Irs Form 708

Irs Form 708 - 708 governs the federal income tax treatment of the merger of two or more partnerships (including limited liability companies (llcs) classified as partnerships). Form 708 will be utilized to report any gifts received by covered expatriates and pay taxes when applicable. 708 (a) provides that a partnership continues unless it is terminated. Return of gifts and bequests from covered expatriates’. Use form 709 to report transfers subject to the federal gift and certain gst taxes. A merger of a partnership into a newly formed llc is one method of converting an existing business from a partnership to an llc. Citizens and residents who receive gifts or bequests from a covered expatriate are required to file irs form 708 ‘u.s. Citizen spouse, child, or u.s. Web go to www.irs.gov/form709 for instructions and the latest information. Web until then, there will be no tax due on gifts and bequests received from the covered expatriates.

708 (b) (1) states that a partnership is considered terminated only if no part of any business, financial operation, or venture of the partnership continues to be carried on by any of its partners in a partnership. A merger of a partnership into a newly formed llc is one method of converting an existing business from a partnership to an llc. (for gifts made during calendar year 2022) see instructions. Citizens and residents who receive gifts or bequests from a covered expatriate are required to file irs form 708 ‘u.s. Web go to www.irs.gov/form709 for instructions and the latest information. 708 governs the federal income tax treatment of the merger of two or more partnerships (including limited liability companies (llcs) classified as partnerships). Allocation of the lifetime gst exemption to property. Web until then, there will be no tax due on gifts and bequests received from the covered expatriates. Web this item contains helpful information to be used by the taxpayer in preparation of form 709, u.s. Form 708 will be utilized to report any gifts received by covered expatriates and pay taxes when applicable.

708 (b) (1) states that a partnership is considered terminated only if no part of any business, financial operation, or venture of the partnership continues to be carried on by any of its partners in a partnership. Use form 709 to report transfers subject to the federal gift and certain gst taxes. The most common situation requiring this form to be filed is when an expatriated u.s. Form 708 will be utilized to report any gifts received by covered expatriates and pay taxes when applicable. 708 (a) provides that a partnership continues unless it is terminated. (for gifts made during calendar year 2022) see instructions. 708 governs the federal income tax treatment of the merger of two or more partnerships (including limited liability companies (llcs) classified as partnerships). Web use form 709 to report the following. Web a treasury regulation [reg. A merger of a partnership into a newly formed llc is one method of converting an existing business from a partnership to an llc.

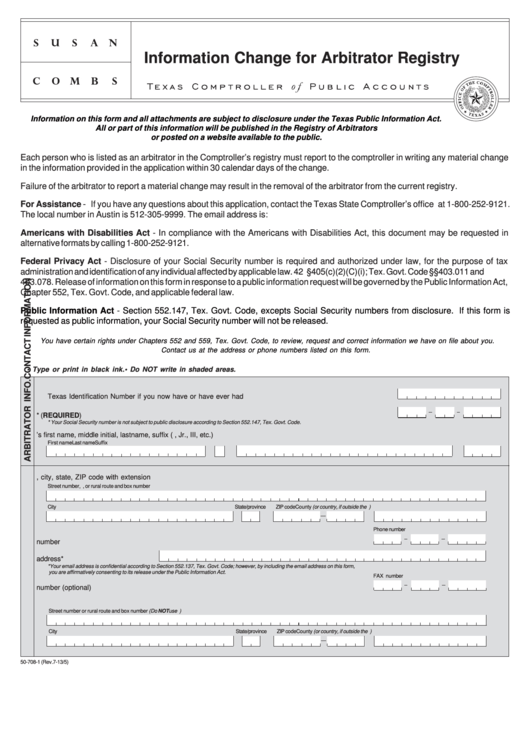

Fillable Form 50708 Information Change For Arbitrator Registry

The partnership would file a final return for the short period ending on the partnership termination date, january 5, 2017. 708 governs the federal income tax treatment of the merger of two or more partnerships (including limited liability companies (llcs) classified as partnerships). Form 708 will be utilized to report any gifts received by covered expatriates and pay taxes when.

