MissNowMrs

See the instructions for form 8846, on page 2, for more information. Tip credits are claimed on form 8846. Web form 8846 gives certain food and beverage establishments a general business tax credit. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Filing this.

Form 8846 Credit for Employer Social Security and Medicare Taxes

Web form 8846 gives certain food and beverage establishments a general business tax credit. This credit is part of the general business credit and is reported on form 3800 general business credit. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of.

Form 8846Credit for Social Security and Medicare Taxes Paid on Tips

To enter form 8846 in taxact ®: It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. The credit is part of the general business credit under section 38 and is figured under the provisions of section 45b. Web below) use form 8846 to claim a.

Form 8846 Credit for Employer Social Security and Medicare Taxes

Web form 8846 gives certain food and beverage establishments a general business tax credit. To enter form 8846 in taxact ®: Certain food and beverage establishments use this form to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Web during the tax year, you paid or incurred employer social.

Filing This Form Can Help Your Business Reduce Its Tax Burden.

Web form 8846 gives certain food and beverage establishments a general business tax credit. Web below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on certain employees’ tips. Go to www.irs.gov/form8846 for the latest information. Web additionally, the employer must not have already claimed a deduction for the fica tax payment (sec.

Web How To Claim And Calculate The Fica Tip Tax Credit.

Tip credits are claimed on form 8846. Web about form 8846, credit for employer social security and medicare taxes paid on certain employee tips. To enter form 8846 in taxact ®: It is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips.

The Tax Court Held That Caselli Was Not Allowed To Claim Any Fica Tip Credits Passing Through From Agi.

From within your taxact return ( online or desktop), click federal. See the instructions for form 8846, on page 2, for more information. Web form 8846 2022 credit for employer social security and medicare taxes paid on certain employee tips department of the treasury internal revenue service attach to your tax return. The credit applies to social security and medicare taxes that the employer pays on some employee tips.

Web Certain Food And Beverage Establishments Can Use Form 8846 Credit For Employer Social Security And Medicare Taxes Paid On Certain Employee Tips To Claim A Credit For Social Security And Medicare Taxes Paid On Employee's Tips.

Determining if the fica tax tip applies to your business can be a challenge. The fica tip credit can be requested when business tax returns are filed. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form 8846, fully updated for tax year 2022. This credit is part of the general business credit and is reported on form 3800 general business credit.

.jpg)