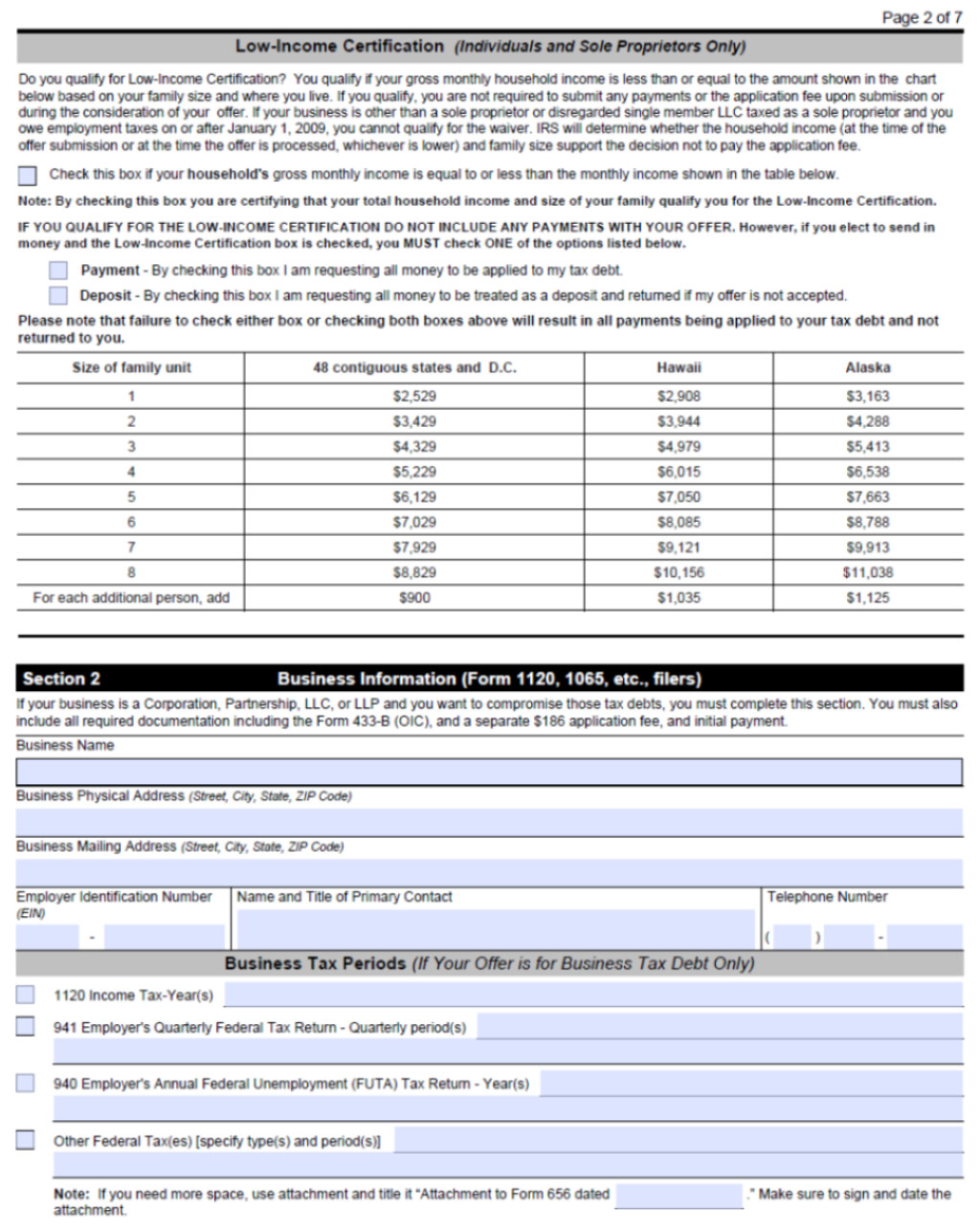

Offer in compromise How to Get the IRS to Accept Your Offer Law

Citizen makes a gift to his u.s. Web use form 709 to report the following. A merger of a partnership into a newly formed llc is one method of converting an existing business from a partnership to an llc. The partnership would file a final return for the short period ending on the partnership termination date, january 5, 2017. Until.

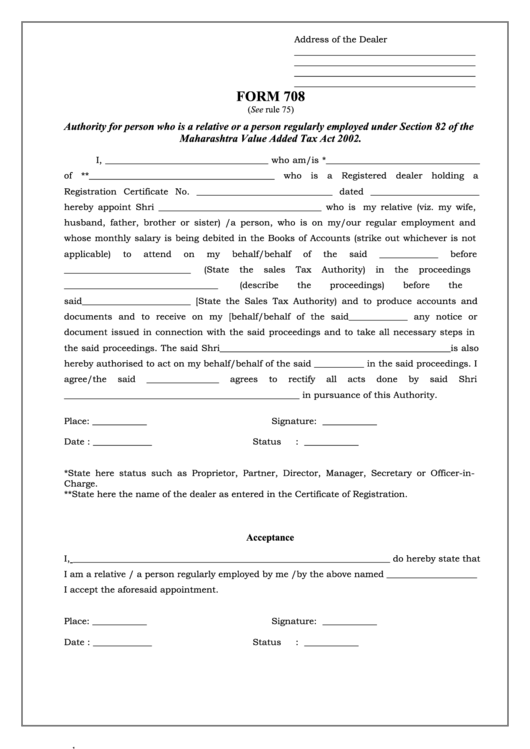

Form 708 Authority For Person Who Is A Relative Or A Person Regularly

Return of gifts and bequests from covered expatriates’. (for gifts made during calendar year 2022) see instructions. Use form 709 to report transfers subject to the federal gift and certain gst taxes. The most common situation requiring this form to be filed is when an expatriated u.s. Web a treasury regulation [reg.

Download IRS Form 2290 for Free TidyTemplates

The most common situation requiring this form to be filed is when an expatriated u.s. Citizen makes a gift to his u.s. 708 governs the federal income tax treatment of the merger of two or more partnerships (including limited liability companies (llcs) classified as partnerships). Use form 709 to report transfers subject to the federal gift and certain gst taxes..

IRS FORM 12257 PDF

Web until then, there will be no tax due on gifts and bequests received from the covered expatriates. Citizens and residents who receive gifts or bequests from a covered expatriate are required to file irs form 708 ‘u.s. Web use form 709 to report the following. Use form 709 to report transfers subject to the federal gift and certain gst.

Download IRS Form 4506t for Free TidyTemplates

Web until then, there will be no tax due on gifts and bequests received from the covered expatriates. (for gifts made during calendar year 2022) see instructions. Form 708 will be utilized to report any gifts received by covered expatriates and pay taxes when applicable. Web go to www.irs.gov/form709 for instructions and the latest information. Web use form 709 to.

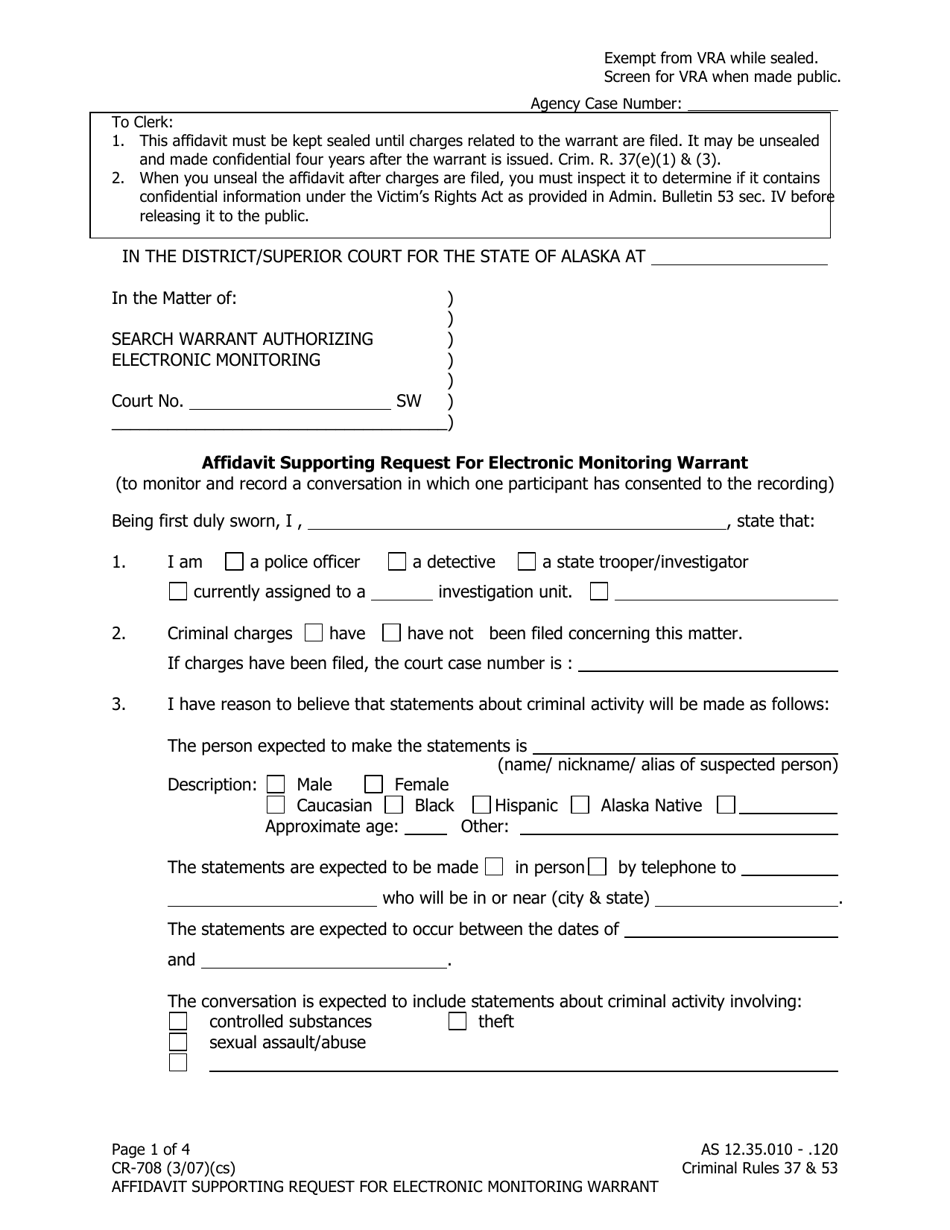

Form CR708 Download Printable PDF or Fill Online Affidavit Supporting

708 (b) (1) states that a partnership is considered terminated only if no part of any business, financial operation, or venture of the partnership continues to be carried on by any of its partners in a partnership. Citizen spouse, child, or u.s. (for gifts made during calendar year 2022) see instructions. 708 governs the federal income tax treatment of the.

DD Form 707 Report of Deposits DD Forms

Web a treasury regulation [reg. Until the department of treasury releases this form, regulations will stay the same. Web go to www.irs.gov/form709 for instructions and the latest information. A merger of a partnership into a newly formed llc is one method of converting an existing business from a partnership to an llc. 708 governs the federal income tax treatment of.

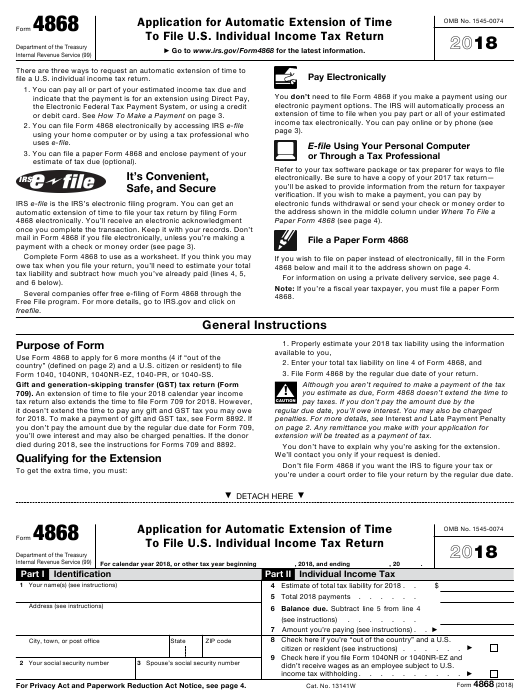

Free Printable Irs Form 4868 Printable Form 2022

The partnership would file a final return for the short period ending on the partnership termination date, january 5, 2017. Return of gifts and bequests from covered expatriates’. Citizen spouse, child, or u.s. Use form 709 to report transfers subject to the federal gift and certain gst taxes. The most common situation requiring this form to be filed is when.

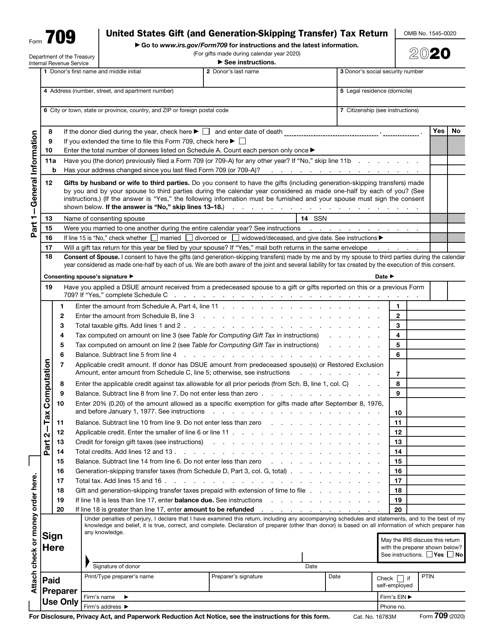

IRS Form 709 Download Fillable PDF or Fill Online United States Gift

The most common situation requiring this form to be filed is when an expatriated u.s. Citizen spouse, child, or u.s. Form 708 will be utilized to report any gifts received by covered expatriates and pay taxes when applicable. 708 (b) (1) states that a partnership is considered terminated only if no part of any business, financial operation, or venture of.

Allocation Of The Lifetime Gst Exemption To Property.

Form 708 will be utilized to report any gifts received by covered expatriates and pay taxes when applicable. The most common situation requiring this form to be filed is when an expatriated u.s. Use form 709 to report transfers subject to the federal gift and certain gst taxes. Web until then, there will be no tax due on gifts and bequests received from the covered expatriates.

Web Go To Www.irs.gov/Form709 For Instructions And The Latest Information.

Citizen spouse, child, or u.s. Web a treasury regulation [reg. A merger of a partnership into a newly formed llc is one method of converting an existing business from a partnership to an llc. Web this item contains helpful information to be used by the taxpayer in preparation of form 709, u.s.

708 (A) Provides That A Partnership Continues Unless It Is Terminated.

708 (b) (1) states that a partnership is considered terminated only if no part of any business, financial operation, or venture of the partnership continues to be carried on by any of its partners in a partnership. Web use form 709 to report the following. 708 governs the federal income tax treatment of the merger of two or more partnerships (including limited liability companies (llcs) classified as partnerships). (for gifts made during calendar year 2022) see instructions.

Citizen Makes A Gift To His U.s.

The partnership would file a final return for the short period ending on the partnership termination date, january 5, 2017. Citizens and residents who receive gifts or bequests from a covered expatriate are required to file irs form 708 ‘u.s. Return of gifts and bequests from covered expatriates’. Until the department of treasury releases this form, regulations will stay the same.

.jpg)